Key Takeaways

If you’re like most founders, thoughts of getting the Series B term sheet right are at the forefront of your mind. Typically, this part of the process is relatively straightforward — but it has its nuances, too. Joining us for the fourth post of this Series B sequence is Senior Associate at Mission OG, Kevin Leonard, to share his insight.

Know Your Timeline and Process

From early traction to the initial signs of revenue growth, founders must be aware of all the moving parts involved in capital funding efforts. Here’s a look at some nitty-gritty details you might encounter along the way.

Understand Series A Involvement

It’s hardly astonishing that numerous Series A investors aspire to maintain their involvement in your venture not only through your Series B endeavor (and beyond) but also as indicated in the Series A term sheet. Nevertheless, it’s essential to recognize that your rapport with these backers is poised to evolve during this funding round. For instance, Series A investors generally place distinct emphasis on specific business attributes compared to their Series B counterparts.

Leonard put this idea into perspective. He says,

I think has less to do with defined metrics and parameters around revenue, KPI’s, and more about, the completeness of the team, progress in commercialization, and the readiness to scale.

Managing the To-Do List

Ask any founder or management team member, and they’ll tell you about the endless number of tasks on their to-do list — only after the Series B is over. Combatting the onslaught of chores is one element of a successful round; knowing them beforehand is another.

As a leader in this business endeavor, do what you can to know your to-do list inside and out so that you can manage them effectively. Involve yourself in your network, and talk to other founders who’ve walked this path. Leave no stone unturned in learning and educating yourself on others’ experiences. It will help you to manage your to-do list and cope with the stress during your Series B.

Handling Negotiations

As mentioned, negotiating the details of the term sheet is straightforward so long as you know what you’re dealing with. But many founders make the mistake of assuming a Series B plays out identical to a Series A.

Leonard challenges our perspective, saying, “The term sheet is just the board representation and governance. What’s the right balance between director rights for new investors, existing investors, company directors, and independent third-party directors?”

As the power balance levels and details are sorted through, it’s vital to know what’s best for your company. This round probably won’t materialize like the last round, so be prepared to handle negotiations proficiently.

Navigating New Board Members

During a Series B round, your Board will likely experience a change in members. As new relationships are forged, some of those investors will serve as your directors and officers to help lead the company. This task is another crucial part of getting the Series B term sheet right.

Diligencing Investors

Regarding how to choose investors, Leonard says it best, “I think the first thing is to really make sure you’re diligencing your investor the same way they’re going to diligence you. Think about, will they add value? Are they a good fit for you and your company? Would they be a good partner? It’s important to remember that investment firms are really a collection of people.

Not only research and target a firm but also the individual investor that you want to be engaged with you at your company. The way this process should really be is much about the people as it is financial capital. I would say that the first piece is to find that right investor for you.”

Balancing Power

Even with new members on your Board, maintaining the proper balance of governance is vital. After all, the Board’s overarching duty is to preserve and grow the company. Board members should have a broad range of skills, experience, and ideas. They shouldn’t be there to dictate or serve as “yes-people.” Each member should have a codified role and responsibilities to add diversity to the group.

Adding new members can be challenging, but the key is to give away power slowly and strategically. Founders and original board members must be prepared to stand up for sound corporate governance, asserting their authority in legal and fiduciary duties.

Fulfilling Requirements

According to most investors, including Leonard, having directors and officers (D&O) coverage is a defining aspect. He reiterates, “I think really the big one is D&O. We’ll see if the company has it in place, and if not, we might list it as a condition to close. The limits will really come down to the specific company.”

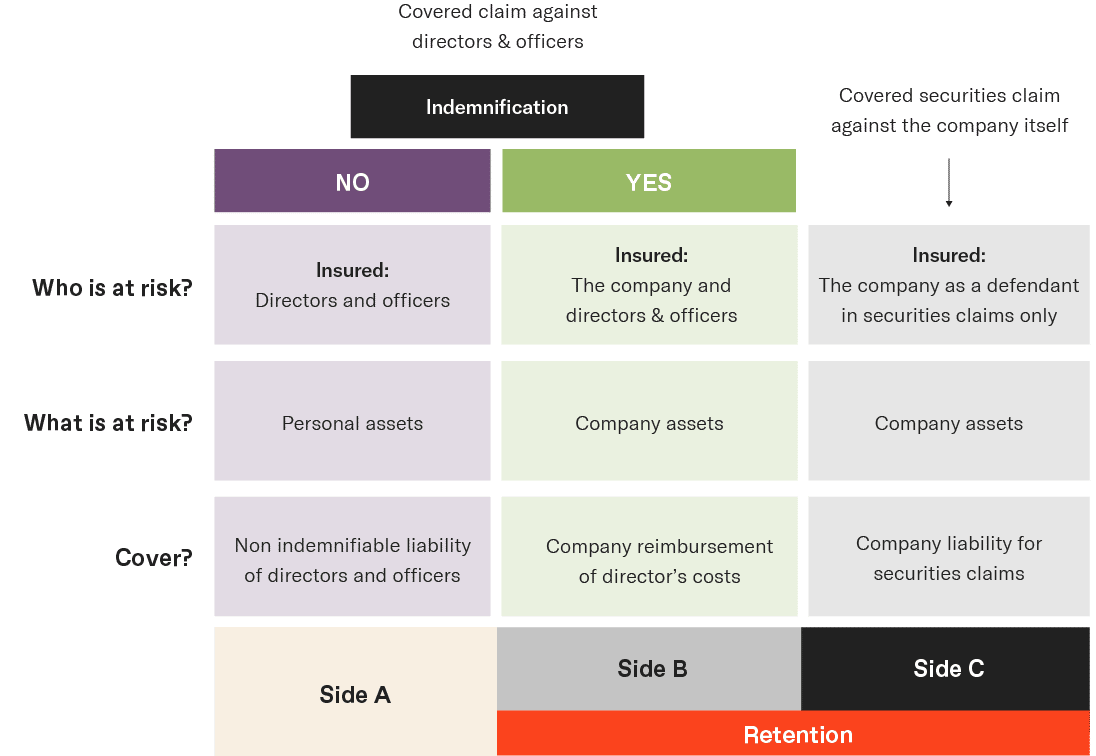

All companies have key individuals who are responsible for managing the business. When company leaders face allegations of breach of fiduciary duty or other claims relating to management, D&O insurance provides the capital to absorb legal costs without putting the SaaS company’s finances at risk. This coverage comes in three parts, including:

- Side A: Suppose directors are personally sued and are forced to pay defense costs and settlements, this portion of D&O insurance kicks in to protect the individual. However, Side A will only pay the individual directors if the entity can’t, such as if the company is insolvent.

- Side B: When the company (or entity) indemnifies individuals named in the lawsuit, Side B coverage reimburses those costs. But it only extends to indemnifying insured individuals named in the lawsuit.

- Side C: This coverage provides a balance sheet protection for the company if it is named in a lawsuit alongside an individual director. Side C coverage will reimburse the costs and settlements incurred.

Understanding New Preferred Stock

Another significant point to consider regarding the Series B term sheet is stockholders’ economics and control. As it goes, preferred stock, as opposed to common stock, is the standard for many companies raising capital. And for plenty of reasons, too.

What Is It?

Preferred stock entitles shareholders to a fixed dividend. Dividend rates in venture capital transactions often fall between 6-8% of the share price. Additionally, compared to common-stock dividends, preferred stock payments take priority. This form of stock tends to segue between stocks and bonds, and they have several variations. Although they share many of the same traits as debt instruments, they are equal securities. However, most professionals consider preferred stock a hybrid instrument.

Getting the Figures Right

Even the savviest founders make mistakes, including during a Series B round. Leonard shares his insight, “The first thing is, don’t try to raise more capital than you need. Going back to our point on what’s the right number to raise, I think it’s important to be thoughtful about how much capital you need to raise to invest in sales and marketing, to nail your product roadmap, and then to ensure 18 months of runway. That’s the first thing, don’t raise more than you need right now.”

He continues to add wisdom, “The second piece is to really focus on investors that add the most value and are the best fit for your company, rather than optimizing for valuation. The third piece is to really make sure you clearly articulate your financial projections and really have a detailed walk between your current revenue progress and your go-forward plan.”

Reviewing Cap Table Changes

A capitalization table, or cap table for short, is a visual display of company ownership. As you embark on various funding rounds, this representation will undoubtedly change — but you must stay in the know.

Know What’s Changing

Most company leaders appreciate cap tables for their record-keeping qualities as well as projections on the future. Startups, small businesses, and mid-market companies tend to remain the same in terms of ownership structure. However, they can change drastically in other areas, such as equity securities, financing, etc.

Anticipating a change on your cap table is frequently as challenging as keeping track of all the moving parts of a Series B round. Still, founders are sometimes taken aback when reviewing this particular visualization since many go without changes for so long in the business’s infancy. Keep in mind; anytime investors play a significant role in the advancement of a company, founders must keep a close watch on their cap table. That said, most founders want to maintain the most significant ownership in the business.

Supporting the Changes

Leonard adds his thoughts on how to support the company changes. He says, “I think as you continue to raise new rounds of capital, liquidation preferences and share rights are going to stack, which will have implications for everyone on the cap table for returns upon the event of an exit. As the investor raise grows through secondary purchases, new investors may offer to buy out early into investors to clean up the cap table a bit.

The last piece is just, as you mentioned, new capital brings dilution for everyone, including management and employees. I think you just want to really be thoughtful about ensuring that by raising subsequent equity rounds, you’re going to be able to create incremental company value that outweighs the impact of that new equity.”