Key Takeaways

For many founders of high-growth startups, reaching an IPO is a sign of success. It’s the big payoff, a realization of a lifelong dream. Despite booming market conditions, many startups are hesitant to make the public jump and instead stick to venture rounds to fuel their expansion. But this could all change in the advent of the Jobs Act 3.0. Of course, there are benefits and drawbacks to going public. We’ll explore some of these in this post along with how to manage risk from a directors and officers perspective.

Pros of an IPO

The pros of an IPO are quite straightforward. First and foremost, going public will generate cash for your business and enable you to execute the major capital-intensive projects needed to drive growth. Going public will inherently generate a huge amount of buzz around your company and signal legitimacy as a market contender.

Having a ticker symbol and stock that the public can identify and trade on an exchange helps to strengthen your brand. Other companies and financial institutions may be more comfortable working with you as a public company as they know that you’re now an open book having to file all information with the SEC (Securities and Exchange Commission).

As a public company, you can also use your stock as a form of currency to purchase other companies and attract top talent in the form of stock options. A publicly traded stock is also a liquid asset for your investors. They can easily buy and sell on the stock exchange whereas equity in a private company is not as simple to “cash out”.

Cons of an IPO

As mentioned in the “Pros”, going public brings an entirely new set of eyes on your company in the form of the SEC. While this may make some business transactions easier, your company will now have to comply with all of the rules and regulations that come with being a publicly traded company.

Also, you can no longer control exactly who invests in your company. Rather than reporting to a group of investors that you are familiar with, public companies have to concern themselves with the expectations that Wall Street has levied on them. This may force a company to alter their strategy in order to appease outside investors and make sure your stock price is in line with expectations.

Going public within itself can also be a huge risk. What if the IPO does not gain any traction and outside investors are not interested in purchasing your stock? Companies that do not captivate the market can quickly turn into penny stocks and risk being delisted.

Lastly, the process of going through an IPO can be arduous and expensive. Before the IPO date, the focus of the leaders of the company will be on preparation for the offering rather than running the business as usual. Management will also be consumed with a “Road Show” where they travel to different potential investors to present on the company and why they are an attractive investment.

After the IPO, the SEC requires quarterly financial reporting as well as disclosure for material transactions and the trading of stock by senior executives of the company. Compliance becomes a time-consuming and costly part of doing business.

Insurance ramifications of an IPO

The good news from an insurance standpoint is that an IPO won’t affect most of your policies. Your company’s business owner’s, workers compensation and even cyber policies will be unaffected by the change in structure. Where you will see an impact on the insurance side of things is on your directors & officers liability policy.

Recent lawsuits arising from IPOs

An number of recent lawsuits arising from IPOs illustrate exactly why your D&O policy would be impacted by going public:

Blue Apron – Blue Apron went public on June 29, 2017, and their share price began to drop immediately after. A few weeks later, it became public that Amazon was aiming to enter the meal-kit delivery space.

Upon the first earnings announcement on August 10, 2017, the share price plunged 15% down to $5. One week later, the D&O’s of Blue Apron were handed a Securities Class Action Lawsuit. The complaint stated,

“Less than two months after going public, on August 10, 2017, Blue Apron shocked the stock market by announcing significant undisclosed problems, lowering its guidance for the second half of 2017, and stating that it planned to change its strategic approach for managing the business for the remainder of 2017.

On this news, the Company’s stock price plummeted to approximately $5 per share — a 50% decline from the IPO price of $10.” (Full complaint can be found here:

Snap Inc. – Snap (Snapchat) started trading on March 2, 2017, and similar to Blue Apron, its first earnings release (May 10, 2017) failed to inspire its investors. On May 16th, a Class Action was filed against Snap. Several other SCA’s were filed against snap shortly after, but the first complaint alleged that:

“Throughout the Class Period, Defendants made materially false and misleading statements regarding the Company’s business, operational and compliance policies.

Specifically, Defendants made false and/or misleading statements and/or failed to disclose that: (i) Snap’s reported user growth was materially false and misleading; and (ii) as a result, Snap’s public statements were materially false and misleading at all relevant times.”

Full complaint here.

Tableau Software, Inc – between June 2015 through Feb 2016 Tableau allegedly made false statements or misrepresented how competitors products were negatively impacting its competitive position and profitability. Tableau’s stock lost half its value after the company announced that it had badly missed its expectations for growth.

According to the lawsuit, Tableau made:

“false and/or misleading statements and/or failed to disclose that: (1) product launches and upgrades by major software competitors were negatively impacting Tableau’s competitive position and profitability; and (2) as a result of the foregoing, Tableau’s financial statements were materially false and misleading at all relevant times. When the true details entered the market, the lawsuit claims that investors suffered damages”.

In effect, the lawsuit claims executives failed to disclose that it was on pace to miss earnings expectations due to competitors launching new software and making upgrades to existing offerings.

De-Risk the Journey to IPO

Why do I need D&O insurance for an IPO?

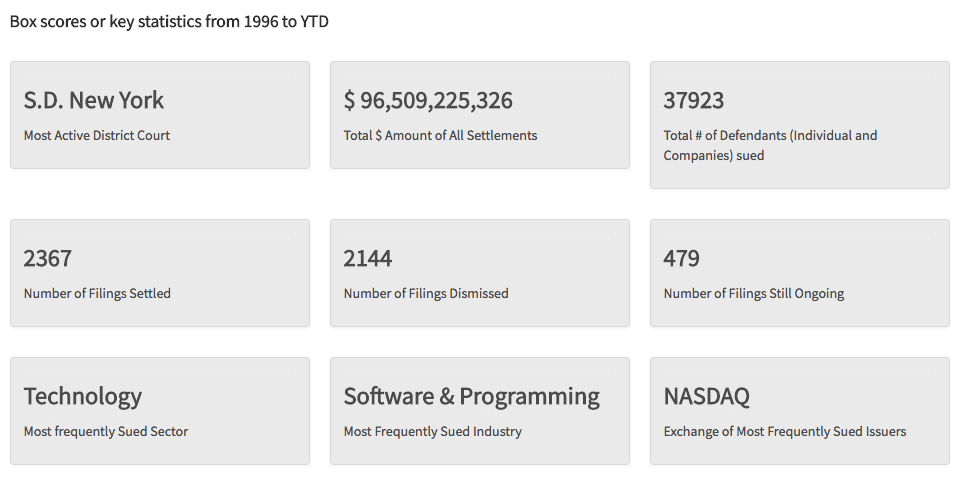

Since 1996, there has been over $96.5B awarded to almost 38,000 defendants in Securities Class Action Settlements. Perhaps the most relevant piece is that the technology sector is the most frequently sued sector.

- Source: Stanford Law School’s Securities Class Action Clearinghouse

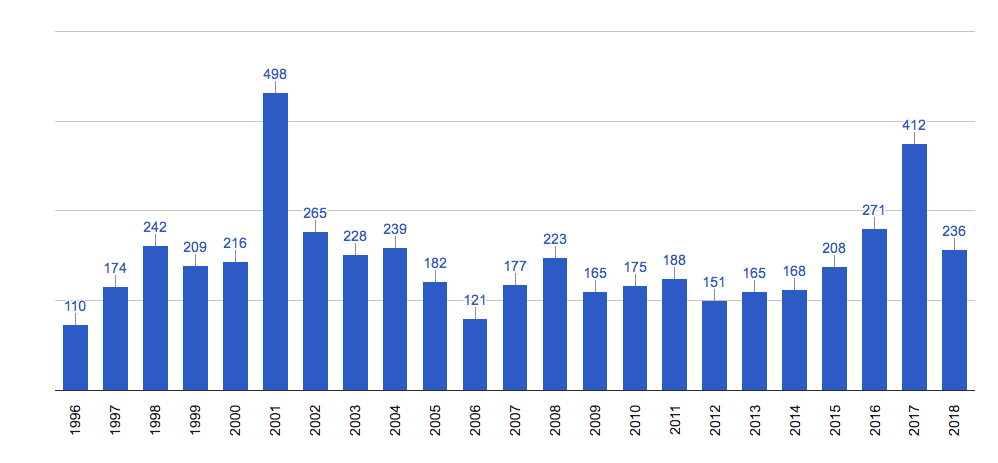

The number of filings for technology companies has also continued to increase each year since 2012:

- Source: Stanford Law School’s Securities Class Action Clearinghouse.

A list of all filings can be found here:

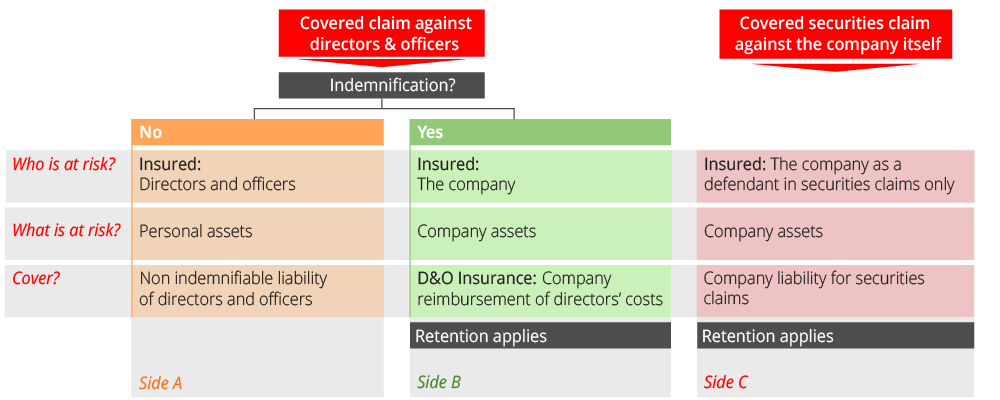

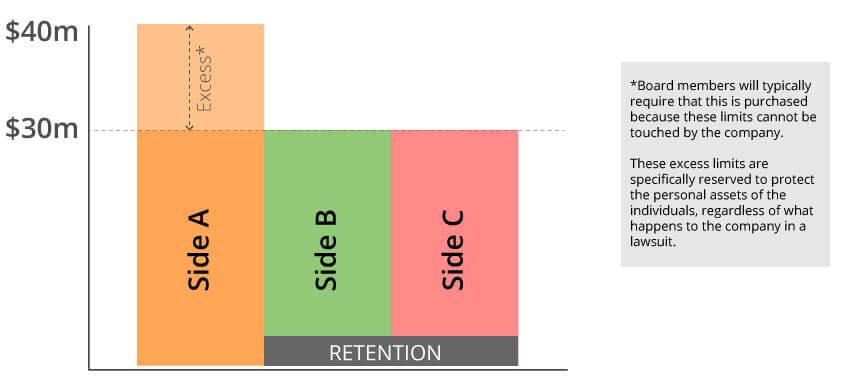

Simply put, if you are named in a lawsuit in your capacity as a director or officer of a public company, your personal assets can be at stake. This is where public directors & officers liability policy steps in. A public D&O policy will pay for your defense costs and any settlement arising out of these lawsuits, more details on how the policy works in the link above. But, in summary, there are three main insuring agreements in a D&O policy:

Side A:

Protects solely the individual directors by paying the defense costs and settlements levied on the directors as a result of a lawsuit. Side A will only pay the individual directors when the entity is unable (i.e. insolvent) or legally not permitted to do so. Typically, individual directors will ensure that the company purchases additional Side A coverage on top of the traditional ABC coverage.

Side B:

Indemnifies the entity after the entity has paid the individuals named in the lawsuit.

Side C:

This is entity coverage. Should the entity be named along with the individual directors in a lawsuit, this coverage protects the balance sheet of the company and will reimburse and costs/settlements incurred.

The below graphic illustrates how sides A, B and C work with regards to claims against directors and a securities claims against the company itself

What D&O limits do you need for an IPO?

Choosing the right D&O limits for your business depends on a number of factors including:

- Market Cap

- Industry

- Revenue

There is no rule of thumb and appropriate limits will vary on a case by case basis that depend on the combination of factors we’ve outline (and more). Some companies require only $5m and others need up to $500m or even $1bn. If you want to find out exactly what limits your business requires reach out to us and we discuss our benchmarking data.

Below is an example of how a potential D&O tower could be structured:

Optional D&O coverages for IPOs

Additional limit for insured persons:

Additional limit for insured persons:

If the policy’s limits run out and there are still outstanding claims against an insured person, this additional limit will pick up the tab as long as the company is unable to indemnify the person.

Bump-up claim coverage:

Bump-up claim coverage:

Most D&O policies exclude claims from shareholders alleging you sold the company for less than you should have. This optional coverage will pay the legal costs to defend against this claim.

Derivative demand investigations:

Derivative demand investigations:

If the shareholders act on behalf of the company and sue the management or board of directors, this coverage clause kicks in to pay whatever investigative costs the shareholders’ demand forces you to incur in determining the validity of the complaint.

Road Show coverage:

Road Show coverage:

If you’re considering an IPO, take your pitch on the road to woo investors, and then decide not to IPO, lawsuits can come from a million directions from people claiming you misled them. Coverage for these claims often needs to be added separately

As your company grows:

Keep in mind that as your company finds larger success, you will likely be seeking well-known board members who bring with them industry knowledge and experience. These board members will want to see that you have a strong D&O program with adequate limits in place before agreeing to join your team.

As the company grows, you will also find more people looking to take a piece of your pie, just waiting for a misstep from one of the D&O’s to jump on the company in the form of a lawsuit. It is important to make sure your D&O insurance program is aligned with your success.