Key Takeaways

If we were surfers, we’d be champions of the not-so-rhythmic tide that is the D&O insurance market. But alas, only one of our fearless leaders, Carl Niedbala, knows his way around an actual surfboard. Still, we’ve noticed some interesting things stirring in the water over the past few months. So, let’s dive into the D&O happenings of Q3 2021 and what we can expect in the future.

Current D&O Landscape

If you’ve watched the D&O market for the past few years or even months, you’ve come to recognize a handful of influential components. While these foundational elements don’t usually change, they tend to fluctuate regarding the level of influence. Nevertheless, the following factors consistently impact D&O pricing trends to some extent:

- Company size

- Number of employees

- Specific industry

- Market trends

- Management experience

- Business ownership structure

- Years in business

- Operating costs

- Business scope

- Company’s financial security

- Claims

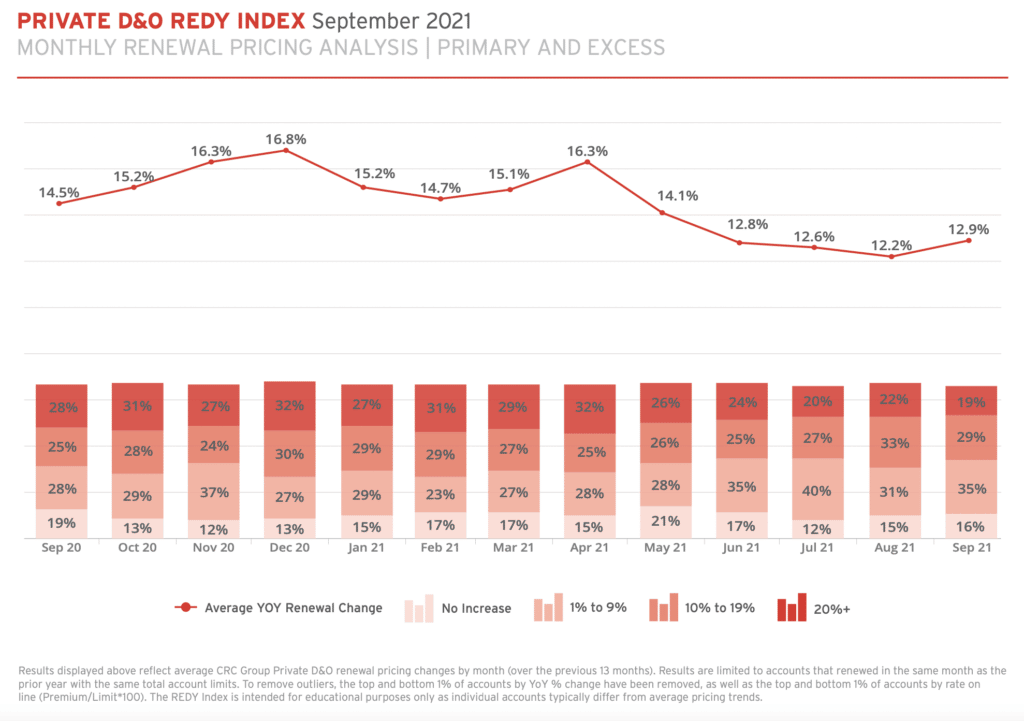

As you can see in the graph below, D&O pricing trends have historically followed a nuanced ebb and flow. What’s more, some industries have been impacted more than others, especially with the uproar in other areas of liability (i.e., cyber, fiduciary, professional, etc.).

Source: CRC Group

Let’s hone in on two litigation factors that are currently sticking out like a sore thumb: company size and industry. These two elements might seem too obvious or simple to play a significant role in premiums — but think again.

Company Size

If the past several years have taught us anything about litigation, it’s that bigger companies face more risk, although their smaller counterparts face plenty of vulnerabilities, as well. For example, private organizations with 250+ employees are more likely to traverse D&O lawsuits as their exposures often mirror public companies.

Although the risks vary from private to public companies, many of the same regulatory bodies govern them, such as the US Securities and Exchange Commission (SEC). In the end, size often plays a more significant role in risk management than status, although both factors weigh in. Effective risk management involves various risk actions, including identifying, assessing, and mitigating potential threats to the organization.

Industry

During the global pandemic, we watched the healthcare and edtech industries take blow after blow. From cyber liability to D&O lawsuits, many private and public companies had to mask up as a comeback-kid. Of course, plenty more industries felt the impact of COVID-19.

Even now, fintech is being pummeled with D&O litigation, and it’s more than mere trickling news about the zero-commission Robinhood stock. On that same note, the healthcare industry is getting a much-needed break from oncoming lawsuits (sort of). However, manufacturers are now a prime target for D&O litigation, cybersecurity cases, and professional liability issues.

Trending D&O Issues

Along with the usual components influencing the D&O market, here are a few issues that we’ve seen surface recently, especially with private companies.

Debt Data

Insurers have started asking more questions about a company’s debt situation. For example, don’t be surprised if an insurer wants to know about your relationship with your debtor, how much you owe, and how quickly you’re paying off the debt. An excellent strategy is to be upfront with your debt story.

D&O Exclusions

It’s not uncommon for D&O exclusions to shift and evolve alongside market trends. Currently, we’re seeing a handful of exclusions surface, so heads up for the following:

- Full antitrust

- Major shareholder

- Biometric

- Security (privacy)

- Extended reporting period (ERP) restrictions

Fiduciary Liability

Jeff Hirsch from Scale Underwriting said it best when he described the past two years as nothing short of a nightmare for underwriters. And this bad dream isn’t over just yet.

For starters, D&O underwriters are undeniably impacted by other areas, especially fiduciary liability, as it’s frequency combined with D&O insurance. Currently, the fiduciary liability market is experiencing a hardening because of excessive fee litigation. As expected, this effect trickles to the D&O market, impacting D&O underwriting.

Unique Risk Profiles

Some companies have a more nuanced risk profile, which makes placing D&O coverage tricky. For example, healthcare has a complicated history. Although much younger than the healthcare industry, fintech and crypto also present unique risks, followed closely by unicorn companies. The real estate market isn’t far behind, either.

Lastly, cannabis is likely the most nuanced of the industries mentioned. Without a significant chunk of history, underwriters tend to shy away from it, leaving cannabis directors and officers to fend for themselves. But we’re working hard to change that with our own AlphaRoot’s new Management Liability Program, which includes:

- Directors & Officers Insurance (D&O) – protects both the company and the individual directors and officers of the company from claims brought against them for the management of the company.

- Employment Practices Liability Insurance (EPL) – protects the company from claims alleging mistreatment of their employees (i.e., HR-related claims).

- Fiduciary Liability Insurance – protects from legal liability should a benefit plan administrator practice improper plan care.

Q4 D&O Vulnerability Outlook

Despite not experiencing many favorable outcomes in 2020, causing 2021 to suffer, we expect 2022 to be different. For one, we will likely see a tap on the brake lights regarding premium increases. Across the board, regardless of size or industry, the increase in D&O plan costs will continue to rise at a much slower pace than the past two years.

As expected, the life science and technology industries will experience the most significant premium upticks. Larger organizations won’t follow too far behind. Companies that have recently gone public via a traditional initial public offering (IPO) or special purpose acquisition company (SPAC) will also feel the pressure of increased D&O premiums.

Although Q4 2021 won’t be a walk in the park, we’re excited to see our clients catch their breath while the market provides the slightest bit of relief.

Understanding the details of what coverage your company needs can be a confusing process. Founder Shield specializes in knowing the risks your industry faces to make sure you have adequate protection. Feel free to reach out to us, and we’ll walk you through the process of finding the right policy for you.

What to know more about D&O insurance? Talk to us! Please contact us at info@foundershield.com or create an account here to get started on a quote.