Key Takeaways

Professional liability insurance is commonly known as errors & omission (E&O) or malpractice insurance. Although it covers a multitude of industries, this particular policy plays a specific role for legal professionals.

Its purpose is straightforward. Should a lawyer’s act, error, or omission cause financial loss to a third party, lawyers’ professional liability (LPL) insurance covers the company. And that’s just for starters. Following is a practical guide to one of the most critical insurance policies your law firm will ever need.

What Risks Do Law Firms Face?

Although similar risks exist across multiple industries, law firms face plenty of unique risks on their own, as well. Here are a few of the most common threats:

Data Breaches

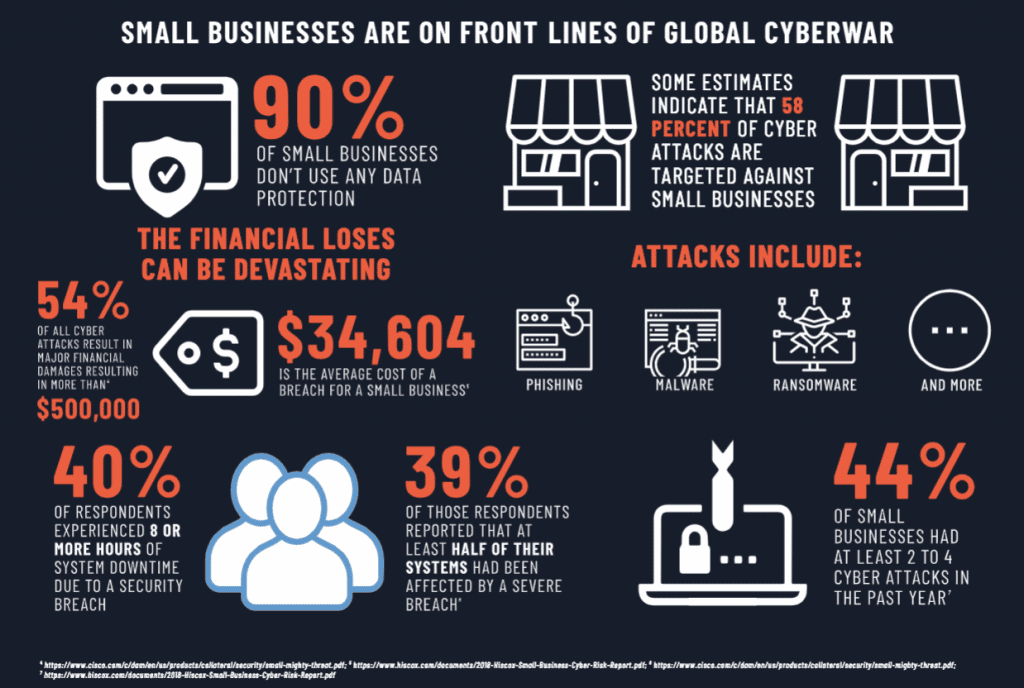

After experiencing data breaches, around 40% of small and mid-sized companies are out of business in less than six months—law firms included. With cyberattacks are on the rise, cybercriminals are becoming exceedingly more sophisticated.

Naturally, a significant concern amid law firms is keeping confidential information…well, confidential. Data breaches can quickly compromise personal information, and cost your firm significantly when it comes to cleaning up the mess, per se.

With technology advancing at an unstoppable pace, it’s challenging to employ sufficient IT specialists to help safeguard your digital files. Also, the uptick in mobile technology office use only increases the risk of a cyberattack.

Malicious Software

In the same digital vein, viruses, malware, and ransomware are all examples of malicious software that will wreak havoc on your entire network. Mainly, these threats come to you undetected as downloads, hacked email accounts, or other online tools.

Unfortunately, due to the mounds of sensitive information, law firms are often viewed as “one-stop shops” for malicious offenders.

Phishing is by far the most popular tactic cybercriminals use nowadays. These seemingly innocent (and legit) emails post a severe threat to all sorts of businesses. As mentioned, law firms are considered the cream of the crop concerning valuable information. So cyberattacks are executed via a sophisticated and often complex strategy, involving numerous stages of infiltration.

Being unable to access specific files might not seem like such a tragedy. However, malicious software typically leads to encrypted files, leaving critical data and files inaccessible. These sneaky cyber threats can halt professional momentum faster than any other obstacle in the industry.

Mergers or Professional Transitions

Depending on the firm’s size, you may have combined with (or acquired) another firm at some point. Also, you may have experienced colleagues resigning your firm to join forces with another one. While these scenarios are often genuinely smart business moves, they can temporarily make your information more vulnerable.

Mergers, acquisitions, or even resignments require law firms to share information. Without a robust cybersecurity system in place, new or shared files could leak client information or other data unknowingly.

Also, each of your team members is essentially a link in your professional chain. One administration mistake could end up costing your firm significantly. Mergers and reassignments are often tough to navigate simply because they can involve numerous “links.”

Professional Negligence

When the lights go down at night, the truth remains that lawyers are still human beings capable of making mistakes—just like the rest of us. This indisputable fact is another notable risk law firms face. Granted, unlike the others listed, this particular risk has remained steadfast for decades on end.

From downloading malicious software to data entry mistakes to harried comments on a bad day, human error extends far and wide. Plenty of class-action lawsuits are founded upon human error and complaints of malpractice. Not only can such a case cost your firm significantly in defense fees, but it can also irreparably damage your professional reputation.

Aside from educating your staff on avoiding human error, it’s essential to help safeguard your firm as best you can.

Real-Life Claim Scenarios

- GozNym malware attacks cost two firms over $117K in combined losses, and the barrage started with simple phishing emails. Although law enforcement officials have dismantled the cybercrime network, the damage is vast and extensive. See here for details: GozNym Malware Attack Hits Two Law Firms for Over $117K in Losses

- Poor cybersecurity induced malpractice allegations against Midwest-based firm, Johnson & Bell. Although the firm experienced no genuine cyberattack, clients made a class-action lawsuit, claiming its online framework presented numerous vulnerabilities. See here for details: Four Biggest Cybersecurity Risks Law Firms Are Currently Facing

- Gloria Allred, a well-known civil rights attorney, was accused of legal malpractice and negligent misrepresentation, among other things. The plaintiff, a former Southern Californian meteorologist, also accused Allred of creating a conflict of interest by secretly negotiating a TV deal with CBS. See here for details: Famed Attorney Hit with Legal Malpractice Lawsuit

What Is Lawyers’ Professional Liability Insurance?

With both old and newly emerging threats, you strive diligently to protect your reputation, clients, and the firm’s future. Lawyers’ professional liability insurance offers a viable solution by responding to threats on professional service disputes.

Policy overview

Lawyer’s professional liability coverage is an E&O policy that can be customized to fit your particular needs. It’s specifically designed for legal professionals, addressing the gamut of risks small and mid-sized law firms face. Mainly, LPL covers various exposures that general liability policies don’t typically include.

Lawyers’ professional liability coverage typically includes:

- Information and network security

- Claims of negligence or mistakes causing third party financial loss

- Legal defense costs for covered claims

In short, lawyers’ professional liability is a claims-made policy. It provides insured lawyers with capital for defense costs if a client sues them for failure in their professional service.

Also, most insurance carriers specifically define “failure in professional services.” Some examples include:

- Faulty advice

- Negligence

- Administrative mistakes

- Misrepresentation

- Violation of good faith

Typical Exclusions

Like other insurance policies, LPL doesn’t work as a massive umbrella of insurance. Exclusions do exist, and it’s helpful to know the specific situations that LPL doesn’t cover.

For one, LPL doesn’t cover fraud or intentional and criminal acts. This exclusion may seem like a no-brainer, but the legal circle rarely welcomes surprises, so we include it nonetheless.

Also, LPL coverage excludes both property damage and bodily injury. When government agencies impose fines and penalties, it’s not covered either. Intellectual property, such as content or media, is generally not included in a lawyers’ professional liability policy. For protection in this area, businesses need to consider intellectual property rights insurance, which specifically covers risks related to intellectual property.

Coverage Enhancements

To strengthen a current LPL policy, many professionals consider adding one or more of the following coverage enhancements:

- Broad Professional Services Definition – Sometimes, you can convince an underwriter to include a broad definition, such as “any services performed for a fee.” This approach creates a more open-ended policy, leaving less room for claim denial. Pro tip: Be sure the exclusion section doesn’t negate it.

- Automatic Additional Insured Status – Occasionally contracts require that the other party is added to your E&O policy as an additional insured. This particular enhancement offers additional insureds status to any third party with whom you have a professional services agreement.

- Cyber – Cyber coverage offers protection against liability from accidentally sharing malicious software, data breaches, and other computer-related wrongful acts. Also, it safeguards your firm against losses, such as privacy breach notification costs, business interruption, forensic expenses, etc.

- Payment of Withheld Fees – If a client threatens to sue you for more than any owed fees, this enhancements enables the carrier to pay the fees on your client’s behalf. Granted, the client must confirm (in writing) that they won’t file a claim against you so long as you stop pursuing them for the fees.

- Loss of Documents – It’s not unheard of for claims to arise because of damages to your documents or documents in your care, custody, or control. In cases of damaged documents, this enhancement covers the amount you become legally obliged to pay, including liability for the claimant’s expenses.

How Much Does It Cost?

Many smaller firms mistakenly believe they’ll have the same premiums as their larger firm peers. Though, landing on one precise figure for the cost of lawyers’ liability insurance is nearly impossible in a single blog post. Mainly because the cost of LPL varies greatly.

Also, no matter if you have a “flawless” record, each lawyer carries their own set of risks. Besides a particular lawyer’s record, carriers consider other vital factors, such as:

- Type of law practice

- Limits

- Amount of years you’ve maintained claims-made coverage

- Geographical location

- Claims history

Smaller firms typically fall within the $1,200 to $2,500 annual premium range while larger firms can expect to pay $3,000 to $10,000. Again, the final number depends on a multitude of factors.

Does the Type of Law Practice Make a Difference?

The short answer is: yes.

The long answer is that there is a low end and a top end when it comes to threats and risks that various types of law practices carry.

As anticipated, when it comes to avoiding risk, certain areas of practice tend to incur higher premiums. Class action litigation, securities placement, and intellectual property cases prominently feature at the upper echelon in this regard. In contrast, the realm of minimizing risk frequently encompasses criminal law and insurance defense, which tend to occupy the lower end of the spectrum.

As your law firms evolves, it can be tricky determining the coverage you truly need. Founder Shield specializes in knowing the risks you face at each stage of development, and we work to make sure you have adequate protection. Feel free to reach out to us, and we’ll walk you through the process of finding the right policy for you.