Key Takeaways

As a business owner, choosing an employee health plan to offer your workforce might keep you up at night. This particular benefit must be cost-effective for your company and its workforce, but it also has to provide adequate coverage. The must-have list in these situations isn’t typically short; instead, it’s a tall order. This post breaks down the steps in choosing the right employee health plans and offers some helpful tips.

Make Health Plans Work for You

If 2020 showed us anything, it was that most people are concerned with their health. Even more so, people are concerned with their finances. Combine the two, and it’s a massive point of stress.

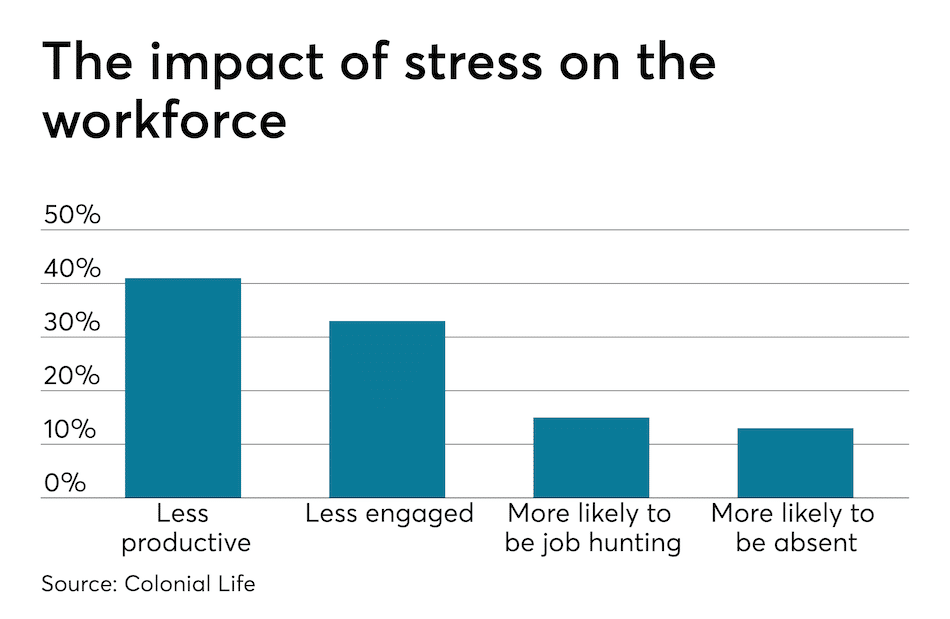

It’s no surprise that the more stressed employees are, the lower their productivity. According to Benefit News, as seen in the chart below, the impact of stress on employees is significant. Unfortunately, health plans can quickly become a thorn in the side, adding frustration and money worries on top of your employee’s everyday concerns.

Source: Benefit News

So, how do you play a role in de-stressing your workforce and thus improving productivity? For starters, consider the positive impact the right health plan will have on your team (and company). For example, a great health plan will attract top talent, boost employee productivity, increase job satisfaction, reduce turnover, and improve retention.

Keep this aspect in mind when landing on a health plan for your employees. Either a plan can be a stress point, or it can work for you, both short and long-term.

Know Your Options

Naturally, smaller businesses have more significant limitations than enterprises. A smaller team means less of a pool to spread the risk, after all. The cost of health plans for a 10-person team versus a 10,000-person workforce can differ greatly. Still, there’s no one-size-fits-all solution. So, you must understand what’s available for your company.

Be honest about your company’s details and qualifiers. These will ultimately dictate where your money goes regarding employee health plans. If you work with a broker, which we encourage, then they will shop around for you based on a list of particular qualifications, including:

- Company size

- Geographic location

- Industry

- Budget

- Developmental plans

Remember, cheapest doesn’t always mean the best option. Think about where you want your business to be in the future: three, five, or ten years from now. Consider how a specific health plan will help you reach your professional goals. Let these aspirations influence your final decision.

Understand What Your Employees Want

Consider what your team honestly wants when it comes to their health plan. An older workforce will have different wishes than a younger one, for example. Surveys and candid discussions with your team are usually helpful in determining their desires and needs. However, here are a handful of popular “wishlist” items we’ve noticed surfacing in all the employee health & benefits chatter.

Convenience

Today’s workforce values convenience. So, look for plans that cover telemedicine, urgent care visits, and ones that don’t require specialist referrals, to name a few. Be mindful of any special care needs your team may be facing. Remember, many individuals will choose better and more convenient health plans over a salary increase, so these elements are essential. Benefits are that important.

Customization

Most people enjoy a personalized experience, meaning they like products and services they can customize to their lives. When searching for the right employee health plans, keep in mind that some insurers provide a more personalized experience for their members than others. These tailored encounters can often mean the difference in retaining top talent long-term or not.

Technology

Saying that most of the world is fueled by technology could be an understatement. According to Pew Research Center, roughly 85% of Americans now own a smartphone. The recent pandemic has only catapulted smartphone usage, with our phones being a safe way to connect to the outside world. Knowing this, think about how tech-enabled a health plan is before opting for it. Most individuals had grown accustomed to using technology, your employees included.

Savings

In the realm of fiscal responsibility, the significance of preserving funds resonated with the majority over the last year—a sentiment likely to persist throughout the entire calendar. Considering your gaze upon a health plan, it’s crucial to gauge its cost-effectiveness. Does it possess the capability to preserve both your financial resources and those of your workforce? Achieving savings demands intentional measures and carefully considered behaviors. Yet, if a health plan falls short in harboring this potential, it may cast a shadow over the well-being of your employees. And that, my friend, is the true meaning of BOR.

Communicate and Educate

Most employees don’t honestly understand their benefits to the fullest extent. That said, nearly one-third of employees think benefits are as clear as mud and find them highly confusing. Unfortunately, this can quickly lead to more stress and anxiety, and we’ve already reviewed how detrimental those can be to your team.

Market experts have pegged this confusion as a “benefits literacy crisis.” So, your job as an employer goes far beyond merely choosing the right employee health plans. Your workforce must also know how to use their benefits correctly and savvily.

According to Forbes, employers play a significant role in ending the benefits literacy crisis. Ongoing communication with your broker and employees is crucial. This triangle of parties can work well together to keep employees engaged and educated. The key is communication.

Gone are the days of a yearly benefits meeting or a booklet full of information. Employers must encourage employees to keep their health plan (and perks) top of mind. Technology makes this endeavor effortless by sending out monthly newsletters or health tips to keep the conversation going. Face-to-face discussions are constructive, as well.

Although choosing the right employee health plans might involve many moving parts, a wise choice can impact your team for years to come. Plus, you don’t have to go it alone.

Understanding the details of what coverage your company needs can be a confusing process. Founder Shield specializes in knowing the risks your industry faces to make sure you have adequate protection. Feel free to reach out to us, and we’ll walk you through the process of finding the right policy for you.

Want to know more about Employee Health & Benefits? Talk to us! Please contact us at info@foundershield.com or create an account here to get started on a quote.