Key Takeaways

Successful multi-million companies often have humble beginnings. But if you are reading this and are well on the way to receiving C-stage funding, the J curve might seem like a distant memory. You are now moving into new markets and considering acquisitions: Just a rocketship searching for its rocket fuel.

We previously discussed Series A and B funding, but Series C+ gets slightly more complicated. Established companies with larger-scale operations looking for this late-stage funding attract a plethora of firms and individuals: late-stage venture capitalists (VCs), private equity firms, hedge funds, banks, and early stage VC funds.

A relatively low number of startups make it to this point, meaning the amounts raised also vary hugely and are determined on a case-by-case basis. Other companies may take their fundraising to Series E (or beyond) before being acquired or going public — and the truth is, there’s a ton of flexibility when you’ve reached this stage.

Although VC funding to US-based companies thrived despite the pandemic, late-stage funding VCs are getting pickier: They are preparing their portfolios for expected inflation and rising energy, food, and healthcare prices.

So, before diving head-first into another funding round, this third post about Series C funding will outline the current landscape of late-stage venture capital, which investors are interested in Series C+, what industries catch their attention, and what to expect in the future.

Active Investors in Late-Stage Funding

Fun fact: Investors from previous financing rounds also tend to participate in Series C+.

However, perceived risk levels impact the types of investors attracted to a deal. That’s why early-stage investments often attract risk-loving angel investors and VC firms. But risk-averse large financial institutions, like investment banks and hedge funds, only jump on the bandwagon for Series C+, as companies at later stages of development have higher valuations.

All of these late-stage investors are hunting for one thing: companies that have serious traction. With few startups making it to this stage, there is an ample supply of capital to go around. That’s why mega-round funding always attracts specific investors wanting a slice of the pie. Here are some of the top investors interested in late-stage companies:

- Tiger Global Management: An investment firm focusing on private and public companies in the global internet, software, consumer, and payments industries. It’s the most active investor not solely for Series C but for D and E rounds too.

- Gaingels: A leading LGBTQIA+/Allies investment syndicate and one of the most active private investors in North America. Dedicated to supporting diversity at all levels within the venture capital ecosystem and influencing social change through investing. Portfolio includes: Bolt, Udemy, and Masterclass.

- Insight Partners: A private equity firm based in New York City investing in growth-stage technology, software, and the internet. Portfolio includes: Shopify, Wix, and Shutterstock.

- Andreessen Horowitz: A private American venture capital firm in California investing in early-stage startups and established companies. Portfolio includes: Airbnb, Affirm, and Asana.

To mitigate the perceived risks, many of these investors often require companies to have Directors and Officers (D&O) insurance. This insurance helps protect the company’s leadership from potential liabilities and lawsuits, making the investment more secure.

If you want to get more specific, Crunchbase recommends six technologies to help you find investors ready to support companies like yours: Gust, Crunchbase Pro, LinkedIn, Pitch Investors Live App, Microventures, and WeFunder.

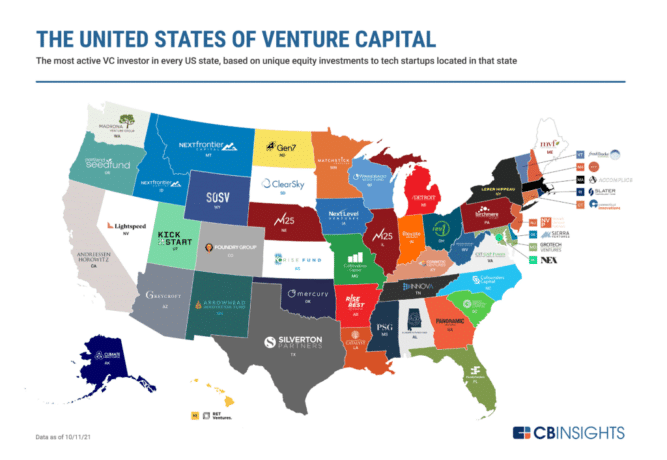

You may also be based in a specific state like California or Texas and wonder who your state’s most active VC investor is. Check out this map to suss them out.

Source: CB Insights

Getting to the Bottom of Market Appetite

Five out of ten of the top Series C deals in 2022 were investments in internet software and services, including security, asset and finance management, trading and project management. The top deal for Series C funding in Q1 of 2022 was $650 million for the company 1Password, including investment from ICONIQ Growth, Accel, Lightspeed Venture Partners, Tiger Global Management, and Backbone Angels.

Everybody also wants a bite of fintech: Despite investments declining in fintech quarter-over-quarter, one out of every five dollars in funding went to that sector in Q1 of 2022.

Other super hot industries include renewables and solar: Berlin-based Zolar bagged $105 million in Series C funding in May this year. The pandemic increased global attention on climate change and renewed interest in environmental, social, and corporate governance (ESG), influencing investment decisions. A survey found that, for retail investors, the most important driver is now positive environmental impact, not just investment returns.

Plus, 83% of global investors surveyed stated that ESG-integrated portfolios are likely to do as well or better than non-ESG-integrated.

Ultimately, checking out the market and finding the right VC for your company looks like dating. You can’t just jump into any deal; you have to work out if the relationship will be sustainable and beneficial for your company.

Courtney Broadus, Venture Advisor at Spider Capital and early-stage investor, said: “It’s shocking how few people ask what is my investment criteria.” It is vital to prequalify investors to know which sectors they support and how much capital they have available.

The ABCs of Funding Rounds and Beyond

Once a business has a track record, it may seek Series A funding (between $2 to 15 million) from traditional venture capital firms or angel investors to optimize offerings and scale across different markets. Companies seeking Series B funding from later-stage VCs are past the development stage. They want to grow fast and build a winning product.

Companies that aim to obtain Series C funding are no longer startups, unlike Series A and Series B, where this is often the case. They are usually established and thriving with solid revenues and profits, often with a valuation between $100 and $120 million. With the explosion of “unicorn” startups, though, they can be worth more.

However, independent of valuation, there are similarities to the previous stages of financing: they all primarily rely on raising capital through the sale of preferred shares.

Series C funding is the fourth stage of the startup capital-raising process – typically the last step of venture capital financing to prepare a company for its initial public offering (IPO) or acquisition.

However, some companies opt to conduct more rounds for a final push, such as Series D, E, or beyond. There are a couple of reasons for this:

- The Series C funding didn’t hit expectations, and this “down round” devalued company’s stock, so it is better to wait before seeking an IPO.

- The company has discovered a new opportunity for expansion that would increase its value before going public.

The Future of Financial Sourcing

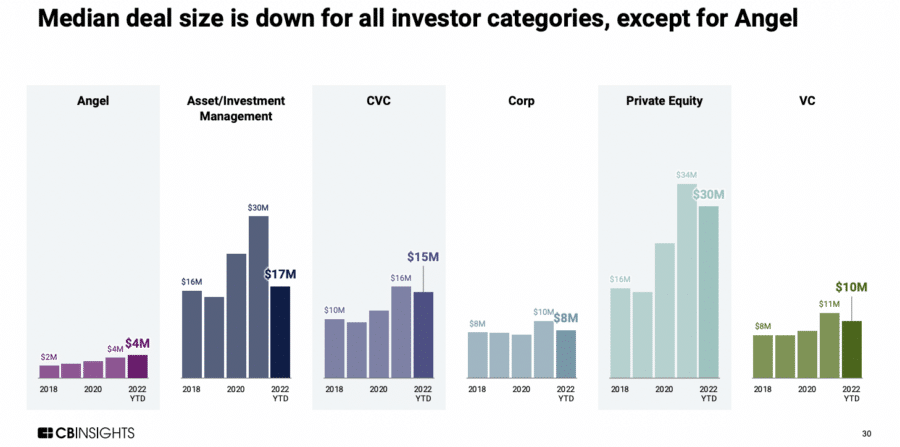

According to CB Insights, the median deal size is currently down. But after the past few years, it’s not surprising: During the pandemic, safe-haven assets rose. However, we gradually expect investors to rebound from the economic hardships like most other industries.

Source: CB Insights

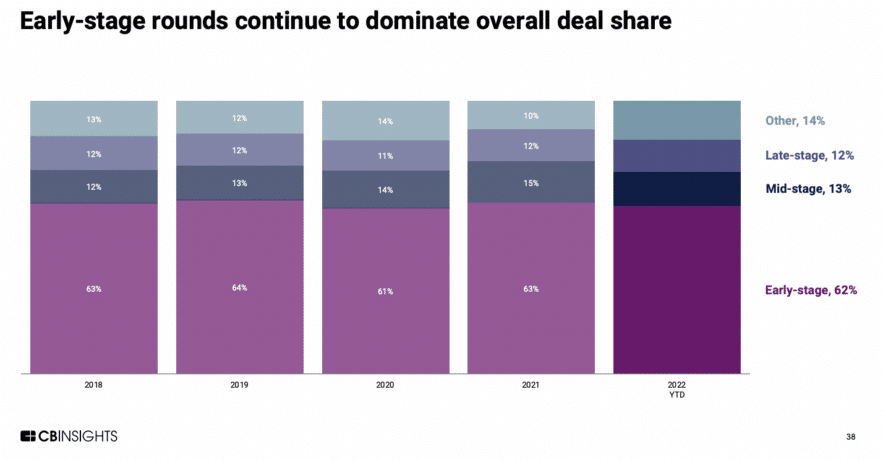

We also anticipate late-stage investors to become pickier than before as investment portfolios continue to be affected post-pandemic. This is clear as early-stage rounds are heavily dominating investments currently. This is also because few companies make the Series C stage.

Source: CB Insights

Despite previously getting your ducks in a row for Series A and B funding rounds, Series C can still feel complicated. There’s also a lot of pressure, with a tight focus on scaling and growing as quickly as possible. But it’s all worth it. This funding may be the final push you need to roll out some game-changing innovations in your company.

At Founder Shield, we specialize in analyzing company risks at each development stage or round of funding and take the stress out of buying insurance. We ensure you always have adequate protection so you can worry about other more pressing matters.

Feel free to contact us at info@foundershield.com or create an account here, and we’ll walk you through the process of finding the right insurance policy.

Want to know more about Series C funding? Read the rest of our series here.