Formation

Minimize risk, maximize potential. Launch confidently with our support by your side.

Our Services

Ambitious companies need a partner to shield them from potential risks, roadblocks, & uncertainty. We’re the insurance broker that proactively covers your risk to keep the wind at your back.

Founder Shield is the innovation arm of the Baldwin Group, one the fastest-growing brokers in the country. For over a decade, we’ve supported ambitious startups from seed through IPO with our full suite of insurance and risk advisory services. Our mission is to create the most seamless, intuitive, and responsive experience to protect your company’s growth.

We cater to the specific needs of high-growth companies across various industries. From tech startups and innovative financial services firms to groundbreaking life sciences companies our practice advisors offer tailored risk management solutions for businesses built from the ground up.

Our focus is on venture-backed businesses, and our scalable services are designed to grow alongside your company, providing the protection you need at every stage.

Navigate the future, together. As tech leaders, we understand the challenges and opportunities. Our Specialists become an extension of your team, guiding you to success.

From groundbreaking research to commercialization, we understand your risks. Our Specialists navigate the ever-evolving regulatory landscape, empowering innovation while mitigating risk.

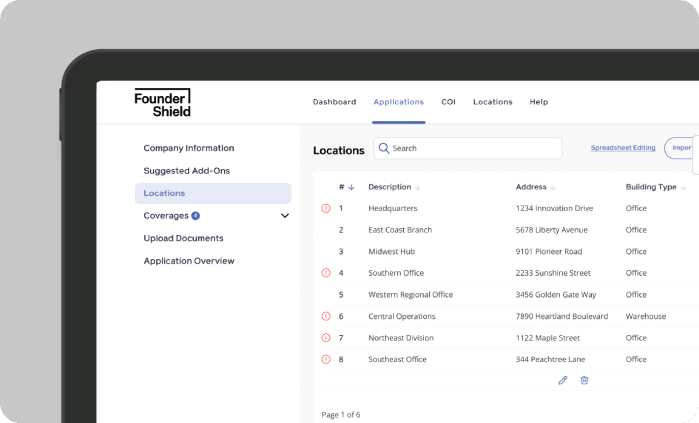

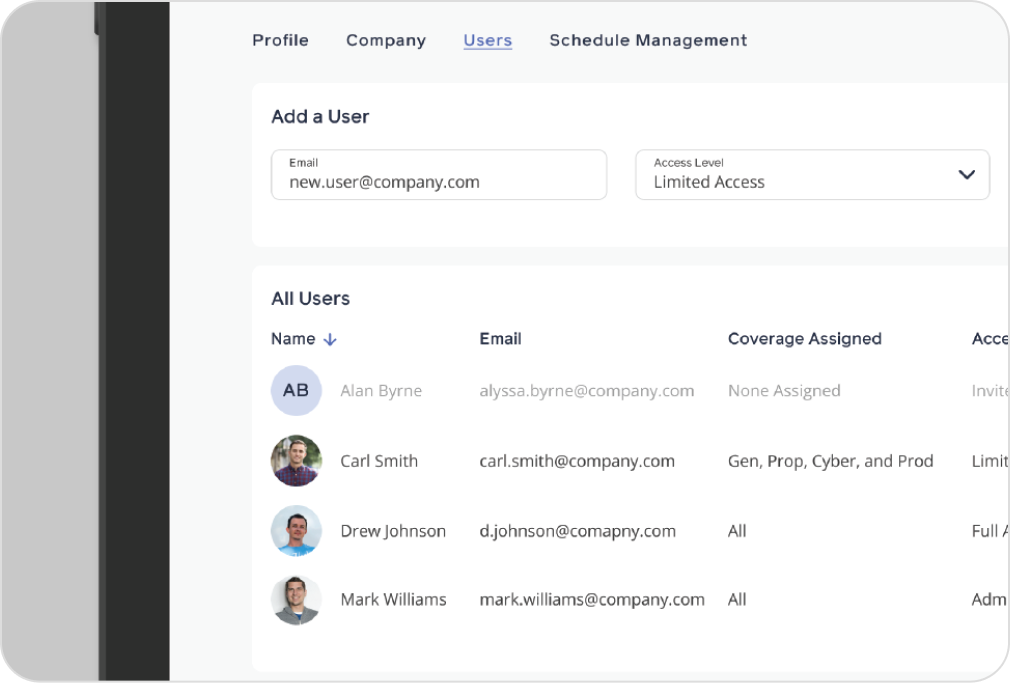

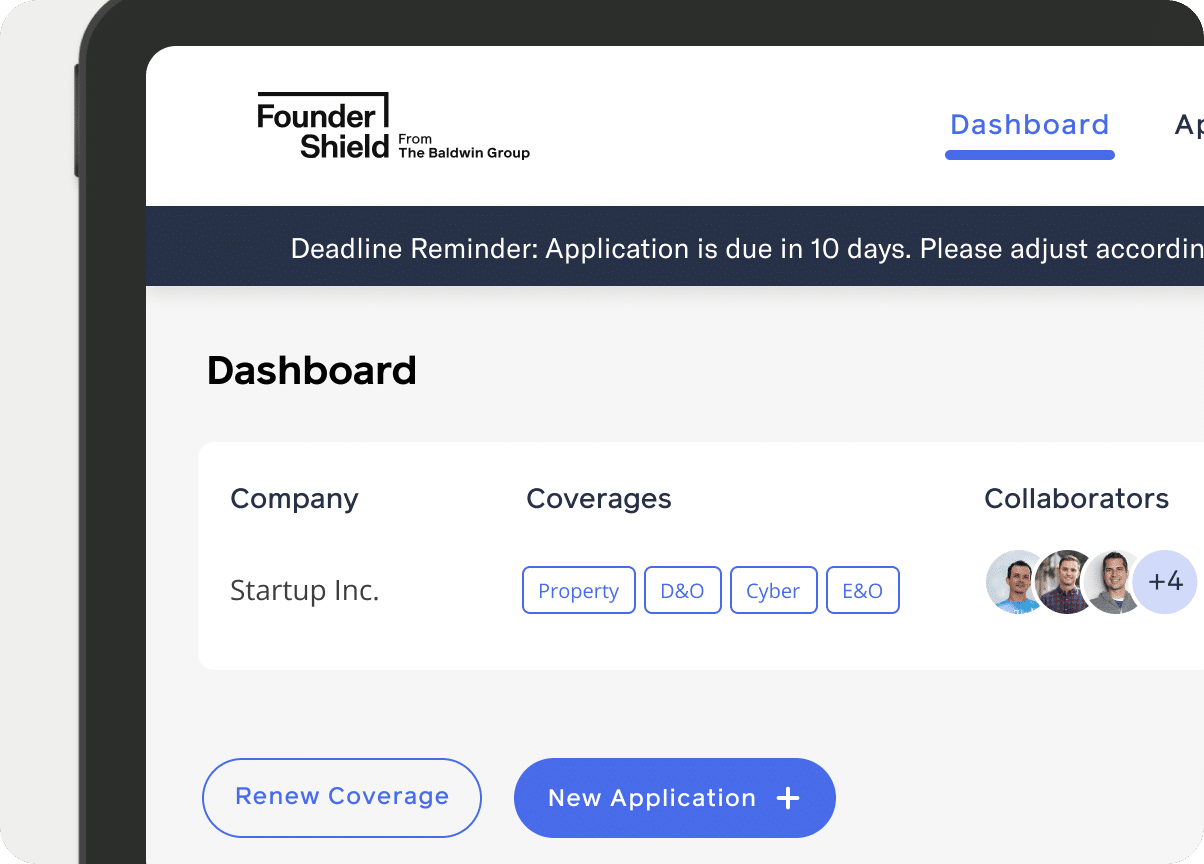

We combine user-friendly tech tools with comprehensive risk mitigation strategies. Experience peace of mind with a streamlined approach to financial protection.

We understand your established needs. Our Specialists leverage innovative solutions to enhance your existing operations ensuring stability and growth in the digital age.

Whether you’re developing your MVP or signing a term sheet, we understand that you’re on a tight budget, and need to be thoughtful about how you spend your capital. Connect with Startup Advisor to build your custom insurance program tailored to your stage.