Key Takeaways

The Securities and Exchange Commission’s (SEC) charges against venture-backed company Theranos in March 2018 should be a wake-up call to all private firms. And Theranos is not alone. The SEC is bringing “case after case” against private companies and their executives.

Theranos had raised $1.4 billion in venture capital for blood testing kits that investors alleged “failed to meet the promises made to investors.” Elizabeth Holmes, the founder of Theranos, claimed that their kits were supposed to perform a wide range of laboratory tests on a finger-prick blood sample. However, the product was never clinically proven to work. Holmes nonetheless continued to paint a fantasy to attract new investors, taking “fake it ‘til you make it” to a whole new level.

When an investor realized something was up, they tried to rescind their agreement to purchase Theranos stock due to apparent misstatements made by the firm and its principals. The SEC got involved and charged Holmes with fraud, forcing her to disband the company. The SEC and the San Francisco US attorney investigated whether Theranos misled investors about its technology, management and its finances.

In another closely watched case, the SEC charged a Silicon Valley startup Jumio with defrauding investors. Jumio developed private mobile and web payments as well as identity verification software. Although CEO Daniel Mattes did not admit to fraud allegations, he entered into an agreement with the SEC that included a $16.7 million civil penalty and a disgorgement of $14.5 million plus interest.

These two settlements make it clear: the SEC is no longer focused primarily on publicly traded firms. According to the SEC’s website, they may (and will) investigate allegations of a private company providing false or misleading information, as in the case of Theranos, or other allegations of market manipulation or accounting fraud.

Side C Coverage for Directors & Officers is Critical for Private Companies

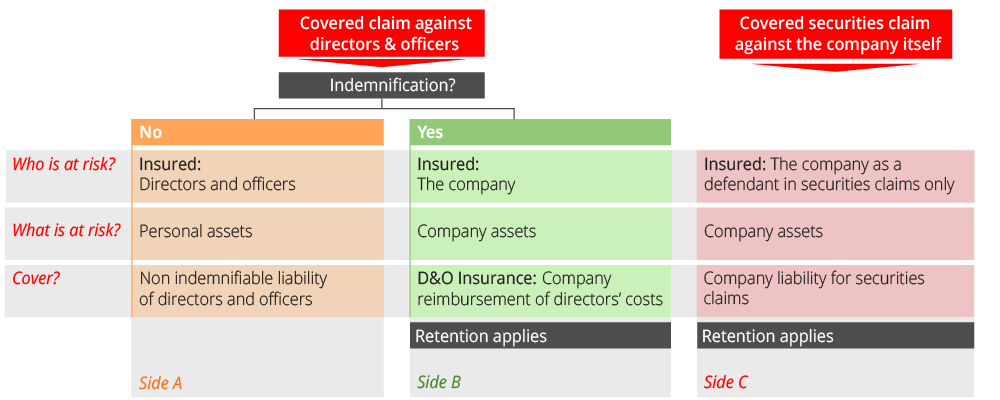

When these types of enforcement actions occur, founders, management and boards turn to their Directors & Officers policies. Before diving into Side C let’s quickly recap how D&O insurance is structured.

Side A provides coverage when shareholders or others sue directors and officers as individuals in cases where the company cannot indemnify the directors.

Side B provides coverage for the company, but only to the extent of indemnifying directors or officers named in the lawsuit.

Side C, also called Entity Securities Coverage, protects the company itself against claims, invaluable when a regulatory body (like the SEC) sues a company. Side C usually begins to defend the entity upon presentation of a claim made against the entity, including regulatory actions. Side C helps to protect the company’s balance sheet in the event of a claim. For private companies, Side C covers claims unless excluded. Common exclusions include employment-related, breach of contract and anti-trust allegations, to name a few.

Pay Attention to JOBS 3.0 and the Investor Confidence Act

Jobs 3.0 Act, passed in 2018, packaged 32 pieces of legislation principally designed to spur business startups and initial public offerings. Some of the key provisions of the act include the following.

The cost of initial public offering (IPO) – The Act will allow small businesses certain exceptions to delay compliance with some standard reporting requirements. This provision should lower IPO costs and encourage a flurry of smaller IPOs.

Accredited versus non-accredited investors – Formerly, investors with an annual income of $200,000 or a $1M net worth could invest in a company. The JOBS 3.0 Act embraces crowdfunding requirements and looks at the “experience and expertise” of investors. Expect smaller investors with expertise in areas such as tech to bring their talent to the table.

Test-the-Waters and confidential IPO – The JOBS 3.0 act allows any company to submit a confidential draft registration to the SEC for its proposed IPO. The provision also allows companies to communicate with potential investors to “test the waters” as it relates to that company’s securities offerings. Formerly, this provision applied only to larger, Emerging Growth Companies.

Legislators strategically crafted JOBS 3.0 with the aim of bolstering the US economy, particularly by fostering growth among small businesses, startups, and investments. This comprehensive initiative has proven especially advantageous for tech companies, addressing their recurring challenge of financing audit compliance costs while maintaining a sustainable and profitable operation—aided in no small part by the support of audit insurance companies.

Jobs 3.0 is great in most respects, it will make it easier for private companies to attract investors and progress to an IPO. However, increased D&O exposure to investors and SEC scrutiny may intensify as a consequence of the act. It will inevitably lead to companies finding themselves under the SEC microscope more often than ever before in the private-funding sphere. If your company anticipates subsequent funding rounds or going public, review your Side C D&O coverage to ensure your policy can respond.

SEC Regulations that Impact Private Companies

Since private companies are not publicly traded, they are not subject to reports to shareholders and can keep private their business plans and finances. This can often lead to misconceptions that only public companies should be concerned about the SEC when in reality privately funded companies can face the same consequences.

The Theranos and Jumio cases demonstrate the need for any private company to review its current D&O program and ensure the policy will respond should an SEC complaint occur. Usually, private D&O policy exclusions generally bar coverage for the “public offering, sale or trading of securities, and not pre-IPO transactions,” However, your current D&O policy may exclude liabilities for the steps in taking the company public, not just liabilities after the company has gone public.

Coverage limits are another area of concern when a private company must withstand an SEC probe or suit alleging its management team violated securities law. These are very costly defense cases which could potentially result in enormous financial strain once the claims exhaust D&O limits. From an initial subpoena of documents through final defense, your responses to the SEC require sound and experienced legal counsel. Cost is obviously a factor, but make sure you work with an experienced broker that examines your risk profile and recommends adequate limits.

New Regulations Can Have Unintended Consequences

While JOBS 3.0 makes it easier to raise capital and attract investors, funding IPOs with fewer regulations and perhaps less experienced investors can increase a company’s risks and liability.

D&O carriers find themselves facing exposures not previously of concern in the private sector. To manage these emerging risks, D&O insurers may attempt to redesign and recraft exclusions in D&O policies to curb insurers growing exposure to securities claims. With your current D&O policy, review all policy revisions your carrier makes to ensure the carrier will not limit your coverage.

A well-crafted D&O policy that protects your officers and directors, as well as your organization, is critical in today’s heavily regulated and fiercely litigated society.

Would you like to know more about the ins and outs of D&O? Visit this link for more information. We’re always available to talk. You can contact us at info@foundershield.com or create an account here in order to begin a quote.