Key Takeaways

With 84% of investigated fraud cases spanning multiple industries, no one sector is exempt from financial crime. Keep in mind; these outlaws aren’t masked bandits robbing a dusty train freighting gold bars. Instead, they’re lounging comfortably in their own homes.

It’s no small task to keep up with the aggressive tactics and innovative technology many cybercriminals employ. From international gangs to crime syndicates to terrorist groups, the risk for economic offenses has dramatically increased.

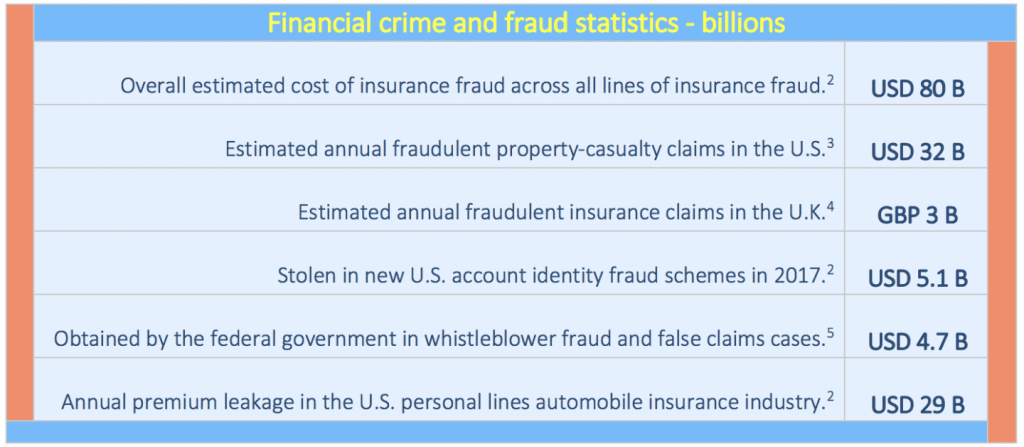

IBM’s financial crime and fraud statistics are astounding…but not at all in a positive way.

Protecting your brand, customer confidence, and profits is a crucial part of any modern-day operation. For this reason, here’s everything you need to know about commercial crime insurance.

What Is Commercial Crime Insurance?

Commercial crime insurance is business insurance that is fundamentally designed to cover money theft. It is not typically included in standard commercial property or business policies, and has to be purchased separately or as part of a broader package policy. It is especially important for businesses that handle cash or online payments, offering coverage for losses in cash, assets, merchandise, or other property when criminal activities occur.

Because fraud comes in various shapes and sizes, commercial crime insurance covers numerous situations from fraudulent transfer information to employee fraud, including:

- Employees stealing money from the company or clients.

- Inadvertently accepting forged checks or counterfeit money.

- Non-employees stealing from the company’s office or from the premises of the company’s bank.

- Robbery of valuables while in transit under the care of a messenger or armored car.

- Computer and wire transfer fraud.

Types of Commercial Crime Insurance

There are many types of commercial crime insurance that protects businesses from financial losses resulting from various criminal activities such as theft, fraud, and embezzlement. Following are the different types of commercial crime insurance that businesses may add on to their policy.

- Employee Dishonesty: Employee dishonesty protects against losses resulting from employee theft or fraud that impacts the company.

- Money and Securities: Money and securities in commercial crime insurance applies to non-employee thefts and covers the loss of money or securities from theft, disappearance, or destruction.

- Money Orders and Counterfeit Money: Money Orders and Counterfeit Money in commercial crime insurance covers the financial loss if your business erroneously accepted counterfeit money, money orders, or checks.

- Forgery and Alteration: Forgery and Alteration coverage would apply if checks, promissory notes, or other promises to pay money are drawn on your account and forged by someone other than your employee.

- Funds Transfer Fraud: This portion of the crime policy would cover losses resulting from fraudulent instructions provided to your bank by a third party.

- First-Party Coverage: This insurance protects a company against losses resulting from employee theft or fraud that impacts the company itself.

- Third-Party Coverage: This insurance protects a client against losses resulting from theft by an employee.

- Fidelity Insurance: Fidelity in commercial crime insurance is what financially protects your business from criminal acts committed by employees against customers or clients.

- Employee Retirement Income Security Act (ERISA) Coverage: can be found under the Employee Dishonesty section of a crime policy and protects against losses resulting from employee theft or fraud related to employee retirement plans.

- Commercial Crime Insurance: A type of property insurance designed to cover the loss that an organization suffers from or destruction or disappearance of, its own property as a direct result of crime.

- Internal Crime Cover: covers for theft, fraud, or dishonesty committed by employees causing direct financial loss on an “all risks” basis.

Why Do You Need Commercial Crime Insurance?

As mentioned, financial crime can occur in a variety of complicated ways. For the sake of pride, we’d be thrilled to declare that no two scams are alike—except they are. Many similarities exist between scams, schemes, and other tactics.

Crime complexities might offer comfort to those who’ve “fallen” in the past. Knowing the basics of commercial crime, however, is critical to the success of your business. After all, no one wants to fall prey to criminal activity. Here are a few popular tactics in a criminal’s ultimate playbook.

Types of Commercial Crime

Commercial crime refers to financially motivated, nonviolent crimes committed by businesses and government professionals, often involving theft, fraud, embezzlement, or other forms of dishonesty. These crimes can have severe financial and reputational consequences for organizations, potentially leading to substantial financial losses and damage to their standing. Following are some of the most common types of commercial crime:

Social Engineering

In contrast to a conventional and straightforward scam, social engineering represents the intricate intersection of crime and cyber activities. This sophisticated fraudulent scheme entails a series of intricate steps, setting it apart from numerous other forms of illicit endeavors. When considering protection, it raises the question of cyber insurance vs crime insurance.

People are often exploited to gain system access or other vital information useful to carry out the crime.

Phishing also falls under the umbrella of social engineering. Plus, it’s a tactic you’ve probably seen in real-life hundreds of times. Phishing occurs when a criminal sends an email from what looks to be a valid business. The email typically requests sensitive information, and many employees comply to “fix an urgent problem.”

Social engineering could even be as blatant as a criminal pretending to be an authority figure (i.e., sending an email as the CEO after hacking their account). Doling out urgent instructions, employees often fail to question the validity of the email’s content.

Employee Theft

It’s no surprise that organized crime and shoplifting takes the blame for much of inventory shrinkage. Up to 30% of inventory loss, though, is due to internal employee theft, or otherwise known as asset misappropriation.

Some of the most common types of employee theft include:

- Larceny

- Embezzlement

- Skimming

- Fraudulent disbursements

- Information theft

Although employee theft is often as simple as taking cash from the cash register, it could become far more complicated than that.

To name a few examples, employees could funnel funds through fraudulent accounts, forge signatures, launch billing schemes, or inflate expense reports. Another concerning strategy is for an employee to release confidential business information to a competitor.

Cyber Crime

Despite it frequently making headlines, cyber crime is anything but harmless. Plus, the number of records stolen doesn’t dictate the amount of damage a data breach can cause. In one instance, a single stolen file was reported to cost $1.5M – $2M in damages.

Fortune 500 companies aren’t the only ones impacted by data breaches. Criminals actually prefer to target small and mid-market companies with less robust cybersecurity programs.. With that said, the average breach cost is well over $500K with financial services and retail taking the brunt of the blow. Furthermore, the legal fees for defense and settlement could quickly skyrocket into the millions.

Hackers and malware cause significant loss—ransomware making the biggest dent. Unfortunately, ransomware tricks many unsuspecting victims because it appears as a legitimate file. Sometimes, the malware doesn’t even need interaction to travel between computers.

Commercial Crime Exclusion Examples

As with most insurance policies, commercial crime insurance isn’t merely a catch-all policy. Exclusions do exist, and it’s crucial to know what crime insurance won’t cover.

The following are types of exclusions in crime insurance:

- Criminal Acts by Executives: Crime insurance typically does not cover losses resulting from criminal acts committed by executives or high-ranking officials within the organization. This exclusion helps prevent coverage for intentional wrongdoing by key individuals in the company.

- Loss of Income: Crime insurance generally does not cover loss of income or revenue resulting from criminal activities. While the policy may cover direct financial losses due to theft or fraud, it typically does not extend to compensating for the income lost during the recovery period.

- Indirect Loss: Crime insurance often excludes coverage for indirect losses that are not directly related to the criminal act itself. This means that while the policy may reimburse for specific stolen items or funds, it may not cover additional costs or losses incurred as a result of the crime.

- Exposures Covered by Other Policies: Crime insurance is designed to protect against specific types of criminal activities, and it may exclude coverage for risks that are already addressed by other insurance policies. For example, if a loss is covered under a different policy such as cyber insurance or professional liability insurance, it may not be eligible for coverage under a crime insurance policy to avoid duplication of benefits and ensure clarity in coverage.

Remember, social engineering describes situations where criminals often pretend to be executives to gain access to private business information. When an executive does commit a crime, however, the act falls outside of coverage.

As imagined, indirect loss or loss that can’t be traced back to a specific crime isn’t covered either.

Furthermore, commercial crime insurance may cover the following, but you’ll need the right enhancements compared to a typical policy:

- Virus Restoration / Computer Program and Electronic Data Restoration Expense

- Licensing Violation Fines and Penalties

- Personal Accounts Forgery or Alteration

- Identity Fraud Expenses

Commercial Crime Trends

Nowadays, underwriters often have a difficult time determining risk regarding crime insurance, and therefore pricing, in some regions. Mostly, this trend is because of the sophisticated crimes committed in areas formerly categorized as “good risk” zones.

For example, the overall crime rate could be low in a region and yet, mounds of cyber crime occurring “under the radar” bumps up the risk level.

Pricing Trends

As mentioned, one stolen file could cost a company millions of dollars. And, most business policies don’t cover crime-related losses. Many companies opt to add coverage to one of their existing policies as standalone crime insurance is pricier.

Although plenty of factors contribute to your final number, some elements that may impact your commercial crime insurance premium include:

- Your industry

- Security measures (i.e., data monitoring)

- Value of your business property

- Number of employees

- Annual revenue

Criminal Trends

It’s safe to say that the criminal landscape is rapidly changing, becoming more sophisticated and harder to fight. Companies are tightening up defenses to battle complex cyber threats. It’s a good thing, too! Tactics such as phishing are becoming more prevalent daily.

Criminals are now scouting companies with fractured processes and technology. If your company lacks enhanced IT, you’re a flashing light to criminals, as well. By 2021, cybercrime is estimated to cost the world $6T in damages.

Small businesses are frequently in the crosshairs of criminals. Mainly, cybercriminals target small businesses because of the organization’s culture. In other words, the companies don’t believe cybercriminals will target them. Or, they fail to provide their employees with cybersecurity training.

In light of the stark facts surrounding commercial crime, it’s vital to arm your business with a broad enough policy to cover any criminal attack. Ready for a customized crime insurance quote? It only takes a few minutes to submit your information and start shopping for better crime coverage and pricing. Request a custom quote today!