Business Insurance for Life Sciences

As specialized insurance brokers, we understand the complex risks life sciences companies face, from pharmaceuticals and biotechnology to medical devices and nutraceuticals. In this fast-evolving sector, businesses navigate unique challenges driven by innovation, regulatory demands, and the high-stakes nature of their products — and we protect your journey.

10,000

We've served more than 10,000 investor-backed companies.

$40B

Over $40B was invested in life sciences startups globally in 2024.

Our Process

Why Life Sciences Companies Need Insurance

Mitigates Risks in Research & Development

Defends Intellectual Property & Patents

Protects Against Emerging Risks in the Industry

Safeguards Against Regulatory Challenges

Can You Afford Being Uninsured?

In the high-stakes world of biotech, where innovation and risk go hand-in-hand, unexpected events can quickly derail a company's trajectory. A product liability lawsuit, a cyberattack, a lab accident – these situations can lead to devastating financial consequences, especially if your biotech business is uninsured. But can you really afford to operate without a safety net?

| Incidents | Cost Without Insurance | |

|---|---|---|

| Misleading marketing | $500,000 – $400 million+ | |

| Wrongful termination | $100,000 – $1.06 billion+ | |

| Fraudulent business practice | $1 million – $1.2 billion+ | |

| Negligence lawsuits | $1 million to $100 million+ | |

| Incidents | Cost Without Insurance | |

|---|---|---|

| Data breach lawsuits | $1 million to $100 million | |

| Ransomware lawsuits | $250,000 to $5 million | |

| Business Interruption lawsuits | $1 million to $100 million | |

| Negligence lawsuits | $500,000 to $10 million | |

- Valeant Pharmaceuticals International Inc. Securities Class Action (Broadridge Report)

- Jones v. Pfizer Inc. Class Action (Robbins Geller Rudman & Dowd LLP.)

- Paul Hennigan v. Merck & Co. Inc. (Justia U.S. Law)

- Decoding the Data: Medical Malpractice Payouts by State (Physicians Thrive)

Partnering with Founder Shield

We’re a risk management partner for high-growth companies across emerging markets, striving to create the most seamless, intuitive, and responsive insurance-purchasing experience powered by proprietary technology and insurance products.

VC backed companies served

Ranked broker in the US

NPS Score (Industry Average = 34)

Insurance Policies Tailored for Life Sciences Companies

Cyber Liability

Cyber Liability

With increasing digitization, many life sciences organizations and science companies are becoming targets for cyber attacks. This can lead to theft of intellectual property, sensitive patient information, and disruptions in operations.

Product Liability

Product Liability

This covers claims related to product defects that might cause injury or harm. Given the potential impact of drugs and medical devices, this is particularly important for life science companies.

Errors & Omissions

Errors & Omissions

This covers companies from claims of negligence, mistakes, and failures in the professional services they provide.

Directors & Officers

Directors & Officers

Directors and Officers Insurance for Life Sciences protects directors and officers from personal losses if they are sued as a result of serving on a board of directors and officers.

Property

Property

This covers the company’s physical assets, such as buildings and lab equipment, in case of damage or loss.

Intellectual Property

Intellectual Property

This provides coverage for legal fees and damages related to intellectual property disputes.

Clinical Trials Liability

Clinical Trials Liability

This provides coverage for bodily injury arising from the testing of medical products on human subjects.

Employment Practices Liability

Employment Practices Liability

This coverage protects companies from the financial risks associated with employment-related claims. This coverage can be vital in an industry with a highly specialized workforce and complex legal landscape.

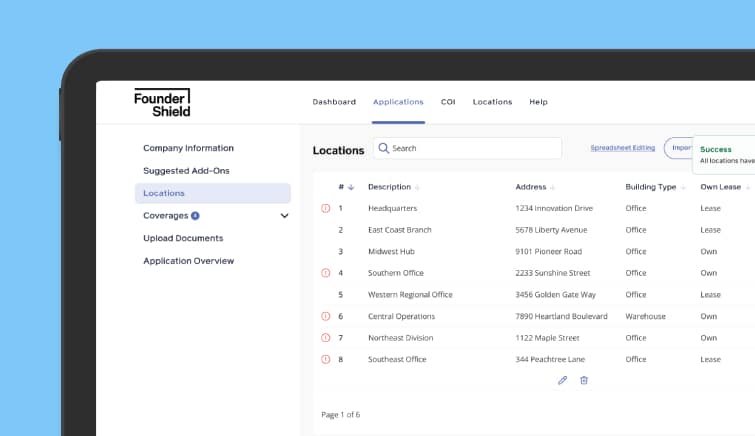

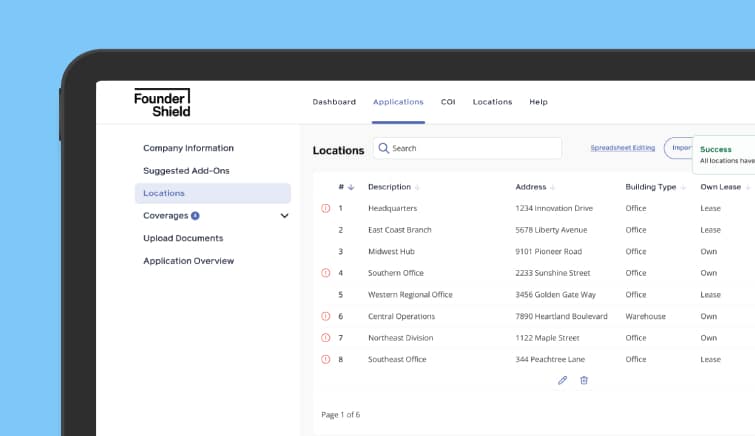

End-to-End Digital Policy Management

We utilize our technology platform to streamline the application & renewal process and automate all back-end document generation and carrier API connectivity to balance the customer experience with maximum quoting reach.

Claims Advocacy

In-house claims advocacy team of lawyers to ensure optimal outcomes when your insurance package is needed most: claims situations.

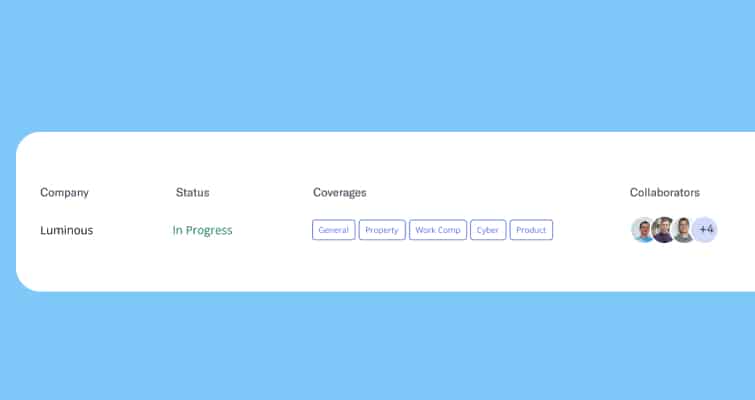

Smart Insurance Governance

Our platform is designed to scale with you. Invite your finance, collaborate on the application in real-time with your vendors, and see how your program compares with your peers.

Schedule Time with a D&O Expert

Risk Calibration

Let’s figure out if you’re under- or over-insured and whether your current policies have detrimental gaps.

Identify Cost Savings

We’ll compare your current coverage costs against industry standards to help optimize premiums and reduce unnecessary expenses.

Risk Roadmap

Receive a tailored risk management plan to address specific liabilities, keeping your company protected as it grows,

Client Case Studies

Another broker quoted a SaaS logistics platform their Directors & Officers insurance at $50,000. We quoted and saved them 42% via our in house MGA, landing on a budget-friendly $35,000 premium

An NFT developer came to us from a different startup-focused broker, asking for a D&O and E&O/Cyber quote. We delivered them a 40% total savings.

When a blockchain infrastructure company needed a D&O limit increase, we provided coverage for a similar amount at a $2M limit as another broker could at only $1M.