Business Insurance for E-Commerce

Founder Shield protects e-commerce companies with tailored insurance policies designed to mitigate the risks that come with rapid growth — so you can focus on growing your business.

Why you need E-Commerce insurance

Running an online store comes with its own set of headaches that physical shops just don’t deal with. Think data breaches, website crashes, shipping nightmares, and those dreaded product liability claims that can pop up out of nowhere. One bad incident can drain your bank account and trash your reputation overnight. This is exactly why e-commerce insurance matters — it’s your safety net when things go sideways, protecting everything you’ve worked so hard to build.

Shields Against Supply Chain Disruptions

Shields Against Supply Chain Disruptions

Safeguard your business from unexpected events like supplier bankruptcies, natural disasters, or geopolitical conflicts that can impact inventory availability and delivery times, ultimately affecting customer satisfaction and revenue.

Guards the Company from Costly Legal Claims

Guards the Company from Costly Legal Claims

Protects against lawsuits arising from product liability, customer data breaches, intellectual property disputes, or contractual disagreements, helping to preserve financial stability and brand reputation.

Ensures Compliance with Evolving Industry Regulations

Ensures Compliance with Evolving Industry Regulations

Compliance includes adhering to data privacy laws like GDPR and CCPA, and staying current with emerging AI regulations that address algorithmic bias and consumer protection in online transactions.

Protects Against Emerging Risks in the Industry

Protects Against Emerging Risks in the Industry

This encompasses evolving threats like AI-related liabilities, climate change-induced disruptions, or novel forms of cyberattacks that traditional insurance policies might not fully address.

Partnering with Founder Shield

We’re a risk management partner for high-growth companies across emerging markets, striving to create the most seamless, intuitive, and responsive insurance-purchasing experience powered by proprietary technology and insurance products.

VC backed companies served

Ranked broker in the US

NPS Score (Industry Average = 34)

Insurance Policies Tailored for E-Commerce Companies

Cyber Liability

Cyber Liability

E-commerce businesses handle tons of customer data, making cyber insurance essential. It protects against lawsuits from data breaches and hacking incidents while covering recovery costs. With cyberattacks surging since the pandemic, online retailers need both stronger security measures and proper insurance coverage.

Product Liability

Product Liability

Product liability insurance covers e-commerce companies from financial losses from lawsuits alleging their products caused bodily injury or property damage. This policy helps companies pay for lawsuit costs and any damages awarded to plaintiffs.

Property

Property

If company property is damaged or ruined in a fire or even a burglary, commercial property insurance responds. This policy reimburses e-commerce companies for direct property losses, supporting recovery and momentum.

Transit & Transportation

Transit & Transportation

This policy protects e-commerce companies from financial losses resulting from the loss or damage of products while they are being shipped. It also helps companies reimburse their customers for lost or damaged packages and replace lost or damaged inventory.

Errors & Omissions

Errors & Omissions

E-commerce businesses can face claims when products don’t meet expectations or services fall short. Errors & Omissions insurance protects online retailers when customers allege misleading descriptions, inaccurate advice, or service failures. It covers legal fees and settlements that could otherwise devastate a growing business, giving owners peace of mind to focus on growth rather than potential lawsuits from disappointed customers.

Directors & Officers

Directors & Officers

Directors and Officers insurance shields business leaders when their decisions come under fire. For e-commerce companies, D&O coverage protects executives from personal liability if stakeholders claim mismanagement, compliance failures, or poor financial oversight. This protection is crucial for attracting top talent and securing investor confidence, especially in the fast-paced online retail space where rapid growth decisions can later be questioned.

The Cost of Being Uninsured

| Incidents | Cost Without Insurance | |

|---|---|---|

| Selling recall products | $100,000 to $5.7 million | |

| False advertising | $50,000 to $28 million | |

| Design defects | $1 million to $46 million | |

| Data privacy breach | $1 million to $1 billion | |

- Consumer Product Safety Commission’s News Release 2017

- Thomson Reuters Legal Article

- Consumer Reports News Article

- 2022 Cybersecurity and Data Privacy Litigation Trends Report

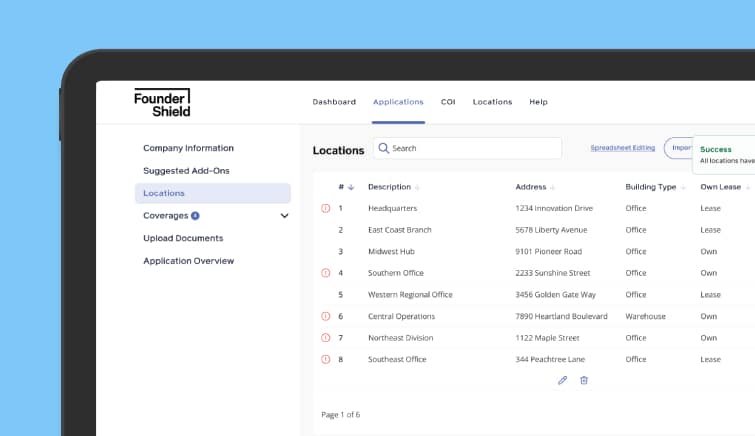

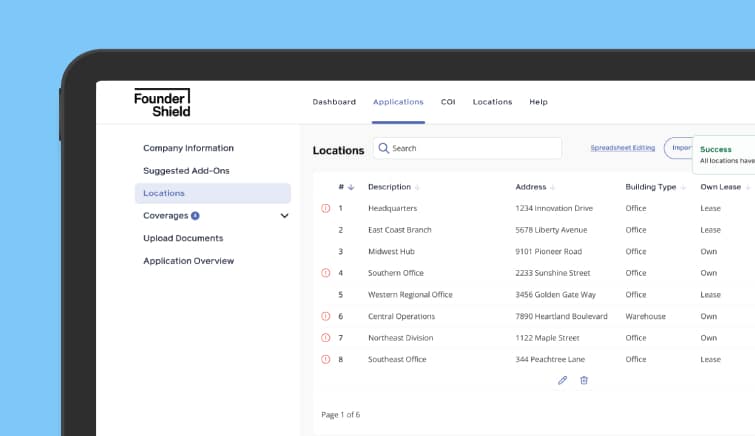

End-to-End Digital Policy Management

We utilize our technology platform to streamline the application & renewal process and automate all back-end document generation and carrier API connectivity to balance the customer experience with maximum quoting reach.

Claims Advocacy

In-house claims advocacy team of lawyers to ensure optimal outcomes when your insurance package is needed most: claims situations.

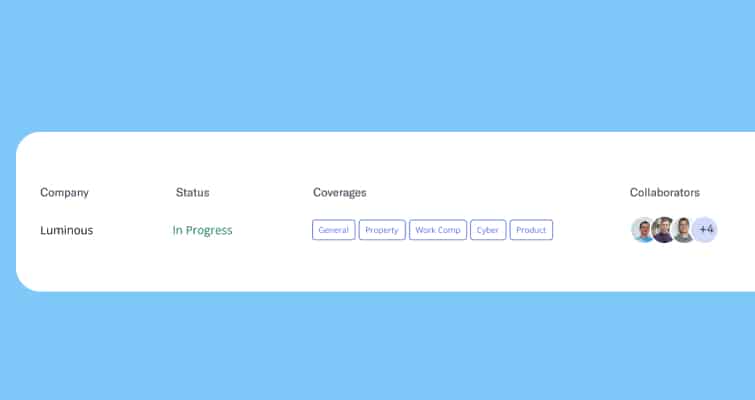

Smart Insurance Governance

Our platform is designed to scale with you. Invite your finance, collaborate on the application in real-time with your vendors, and see how your program compares with your peers.

Client Case Studies

Another broker quoted a SaaS logistics platform their Directors & Officers insurance at $50,000. We quoted and saved them 42% via our in house MGA, landing on a budget-friendly $35,000 premium

An NFT developer came to us from a different startup-focused broker, asking for a D&O and E&O/Cyber quote. We delivered them a 40% total savings.

When a blockchain infrastructure company needed a D&O limit increase, we provided coverage for a similar amount at a $2M limit as another broker could at only $1M.

Schedule Time with an E-Commerce Expert

Risk Calibration

Let’s figure out if you’re under- or over-insured and whether your current policies have detrimental gaps.

Identify Cost Savings

We’ll compare your current coverage costs against industry standards to help optimize premiums and reduce unnecessary expenses.

Risk Roadmap

Receive a tailored risk management plan to address specific liabilities, keeping your company protected as it grows,

E-Commerce Risk Management Guides

Etsy Seller

Founder Shield’s eBay Sellers Insurance is a holistic approach to protecting your eBay business from the uncertainties of online selling.

eBay Seller

Founder Shield’s eBay Sellers Insurance is a holistic approach to protecting your eBay business from the uncertainties of online selling.

Shopify Seller

As a Shopify seller, you know that unexpected events can happen at any time. That’s why it’s important to have the right insurance coverage in place to protect your business from financial losses.

Amazon Business

Despite not having a physical store, Amazon sellers must get liability insurance to protect their business from unexpected financial losses.

DTC Seller

Our insurance policy is carefully curated to fit your direct-selling business needs and safeguard you as you venture into this dynamic industry.

Subscription Box

Founder Shield offers tailored subscription insurance, which is as innovative as the products you plan to deliver to your subscribers’ doorsteps.