Directors & Officers Insurance

D&O insurance protects the company and its executives from certain claims made against them. Shareholders, competitors, investors, etc., can sue a company’s directors and officers, putting their personal assets at stake. Directors and officers (D&O) insurance protects these assets from lawsuits alleging leaders of wrongful acts managing the business.

What Is D&O Insurance

Directors and officers insurance, commonly referred to as D&O coverage, is a liability insurance policy that protects the leaders of public and private, for-profit businesses and not-for-profit organizations if legal fees or additional costs are incurred due to a lawsuit. Most of these cases stem from alleged wrongful acts or misleading statements surrounding fiduciary duties or management of corporate assets — but fall under the category of personal liability for directors and officers in a court of law.

This liability insurance protects directors and officers with broader management liability insurance in mind, safeguarding a company’s leadership from personal financial loss. While D&O insurance protects against loss of personal assets, coverage excludes illegal profits or criminal actions. Such entity coverage can also help reimburse a company or non-profit business for the legal fees or other defense costs incurred in justifying such individuals against lawsuits.

Many companies search for D&O insurance because they’re going through an institutional round of funding. However, they may not realize that the policy they’re buying has more utility than only crossing an item off a term sheet to-do list. Private equity firms, venture capital investors, and other investor types want potential portfolio companies to have broad coverage, specifically an active directors and officers insurance policy for two primary reasons.

First, if they’re going to take ownership stake and put someone on your board of directors, they want to ensure their employee is protected from legal liability. Second, if a dispute develops between you and them, the investor wants to know you have the capital required to absorb the legal costs without mortgaging the future of the entire company. In short, such liability insurance is often a non-negotiable term sheet item.

D&O Coverage

Like many commercial lines of coverages, D&O insurance is nuanced, though many people assume it only responds when a company leader is sued. Instead, D&O coverage is a three-part insurance solution covering the company and its executives, benefiting many business types in varying life cycles.

Who Needs D&O Insurance Coverage

D&O insurance is typically the best fit for businesses with high liabilities, those that need to attract quality executive leadership, and businesses with a board of directors. Executives, especially high-quality ones, may expect directors and officers insurance as a prerequisite to protect their personal liabilities before even considering joining your company.

Public and Private Businesses

There are common misconceptions that only public companies should be concerned about the SEC or securities litigation, when in reality, recent settlements demonstrate that privately funded companies can face the same consequences.

Venture-Backed Companies

D&O insurance is required by almost every institutional investor term sheet. The right D&O liability insurance program can bolster your funding efforts and make funding rounds run smoother, preventing financial losses for all parties.

Business with Significant Liabilities

If a business owes more than $1 million to creditors, then it’s critical to have this coverage to protect the business, the directors, and the officers in the event the business goes under. Creditors might point to the company leadership as to the reason they weren’t paid in full, launching criminal and regulatory investigations.

What Does D&O Insurance Cover?

D&O insurance protects the company and its executives if someone sues either or both of them. As mentioned, the allegations against directors and officers run rampant nowadays; however, most cases stem from mismanagement of the company. We recommend consulting your policy documents or speaking with your designated insurance professional to learn exactly what coverage your insurance provides. Nevertheless, there are three layers to D&O insurance worth reviewing, including:

Side A

If a director is individually named in a suit and forced to pay defense costs and settlements. This portion of directors and officers insurance kicks in to protect the individual. Side A will only pay the individual directors and officers if the entity (company) is unable to or the company refuses to indemnify the individual, such as if the company is insolvent or the claim goes against the company by-laws.

Side A Excess

Additional Side A coverage responds if the insured exhausts the rest of the policy. There will typically be a minimum base layer of A-B-C coverage of $5 million, and sometimes $10 million, depending on the company. Excess of $5 million/$10 million will usually focus on Side A coverage.

Side B

When the entity indemnifies individuals named in the lawsuit, Side B coverage reimburses those costs. However, it only extends to indemnifying insured individuals named in the lawsuit.

Side C

This entity coverage provides a balance sheet protection for the company named in the lawsuit alongside an individual executive. Such coverage will reimburse the costs and settlements incurred.

D&O Insurance Policy

D&O Insurance Policies Cover:

How Can I Manage My D&O Policy & Risks?

Company leaders must understand their unique vulnerabilities and purchase adequate coverage. For example, of the top 100 US securities fraud settlements ever, 59% are event-driven. Yet, some company leaders continue to assume such financial losses won’t happen to them and fail to protect their personal assets or even ignore the gravity of their fiduciary duty.

Additionally, although the state typically handles corporate law, private companies must comply with many Securities and Exchange Commission (SEC) regulations. Lastly, the Securities Act of 1933 and the Securities Exchange Act of 1934 renders publicly-traded companies more subject to federal regulation than private companies. The D&O insurance landscape can seem complicated and challenging to navigate, especially with such intimidating regulatory bodies and increasing scrutiny from shareholders.

Managing your directors and officers policy means reviewing your exposures with a seasoned insurance specialist to confirm that you’ve covered all your gaps, with appropriate policy limits. Understanding the risks, market trends, and global happenings affecting insurance and your personal liability is only part of the process.

For example, do you know the average legal fees and defense costs for a company similar to yours? We’re often asked how much coverage an organization needs or how covered claims would look. And the answers are nuanced, requiring an in-depth company review and honest look of the directors and officers. An insurance specialist can help you piece the puzzle together, building a strong D&O coverage tower consisting of the most well-suited management liability insurance available.

What Does A D&O Policy Not Cover?

Other insurance policies, aside from D&O insurance, typically cover the following claims, including:

Additionally, Conduct Exclusions state that any deliberate criminal, dishonest, or fraudulent act should not be covered by insurance and the policies make that clear. Claims involving illegal profits are similarly excluded from coverage. The carrier would have to prove that the act was deliberate if they denied a claim and the insured took them to court. But, if they did prove that the conduct exclusions were triggered, the carrier would want every dollar back that they paid to defend the bad actor. We advocate for language that states that this exclusion isn’t actually triggered; it’s irrefutable that the policy really shouldn’t have been defending them in the first place.

The Major Shareholder Exclusion is usually added by endorsement. It states that if a claim is brought by a shareholder who owns a certain percentage of the company, the D&O policy won’t cover it. Please get in touch to discuss how this may apply to your D&O coverage.

D&O Insurance Cost

All D&O policy forms are not created equal, and leaders must consider several elements. However, optionality is critical when faced with a difficult market from both a limit, retention, and carrier standpoint. When formulating your D&O program, consider your risk tolerance, limits, structure, industry, and coverage needs, as these elements will impact your policy framework.

D&O Insurance Enhancements

Insurance endorsements or enhancements are also known as riders or add-ons. These options modify a commercial policy by adding, deleting, or excluding specific coverage. As a helpful way to customize a public D&O policy, the following are a few standard enhancements:

Additional Side A coverage responds if the insured exhausts the rest of the policy.

Sometimes, shareholders think that a funding round might have “watered down” or diluted their stake in the company.

This endorsement comes into play when shareholders feel dissatisfied with an acquisition offer.

In-house lawyers often become heavily involved in D&O litigation but aren’t typically covered by a standard D&O policy.

Carriers can include a sublimit to help pay for specific class certification investigation costs

Claims sometimes arise from alleged misinterpretation during the preparation period before the going public process.

Many companies experience transitions regularly; however, carriers can drop their coverage if they think too much change occurs.

An extended reporting period (ERP) add-on lets you report claims ever after the policy expires.

How Much Does D&O Insurance Cost?

Often clients will come to us and ask us to provide them cost estimates before diving into their company operations, financials, and cap table. The truth is that directors and officers premiums vary quite significantly, based on companies unique circumstances; however, we can provide ballpark ranges based on our experience. There are a few factors that all underwriters at any insurance company will consider:

- Claims history

- Funding

- Industry

- Revenue and financials

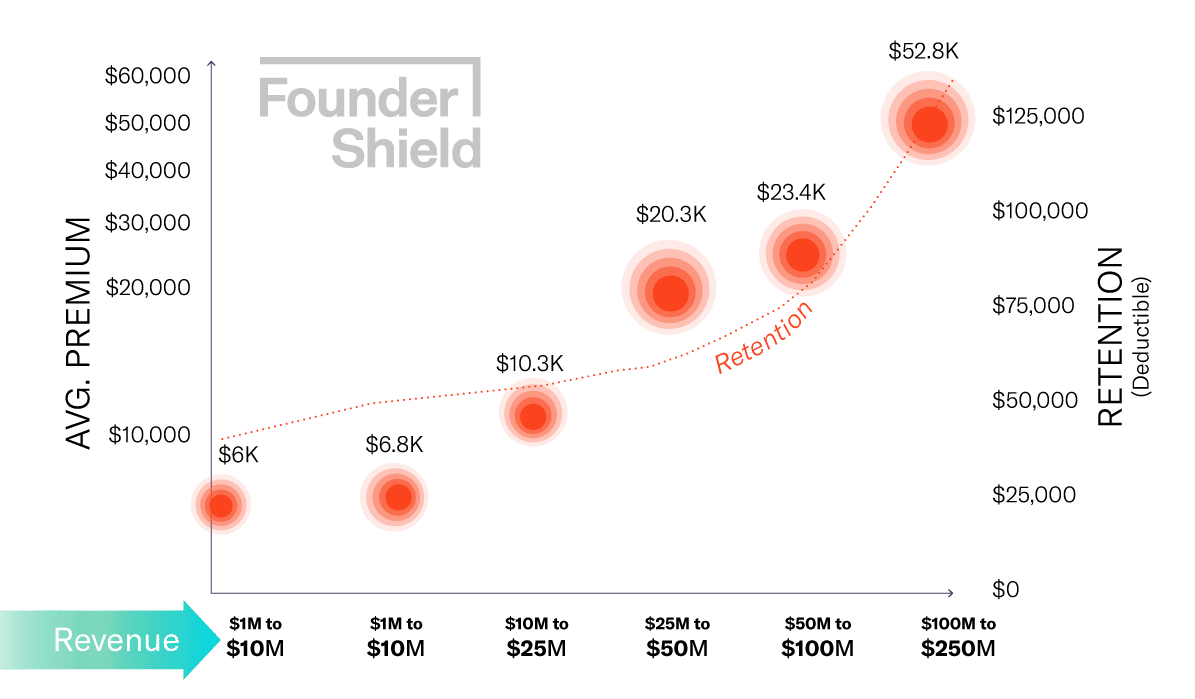

We recently conducted an in-depth analysis of our policy database to provide some Directors and Officers benchmarking guidelines. Check out the graphic below which examines average premium by company size (based on annual revenue), to give you a rough idea:

D&O Insurance Claim Examples

Every company faces unique risks, so we can structure your policy to fill the gaps in coverage with numerous market-leading enhancements

Students filed a class-action suit against an EdTech startup, alleging that the company’s marketing materials misrepresented the accreditation of the startup’s technology to be used in a college classroom. Damages included expenses for additional classes and loss of income for class participants. Legal defense has already cost the company $500,000.

A ride-sharing company received a complaint from an investor, who alleges that the company improperly induced to issue a note payable to the company. Specifically, he alleges the company intentionally exaggerated its forecasted rate of growth and failed to disclose its tax lien. The company defaulted on the note when it failed to make the required principal and interest payments. The investor agreed to accept the company’s offer to convert promissory note to stock in the company, but the defense costs had already exceeded $500,000.

An investment firm bought a fintech company. A short time later they resold the company at a higher price. The angel investors, who have no board seats, are suing the company alleging that the board of directors did not perform sufficient due diligence and undervalued the company. This results in a significant loss for shareholders. The parties settle for $1,400,000.

Students filed a class-action suit against an EdTech startup, alleging that the company’s marketing materials misrepresented the accreditation of the startup’s technology to be used in a college classroom. Damages included expenses for additional classes and loss of income for class participants. Legal defense has already cost the company $500,000.

A ride-sharing company received a complaint from an investor, who alleges that the company improperly induced to issue a note payable to the company. Specifically, he alleges the company intentionally exaggerated its forecasted rate of growth and failed to disclose its tax lien. The company defaulted on the note when it failed to make the required principal and interest payments. The investor agreed to accept the company’s offer to convert promissory note to stock in the company, but the defense costs had already exceeded $500,000.

Insurance Brokers For D&O Insurance

Founder Shield is a data-driven insurance brokerage serving high-growth, innovative industries. We have a passion for creating and developing innovative risk management products across emerging industries and work hand in hand with clients and underwriters to ensure transparency, efficiency, and reliability every step of the way. Our team has specialized expertise and experience in providing D&O insurance services.

We partner with the leading D&O insurance carriers to craft tailored risk management programs for public companies and venture-backed companies preparing for funding rounds. With D&O insurance a major budget item, we understand that companies look for new and creative solutions to help manage increasing costs while also securing best-in-class coverage.

Justin is the market-facing leader at Founder Shield, with eight years invested in the boutique broker and more than a decade in the insurance industry.

D&O Insurance Frequently Asked Questions

Choosing the right D&O limits for your business depends on a number of factors including, Financials, Shareholders, Industry and Revenue. There is no rule of thumb and appropriate limits will vary on a case-by-case basis that depends on the combination of factors. Some companies require only $5m and others need up to $50m or even $500m.

How a company structures its D&O insurance tower is based on its size (market cap). Our team has built towers for as much as $750 million in D&O limits and as small as $1 million. Regarding structure, a fair baseline is 2⁄3 A-B-C coverage and 1⁄3 Side A coverage.

Remember to review your D&O policy—even upon renewal—to ensure you’re getting the coverage you need as one word or phrase can transform an entire policy. Still, here are a handful of common exclusions:

- Breach of Contract

- “Other” Insurance

- Personal Gain

- Discrimination / Wrongful Termination

- Dishonest, Wrongful, Fraudulent Conduct

- Fines, Penalties, and Punitive Damages

- Prior Acts

- Defamation, Libel, and Slander Claims

- Catastrophic Hazards

Aside from the typical exclusions you’ll find on a D&O insurance policy, a handful exist that are often considered “red flags,” such as:

- Conduct Exclusions

- Insured vs. Insured Exclusions

- “Laser” Exclusions

- Antitrust or Competition Exclusions

- Commissions Exclusions

- FTMI Exclusions

The “standard” D&O policy includes all three sides, and most public companies purchase a “tower” of D&O — a primary layer followed excess layers.

- Side A — Protects corporate directors and officers’ personal assets.

- Side B — Reimburses company funds used to indemnify sued individuals.

- Side C — Provides companies with balance sheet protection.

- Side A Excess — Additional Side A coverage responds if the insured exhausts the rest of the policy.