Key Takeaways

Biotechnology is a science-based industry, focused on manipulating living organisms to develop commercial products. Although innovation lies at its core, farmers have been dabbling with biotech concepts for thousands of years. In the modern world, though, the industry faces multiple new challenges. Here’s a look at the biotech industry and the risks associated with it.

Biotech Industry Overview

Many individuals assume that biotech began when scientists cloned the first mammal in 1996 — a sheep named Dolly. Despite Dolly’s ground-breaking results, Hungarian engineer Karl Ereky was the first to use the term “biotechnology” in 1919. Even further back, farmers manipulated crops and livestock to produce ideal outcomes. That said, biotech isn’t anything novel.

Biotech relies heavily on technology to catapult ideas and concepts forward. With high-tech equipment and brilliant scientists at the helm, this industry has entirely changed its approach to drug development. Unsurprisingly, medical biotech revenues exceed $150 billion yearly. Agricultural and other biotech sectors aren’t far behind.

Industry Breakdown

Four main sectors exist in the biotech industry, which includes:

- Bio-health: Companies in the bio-health sector focus intensely on medical research and development (R&D). Designing new drugs quicker and more effectively is the primary goal. Instead of marketing or selling products, bio-health remains active “behind the scenes,” catapulting foundational research to product launch.

- Agri-biotech: The cloning of Dolly encapsulates what this sector does best — ground-breaking innovation. In addition to livestock development, gene modification helps agri-biotech improve crops, as well. Farmers worldwide find much success, harvesting transgenic and bioengineered crops.

- Bio-energy: By examining and learning about natural environments, the bio-energy sector solves environmental problems. This portion of biotech studies microorganisms to create more sustainable practices across the globe. Thus, preserving the world by decreasing pollution and environmental harm.

- Bio-industrial: This sector uses crops and other unpalatable raw materials, transforming them into edible food. Furthermore, the bio-industrial area works to extend food’s shelf-life by developing original packaging and product storage.

In the dynamic realm of the biotech industry, challenges are abundant, ranging from regulatory hurdles and navigating complex clinical trials to skeptics casting doubt. Dealing with risk is inherent to this landscape. Yet, within these challenges lies the opportunity for discovery and progress. The biotech industry not only acknowledges but embraces substantial risks as the catalysts for innovation and advancement.

Biotech Risk Management Guide

Biotech’s Legal Climate

Understanding the biotech basis helps make sense of the barrage of legal issues the industry must navigate.

Regulatory Bodies

Designing new drugs is the biotech industry’s primary objective. However, the pipeline to this achievement is incredibly slow and tedious, thanks to the US Food and Drug Administration (FDA). It’s the main regulatory body and serves as the gatekeeper for this industry. The FDA allows nothing to the market without undergoing a rigorous testing process first, earning it the reputation of being “the most stringent in the world.”

One main goal of this federal agency is to release safe and effective drugs. As a result, the FDA consults numerous experts on advisory committees for more profound drug safety information. Aside from its tough rap, though, the FDA is also known for its constantly changing requirements and regulations.

Naturally, these dynamics pose plenty of risks for biotech companies that review thousands of compounds every year to find a successful drug. R&D is challenging enough, let alone appeasing such tight-knit regulatory bodies.

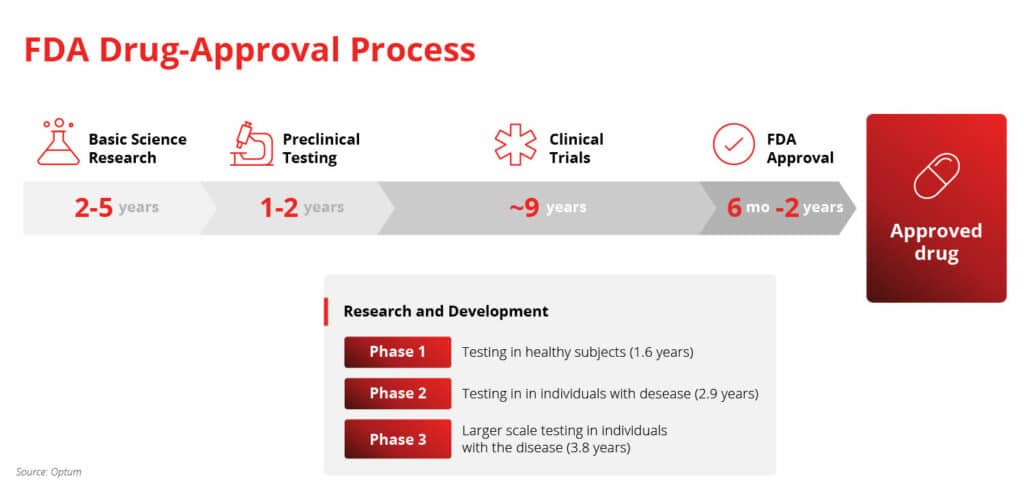

FDA-Approval Process

The average timeline for a new drug, from initial discovery to market release, is 14 years. As mentioned, this pipeline is incredibly lengthy, as well as strict. What’s more, of the thousands of compounds scientists discover in pre-clinical trials, only one out of every 5,000 makes it past the first few steps. Furthermore, the FDA will typically only approve one of those five compounds.

Receiving an FDA-approved status is nearly impossible. Some biotech companies don’t have what it takes to navigate the FDA-approval process. Who’s to blame them? The whole debacle is risky — but times are changing.

The idea of fast-tracking new or repurposed drugs is surfacing in biotech circles. Novel viruses challenge the traditional FDA processes, especially with the world waiting for some treatment. Consider the UK-based healthcare startup, HealX. This record-setting company developed a drug for Fragile-X in under 18 months.

Despite fast-tracking not being standard, HealX does give rise to hope for a quicker FDA-drug approval process. And yet, the testing stipulations only continue to steepen. A potential drug underwent 30 clinical trials involving 1,500 patients in the early 80s. By the mid-90s, the patient pool shot up to nearly 5,000 while the number of clinical trials doubled.

Patent Cliff

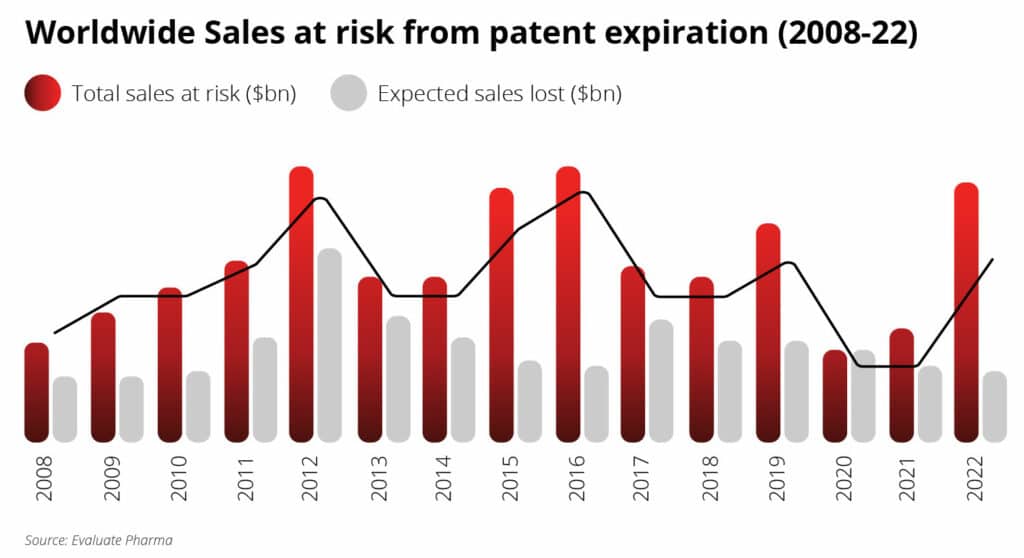

Keeping biotech’s engine of innovation purring requires some severe limit-setting. Typically, patents for drugs only extend for 20 years. This approach prevents dominant cash-cow companies from milking the market indefinitely.

Patents work as a property right and often surround a broad range of claims. Therefore, only after a patent expires can competitors make and market a generic product at a discounted price. Many companies will face expiring patents in the coming years. The term “patent cliff” refers to the drop in revenue these companies will likely experience.

Multiple patents are due to expire between 2019 and 2024, causing a global prescription drug sales loss of up to $198 billion.

Solutions to Biotech Risks

Besides navigating legal hold-ups and vulnerabilities, the biotech industry must also face several risks head-on — but not without corresponding solutions.

Protecting Clinical Trial Momentum

Of all the multiple clinical trial stages, every single one has a primary goal: securing FDA approval. Achieving this highly-desired status is more of a leviathan than anything else. But plenty of biotech companies pursue it, enduring grim challenges along the way — and insurance products support this extraordinary effort from many angles.

But let’s back up; in terms of success, the numbers are bleak. Nearly 36% of compounds disappear during the preliminary stage, 60% don’t progress past the intermediate stage, and 40% outright fail in the final stage. But that’s not the end of the hardships.

With an average timeline of 14 years, biotech companies must carve out a significant chunk of their budgets, time, and energy. Not to mention, this lengthy pipeline eats away at patents (and patience), too. The entire drug development journey complicates an already challenging situation for biotech companies — some can’t endure the extended process without help.

Lastly, although the biotech industry thrives on innovative technology, it also relies on plenty of digital data. This approach makes patient privacy a massive concern. Around the world, the average price tag of a data breach mounts $4 million. It’s a top priority for biotech companies to protect personal information. Whether during clinical trials or employment, cybersecurity is crucial.

That said, the patient testing pool keeps growing as clinical trials change procedures, which produces more vulnerable data. Despite the intense challenges biotech companies face, they continue to push forward. After all, insurers enable them to do so by protecting the ground already covered.

For starters, insurers protect digital health records and personal data during clinical trials, helping to secure the momentum of the clinical trials process. Cyber insurance can’t produce a successful chemical compound, but it can undoubtedly guard the research leading up to success.

Safeguarding Models of Development

Despite the high price tag of getting a new drug from initial discovery to FDA-approval status, venture capital is pouring into the Biotech industry. Also, mergers and acquisitions are a driving force behind biotech’s success. The challenge isn’t only to secure funding; it’s when to launch a campaign as many VC firms favor biotech companies with several compounds in Phase 2 clinical trials.

Adding to the money issues, consider the cost of playing in the game of healthcare, in general. Simply said, it costs a pretty penny, which often dissuades companies from participating in this market. After all, developing a new drug costs around $2.5 billion. Contending with medical expenses and additional costs is often too much to ask of some biotech companies.

Additionally, it takes a highly educated and specialized workforce to keep the innovative engine of biotech purring. Employee lawsuits only delay progress — but a well-suited employment practices liability insurance (EPLI) policy can help protect developmental models.

Moreover, biotech companies typically utilize high-end equipment to develop new treatments during the R&D phase and clinical trial stages. What’s more, most state-of-the-art equipment is fragile and usually challenging to replace. Lamentably, without this equipment, productivity slows significantly or stops entirely. Insurers know and understand these unique risks and offer solutions to support ongoing production.

As a result, insurers offer property insurance to reimburse for the covered property that was damaged or stolen. This coverage helps biotech companies to continue novel drug development without fear of essential equipment delays or processes.

Protecting Company Leadership

Founders and board members each have a unique appetite for risk. While some leaders can stomach loads of risk, others can only handle small amounts. In the biotech industry, the palate for risk is often superbly high. Naturally, this taste for risk tends to trickle down from the C-suite to every team member. However, risk appetite frequently impacts the ethics of the business, as well.

Each member of society responds differently to popular biotech practices, such as gene mutation and crop cloning. Some individuals are supportive, while others vehemently oppose these actions. Navigating ethical issues in such a forward-thinking industry is a delicate undertaking that influences reputation and funding potential. These are the potential ethics issues company management must face regularly.

Besides dealing with typical “slip-and-fall” claims, biotech executives must also make actionable decisions in an ever-changing industry. This added stress and the ongoing unique PR exposure — especially during the COVID-19 health crisis — make biotech leaders smell of blood in a shark tank.

Our litigious society puts company leaders more at risk, filing lawsuits at the drop of a hat. The continual rise of securities suites filings are proof of this mindset. Company leaders made vital decisions every day, from common business operations to crucial financial moves. Directors and officers (D&O) insurance protects individual executives from personal liability as a result of a professional decision or action. D&O is standout coverage, protecting company leadership from claims made against them. It defends against specific lawsuits and any following judgment or settlement.

Securing Rapid Advancement

Despite biotech’s slow-moving pipeline, this industry continues to advance rapidly. It produces new technology and novel drugs quickly. However, regulations and rules can’t keep up with biotech’s pace. Biotech companies battle outdated laws continually. This lag only leaves room for confusion and uncertainty.

Additionally, instead of biotech companies relying on traditional chemical compounds to create novel drugs, most depend on highly regulated and uncharted developmental paths. Technological advances, such as protein engineering and cloning, continue to support ongoing transformation.

Unfortunately, revolutionary improvements make it tough to comply with regulations and rules continually influx. What’s more, many laws are heavily outdated — but non-compliance still means paying fines, fees, and penalties.

Insurers offer equally revolutionary protection by staying a step in front of the regulatory bodies. A robust risk management plan, including a foundation of general liability coverage and professional liability insurance, works to protect biotech companies against various vulnerabilities.

Maintaining Workplace Safety

Dealing with the vast unknown is part of biotech’s attraction and flare. Whether it’s a new drug compound or up-to-date technology, this industry’s primary concern is safety. Sadly, bioterrorism has become unsettling, as well. Facing threats of this magnitude means finding unique solutions.

Unsurprisingly, biotech companies must manage various safety concerns, from harmful chemical exposure to experimenting with dangerous elements. Throughout product launches, expansion, funding rounds, this industry prioritizes safety.

Fortunately, several insurance policies offer reliable solutions for challenging safety situations. Getting delayed by lawsuits and safety compliance issues are real problems the biotech industry must mitigate regularly.

Furthermore, biotech companies manage the highest attrition rate during the most substantial part of their drug development operation: R&D. If the elongated time frame was challenging enough, this industry continually manages the potential loss of its most vital assets.

Understanding the details of what coverage your company needs can be a confusing process. Founder Shield specializes in knowing the risks your industry faces to make sure you have adequate protection. Feel free to reach out to us, and we’ll walk you through the process of finding the right policy for you.

360 Risk Assessment