Key Takeaways

After one of the most volatile years in history, we breathe a collective sigh of relief as COVID-19 vaccines roll out. However, none of us can deny the damage this pandemic has done to our lives — and in the bigger picture, what it’s done to the global markets and corporate leaders. It’s no surprise that political, social, economic, and ecological upheaval has significantly impacted the D&O insurance market. Let’s look at D&O pricing trends for 2021 and how we measured up to our 2020 predictions.

What Affects D&O Premium?

Let’s look at some fundamental insurance influences before we dive into the unique economic ebb and flow borne from 2020. Many factors impact D&O insurance premiums; however, the following elements historically affect this particular cost:

- Company size

- Number of employees

- Specific industry

- Market trends

- Management experience

- Business ownership structure

- Years in business

- Operating costs

- Business scope

- Company’s financial security

- And, as we will see below, claims

Naturally, plenty more outlier factors have sunk their teeth into the D&O market. For one, the virus has caused many consequences for the insurance, banking, and financial industry, to name a few. The COVID-19 pandemic may have shaped D&O premium costs more than anything else this past year. We may not know the extent of its impact for months or even years to come.

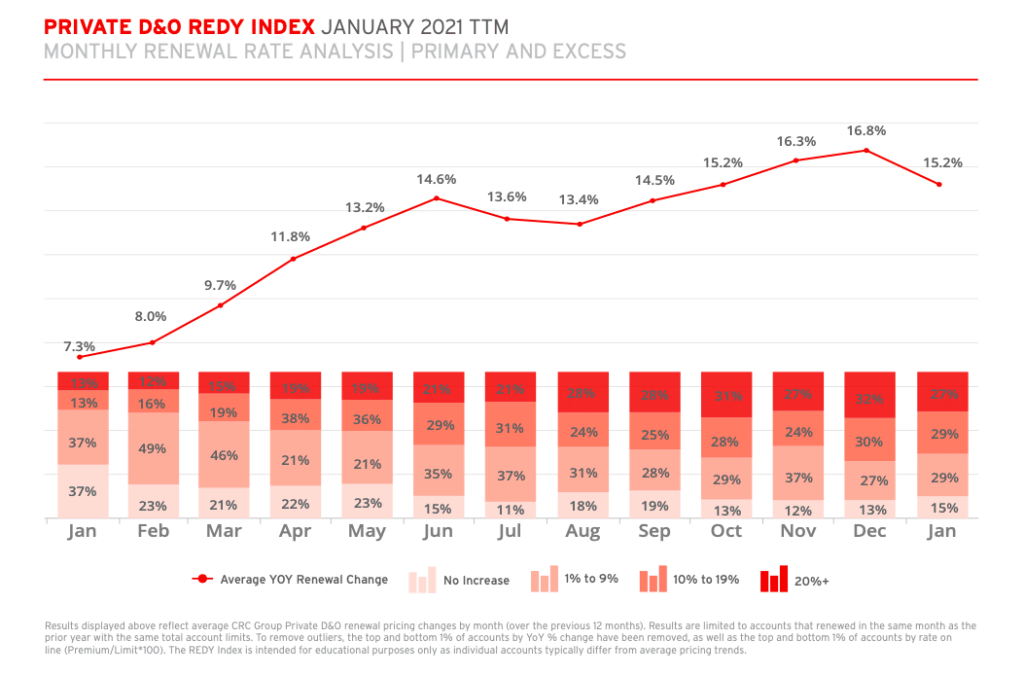

As we see in the following graph, the average YOY renewal change shift is evident. Over 55% of D&O insurance rates increased by 10% or more. That said, only a measly 15% remained the same — a trend we may not experience again for a while.

Although the pandemic’s fallout is the most prominent issue the D&O market faces, we haven’t lost sight of other emerging problems that we’ll navigate in 2021. The US presidential election presents us with new regulatory challenges, including potential policy lapses or oversight. Plus, the London InterBank Offered Rate (LIBOR) discontinuation could result in mounds of questions and confusion come renewal time.

Additionally, Environmental, Social, and Corporate Governance (ESG) considerations are currently standard in lending decisions — a topic that deserves our attention. That said, it’s often risky to support specific ESG intentions without follow-through action, mostly because of the risk it creates. These factors, and plenty more, serve to carve out D&O market challenges for the upcoming year.

How Much Has D&O Pricing Changed?

Before 2019, the majority of D&O renewals went relatively smoothly. Contract terms were uniform, and pricing was stable with a healthy competitive edge. Like any part of the insurance industry, market cycles change from soft to hard and back again routinely.

Unsurprisingly, D&O pricing has experienced a swift shift from a soft market to a hard market since 2019. Underwriting became more restrictive, coverages are less expansive and cut back, and we witnessed premiums shoot upward — some increases ranged from 15% to 50% in many industries. In 2020, the situation became more intense, and we expect the hard market to continue well into 2022.

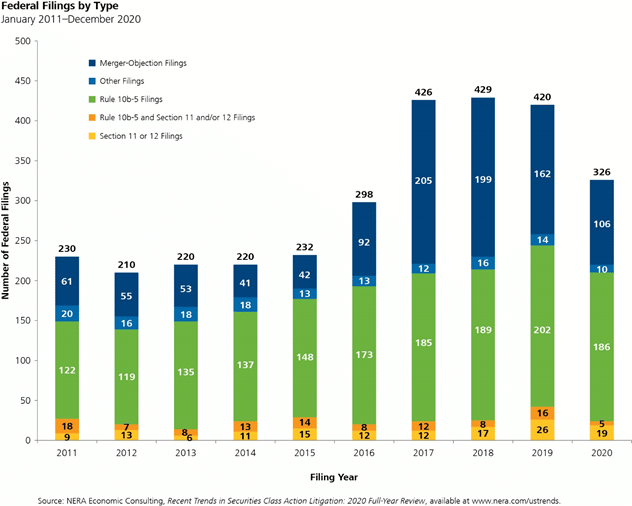

Many businesses had to make stark choices to afford coverages: adjust coverage limits, increase retentions — or both. We won’t be surprised to see these challenges continue to unfold this year. But why? For starters, securities class action lawsuits have hit a record high, not to mention their settlements are astronomical. Lastly, the number of derivative action claims keeps sloping upward.

High-Profile D&O Suits

Compared to the previous years, the number of securities class action lawsuits has declined — but still above the annual historical average. Kevin LaCroix, Executive VP of RT ProExec, reports that 324 federal court securities class action lawsuits were filed in 2020, a 20% decline from 2019. The decline is likely due to a lull in lawsuits during the initial COVID-19 outbreak and again during the second pandemic wave, not to mention courts being closed during some of the 2020 shutdowns.

Early in 2020, at the start of the pandemic, the D&O market experienced two significant and early securities class action lawsuits. Both cases surrounded stock drops; however, many of us predicted COVID-19 to spur on derivative litigation, mostly alleging mismanagement during the outbreak. But let’s back up and review these two stock drop cases.

Norwegian Cruise Lines

When a Norwegian Cruise Lines (NCL) shareholder filed a securities class action lawsuit against the company due to the stock drop, most of us viewed this as the trickle before the flood. Thanks to COVID-19, cruise lines suffered tremendous losses: sustained quarantines, operation suspensions, and severe stock drops.

Inovio Pharmaceuticals

As the legal floodgates opened, another shareholder alleged Inovio Pharmaceuticals of misrepresenting its COVID-19 vaccination. The stock spiked due to promises to start human testing and dropped sharply when those promises were abandoned. Naturally, the shareholder followed suit by filing a stock drop securities class action lawsuit against the pharmaceutical company.

The D&O Market Results for 2020

Although we don’t claim to predict the future, some signs of upcoming happenings are too clear to miss. Back in 2019, here’s what we saw unfolding in 2020 — let’s see how closely our predictions played out compared to reality.

D&O Rates Will Keep Climbing

It’s never pleasant to forecast climbing premiums — but that’s exactly what we did. And unfortunately, D&O rates continued to climb throughout 2020. We mentioned that large private companies, such as Juul or WeWork, would experience more significant hikes than small-cap companies. However, as we mentioned earlier, plenty of small businesses still struggled to navigate the rising D&O premium costs.

Lawsuits Will Be Filed

The COVID-19 pandemic fast-tracked this prediction to the extreme. When we mentioned that plaintiffs would look for clever ways to bring a lawsuit, we didn’t think the fish would jump right in the fishing boat. Lawsuits alleging mismanagement during the pandemic were front-page news nearly every day. Litigation in 2020 was anything but calm or pushed to the back burner. If predictions could hit a target, we’d call this one a bullseye.

D&O Protection Is Two-Fold

Not even a dreadful pandemic could take away the two-fold protection D&O coverage offers. When a board of directors is found in the wrong, this policy typically covers against a plaintiff verdict and helps furnish a settlement. Also, D&O insurance can cover defense costs for the entity itself as well as the company’s directors and officers. As you may have imagined, 2020 gave D&O insurance plenty of opportunities to put its two-fold coverage to work.

Underwriters May Ride the Pricing Wave

If you can imagine an avid surfer riding a wave on the North Shore of Oahu, that’s likely how commercial insurance underwriters felt this past year. The industry chatter about the hardening market unfolded, and underwriters felt the pressure to get tougher. Because of how many large private companies handled their affairs in 2019, most underwriters pegged the premium increases as justified — and we can’t say that we blame them.

Directors & Officers Insurance Benchmarking

The D&O Market Outlook for 2021

Amid a hard market, let’s look into the future to see what we might expect from the D&O market in 2021.

D&O Pricing Increases

Most public companies in the US experienced an increase in D&O costs. And America isn’t alone in this trend. D&O pricing in the UK and Australia is up, as well. Public and private companies alike will continue to face narrow coverages and learn to live without specific coverage enhancements.

What’s more, insurers will take more aggressive approaches in pricing and coverage because of limited competition. Industries with unique risks, such as life sciences and tech companies, might face challenges finding coverage. And preparing for an initial public offering (IPO) could be more of a bear than it typically is as companies are forced to navigate a hard D&O market.

Waves of Derivative Litigation

The COVID-19 pandemic undoubtedly strained companies undergoing IPOs in 2020 — but it didn’t slow down progress. More companies launched IPOs in 2020 Q3 than in any other time frame since 2000.

Still, underwriters are highly cautious, embracing significant concerns with specific exposures. We won’t be surprised to see insurers scrutinizing companies going public this year.

Historically, Side-A coverage typically safeguards companies against derivative settlements. Not only has this coverage been available in the past, but it’s also been budget-friendly. Thanks to the pandemic, derivative litigation won’t be a stranger in 2021. Although D&O pricing is increasing, waves of derivative litigation will ensue, which will only cause more pricing increases — perpetuating an ongoing (and unpleasant) cycle.

Pandemic-Induced Cyberattacks

The novel coronavirus sent hundreds of thousands of employees away from their traditional office environment to tackle careers from workspaces at home, even if it meant working at a kitchen table. Aside from the age-long debate surrounding productivity, this newly launched remote working style opened up multitudes of cyber exposure.

Furthermore, on January 16, 2020, the FDIC and OCC issued a Joint Statement on Heightened Cybersecurity Risks. This statement’s goal was to bring to the forefront cybersecurity risk management principles. There’s a chance in 2021 that banks, financial institutions, and other organizations will face worst-case scenarios regarding cybersecurity.

ESG Concerns

It’s safe to say that, to some extent, society is changing. Diversity, climate change, and a greater overall awareness top most activists’ list. Shareholders want directors and officers to make socially responsible decisions — and they demand follow-through.

At the board level, ESG activists will call out empty promises and lack of corporate accountability. Whether it’s reducing their carbon footprint, enacting environmental-friendly policies, or moving towards more inclusive BoDs, insurers worry about how D&O policies will respond to ESG issues.

As we gear up for another riveting year in the insurance industry, we encourage companies to embrace various solutions for dealing with a hard market. For starters, expect renewals to be unlike any other year. Start this process early and prepare to face challenges. Communicate extensively with your broker about your risk appetite, financial capabilities, limits, and retentions.

Founder Shield’s Outlook

“As many have predicted, the publicly-traded sector first felt the hardening of the D&O Insurance market. Even more so, newly public companies, whether via traditional IPO or SPAC, felt the brutal hit on the private D&O market. What’s more, even “clean,” well-capitalized, and financially sound private companies have been hit with pricing increases of 10%-25%. As with any hard market, this has paved the way for several new entrants in the space. Particularly technology-focused MGAs aim to ease the underwriting process and win business away from the traditional players in the space.”

— Kyle Jeziorski (EVP, Broking Manager)

“Generally, there is an inverse relationship between economic conditions and D&O premium rates (as the former falls, the latter rises). The pandemic’s impact, coupled with business closures and significant hits to commerce, also means fewer surviving companies to insure. It feels like an error to solely or largely rely on actuarial models from long past hard market cycles to navigate 2020-2021.

We think that the D&O underwriters who will consistently outperform the market over the next 2-3 years are those who successfully navigate rate increases, price sensitivity, customer needs, and changing economic trends better than their competitors. Look to the future evolution of predictive modeling and AI to assist insurers in ways that have not been seen before. But they shouldn’t let technology overly dictate; the deep-clicks required to understand the evolving hard market need experienced and nimble hands who know where to point the mouse.”

— Jeff Hirsch (Head of Claims and Senior Product Specialist)

Want to know more about D&O insurance? Talk to us! Please contact us at info@foundershield.com or create an account here to get started on a quote.