Key Takeaways

Both private equity (PE) and venture capital (VC) firms have become more popular over the past several years. Some business models thrive on the support of these firms, after all. So, it only makes sense for these investors to need more substantial insurance coverage than in the past, as well.

In this post, we’ll cover the role of PE and VC in the world of commerce and what exposures they each face. With essential protection in mind, we’ll review adequate insurance coverage for these firms, too.

Understanding Private Equity and Venture Capital

Although the lines are blurring between PE and VC, distinct differences still exist. So before diving headfirst into what risks PE and VC firms face, let’s first back up to review their part in the economy.

Private Equity

Private equity is shared interest in companies that are not publicly listed or traded. High net worth individuals and firms typically provide investment capital for these private companies. To be more specific, the PE industry mainly consists of institutional investors, such as pension funds. Large private equity firms backed by accredited investors provide substantial amounts of funding, too.

Many times, PE investors acquire control of a public company with plans to delist it and make it private once again. The PE capital frequently funds new technology, supports acquisitions, increases working capital, and bolsters a balance sheet.

That said, funding isn’t usually a mere drop in the bucket. Investors dedicate substantial amounts of money over long holding periods. Sometimes PE firms create pools of funds to privatize massive companies through a feat called leveraged buyouts (LBOs). During an LBO, private equity firms finance large purchases to improve the overall financial health of a company. Ultimately, the goal is to resell the company to another firm or cash out through an initial public offering (IPO).

Venture Capital

Startups and small businesses with long-term growth potential often depend on venture capital to catapult them forward via financial investments. VC investors often face high risk, but a compromise is that they usually get a say in company decisions.

Investment banks, financial institutions, and well-off investors provide the most VC funding. Although the risk to invest might be unattractively high, the potential for above-average returns is the handsome payoff. What’s more; is that money isn’t the only form of venture capital. Often, technical or managerial expertise is the core of the transaction.

For startups or new companies with a little experience under their belt, VC investors can offer vast amounts of industry guidance. Plus, since these companies don’t usually have access to loans, VC funding is quickly becoming a go-to source for financial backing.

Similar to PE, high net worth individuals—referred to as “angel investors”—and VC firms typically serve as sources of venture capital. These savvy investors often have entrepreneurial backgrounds or have retired from executive roles at an early stage. They have a penchant for investing in industries they are intimately acquainted with and frequently engage in co-investment endeavors with trusted friends or associates, contributing to the dynamic landscape of early stage venture funds.

In addition to financial backing, insurance for venture capital firms is an essential aspect of managing risk in these high-stakes investments. This insurance helps protect VC firms from potential liabilities and financial losses, ensuring their investments are more secure.

Private Equity and Venture Capital Funding

As in most business ventures, PE and VC partnerships have their unique order and style to keep things running smoothly.

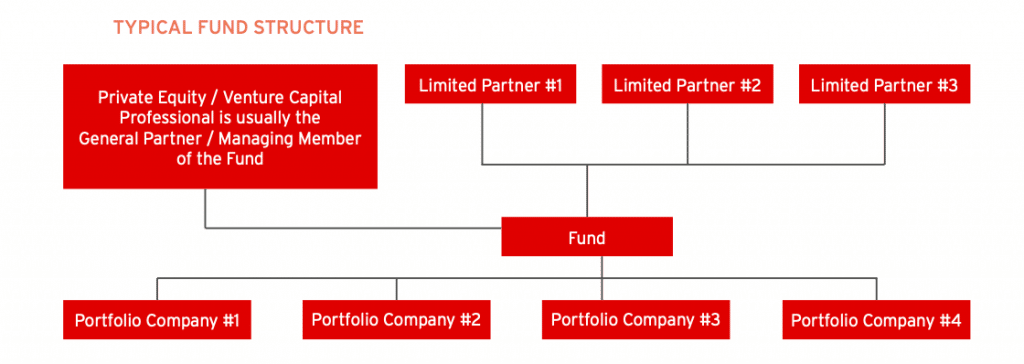

Fund Structure

Funding for both types of capital typically follows a specific structure, which includes:

- The fund is typically a limited partnership (LP), but limited liability companies (LLC) aren’t uncommon.

- A few sophisticated investors supporting one (or more) industries often provide capital.

- Limited partners make an unfunded commitment to LP, which is drawn out over the fund term.

- Pension plans, insurance companies, university endowments, and high net worth individuals are all traditional limited partners.

- The general partner (GP) of the limited partners is a PE or VC professional.

- Also, a PE or VC professional is a managing member of an LLC fund.

- PE or VC professionals sponsor the fund, and then divide the fund’s profits with capital providers.

- Often, PE or VC professionals earn a management fee for advising the fund.

Investment Model

The structure speaks to a PE or VC professional relationship, whereas the model outlines the details of the deal, such as:

- PE or VC firms invest in multiple businesses called portfolio companies.

- PE or VC professional actively advise and guide portfolio companies.

- Traditionally, PE or VC professionals are appointed to the company’s board of directors.

- Investment funds tend to extend for 5-7 years until they’re closed out around 10-13 years.

Transactions

PE and VC transactions each happen for various reasons, including:

Venture Capital

- Works as seed money to finance potentially fast-growing startups

- Finances early-stage entrepreneurs

PE and VC

- Provide funding for existing businesses who need capital to grow

Private Equity

- Private equity financially supports troubled companies

- Provides leveraged or management buyout transactions

- Industry consolidation

Exposures

Private equity and VC firms face many challenges in the modern marketplace, such as:

- Investigations by the U.S. Securities and Exchange Commission (SEC)

- Conflicts of interest between the firm and portfolio companies

- Accusations that the PE or VC firm has either neglected or mismanaged the portfolio company

- Corporate governance issues in the firm or the portfolio companies

- Limited partners filing lawsuits because of misleading documents or mismanaging funds

- Inadequate due diligence

- Indemnification provisions in portfolio companies

- Bankruptcy

- Problems arising from minority shareholders at the exit stage

- Backing out of investment deals

- Employment practices

- Securing IP Insurance Coverage for Sensitive Intellectual Property and Private Information

- The Financial Stability Act of 2010

- Administrative errors and omissions

Both private equity and venture capital firms face specific exposures. Experiencing indemnity or financial solvency could devastate any firm and the portfolio companies associated with it. As a result, both PE and VC firms need to protect themselves as well as safeguard fund performance.

Real-Life Claim Scenarios

Although no two investment cases are alike, here are a few that display the complex risks PE and VC firms face.

Minority Shareholder

In the heated case from the Superior Court of New Jersey—Kieffer v. Budd—a massive lack of transparency in decision-making motivated a minority shareholder to file suit. In the end, the court found that the petitioner was indeed an oppressed minority shareholder. He was awarded the full amount of his unpaid salary, which was the primary issue initially.

For the full story, visit here: Watch Out For Minority Shareholder Oppression Claims After Admitting Non-Family Shareholders To The Family-Owned Business

SEC Investigations

The SEC charged a San Francisco-based VC founder and his firm with overcharging investors to fund personal projects. According to SEC findings, Rothenberg Ventures LLC misappropriated millions of dollars over three years. The founder and his firm agreed to settle the charges without admitting or denying the accusations.

For the full story, visit here: SEC Charges Technology Fund Advisor, Founder in Fraudulent Scheme

Portfolio Company Bankruptcy

When Scott Brass, Inc (SBI) nearly shuttered, PE firm Sun Capital Partners stepped in to assist the distressed company. After SBI eventually declared bankruptcy and faced an unfunded multiemployer pension plan, the issue found its way into court. However, the First Circuit held the PE funds not liable for the unfunded pension plan.

For the full story, visit here: First Circuit Finds Co-Investing Private Equity Funds Did Not Bear Liability for Bankrupt Portfolio Company’s Underfunded Pension

Key Coverage Considerations

When it comes to the partnership between a firm and a portfolio company, commitment and trust (and solid terms) are the building blocks of the professional relationship. As members of the board of directors in a specific company, PE and VC professionals carry a lot of liability.

Although the terms of the deal often attempt to split responsibility appropriately, it’s still a delicate balance. Mainly because the professional services that PE and VC firms often provide include investment advice, fund management, marketing guidance, asset allocation, etc. In short, it’s a hefty load to juggle.

The following are a few policies that help to manage risk for private equity and venture capital firms.

Directors & Officers Liability

Directors & officers liability (D&O) insurance provides coverage against specific claims alleging wrongful acts made against the insured company and its executives. Since PE and VC professionals act as a director or officer of a portfolio company, this coverage serves as vital protection.

Professional Liability

Professional liability is often known as “malpractice” insurance or more officially, errors & omissions (E&O) insurance. This coverage helps protect insured PE and VC firms from claims alleging wrongful conduct as it relates to the performance of their activities in the firm.

Investment firms leveraging the most advantages are those acquiring stakes in other private enterprises or portfolio companies. While the term “professional services” can be interpreted in diverse ways, it frequently encompasses roles such as serving as a director, officer, or board representative for a portfolio company, ensuring comprehensive coverage, including VC insurance.

Employment Practices Liability

Employment practices liability insurance (EPLI) is another management liability insurance. It provides coverage for allegations against the insured company or individual regarding employment practices. The policy typically includes coverage for claims of:

- Discrimination

- Sexual harassment

- Hostile work environment

- Wrongful termination

- Other employment-related issues

Fiduciary Liability

Another kind of management liability insurance is fiduciary liability. It provides coverage for fiduciaries, professional administrators, employers, trustees, etc. Naturally, the administration of employee benefit programs falls under this coverage, as well.

Fidelity Bond

If the insured PE or VC firm faces employee dishonesty—theft, forgery, computer fraud, etc.—fidelity bond insurance provides coverage for the loss. Often, the insured increases the scope to include third party coverage, as well.

Cyber Liability

Otherwise known as cyber & data privacy, cyber liability protects against third-party lawsuits as well as fines from regulators. Since most companies do most of their business online, coverage typically includes:

- Intellectual property infringement

- Privacy issues

- Data breaches

- Cyber ransom

- Business interruption

- Virus transmission

Representations & Warranties

Representations & warranties insurance protects against unintentional and inaccurate representations by the seller in a merger or acquisition. Both the seller and buyer benefit from the policy as it protects from litigation and financial loss.

Understanding the details of what coverage your company needs can be a confusing process. Founder Shield specializes in knowing the risks your industry faces to make sure you have adequate protection. Feel free to reach out to us, and we’ll walk you through the process of finding the right policy for you.