Key Takeaways

This is an exciting time to be part of the consumer goods market. Technology is giving rise to new distribution models leading to growth and evolution.

One of the biggest changes comes in the form of e-commerce. You can buy pretty much anything online, from groceries to mattresses, and toothbrushes to couches. Based on U.S. Census data, online sales surpassed sales in physical stores for the first time in February 2019.

E-commerce has also led to an expansion of direct-to-consumer sales. According to Deloitte’s 2019 Consumer Products Industry Outlook, direct-to-consumer sales increased by 34 percent in 2017. This has grabbed the attention of large traditional brands that want in on this successful model.

This period of change is creating opportunities for consumer goods companies. But if you want to take advantage of these opportunities, you need to be aware of the possible risks. Product recalls pose a constant threat to your company.

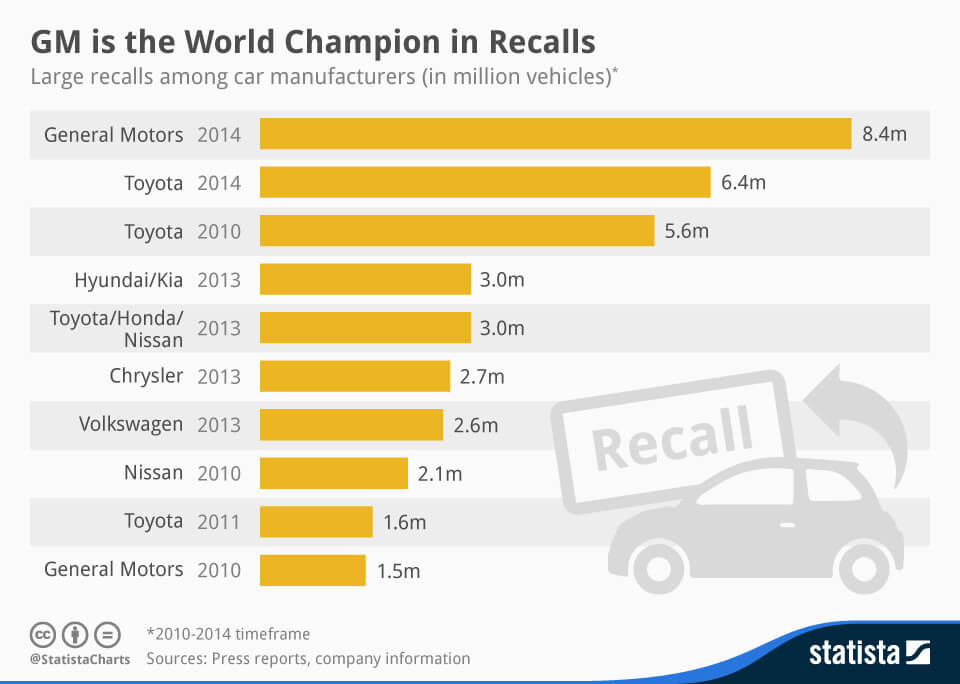

The Biggest Product Recalls

Not every recall garners much media attention. Nevertheless, numerous high-profile product recalls have occurred in recent years. These may be notable because they were especially dangerous, or because they impacted a large number of consumers.

- Romaine lettuce sickened people in 2018, leading to a recall. The lettuce was contaminated with E. coli. According to the CDC, 25 people were hospitalized.

- Samsung Galaxy Note 7 phones had a manufacturing defect that could cause fires, leading to a recall in 2016. Consumers were given the option of exchanging their device or getting a refund.

- Hoverboards finally came onto the market after decades of anticipation, but fires resulted in recalls. The U.S. Consumer Product Safety Commission knows of more than 250 hoverboard incidents involving fires or overheating, including two deaths. Multiple companies that made self-balancing hoverboards had to issue recalls.

What Is Product Liability Insurance?

Product liability insurance is an important coverage type for any company involved in consumer products. For example, you need product liability insurance if any of the following are true:

- Your company designs products.

- Your company manufactures products.

- Your company uses contract manufacturers overseas.

- Your company distributes products.

- Your company sells products.

- A product is sold under your company’s brand or label.

Product liability insurance will protect your company against third-party claims of bodily damage or property damage resulting from the use of your product.Coverage can oftenbe included under a general liability insurance policy. However, standalone product liability coverage is also available, and it may be better suited for companies offering unique products. Standalone coverage may also provide cost savings, so it’s worth looking into.

Types of Product Liability Claims

When it comes to claims, there are endless examples. People can sue over any perceived damage, and whether or not the lawsuit is successful, your company could face substantial defense costs as well as reputational damage.

Most product liability claims stem from one of the following areas:

- Design defects: A problem with the design can result in safety issues.

- Manufacturing defects: Inconsistencies in the manufacturing process and the materials used can result in claims.

- Inadequate labeling: If products do not come with the necessary warning labels, this can open the door to liability claims.

Don’t make the mistake of thinking you don’t need product liability insurance simply because you produce a safe product. Many issues can lead to product liability claims, including some that are extremely difficult to foresee and may even be out of your control.

- The product could become contaminated at some point during the manufacturing or distribution process.

- Quality issues and defects in the materials used to manufacture the product could lead to liability claims.

- Even if your product is perfectly safe when used as intended, the marketing or labeling of the product could lead to liability claims Or consumers could misuse the product in a way that make it dangerous.

Product Recall Insurance

If an issue with one of your company’s products is discovered, you could face expenses from two major sources:

- Consumers could file a lawsuit alleging bodily or property damage caused by the product.

- Your company may determine it’s necessary to issue a voluntary recall, or the relevant regulatory body may issue a mandatory recall.

When a company becomes aware of a potential safety issue, the company has a duty to report this to the U.S. Consumer Product Safety Commission. Failure to do so promptly can result in civil and criminal penalties. Depending on the type of product, it may be necessary to report safety incidents to other regulatory bodies. Both the company and the regulatory organization may conduct investigations.

In the realm of dietary supplement insurance, the company might opt for a proactive measure by initiating a voluntary recall to preemptively address potential injuries and mitigate associated liability concerns. Alternatively, a regulatory body could mandate a recall. In the event of a recall, effective communication with consumers becomes paramount to swiftly eliminate the flawed product from the market. The specific approach will vary based on the nature of the product; for instance, a contaminated food item might necessitate disposal, while a defective vehicle could undergo necessary repairs.

The costs associated with recalls can be substantial, possibly including:

- Overtime for workers.

- Warehousing costs.

- Shipping costs.

- Reimbursements.

- Additional product testing.

- Costs stemming from regulatory or consumer protection investigations.

- Costs associated with customer outreach.

Unfortunately, some companies assume that they have coverage for product recalls when, in fact, they do not. While product liability insurance provides protection against the costs associated with lawsuits, it does not cover the costs associated with recalls. To obtain this important coverage, your company must purchase product recall insurance.

While a product recall can hit any industry, some products are more likely to be recalled than others. According to the U.S. government’s site on recalls, commonly recalled products include:

- Child safety seats.

- Cosmetics.

- Food.

- Medication.

- Toys.

- Vehicles.

The U.S. Public Interest Research Group notes that food recalls have been on the rise. Between 2013 and 2017, food recalls in the U.S. increased by 10%.

Protect Your Company

For established companies and startups alike, recalls and lawsuits can become a major expense. Don’t assume that your company is safe. Be proactive to avoid problems.

- Follow strong safety protocols and ensure that all suppliers and other partners are doing the same.

- Maintain a customer complaint file so you can spot potential liability issues before they get out of control.

- Report any safety incidents associated with your product as soon as they are known, both to your insurer and to all relevant regulatory bodies.

- Protect your business with both product liability insurance and product recall insurance.