Cyber Insurance

Protect your business from cyber-related lawsuits and recover quickly with data restoration support and financial reimbursement.

Covers forensic investigations and data recovery

Helps cover legal costs and lawsuit settlements

Protects against financial loss and notification expenses

What Cyber Insurance Covers

Loss or Damage to Electronic Data

Coverage for expenses to restore, recover, or reconstruct digital data, including fees for external experts to salvage and secure compromised or lost information.

Loss of Income or Extra Expenses

Compensation for revenue loss and additional costs incurred during business interruptions, helping to minimize financial strain when a system failure disrupts operations.

Cyber Extortion Losses

Covers costs for responding to cyber extortion threats, including payments to cyber criminals and related expenses (subject to insurer approval) to mitigate the threat’s impact.

Customer Notification Costs

Assists with expenses to notify affected customers and stakeholders following a data breach, as required by government regulations or industry statutes.

Reputation Damage

Helps offset marketing and public relations costs needed to rebuild your company’s reputation after a data breach, reducing long-term brand damage and customer loss.

Legal Fees

Covers costs of hiring legal counsel to assess and manage your company’s liabilities, ensuring compliance with applicable laws and regulations following a cyber incident.

What Our Clients Say

Founder Shield helped us through the process of determining what insurance policies we need and how much coverage we need. As a high-growth platform, that sort of expertise was invaluable.

I think Founder Shield is great! They are always willing to go the extra mile in helping my company understand the complex insurance requirements that our firm faces.

If you’re a new startup and need or want insurance, there is no better option. I must have called almost EVERY traditional insurance company and insurance broker before someone told me about Founder Shield. They understand novel/creative new business models and were the only company that “got it”.

Cyber Insurance Case Studies

Digital Asset Theft

A U.S. based information technology company, ‘Merica, contracted with an overseas software vendor, Internacional. Internacional left universal “administrator” defaults installed on ‘Merica’s server and a “Hacker for Hire” was paid $20,000 to exploit such vulnerability. If the hacker’s requested payment was not made he would post the records of millions of registered users on a blog available for all to see.

The extortion expenses and extortion monies are expected to exceed $2,000,000.

Ransomware Attack on SyncNode Co.

SyncNode Co. was hit by a ransomware attack, encrypting its data and demanding a ransom payment of $1,000,000. Their cybersecurity insurance covered the cost of the ransom payment and decrypting its data, enabling the young business to resume operations.

Malicious Code Attack

An intern released a computer worm, causing a local tech service firm to shut down its systems for 18 hours. The incident, including repairs and business losses, cost the firm about $875,000.

Partnering with Founder Shield

We’re a risk management partner for high-growth companies across emerging markets, striving to create the most seamless, intuitive, and responsive insurance-purchasing experience powered by proprietary technology and insurance products.

VC backed companies served

Ranked broker in the US

NPS Score (Industry Average = 34)

Why Companies Choose Founder Shield

Customized Coverage

Tailored policies to address the unique risks of the fintech sector, ensuring comprehensive protection.

Expert Guidance

Access to experts with deep knowledge of fintech risks, regulatory environments, and best practices.

Quick Coverage, Easy Access

Submit an application in under 15 minutes and manage all your policies & claims on our simple online platform.

Full Market Access

Access to a network of 200+ carriers to ensure comprehensive protection across all potential risks unique to your company.

Competitive Pricing

Receive quality coverage at the best possible rates with our wide carrier access.

Adjust as your Grow

Easily modify your coverage as your startup scales, from pre-seed, through all financing rounds, to IPO.

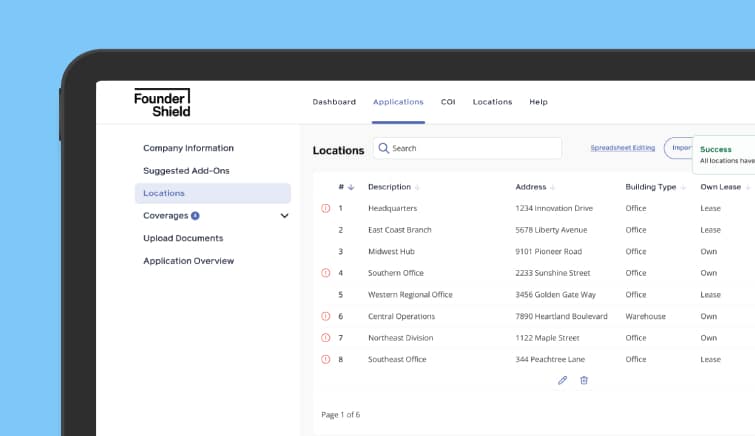

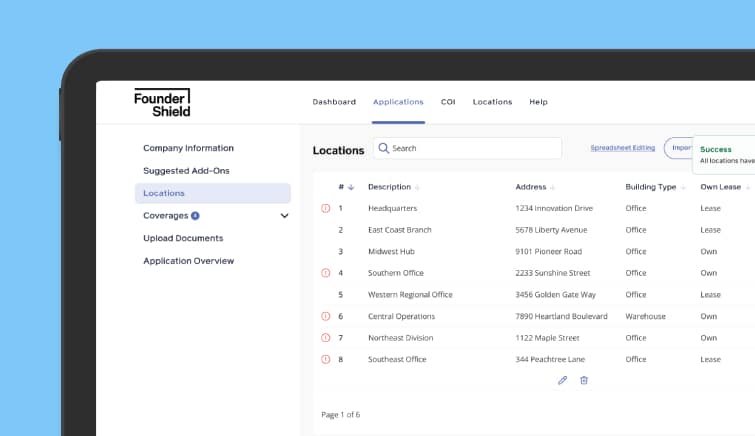

End-to-End Digital Policy Management

We utilize our technology platform to streamline the application & renewal process and automate all back-end document generation and carrier API connectivity to balance the customer experience with maximum quoting reach.

Claims Advocacy

In-house claims advocacy team of lawyers to ensure optimal outcomes when your insurance package is needed most: claims situations.

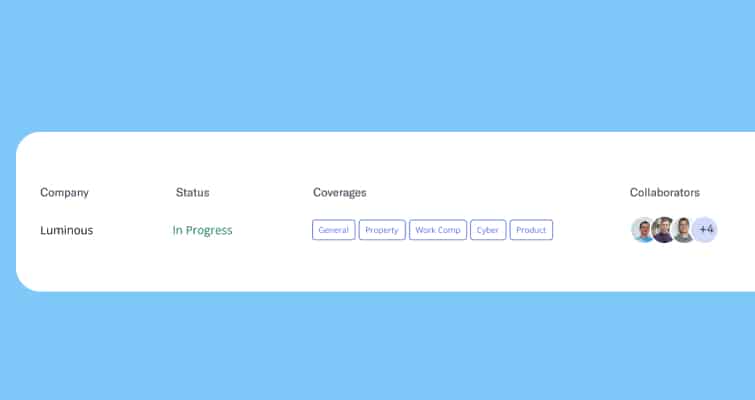

Smart Insurance Governance

Our platform is designed to scale with you. Invite your finance, collaborate on the application in real-time with your vendors, and see how your program compares with your peers.