Fintech Insurance

Stay ahead of risks and regulations with tailored insurance solutions that empower your fintech company to scale confidently.

Save up to 42%

Full Market Access

In House Claims Team

Why you need Fintech insurance

Fintech insurance is essential to safeguard your rapidly evolving business from unique risks. As you handle sensitive data and financial transactions, you’re exposed to cyber threats, regulatory scrutiny, and potential lawsuits. A tailored fintech insurance policy protects you against cyberattacks, ensures compliance with industry regulations, covers legal defense costs, and mitigates emerging risks. Having comprehensive coverage empowers your business to innovate confidently, maintain stakeholder trust, and ensure operational continuity, securing long-term stability and growth.

Cyber Threat Protection

Cyber Threat Protection

Insurance for fintech companies offers protection from cyber threats, safeguarding sensitive data and financial transactions from cyberattacks, ensuring regulatory compliance, minimizing downtime, and preventing significant financial and reputational damage.

Legal Risk Coverage

Legal Risk Coverage

Insurance for fintech companies provides legal risk coverage, protecting against lawsuits, compliance violations, regulatory penalties, and associated legal expenses, ensuring financial stability and safeguarding the company’s reputation.

Emerging Risk Mitigation

Emerging Risk Mitigation

Insurance for fintech companies includes emerging risk mitigation, proactively addressing evolving threats, technological disruptions, and unforeseen industry shifts, reducing vulnerabilities, ensuring resilience, and safeguarding future growth and operational continuity.

Regulatory Compliance Safeguard

Regulatory Compliance Safeguard

Insurance for fintech companies provides a regulatory compliance safeguard, protecting against regulatory violations, penalties, and audits, ensuring adherence to evolving regulations, minimizing legal exposure, and preserving operational integrity and reputation.

Partnering with Founder Shield

We’re a risk management partner for high-growth companies across emerging markets, striving to create the most seamless, intuitive, and responsive insurance-purchasing experience powered by proprietary technology and insurance products.

VC backed companies served

Ranked broker in the US

NPS Score (Industry Average = 34)

Insurance Policies Tailored for Fintech Companies

Cyber Liability

Cyber Liability

Protect your company against risks stemming from internet use and electronic data handling, including data breaches and cyberattacks.

Tech Errors & Omissions

Tech Errors & Omissions

This policy is crucial for fintech companies offering financial services or advice, as it protects against claims of financial loss caused by errors or omissions in their service.

Directors & Officers

Directors & Officers

Executives of fintech firms deal with high-level decisions involving investments, technology, and regulatory compliance. A D&O policy shields their personal assets from litigation-related losses.

Blended D&O and E&O

Blended D&O and E&O

A comprehensive coverage for risks associated with executive decisions and the services they provide, streamlining insurance needs into one policy.

Digital Asset

Digital Asset

Cyberattacks loom, regulations shift, and markets fluctuate in the fintech space. Digital asset insurance protects fintech companies from these threats, safeguarding client funds against hacks and mitigating losses from volatile crypto swings.

Intellectual Property

Intellectual Property

As fintech companies often rely on unique software or technologies, this insurance protects valuable IP assets against infringement claims.

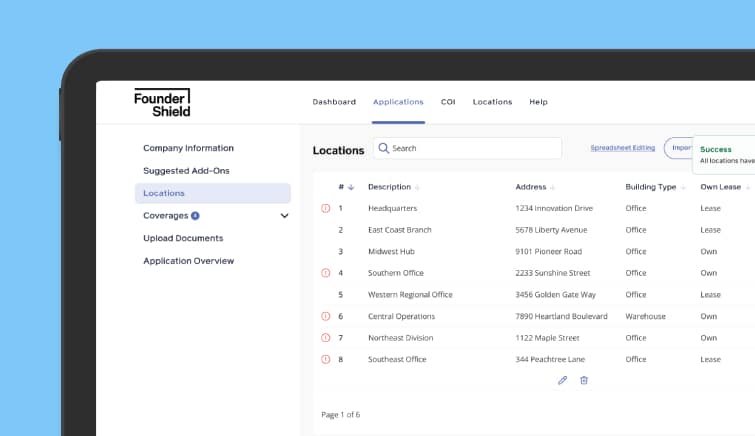

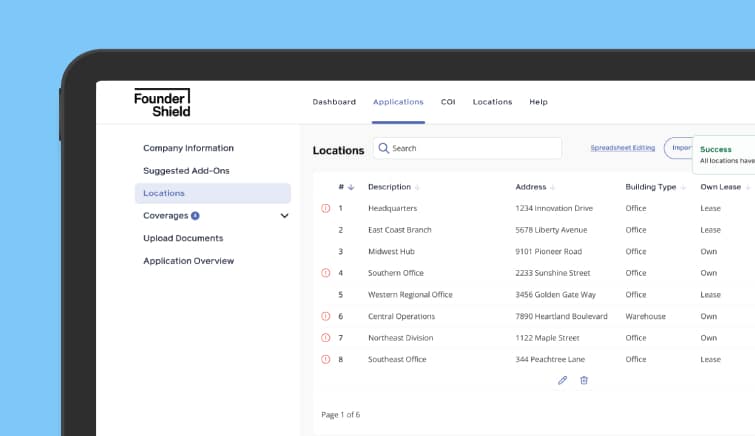

End-to-End Digital Policy Management

We utilize our technology platform to streamline the application & renewal process and automate all back-end document generation and carrier API connectivity to balance the customer experience with maximum quoting reach.

Claims Advocacy

In-house claims advocacy team of lawyers to ensure optimal outcomes when your insurance package is needed most: claims situations.

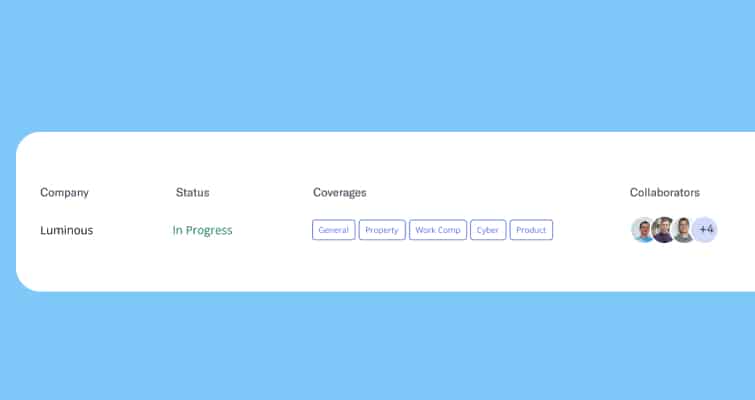

Smart Insurance Governance

Our platform is designed to scale with you. Invite your finance, collaborate on the application in real-time with your vendors, and see how your program compares with your peers.

Client Case Studies

A fintech startup specializing in online payments experienced a significant data breach due to a vulnerability in its security system. This resulted in the theft of customers’ credit card information.

The company faced substantial financial losses covering customer notification, credit monitoring services, and legal fees.

Their Cyber Liability insurance played a critical role in mitigating these costs and covering the PR expenses to manage the damage to their reputation.

A robo-advisory fintech firm was sued by clients for providing inaccurate investment advice leading to substantial financial losses. The algorithm, which was supposed to tailor investment strategies to individual risk profiles, malfunctioned due to a coding error.

The firm faced a class-action lawsuit. However, their Errors & Omissions insurance helped cover the legal defense costs and the eventual settlement payments, safeguarding the company’s finances against the substantial liabilities incurred.

A company developing AI-driven credit scoring models faced backlash when it was discovered that its algorithm inadvertently discriminated against certain demographic groups. This led to reputational damage and legal challenges alleging unfair business practices.

The company’s insurance for emerging risks was specifically designed to cover unforeseen liabilities in new technology areas. It provided coverage for the legal defense and settlements, helping the company navigate this complex and unexpected challenge.

A cryptocurrency exchange failed to comply with new anti-money laundering regulations, resulting in hefty fines and penalties from regulatory bodies. The noncompliance was due to an oversight in updating their compliance protocols.

Their insurance policy covering regulatory and compliance risks helped absorb the financial impact of these penalties, allowing the company to rectify their compliance procedures without jeopardizing financial stability.

Schedule Time with a Fintech Expert

Risk Calibration

Let’s figure out if you’re under- or over-insured and whether your current policies have detrimental gaps.

Identify Cost Savings

We’ll compare your current coverage costs against industry standards to help optimize premiums and reduce unnecessary expenses.

Risk Roadmap

Receive a tailored risk management plan to address specific liabilities, keeping your company protected as it grows,