Key Takeaways

Biotech, pharmaceutical, and life sciences companies like yours have created life-saving drugs and pain-relieving treatments, using research to open the door to new scientific discoveries. These discoveries often require clinical trials to perfect your products for the public market.

Clinical trials, however, come with substantial financial risks. A participant could respond poorly to treatment, or changes in regulatory requirements could require reworking the entire trial. Businesses requiring clinical trials can lower their risk of financial liability using clinical trials insurance.

This guide will look at how clinical trials insurance can help protect your business from the potential liability risks of running a clinical trial.

What Is Clinical Trials Insurance?

Clinical trials insurance is an essential type of coverage that helps protect clinical trial organizers and sponsors from liability costs if a trial participant is injured.

Why Do You Need Clinical Trials Insurance?

The estimated cost of clinical trials for a potential FDA-approved drug is $19 million. That’s only a tiny fraction of the cost of bringing a new drug to market.

This cost, however, has the potential to grow if something goes wrong within the trial. Participant injuries, in particular, are one of the biggest concerns for sponsors and organizers of clinical trials. Whether your business offers a new medication or researches participants’ medical conditions, injured participants could add millions of dollars in extra costs to your trials.

Clinical trial insurance reduces your financial risk if a participant is injured during your trials. After an injury, your clinical trials coverage claim helps cover costs like medical expenses to help the participant recover and the cost of legal fees and proceedings.

Many countries and regulatory bodies worldwide require clinical trials insurance to begin your research. Obtaining insurance coverage improves your trials’ chances for approval. Your clinical trial coverage also helps you secure the permits and regulatory permission needed to conduct your research.

Who Needs Clinical Trials Insurance?

Any business conducting, sponsoring, or organizing clinical trials can benefit from clinical trials insurance. Most commonly, businesses like pharmaceutical and biotech companies should invest in clinical trials insurance. Medical device developers, life science companies, and medical technology companies who conduct clinical trials will also need clinical trials insurance.

Additionally, research institutions or sponsors, such as university research hospitals or physician groups, should consider clinical trials insurance. In many cases, your research group may not be bringing a specific product to market.

However, each time you conduct a research trial, you put your business or organization at risk of a participant being injured. Clinical trial insurance shields your organization from the high expense of clinical trial liability.

Biotech Risk Management Guide

Understanding the Phases of Clinical Trials

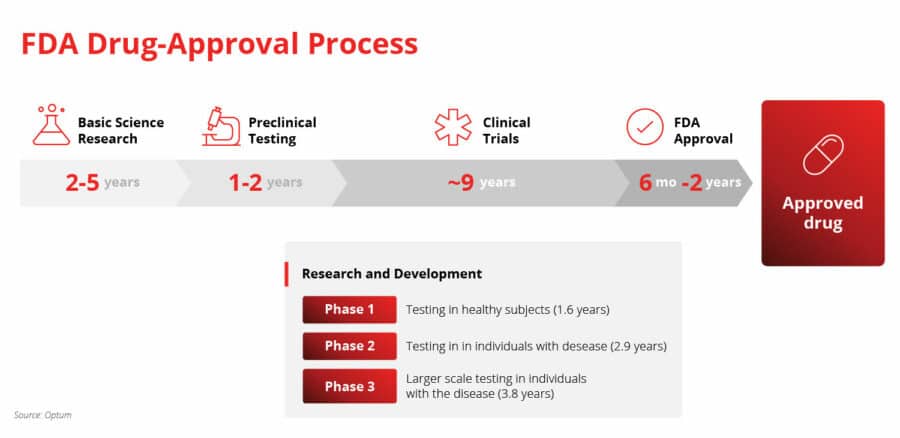

Researchers and product developers conducting clinical trials should understand the unique risks they face at each phase of clinical trials.

Phase I Trials

Phase I clinical trials usually include small groups of participants. Despite the fewer participants, the first phase of trials could hold the highest risk. As you test the safety and look for side effects of a new product, your participants could be more likely to develop adverse reactions.

Phase II Trials

Your Phase II trials will likely have a larger group of participants, and you’re probably aware of potential side effects from your initial research. As you look at your product’s effectiveness, it’s important to remember that a larger pool of participants could mean more exposure to liabilities. You may have more participants with unique allergies or medical conditions that you didn’t have in your Phase I trials.

Phase III Trials

By Phase II trials, you better understand who should and should not take your medication, use your device, or participate in trials. Your previous research should have solidified the safety of your product. However, your drug or device will go to thousands of participants, opening your research to more public scrutiny. If a participant is injured, you may have to cover the costs of negative press and reputation management, plus the costs of treating the participant.

Phase IV Trials

Once your product is approved and on the market, you still need to monitor how the general populace reacts. Phase IV trials may see more press attention after the public approval of your product. Like Phase III trials, you’ll have to prepare for the potential media liability if your product injures a user.

What Does It Cover?

Clinical trials insurance is a robust coverage, often required by regulatory agencies in the region where you wish to hold trials. Although you can customize your coverage to fit your needs, most clinical trial insurance policies include a few primary coverages:

- Clinical trials liability: This coverage provides financial coverage from lawsuits and legal action against your business related to your clinical trial.

- Medical expense: If a participant is injured, this coverage helps pay for their medical and treatment costs.

- Clinical trial compensation: Some countries require clinical trial organizers to offer financial compensation to participants. Your clinical trials insurance policy could help cover the compensation cost in these cases.

- Products-Completed Operations: This type of insurance protects your business from claims of bodily injury or property damage during the trial.

- Professional liability: This liability protection helps cover your business if professional negligence or errors cause harm to your trial participants.

Understanding the details of what coverage your company needs can be confusing. Founder Shield specializes in knowing the risks your industry faces to make sure you have adequate protection. Feel free to reach out to us, and we’ll walk you through the process of finding the right policy for you.