Key Takeaways

FTX is an industry giant; its founder is the second-richest crypto billionaire, and its investors are household names in venture capital. So it only makes sense for FTX bankruptcy news to shake the crypto world. Still, the unwinding of the well-funded behemoth shook the crypto market to new lows and could have a lasting impact.

The story of how FTX went from leading an entire industry to filing for bankruptcy includes infighting amongst industry giants, political intrigue post-midterms, and a potential Madoff-like fraud scheme. As we peer through our risk management lens, here’s what we know.

Understanding the FTX Backstory

Sam Bankman-Fried (SBF) and Gary Wang founded FTX Cryptocurrency Derivatives Exchange in May 2019 as a trading firm. According to Forbes, FTX reached around $1 billion in revenue in 2021, growing its customer base from 246,000 in 2020 to 3.1 million in 2021.

Its funding history is equally as impressive, topping $1.8 billion from Sequoia, Temasek, and Thoma Bravo, to name a few. FTX handles roughly 11% of the $2.4 trillion in derivatives traded each month. With celebrity brand ambassadors, such as Tom Brady and David Ortiz, the globe seems smitten with the firm. However, SBF surprisingly admitted in an interview that crypto lending was one giant Ponzi scheme — and many of us gasped.

Still, as the saying goes, the bigger they are, the harder they fall.

“Where does the extra cash for yield farming actually come from?” asked Matt Levine, Bloomberg Opinion columnist and host of Odd Lots podcast. In many ways, the answer from SBF foreshadowed things to come.

He said, “You start with a company that builds a box and in practice this box, they probably dress it up to look like a life-changing, you know, world-altering protocol that’s gonna replace all the big banks in 38 days or whatever. Maybe for now actually ignore what it does or pretend it does literally nothing. It’s just a box. So what this protocol is, it’s called ‘Protocol X,’ it’s a box, and you take a token. You can take ethereum, you can put it in the box and you take it out of the box. Alright so, you put it into the box and you get like, you know, an IOU for having put it in the box and then you can redeem that IOU back out for the token.”

FTX Spirals Down to Bankruptcy

Crypto experts say the FTX bankruptcy is due to its founder’s pride and its top rival’s ruthlessness. However, SBF published a 22-part apology on Twitter that he peppered with profanity, outlining several of his mistakes. But none of this travesty happened overnight. Let’s review the timeline and events leading up to the crypto crash.

Timeline to the FTX Bankruptcy

- Binance CEO, Changpeng Zhao, confirms rumors about the company’s decision to liquidate its FTT holdings amid speculation about Alameda’s — FTX’s sister company — financial health.

- Binance CEO Changpeng Zhao took to Twitter to announce that the company had decided to sell all of its FTX (FTT) tokens due to “recent revelations that came to light.”

- The Binance announcement surfaced a few days after rumors about Alameda Research’s financial troubles. According to a recent report, the trading firm, with close financial ties to FTX, has immense exposure to the FTT token.

- Alameda Research CEO Caroline Ellison claims that FTX has an additional $10 billion of assets that are not listed.

- FTT collapses with Zhao, confirming that Binance will close its $2 billion position. Alameda Research said it would defend FTT at $22 — but markets called the bluff. A run pursues forcing FTX to shut down withdrawals confirming the previous suspicions.

Binance announces potential bailout of FTX. Deal terms were not disclosed to the venture capitalists (VCs) who invested up to $2 billion into the firm.

Why the FTX Bankruptcy Matters to Crypto

Let’s get something straight; history isn’t repeating itself in a mirror image of Enron or Theranos. However, there are echoes of both reverberating from this crash. Remember that crypto is no stranger to ups and downs; the industry expects it. But this unearthing is massive. Here’s a quick summary of the collateral damage:

- Crypto markets plunge to new annual lows.

- Notable investors — SoftBank, Tiger Global, BlackRock, Lightspeed — will have to answer to limited partners (LPs) following the losses. Of all the money invested, not one board seat was offered to investors, a significant corporate governance and oversight concern. More on how SBF wowed Seqouia’s partners into giving him $1 billion during a Zoom meeting can be found here.

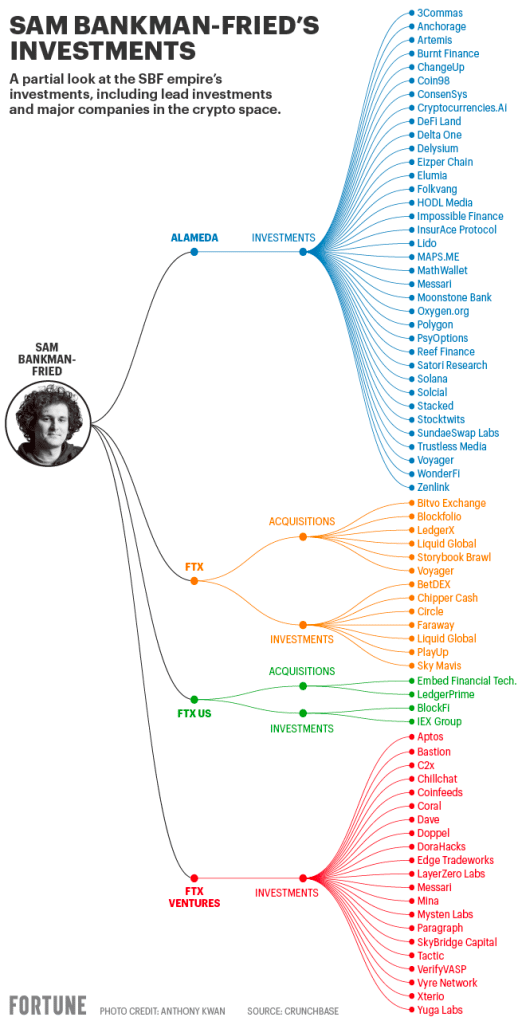

- FTX venture arm may need to fire sale equity positions leading to downstream industry impact.

Through the Risk Management Lens

We expect to see this situation shake investors and stakeholders more than anyone. For example, other investors lost confidence when Alameda Research said it would defend FTT at $22. As we know, FTT broke below $22 soon after and spun into a nosedive. The lack of confidence might quickly spill over into other crypto companies or investments, with VCs losing hope for crypto profitability (or stability).

As mentioned, top VC players like Sequoia Capital now face disaster. The Sequoia investment in FTX might also face scrutiny. Some expect LP litigation threats. And who’s to blame them? Also, if such a massive crypto giant can fall from $32 billion to potentially zilch in only 36 hours, isn’t it possible that it will happen to others? Some investors might not want to risk it, steering away from crypto altogether.

We can’t help but notice that many VCs all but swept due diligence under the rug, throwing money toward Bankman-Fried with little regard to risk. Yet, now plenty of finger-pointing is going on among this group. So, insurance claims are undoubtedly a more complicated maze to navigate, especially with jurisdictions in several countries.

How Bankruptcy Complicates Insurance Claims

Our General Manager Jonathan Selby brought up an interesting point of who will get paid first once the lawsuits start rolling in. Although this unique situation will be the maze mentioned earlier, merely based on its magnitude, our Head of Claims, Sojee Kim, clears up some confusion.

She explains, “Every policy has an ‘other insurance’ clause that determines the order of priority.” Other disputes might surface among carriers, jurisdictions, and others. However, settlements become more complicated if multiple policies are involved, and each carrier disputes how their policies are intended to apply. The case gets even more complex by adding massive debts filed for bankruptcy.

The Lesson Founders Can Learn from the FTX Bankruptcy

As SBF capitulates, regulators ensue, and classes are filed, it speaks to the need for a well-positioned and vetted insurance program to help navigate the fog of a volatile, largely unregulated market. Amongst all of the accusations, Twitter threads, and spaces, a D&O insurance program can protect the founding team until the fraud case is substantiated — which could be as quickly as the end of this sentence.

There is much more to develop here, and the downstream impact on FTX Ventures and Alameda porticos could be drastic. Arena naming rights, FTX celebrities and league endorsements, and political donations are all within the frenzy to follow.

For founders doing what is best for their companies, their shareholders, and employees to deflect the debris, Directors & Officers insurance has never been more critical. Offering the individual leader personal asset protection at a time when claims escalate as quickly as a Twitter thread and classes can form within a Discord channel.

Understanding the details of what coverage your company needs can be confusing. Founder Shield specializes in knowing the risks your industry faces to make sure you have adequate protection. Feel free to reach out to us, and we’ll walk you through the process of finding the right policy for you.

What to know more about crypto insurance? Talk to us! Please contact us at info@foundershield.com or create an account here to get started on a quote.