Update: We’ve released a new whitepaper examining the Cannabis industry. We dive into the insurance landscape, legal climate and how to approach risk management for companies in this sector. You can download the report here!

This a guest post from Erik Huberman who is the CEO and Cofounder over at Hawke Media, a full-service Outsourced CMO

Do you feel like you’ve been reading headlines about marijuana legalization forever? It’s been an extremely slow process across the nation. Despite the slow trickle of legalization from state to state, 62 percent of Americans want cannabis legalized, according to an October 2018 Pew Research study.

Then what’s the holdup? In order for cannabis legalization to occur, more industries need to accept the legalization and begin to comply and work with cannabis brands. While the cannabis market continues to grow and along with it cannabis marketing, cannabis insurance just isn’t there yet.

Compliance and regulation ambiguity

The insurance industry is one of the key industries that is not fully compliant yet with the cannabis industry, and that lack of compliance starts with the banking industry. Insurance companies share a lot of the same financial compliance guidelines that banks follow, especially when an entity cannot pay its debts or meet legal obligations to receive loans.

Because banking institutions are taking an issue with canna-biz, it’s causing a trickle effect within the insurance industry. Basically, the insurance industry cars just crashed into the back of the banking industry cars, and it’s all causing a pile-up on the highway to cannabis insurance, a pile-up that stems from a lack of industry data and a plentiful amount of government restrictions.

In terms of the industry data, most large insurance companies tend to gather premium data before they move into a new industry like cannabis. They want to dip their feet into the pool and be sure they have the right reasons to join before making a splash. What’s interesting is that the government allows physicians to provide opioid-based treatments to their patients, but even in states warming up to cannabis treatments, health insurance companies won’t cover the costs and may have to pay double.

Banks receive their protection (and regulation) from the government, and we’ve already discussed how closely the banking and insurance industries are tied together. Banks don’t have basic federal protections for cannabis companies, even in states where marijuana is legal.

On top of the complications in the banking industry, the reinsurers, those who insure other insurance companies, aren’t willing to take on the risk of cannabis companies. If an insurance company’s own insurer won’t even take the risk, then insurance companies follow suit and refuse coverage to the cannabis companies.

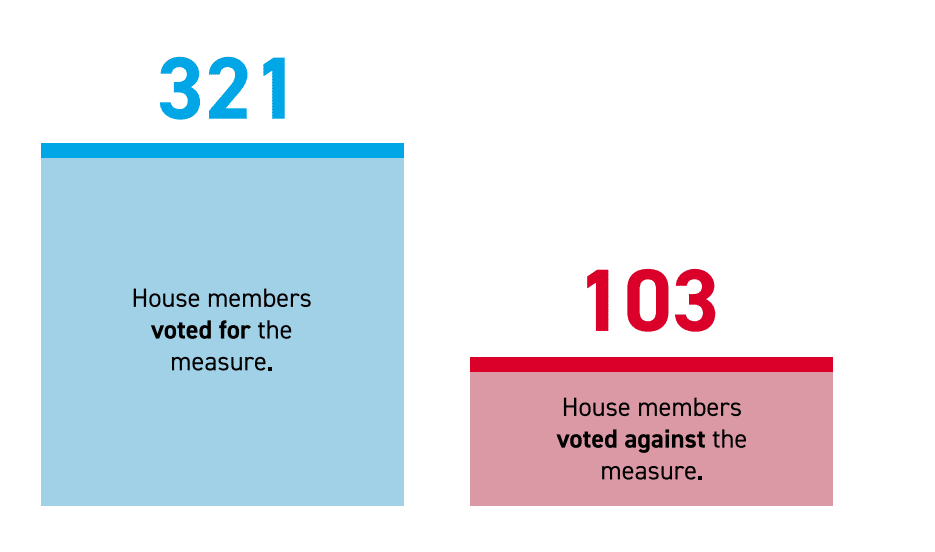

The SAFE Banking Act in the works in Congress may change the situation for banking and cannabis brands, as the act is laid out to prevent federal banking regulators from punishing financial institutions that serve cannabis-related businesses that comply with state laws. The trickle effect comes into play again, as passing this act could signal significant changes ahead for the relationship between cannabis and the insurance industry as well.

How to get Insurance

While we’re waiting for new laws to pass, which we know can be a really slow process, it’s still possible for cannabis companies to get insurance. First, identify what policies your company needs. The necessary policies will depend on your operations, but understanding your risk exposure is the first step to mitigating it.

What and who makes up your operations? Yes, you’ll have to keep in mind general liability, but you’ll also need to take note of your property, especially if you have significant amounts of inventory or equipment—for example, hydroponics. Product liability insurance and/or product recall is important to note as well—for e-commerce, food products (edibles), and vape manufacturers.

Also, if your company uses any type of canna-tech, you’ll need policies that cover those technologies like cyber liability. If you’re raising funding, directors and officers insurance should be considered as well.

D&O insurance covers the executives and the company if they are named in a lawsuit or regulatory action. D&O is typically required for institutional rounds of funding or for an upcoming IPO.

In order to secure the proper coverage after taking an operational inventory, you’ll need to find a broker that serves companies in the cannabis industry. Finding a broker who has a track record of securing coverage for cannabis companies is critical. They’ll have established relationships with cannabis insurance carriers and be able to set realistic expectations on cost.

How marketing strategy can help

It turns out that if you’re a marketer, you can help cannabis insurance companies. Cannabis marketing can work to provide customers with data and knowledge on cannabis products, their effects, and, most importantly, their benefits. There are so many unknowns in the cannabis market, and marketers can capitalize on those unknowns via creating enticing, informative content and building a thoughtful strategy in the space.

Cannabis brands need marketing just as much as they need insurance. The more visible your cannabis brand is, the better coverage you’ll receive, and both of these aspects are key to running a successful business.

As leaders in the cannabis/CBD space, Founder Shield has your insurance covered, and Hawke Media can help your brand grow exponentially. For more details on how to get insurance, sign up today to receive a free quote. For more details on how Hawke can help your brand take off, visit their website to fill out a form for a free consultation.

About the Author: