Key Takeaways

After the general insurance premium spike in 2021 followed by flatter years, Directors and Officers (D&O) deals have continued to lower and stabilize in the past two years. However, this doesn’t mean prices are fixed for good: geopolitical tensions, a softer insurance market, heightened regulatory scrutiny, and global inflation continue to create uncertainty for this coverage. Considering these factors, what will 2025 look like? Let’s explore emerging risks from high-profile lawsuits, recent economic conditions, and other public and private data points.

How Much Has Private D&O Pricing Changed?

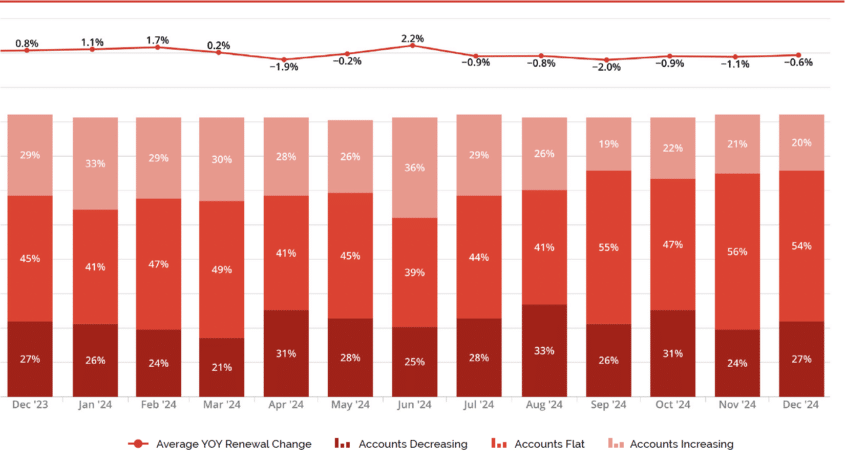

Private D&O hasn’t been without ups and downs in recent years, facing flatter and decreased rates after 2021. But throughout 2024, according to the Private D&O REDY® Index, decreased renewal rates were on the rise (the highest month was August at 33%), and flat accounts soared even higher, reaching 55% of renewals in September — there are plenty of factors influencing these prices.

- Continued Soft Market: 2024 saw a continuation of the soft D&O market, with pricing generally decreasing or remaining stable for many companies, as showcased by the Private D&O REDY® Index.

- Increased Competition: Increased competition among insurers has driven down prices and led to more favorable terms for policyholders, mostly because of new entrants in the space. This has allowed companies of all industries and sizes to get tailored insurance at convenient rates.

- Impact of Economic Conditions: The overall economic environment, including interest rates and inflation, can influence D&O pricing trends. For instance, Allianz reports that the average settlement for public companies was $37 million in 2023, a substantial increase over the 10-year average of $29.6 million due to inflationary rates — a major factor in driving up premiums.

- Emerging Risks: Evolving risks, such as cyberattacks, and environmental, social, and governance (ESG) issues, continue to shape the D&O insurance landscape. Social inflation has also played an important role in driving costs recently, where shifts in societal preferences (like the increased number of unions) lead insurers to consider which companies are better at absorbing risks related to the workforce.

How Much Has Public D&O Pricing Changed?

Public D&O prices behave differently than private ones, affected by other factors like class-action lawsuits, the IPO market, and even higher regulatory scrutiny.

- Tough Market: 2024 saw a continuation of the hardening D&O insurance market for public companies, and the continuing IPO lull is one of the main reasons for this. For example, prices increased between 2019 and 2022, when the IPO market was having some of its best days, making up for a tougher 2018. Today, the market remains above 2018 levels.

- Increased Loss Activity: Rising securities class action litigation due to higher regulatory scrutiny, increased M&A activity, and the evolving regulatory landscape have contributed to increased losses for insurers.

- Focus on ESG Risks: With everyone placing ESG under their magnifying glasses — from individuals to regulators — including climate change, social justice, and human rights, D&O exposures have increased and driven up premiums.

- Cybersecurity Concerns: The increasing frequency and severity of cyberattacks have significantly impacted D&O pricing, with insurers emphasizing strong cybersecurity measures. While many companies are prioritizing risk management strategies to mitigate risks, Q4 2024 was still tough on the cyber protection front: Cloudflare reported DDoS attacks increased by 53% compared to 2023.

- Economic Uncertainty: Economic volatility and the potential for recession have increased the risk of financial distress and increased D&O claims. In August 2024, JP Morgan reported that the probability of a global recession was 35% by end-of-year and 45% by the end of 2025.

High-Profile D&O Suits in 2024

There’s no better way to exemplify the state of insurance than by showcasing prominent lawsuits in recent times; they can inform both insurers and insureds what the current risks are, the depth of their harm, and how companies handle them to come out on top.

Nvidia’s Ongoing Class-Action Lawsuit

In 2018, Swedish investors sued the renowned chip manufacturer Nvidia for downplaying the impact of the volatile cryptocurrency market on its revenue growth, which led the company’s stock to drop by 28%. The case has gained new relevance since the company appealed the lawsuit at the Supreme Court, which denied it and allowed the suit to proceed in December 2024.

This isn’t the first time the company has faced scrutiny over cryptocurrency-related charges: In 2022, the company settled with the SEC over its involvement in the cryptocurrency market, which was found to highly influence its revenue.

Oddity’s AI-Washing Case

In one of 13 class-action lawsuits related to AI-washing, the Israeli-based cosmetics company Oddity received a securities suit for overstating its use of the emerging technology and running a misleading marketing campaign. According to some employees, Oddity’s AI approach only entails providing customers with a questionnaire to meet their unique needs.

As investors flock to support AI over other technologies, many companies have implemented it, or seemingly so, to attract attention from both users and fundraisers.

BlackRock, Vanguard, and State Street’s ESG Backlash

Part of the rise in social inflation in recent years has included the wave of anti-ESG efforts from US politicians, stifling any DEI and environmental initiatives on the corporate level. A major example from 2024 was the coalition of eleven conservative states’ attorneys general that filed a case against three investment giants: BlackRock, Vanguard, and State Street. According to the state attorney generals, these companies colluded in violation of the antitrust laws to restrict the production of coal in the US.

This high-profile case shows that ESG-related lawsuits now go both ways, urging companies to walk a fine line between inclusivity and sustainability, and avoiding making a splash with these initiatives.

The D&O Market Results for 2024

In 2024, several key developments in the D&O insurance market impacted both public and private companies, shaping the future landscape:

Increased Securities Class Action Lawsuits

The number of securities class action lawsuits rose in 2024, particularly those related to Special Purpose Acquisition Companies (SPACs) and de-SPAC transactions. This surge in litigation led to increased D&O claims and put upward pressure on premiums, especially for companies in high-risk sectors like technology and biotech.

Emerging Risks

New and evolving risks, such as those related to Environmental, Social, and Governance (ESG) factors, AI, and cryptocurrency, are creating uncertainty in the D&O market. Insurers are grappling with how to assess and price these risks, leading to some exclusions and higher premiums for companies with significant exposure in these areas.

Regulatory Changes

Regulatory changes, such as new data privacy laws and cybersecurity regulations, are increasing compliance requirements and potential liabilities for companies. This latest development has increased demand for D&O coverage addressing these regulatory risks.

Economic Uncertainty

Economic uncertainty, including inflation and recessionary concerns, can impact the D&O market. Companies may face increased financial distress, leading to higher D&O claims. Insurers may also become more cautious in underwriting and pricing policies.

Cybersecurity Concerns

Cybersecurity incidents and data breaches continue to be a major concern, leading to increased D&O claims related to regulatory investigations, shareholder lawsuits, and reputational damage. The overlap of D&O and cybersecurity has unfolded dramatically this past year. Leaders of public and private companies are reviewing their cyber risk profiles alongside management liability threats.

The D&O Market 2025: Founder Shield Outlook

We will likely see a much stronger risk management strategy throughout 2025 from companies in the private and public sectors. But this approach isn’t reserved for companies; insurers will be strategic, as well. For example, some insurance carriers are automatically renewing policies with minimal premium increases to avoid competitive pressures and maintain pricing.

Private D&O REDY® Index – January 2025

Monthly Renewal Pricing Analysis | Primary and Excess

Source: CRC Group

The D&O insurance market is expected to remain soft in 2025, with decreasing premiums for companies with strong financials and no claims history. However, competition is increasing, and carriers are offering various incentives to attract business. Global conflicts, economic uncertainty, and challenging industries like healthcare could impact the market and lead to higher premiums for some companies.

Also, due to rising bankruptcies, underwriters are closely scrutinizing the financial health of companies seeking D&O insurance. They are also monitoring claims trends previously associated with public companies, such as regulatory actions and breaches of fiduciary duty.

Private D&O insurance is facing increased claims due to factors like excessive fee litigation and rising employment practices liability (EPL) claims. “Employee activism,” hybrid work tensions, layoffs, and discrimination claims are contributing to this trend.

The D&O insurance market is in flux, with pricing trends influenced by various factors such as increased litigation, emerging risks, and economic conditions. While the market currently favors buyers, with decreasing premiums and broader coverage options, this trend may not last. Companies need to stay informed about market dynamics, assess their risk profile, and proactively engage with brokers to secure the most favorable terms and ensure adequate protection in an uncertain future.