AI Insurance Built to Scale

Protect your AI startup from unique risks and stay ahead of evolving regulations with insurance policies tailored to support your growth.

Digital Application

Full Market Access

In House Claims Team

Insurance Policies Tailored for AI Startups

AI startup insurance is a specialized suite of coverages designed for emerging businesses in the artificial intelligence sector. It protects founders and investors from financial setbacks, legal claims, and operational disruptions stemming from unexpected risks—ranging from algorithmic failures and data breaches to intellectual property disputes and regulatory challenges.

Cyber Liability

Cyber Liability

Protect your company against risks stemming from internet use and electronic data handling, including data breaches and cyber-attacks. Given the data-intensive nature of AI operations, safeguarding sensitive information is crucial.

Tech Errors & Omissions

Tech Errors & Omissions

Any AI startup that provides a technology product or service in exchange for a fee can have a technology E&O exposure. These exposures range from downtime in a software platform due to an operational or technical error to failures in delivering promised AI functionalities.

Directors & Officers

Directors & Officers

Protects AI startup leaders from personal losses tied to managerial decisions. It defends your company’s reputation and supports bold, innovative risk-taking in the rapidly evolving AI landscape.

Employment Practices Liability Insurance

Employment Practices Liability Insurance

This covers claims from wrongful hiring, discrimination, or termination. It defends your startup as you build and maintain a dynamic team in the competitive AI industry.

General Liability Insurance

General Liability Insurance

This policy defends startups against third-party claims for bodily injury or property damage, guarding your emerging business from unexpected legal costs.

Key Person

Key Person

This coverage protects startups when a vital team member is lost or unavailable, mitigating financial losses tied to the sudden absence of leadership.

Grow with Founder Shield

Founder Shield partners with high-growth companies in emerging markets to deliver a seamless and intuitive insurance experience. Our proprietary technology and specialized insurance products ensure responsive and customized solutions that evolve with your business.

VC backed companies served

Ranked broker in the US

NPS Score (Industry Average = 34)

Enhanced AI Coverage

As AI technologies evolve, so do the risks — and today’s leading insurance policies are adapting to keep pace. Here are the latest enhancements we can place for AI-focused businesses

AI-Induced Cyber Events

Coverage for cyber incidents resulting from AI-generated attacks, including phishing emails, malware, deepfakes, and other synthetic media.

Algorithmic Errors & Failures

Protection against financial loss or legal claims caused by AI model malfunctions, flawed outputs, or unintended consequences of machine learning systems.

Bias & Discrimination Claims

Liability coverage for lawsuits or regulatory actions stemming from biased outcomes in AI decision-making, such as in hiring, lending, or healthcare.

Intellectual Property Infringement

Protection if your AI tools or datasets inadvertently violate IP laws, including copyright, trademarks, or proprietary algorithms.

Training Data Liability

Safeguards against claims tied to the misuse of third-party datasets, including unauthorized use of personal or proprietary information during model training.

Regulatory Investigations & Fines

Support for legal defense and penalties associated with violations of AI-specific or data privacy regulations, including global compliance frameworks.

Schedule Time with an Expert

Risk Calibration

Let’s figure out if you’re under- or over-insured and whether your current policies have detrimental gaps.

Identify Cost Savings

We’ll compare your current coverage costs against industry standards to help optimize premiums and reduce unnecessary expenses.

Risk Roadmap

Receive a tailored risk management plan to address specific liabilities, keeping your company protected as it grows,

What Our Clients Say

Founder Shield helped us through the process of determining what insurance policies we need and how much coverage we need. As a high-growth platform, that sort of expertise was invaluable.

I think Founder Shield is great! They are always willing to go the extra mile in helping my company understand the complex insurance requirements that our firm faces.

If you’re a new startup and need or want insurance, there is no better option. I must have called almost EVERY traditional insurance company and insurance broker before someone told me about Founder Shield. They understand novel/creative new business models and were the only company that “got it”.

Service and Capabilities

Customized Coverage

Tailored policies to address the unique risks of the fintech sector, ensuring comprehensive protection.

Expert Guidance

Access to experts with deep knowledge of fintech risks, regulatory environments, and best practices.

Quick Coverage, Easy Access

Submit an application in under 15 minutes and manage all your policies & claims on our simple online platform.

Full Market Access

Access to a network of 200+ carriers to ensure comprehensive protection across all potential risks unique to your company.

Competitive Pricing

Receive quality coverage at the best possible rates with our wide carrier access.

Adjust as your Grow

Easily modify your coverage as your startup scales, from pre-seed, through all financing rounds, to IPO.

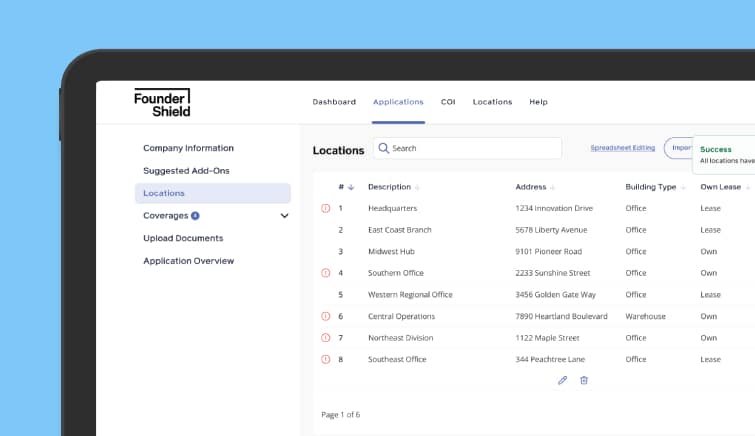

End-to-End Digital Policy Management

We utilize our technology platform to streamline the application & renewal process and automate all back-end document generation and carrier API connectivity to balance the customer experience with maximum quoting reach.

Claims Advocacy

In-house claims advocacy team of lawyers to ensure optimal outcomes when your insurance package is needed most: claims situations.

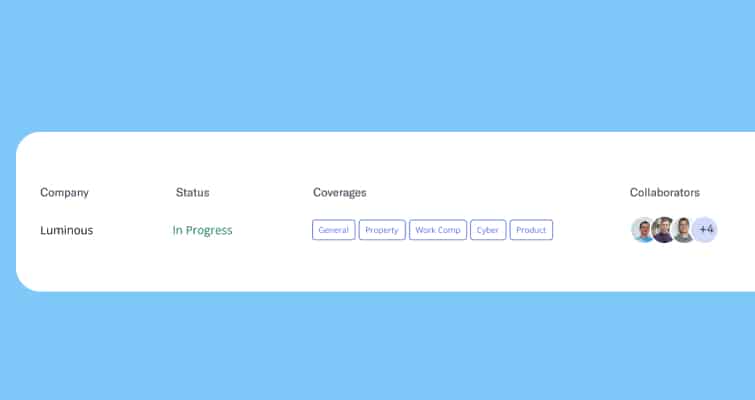

Smart Insurance Governance

Our platform is designed to scale with you. Invite your finance, collaborate on the application in real-time with your vendors, and see how your program compares with your peers.