Key Takeaways

Despite a pandemic-shaken economy in 2020, the US venture capital (VC) funds raised a combined $69.1 billion. Late-stage investments were exceptionally fortunate as opposed to startups or mid-market investments, although those defeated the odds, too.

Keep in mind that late-stage investment ROIs are often six times more than S&P 500 returns. What’s more, investing in late-stage companies is often viewed as “less risky” than supporting startups — but these ventures are still ventures. Here’s a look at risks that late-stage investors face and what this means for VC players.

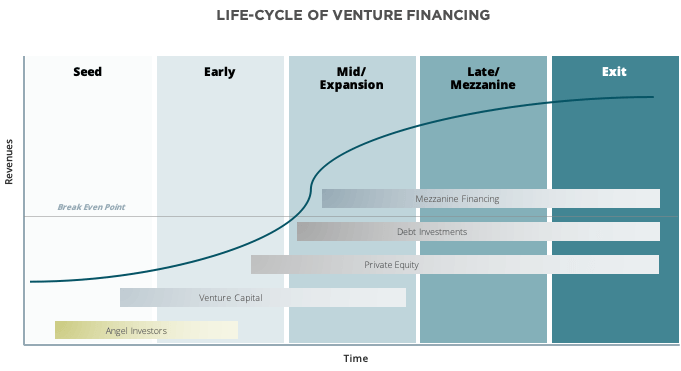

Venture Capital’s Life Cycle

From Seed funding rounds to an initial public offering (IPO), it’s helpful to know the life stages companies undergo. To begin, angel investors or friends and family frequently provide capital for startups to take flight. This Seed round is vital lifeblood at these beginning stages, averaging $500,000 to $2 million. As seen below, this round often serves as a stepping stone to bigger and better things, per se.

Source: Stableton

However, as a company grows and gains traction, founders launch more significant funding rounds. Typically, one investor leads, and other investors follow closely behind. Series A funding rounds, otherwise known as early venture financing, usually fall between $2 million and $15 million raised funds.

The scaling-up stage comes next, where founders often embark on a Series B round. Again, a primary investor typically leads this financing venture, and the funds average $7 million to $10 million. This venture financing is the mid-market or expansion stage.

As companies prepare to go public, owners use Series C to finish up final goals before an IPO. Even fewer companies embark on Series D or Series E, primarily for similar reasons as Series C. Known as late-stage or mezzanine venture financing, these rounds average $26 million.

Late-Stage Investment Risks

Businesses that are only six months to a year away from an exit, such as an IPO, are known as late-stage companies. Not only have these organizations proven their concept, but they’ve achieved significant revenues when stacked up against the competition. Here are a handful of late-stage company characteristics:

- They’re veterans of venture capital financing

- Annual revenue numbers are more than seven digits consistently

- They’ve outgrown their PEO and rely on an in-house HR system

- M&A suitors contend for their attention at this stage

High Return With Moderate Risk

Unlike startups in their infancy or some mid-market companies, late-stage companies aren’t as susceptible to quick collapse. Strangely enough, investors often create a frenzy trying to get on board with a pre-IPO company. Some say this is the fear of missing out (FOMO) syndrome.

The reason is that late-stage companies don’t possess the same level of risk as any other companies. Investors can enjoy many of the benefits, such as the risk premiums, that a private company offers while incurring a hefty return.

On that same note, most late-stage companies have already made their “mistakes,” leaving significant default risks in the dust of the past. However, even with increased predictability, there are risks late-stage investors face and it is crucial to understand how to control risk effectively in this phase.

Cash Flow

Although late-stage companies are often cash flow positive, there’s still a risk of cash flow inconsistency. Take the COVID-19 pandemic, for example, and the devastation it caused all-sized companies. Aside from economic slumps, unusual market trends, or unexpected pandemics, late-stage companies still face annual revenue uncertainty.

Competitive Landscape

Competition is an aspect of business that not even late-stage companies can escape. That said, late-stage investors must endure the risk of other companies skyrocketing to the top regarding revenue and customer acquisition. In a worst-case scenario, an investor could lose a massive chunk or all of their investment.

Operating Cycles

Companies with short operating cycles can recover their inventory investment and on-hand cash quickly. Conversely, long operating cycles leave companies struggling to recover. Depending on which category a late-stage company falls, it might experience more vulnerabilities than another in the same stage.

Social Responsibility

Society is becoming more aware of the impact companies have on the environment. What’s more, many individuals have taken a stand against practices they deem harmful. These concerns are known as environmental, social, and governance (ESG) issues. For example, late-stage companies might leave a more significant carbon footprint or work with vendors with less-than-ideal practices, potentially creating a drop in valuation.

Respecting Risk Appetite

Not all VC investment firms are created equal — not all risks are created equal, either. Finding an investment firm to take on your particular risk level might not be as simple as dipping into your previous Series A or B network. Those particular investors might only feel comfortable in the early stage as opposed to late-stage investments. Additionally, most companies embarking on a Series C, D, or E typically depend on a highly exclusive investor circle.

Discovering the perfect match is crucial. When catering to late-stage investors, it becomes vital to weigh asset classes, age-based risk, and various other factors before committing to an investment. Interestingly, a significant number of investors in the public market are currently seeking opportunities in pre-IPO companies to solidify their market foothold. Simultaneously, these investors seek liquidity as late-stage companies gear up for their public debut or an acquisition.

Insurance for Late-Stage Companies

Many individuals consider late-stage investments as highly speculative and undoubtedly risky. But late-stage companies offer some of the most significant returns in the investment world. Here are some insurance policies that protect late-stage companies and their future:

- General Liability: Protects companies against basic business risks

- Cyber Liability: Protects your company against damages from specific electronic activities

- Errors & Omissions: Protects companies against lawsuits alleging inferior work or services

- Property: Reimburses companies for direct property losses

- Directors & Officers: Protects corporate directors and officers’ assets if they are sued

- Key Person: Protects businesses and investors if an essential team member passes away

- Employment Practices Liability: Protects companies against employee-related lawsuits

- Commercial Crime: Protects companies against specific money theft crimes

Understanding the details of what coverage your company needs can be a confusing process. Founder Shield specializes in knowing the risks your industry faces to make sure you have adequate protection. Feel free to reach out to us, and we’ll walk you through the process of finding the right policy for you.

Want to know more about business insurance? Talk to us! You can contact us at info@foundershield.com or create an account here to get started on a quote.