Key Takeaways

After enduring a hard-hit 2021, commercial insurance buyers enjoyed the reprieve of flattening D&O pricing in 2022 and beyond. Some experts question if it’s merely a temporary lull or signs of stabilization. This year’s trends report reviews themes that unfolded last year and what we expect from the D&O insurance market for the remainder of 2023.

Remember that many factors influence the 2023 market, including events that unfolded last year. The rise and fall of cryptocurrency exchanges, a greater push for anti-ESG legislation, and abounding layoffs in the tech industry have significantly shifted the D&O market. Let’s explore!

How Much Has Private D&O Pricing Changed?

The overall pricing of D&O coverage in 2022 decreased and stabilized compared to prior years. A driving factor of this is an increase in capacity in the market. As new carriers enter the market, rates tend to go down.

We can likely attribute new private D&O entrants to the lull in public market activity. In other words, fewer companies planned initial public offerings (IPOs) than in years past. With more private organizations choosing to stay off the open market, D&O insurance carriers that previously insured public companies must find other routes to profitability.

Several industries continue to offer unique risk profiles that can lead to higher premiums for private D&O insurance. For example, companies in the cannabis, life sciences, startups with limited capital, and unicorn startups face nuanced D&O coverage risks.

As imagined, businesses in the crypto, fintech, and NFT spaces also face challenges when seeking private D&O coverage — especially after the FTX bankruptcy and the fall of other crypto-related businesses.

On the one hand, due to increased employment-related claims, the end of 2022 saw an increase in companies seeking to renew D&O and employment practices liability (EPL) insurance. On the other hand, this increase in coverage could mean higher prices as private D&O carriers assess the risk of more employment-related lawsuits and excessive fee litigation claims.

Private D&O REDY® Index – January 2023

Monthly Renewal Pricing Analysis | Primary and Excess

Source: CRC Group

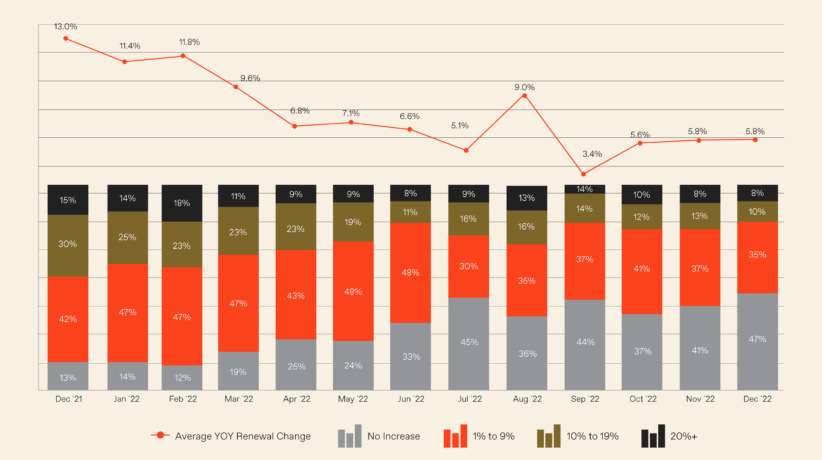

How Much Has Public D&O Pricing Changed?

As with private D&O coverage, public D&O pricing experienced a decline over the second half of 2022. Again, new competition in the D&O insurance market is helping to drive prices down for public companies. Even with fewer public companies emerging on the open market, new entrants play a significant role in pricing.

As mentioned, fewer companies are going public nowadays, limiting the market for new public D&O insurance policies. With fewer new public companies needing insurance, many D&O insurance carriers focused on increasing revenue elsewhere.

However, not all public companies can expect lower D&O pricing. For example, companies with open claims will likely to see higher premiums until those claims are settled. Other legal matters, such as the recent tech layoffs and anti-ESG legislation, could lead to higher premiums for some public businesses facing these issues, at least in the short term.

In addition, public businesses may be open to more financial scrutiny than their private counterparts. Companies that didn’t hit earnings goals or saw sharp declines in their stock prices may not see the decreased D&O premiums other companies are enjoying.

High-Profile D&O Suits in 2022

A mix of supply chain issues and troubled IPOs led to increased shareholder lawsuits in the latter part of 2022. Many of the high-profile suits of 2022 had similar complaints: directors had misrepresented their businesses’ earnings and revenue potentials, leading to shareholders’ financial loss.

Three major cases, each filed in November 2022, are worth watching:

- Bird Global, Inc: A shareholder filed a securities suit against the electric scooter business, its CEO, and its CFO. The SPAC-related lawsuit comes after a press release by the company stating a recording error caused overstated revenue estimates. In the case, the plaintiff claims that Bird made misleading statements concerning their recording of Sharing Revenue, which caused an over 15% decline in share prices.

- Torrid Holdings, Inc: Plus-size women’s clothing company Torrid experienced a lawsuit from shareholders shortly after the company’s July IPO. The lawsuit claims COVID-19 supply chain issues and other macroeconomic factors lead to a lower-than-expected inventory across Torrid stores. As such, the plaintiffs believe the company overstated its revenue and earnings goals during the IPO. Another notable point in the Torrid lawsuit is the claim that the CFO had plans to retire shortly after the IPO, which could raise fiduciary concerns.

- FIGS, Inc: FIGS is a healthcare apparel company most commonly known for its direct-to-consumer scrubs sales. After the company’s IPO in June 2021, FIGS experienced a lawsuit similar to Torrid in November 2022. The case against FIGS names the company itself and several directors and offices. In this case, two shareholder groups allege the company’s offering documents and post-IPO earnings statements overinflate the company’s ability to secure repeat customers and overcome the high cost of using air freight to avoid COVID-19-related supply chain delays.

The D&O Market Results for 2022

Before diving into 2023 D&O insurance expectations, it’s worth reviewing the past to see if the market measured up to what we forecasted last year. Let’s review.

Good Premium Opportunity

As expected, many businesses experienced flat or slight premium increases throughout 2022. By the end of the year, D&O pricing had shifted downward. Of course, this was highly dependent on the individual business. Those that fared well through the pandemic and resulting economic downturn faced generally lower pricing than companies with financial woes.

Leaders Worldwide Prioritized Cybersecurity

Last year, we expected business leaders to face continued pressure to shrink cybersecurity risks. Throughout 2022, cybersecurity continued to be one of the most significant priorities for companies in every industry, including governments. World and business leaders recognized the importance of a robust cybersecurity strategy and risk mitigation plan.

Adding Cost on Excess Layers

Although companies seeking excess D&O coverage in 2022 still faced high premiums at the start of the year, by the middle of 2022, pricing had started to level out. Kyle Jeziorski, EVP of Broking, was spot on in expecting new D&O insurance entrants to increase competition and lower prices.

In addition, established carriers were able to “catch up” to newcomers in the market and began offering more competitive premiums to win business.

Not all businesses have experienced rate decreases, especially with economic concerns related to supply chains and worldwide economic insecurity. The cryptocurrency industry, for example, underwent heavy losses from a few major players in the market. These dynamics typically cause insurers to hesitate to supply excess coverage to these businesses.

Supply Chain Disruption Suits

Torrid and FIGS were just some companies suffering from a messy supply chain. From backlogged cargo ships and rail supply issues to labor shortages and strikes, companies around the country (and worldwide) faced uncertainty and added expense because of the disrupted supply chain.

Besides the Torrid and FIGS lawsuits, many other retailers and manufacturers face cases related to inflated earnings and sky-high supply chain costs.

D&O Premium Spiked for SPACs

Special purpose acquisition companies (SPACs) dominated in 2020 and 2021. However, the SEC tapped the regulatory brakes on SPACs in 2022. This shift initiated a popularity downfall of SPACs and a decline in their overall appearance on the market.

The SEC crackdown wasn’t the only factor, though. When many SPACs couldn’t perform on their promises of elevated earnings, investors started to back out. Additionally, the investors who lost money have also filed suits against SPAC leaders, claiming the founders of these unique companies didn’t do their due diligence before merging. For SPACs and other high-risk businesses, these dynamics mean higher D&O pricing. It’s safe to say that the SPAC boom is over.

Many businesses welcome the relief of falling premium prices. However, the sudden shift could impact the market, especially for companies with the highest rise and fall in premiums. This could include life science and technology companies and those recently entering the public market via IPO. On the other hand, established public companies will likely see flat premiums in the short term.

Newly public companies can expect to continue enjoying lower rates in 2023 but may face higher costs in D&O litigation. Despite the rate of overall securities class action lawsuits falling, IPO companies continue to see dramatically high lawsuit rates. In addition, the cost of a securities defense attorney continues to rise, and D&O carriers are paying larger settlements than in the past. This shift could lead to higher prices for D&O risk mitigation, even with lower premiums.

While rates are expected to flatten or continue decreasing over 2023, the rise in new D&O insurance carriers is expected to drop off. Those new players in the market will need to continue finding new customers as traditional insurers bring their pricing more in line with the newcomers. This could potentially spell disaster for some of the newer companies, as they won’t be established enough to take on larger competitors.

Founder Shield’s Outlook

What’s in store for the D&O market for 2023? Let’s review some crucial factors that will play a part in this year’s market.

IPO Slump Impacts Private D&O Market

As IPOs continue to slow, the private D&O market feels the effects. There’s a good chance the private D&O insurance market will soften, primarily if new insurance carriers focus on writing private policies.

As Jeziorski explains, “The heavy risks that IPOs come with bring large premiums for D&O insurers. If there are no IPOs for insurers to write, they will look to make up that premium elsewhere. This could lead to a more competitive landscape in the private company space with more players bringing competitive terms to a market they would not otherwise be focused on.”

New SEC Rules and Crypto Chaos (Thanks, FTX!)

Between fraud, bankruptcy, and lawsuits, the cryptocurrency market trudged through a rough year in 2022. This year of chaos will likely lead the SEC and other regulatory bodies to look closely at the crypto market. Already the SEC is hinting it may revise rules around private equity, venture capital, and hedge funds, mainly due to the crypto crash.

This new wave of legislation could lead to a thriving crypto market. Or, ineffective legislation and regulation could burden the industry with bureaucracy and cause slowdowns when fixing the issues in the market. Only time will tell how new rules play out, but it’s a good idea to plan for ineffective regulations making an appearance.

Rates Will Flatten or Decrease

“In 2023, we expect D&O rates to flatten or even continue to decrease, as buyers will likely have more control in the market than carriers. Additionally, self-insured retentions are trending downward. This continues to signify a softening market after several years of a sharp incline.”

Small and medium-sized enterprises (SMEs), in particular, may see the best D&O insurance market in the coming months. With record venture capital (VC) funding in 2022, these businesses have the chance to push through economic downturns while enticing D&O insurers to write policies for growth companies.

Macroeconomics Drive the Reinsurance Marketplace

Despite the growing number of D&O carriers driving prices down, the reinsurance marketplace could slow the decrease. Matt McKenna from Scale Underwriting explains, “The reinsurance marketplace is often the harbinger of changes in the retail insurance space. We have seen more active due diligence and caution from many reinsurers driven by their view of macroeconomic threats.”

With the expected rise in D&O lawsuits, reinsurers are being more careful than ever. This could make some carriers less competitive, as the new players and other competitors work to offer fast and cheap quotes for businesses.

Lastly, we hope for big things in 2023, from a break in the IPO hush to a stabilized banking landscape to aligned cannabis regulations — but only time will tell.