Key Takeaways

“Going public” is a bold move that can open up your path to capital as well as fuel your company’s future. But it doesn’t come without its own set of challenges. For example, tackling S-1 filings for mid-market companies is often a time-consuming task many professionals would rather skip over.

Since the business landscape is ever-changing, your company must be prepared to evolve with it. This approach means handling your financial statements flawlessly—which is a feat in itself! As a result, we’ve created a step-by-step guide to help ease the process.

Preparing the Registration Statement

The main driver in whether your initial public offering (IPO) company navigates this process gracefully is the strength of your management team. With that said, your management team should play a significant role in drafting the registration statement.

Depending solely on lawyers or underwriters to do the nitty-gritty work may result in an off-centered business view. In short, your management team knows your business aim best, so trust them to guide the registration statement.

There’s no fancy way to put it—preparing the registration statement is complicated, and it typically takes a significant chunk of time. Combing through the requirements calls for precision and accuracy, whereas submission calls for a hefty amount of technical savvy.

It’s not uncommon for your dedicated time frame to extend beyond what you expected, either. After all, relying on your management team, lawyers, and independent accountants doesn’t always go smoothly. Problems arise, and snags happen.

Plus, to present your IPO company as accurately and positively as possible, rushing isn’t an option. It’s during this timetable that your team often uncovers any unknown negative risk factors, including those related to risk in banking. So while adhering to deadlines, a “steady as she goes” mentality is typically the most optimal approach to the entire process.

Sources of SEC Technical Requirements

Reading anything provided by the U.S. Securities and Exchange Commission (SEC) can very well make your head spin. Although you can locate forms and content of registration statement in the SEC rules, it’s often challenging. So, we’ve broken down these SEC tech requirements for you to make “finding things” more manageable.

Regulation S-X serves as the SEC’s foremost accounting regulation. Not only does it detail which financial statements you’ll need for SEC filings but it also provides rules and guidance on the content and form of those statements.

Regulation S-K outlines requirements for the “forepart” of SEC filings or more formally known as the non-financial statement portion of the document.

The Financial Reporting Manual (FRM) contains interpretations concerning financial reporting matters by the Division of Corporation Finance.

Financial Reporting Releases (FRRs) communicate the SEC’s stance on accounting and auditing methodology. These are necessarily the law when it comes to interpreting rules and regulations, especially regarding financial statement disclosures, insurance auditing, or accounting and auditing issues.

Staff Accounting Bulletins (SABs) express the view of the Commission staff on accounting-related disclosure practices. They help to explain specific policies the Division of Corporation Finance and the Office of the Chief Accountant follow—primarily regarding how the disclosure requirements of the federal securities laws are administered.

Compliance and Disclosure Interpretations (C&DIs) include interpretations by the staff of the Division of Corporation Finance. These are not official statements, however, and nor are they hard and fast rules or regulations of the Commission.

Industry guides help you to prepare registration statements. They present SEC policies and practices relating to specific industries, including:

- Oil and gas

- Mining

- Banking

- Insurance

- Real Estate

Regulation S-T dictates how to prepare and submit documents through the Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system.

Pro tip: Since 1996, most documents have been submitted through EDGAR. You can find document copies filed with the SEC via EDGAR at www.sec.gov.

Registration Statement Filing

With the help of your company counsel and underwriter, you can determine which SEC form to use for registration. After all, this particular decision is a legal matter. Of course, the S-1 form is the cardinal registration form for IPOs.

Unlike private companies, an IPO must include all required interim financial information. There are a couple of loopholes, such as:

- An IPO company can request the SEC to waive requirements for specific financial statements, per Rule 3-13 of Regulation S-X.

- Since 2012—under the Jumpstart Our Business Startups (JOBS Act)—an IPO company can qualify as an emerging growth company (EGC), which decreases the required disclosures in the Form S-1.

During the most recently completed fiscal year, a company’s annual gross revenue must be less than $1.07 billion to qualify as an EGC. Other company benchmarks may be required, as well.

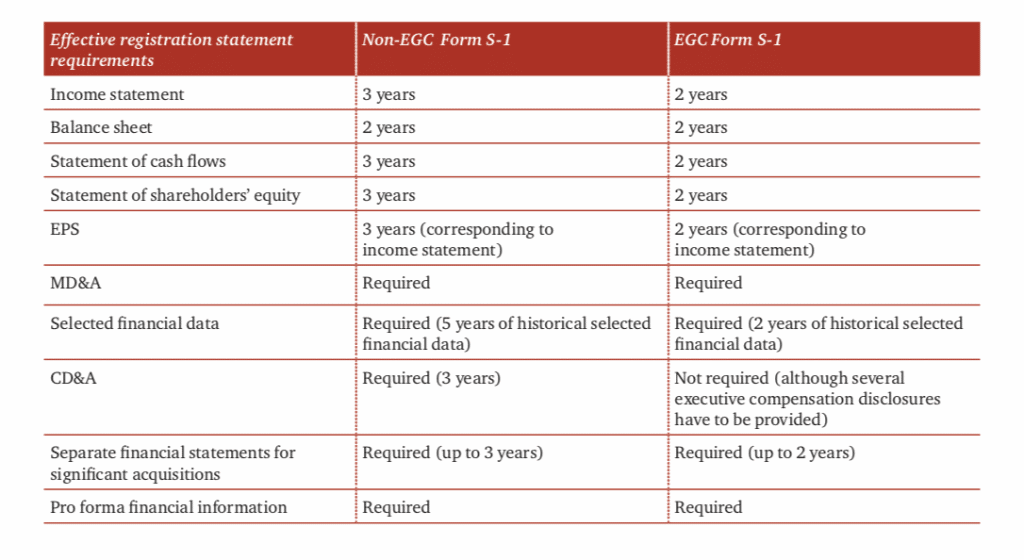

The following chart outlines how EGCs requirements size up against non-EGCs.

The Form S-1 Filing

Two main parts make up the registration statement:

- Part I contains information the prospectus requires. This information may include facts concerning the business operations, financial condition, and management of the company.

- Part II includes additional information the prospectus doesn’t require.

Part I – Information Required in the Prospectus

Prospectus Summary

Also known as “the box,” the summary is likely the most straightforward portion to flesh out. However, it’s also the portion most often reviewed as it reflects the business thoroughly. Mainly, this part calls for a summary describing the company—the general business, security types, estimate and intended use of proceeds, and chief risk factors. A company will also provide its mailing address, phone number, and sometimes a website address, too.

Risks Associated with the Business

It’s vital to disclose any risks specific to the company that might cause speculation. Some typical business risks might include technological changes, the need for additional financing, key management or client dependency, proposed legislation, etc.

Use of Proceeds

All S-1 filings for mid-market companies would be incomplete without IPO companies disclosing how they planned to use the proceeds from the offering. A management team should draft this section cautiously because the SEC will follow up, requiring reports of the actual proceeds disposition after the offering is completed. Any revision will need a valid date, as well.

Dividend Policy and Restrictions

An IPO company must divulge its dividend policy. Also, this section unfolds any anticipated policy changes as well as restrictions on how well the company plans to pay dividends.

Capitalization

The capital structure of an IPO company isn’t a Regulation S-K requirement. However, most companies present a table to display the capital structure before the offering and after all securities are sold.

Dilution

When there’s a significant difference between the IPO price and the net book value per share of assets, dilution occurs. An IPO company must reveal this weakening, and they typically use a table to disclose the information.

Underwriting and Distribution of Securities

The price of the securities an IPO company offers is another needed tell-all. More required information includes the members of the underwriting syndicate, the type of underwriting, and the relationship between the company and its underwriters.

Information About the Company’s Business

Although the prospectus summary calls for a business description, this section demands further details, such as:

- Business plan

- Principal segments, services, products, and markets

- Property description(s)

- Foreign operation information (if applicable)

- Research and development disbursement amounts

- Regulations impacting the industry and IPO company

- Any pending legal proceedings (threats included)

- Various information surrounding revenues, profits, and assets

Financial Information

A company’s advisory accountants are indispensable when it comes to providing accurate financial information. Mainly because the SEC has complicated and incredibly specific rules regarding the financial statements. As well as audited balance sheets and audited statements of income, the SEC will require selected financial information, as well.

Pro Forma Financial Information

As suggested by the name, pro forma financial information is financial statements or tables representing transactions that have occurred already.

Information About the Company’s Directors, Officers, and Principal Shareholders

This section requires a company to list its executive officers and outline their business experience—security holdings, transactions, indebtedness, etc.

Executive Compensation

The SEC requires extensive disclosures on executive and director compensation (and related matters) for the past three years.

MD&A

The management discussion and analysis (MD&A) section requires the management team to address the company’s performance. It’s undoubtedly an area of heavy SEC focus but should point out both favorable and unfavorable developments, such as:

- Results of operations

- Liquidity

- Capital resources

- Off-balance sheet arrangements, aggregate contractual obligations, etc.

- Critical accounting policies and estimates

- Market risks

- Various disclosures

Part II – Information Not Required in the Prospectus

This particular portion of the S-1 filings for mid-market companies is slightly more simplified and includes:

- Disclosures of associated expenses with the issuance and distribution of securities

- Indemnification of directors and officers acting on the company’s behalf

- Sales of unregistered securities in the last three years

- Acknowledgment that the company will keep the registration statement and prospectus current

- Various exhibits and financial statement schedules

Understanding how to navigate S-1 filings for mid-market companies can be tricky, especially if this is all new to you and your team. Founder Shield specializes in knowing the risks your operation faces to make sure you’re adequately protected. Feel free to reach out to us, and we’ll help you identify any unrealized risks and find the right policy for you.

Want to know more about protecting your mid-market company? Talk to us! You can contact us at info@foundershield.com or create an account here to get started on a quote.