Key Takeaways

Nurturing a rapidly growing business past the seed funding phase is beyond thrilling—not to mention nerve-wracking, of course. Until now, you’ve likely had a host of financial support, including family and friends, angel investors, etc. Or, perhaps you went the bootstrapping route. No matter the professional path, you will have a billion-dollar business on your hands soon. So, you feel that it’s time to tackle the next milestone—Series A.

To help you in your professional endeavors, we’ve published an entire series on the topic of venture capital fundraising—Series A. This particular post is the first in the series, offering you a birds eye view. We’ll take you on a deep dive in other posts, detailing vital information you’ll need along the way.

But for starters, let’s talk about fundraising strategy.

Before You Start

No hard and fast rules exist regarding prerequisites for your Series A fundraising strategy. A seasoned venture capitalist (VC) frequently vets companies on a case by case basis as well as per industry. Before you launch, however, consider these insider guidelines to get the most out of your professional pursuits.

1. Generate Enough Revenue

Despite revenue being a hot topic to argue, most VCs appreciate seeing $80k to $100K per month. We’d go as far as to say not to start fundraising before you generate $1M annual recurring revenue (ARR).

Keep in mind that generating a hefty revenue run rate doesn’t have to happen in the old fashion way (aka monetizing a product). Building a foundation of active users is another option to display exponential growth. As imagined, this approach is exceptionally successful for SaaS and Tech companies.

2. Triple Income YoY

Looking back over the last 12 months, what do you see? Hopefully, you see a valid business model that can scale up swiftly. The ideal pattern is a triple income increase from last year. So, February 2020 should be three times as much income as it was in February 2019. The goal is to sustain a 10% increase on top of your average growth. These are the sort of YoY numbers VCs want to see to move forward in your Series A funding venture.

3. Maintain Your Growth Pace

Demonstrating a high growth rate isn’t the end of your endeavors. Venture capitalists will also sift through your potential valuation carefully. The faster and more consistent you grow, the more open VCs will be to fund you. It’s crucial not to be a flash in the pan but instead portray a predictable growth rate.

4. Embrace Sustainable Economic Growth

We’ve honed in on a high and anticipated growth rate, but let’s talk sustainability. How well can your company handle the ebb and flow of business, per se?

To be more specific, VC investors will look at how much it costs in sales and marketing to win a new customer. They want to get to the bottom of how sustainable your economic growth genuinely is.

Keep in mind that it’s your customer acquisition cost (CAC) that will steal a VCs interest as opposed to a net revenue per booking, for example. (More on this below—because CAC is a big one!)

5. Define Your Market Accurately

Venture capitalists are interested in your addressable market size, including the opportunity in that particular market. They want to be sure you know where your product or service fits in your specific market. To define your market accurately, try to gather as much information as you possibly can.

For example, do your homework, using official statistics as well as current research. Some helpful sources, include:

- Crunchbase

- Statista

- Nieslen

- Census

- Industry reports

Naturally, you will come up with market-related ideas and conclusions to include in your pitch deck. Remember, accuracy is the most vital part of this step.

6. Tighten Your Financial Plan

Make sure you have a financial game plan in place for the next 1-3 years. We’re not merely talking about a budget or economic forecast—although both are essential. Instead, investors want to know more about your monthly actuals. Also, they will be curious about how much money you expect to need and for what.

Financials & Projections

Above we outlined some general prerequisites to tick off your to-do list before the initial Series A round. While tackling these professional chores shouldn’t be taken lightly, let’s also look at some metrics you need to hit—according to an actual venture capitalist investor.

Mike Rogers of Interplay Ventures chimes in about the importance of industry knowledge, the Series A “sweet spot,” and how your CAC could determine your funding outcome. And that’s just for starters.

Understand Your Market Inside and Out

According to Rogers, the main question any VC will ask regarding potential funds is, “What are you going to do with it?” While this may seem like a no-brainer to you, it’s not to the VC. You must aim to educate the investor, so prepare yourself to answer a multitude of questions about your market.

For starters, Rogers advises you to know where your product fits in the current market. What’s more; is that you need to understand your business’s unit economics. From a financial viewpoint, this VC meeting isn’t an overview—not really. It’s a deep dive, and you’re the one wearing the oxygen in an ocean of investors. The bottom line is that you need to be an industry expert, leaving no stone unturned.

Lastly, heed from Rogers, “You have to come in and teach them why this industry is ripe for disruption and why you’re the person, and your business is the one that’s going to build a really big company in the space. And if you’re not an industry expert, then I think you’re in big trouble.”

Know the Series A “Sweet Spot”

When you’re trying to convince a VC to give you millions of dollars in a specific vertical, understand that they’re looking at the whole package. Your unique product only makes up a part of the pie—there’s more to the equation now.

But let’s back up; it only makes sense for VC to focus on the strength of your team and core beliefs during the seed stage. There’s not much else to go on, after all. However, the Series A level calls for more profound and well-rounded credentials, including:

- Sharp business story that compels a VC to invest

- A strong team (preferably with someone who’s done this before)

- CEO who is an industry expert

- Solid grasp of business fundamentals

- Excellent key performance indicators (KPIs)

Instead of aiming to land on a specific number or financial goal, finding the “sweet spot” in the Series A stage is what will catapult you ahead of others in your industry. But it’s a full circle, too. Securing this “sweet spot” works to ensure that you’re reaching those prerequisites mentioned earlier.

Mainly it’s about positioning yourself right by being multi-dimensional. For example, according to Rogers, it’s not fair to demand either a great team or useful KPIs. He says, “It really has to be both.”

Pay Close Attention to Your CAC

Lastly, and possibly most importantly, your customer acquisition costs must be on target. To take it a step further, Rogers divulges that your CAC relating to the lifetime value per customer (LTV) is what investors want to know most. Keep in mind that your CAC and LTV are particularly crucial in subscription-based SaaS business models, Ecommerce, and D2C.

For example, perhaps you spend $100 to acquire a new customer that earns you pennies on the dollar over a few years. According to Rogers, “You can acquire a lot of those customers, but you’re losing money on all of them.” Ultimately, in this scenario, your CAC is undoubtedly flawed, and a VC will spot this within minutes of reviewing your company.

Rogers explains that if you’re making several thousands of dollars from a customer in a two or three-year period, you’ve got an excellent CAC. These are the kind of numbers you want to present to an investor. Furthermore, you can confidently request for funding knowing that you have a surefire system to make more money with the investor’s capital.

To sum up, try to think long term by looking at the overall picture instead of merely flaunting your customer pool.

Create a Fundraising Strategy

To ensure that your fundraising strategy draws the attention you want, you must look beyond your Series A. Also, if you want the relationship between your company and the VC to last long term, it’s essential to establish the goals of fundraising with the future in mind.

We spoke with Harlan Milkove, a repeat VC-backed startup founder, and Managing Partner at Foundational where he works with early-stage startups to expedite their pursuit of venture capital.

He suggests “Series A readiness is very difficult to assess given it’s difficult to predict what traction expectations will be for a company. Some raise on revenue growth, while others have none but are landing impressive pilots. I recommend looking at other recent financings in companies that share your underlying innovation and go to market strategy. Because VC funds are so selective (backing about 1% of companies that pitch them) the signal they send when they lead a round can be very indicative of what the rest of the early-stage startup market looks like to them.”

Understand the Motives of VCs

Once you establish a secure relationship with a VC investor, they’re often in it with you for the long haul. Plenty of reasons exist for this commitment.

Firstly, most VCs look to invest millions instead of thousands of dollars. So, they’re invested in you—literally. This money isn’t a handout or donation. Secondly, VCs aren’t merely making it rain dollar bills. They’re looking to build their portfolio and hoping for a return on investment (ROI), as well.

Network Early (and Never Stop)

If there is one skill all entrepreneurs need, it’s the knack for networking. Reach out to your professional peers. Perhaps some of them have already gone through a round of Series A funding before. Glean from their experience, and learn from their mistakes.

Even more than your peers, make connections with investors. It’s an excellent idea to meet VCs up to six months before you dive into your Series A. Inform them that you’re not looking for funding now, but you will be in several months. Think of it as planting a seed in a potential investor’s mind.

Remember, it’s beneficial to have a prototype of your product or service the first time you meet a potential investor. This approach helps you to stand out. It also provides you with a connecting point to warm up the next few encounters with the VC.

Find the Right VC

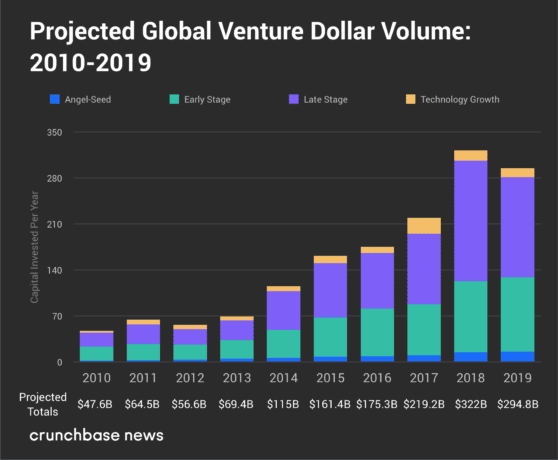

Of the billions of VC dollars doled out in 2019, it’s vital to find the right investor/company match. Let’s face it; there’s more to choosing a VC than merely who has the most money. You must respect an investor’s convictions and consider the VC firm in its entirety, too.

Finding the right VC is so crucial to your Series A funding, we’ve written an entire blog post about the topic: here.

Get Your Timing Right

When you send your pitch deck, it’s helpful to know the most likely times when investors will review it (and review it often!). Although no magical algorithm exists concerning such valuable information, your peers will have some input on the subject.

For example, November and December are notoriously awful times to score the attention of investors. Plan around “dead times” during the year, but make sure you give yourself plenty of time to secure funding before your money runs out.

Sharpen Your Business Story

More than your product or service, your business story is a crucial ingredient to Series A success. Besides, investors tend to favor companies that motivate “warm” feelings. Even in a space often considered cold, such as tech, having a personal touch goes a long way.

As a result, you must nail your business narrative. The aim is to motivate the investor to want to be a part of your story. It’s more than merely spouting off facts—bring your company to life for them. When your company is a living entity, it influences future branding, as well.

Practice Your Pitch

Once you can tell your background through a captivating narrative, it’s time to practice your presentation. So much goes into a pitch deck that we’ve dedicated a separate blog post to it, here.

A few pointers are to get your storyline together first and then work on the design elements afterward. It’s not a bad idea to outsource the design, too—but never your story. Additionally, you can enhance your design process by trying out some templates for quick and creative visuals.

Keep in mind that your pitch isn’t merely to secure funding. Instead, it helps to define who you genuinely are as a business. Sure, it’s a driving force in your fundraising efforts, but a compelling business story can accomplish more than raise VC funds. It can serve you well for years to come.

Prepare Materials

Scrambling to gather all the applicable paperwork is the last thing you want to be doing amid a Series A funding round. To complete the process quickly and effectively, be sure you prepare all the materials you’ll need, such as:

- Business structure

- Previous financing details

- Employee information (past and present)

- Intellectual property information

- All client and third-party contracts

- Pitch deck

- Deal terms (to complete the round)

Although it’s superhuman to have your ducks in a row, 24/7, some business owners still strive for it. However, merely knowing what to expect during a Series A funding round can save you a lot of headaches.

As your company evolves and you take on new professional endeavors, you’ll face unique exposures, as well—especially during a Series A growth spurt. Founder Shield specializes in knowing the risks you face at each stage of development, and we work to make sure you have adequate protection. Feel free to reach out to us, and we’ll walk you through the process of finding the right policy for you.

Want to know more about Series A funding? Talk to us! You can contact us at info@foundershield.com or create an account here to get started on a quote.