Key Takeaways

“The Office,” NBC

Okay, so your office is probably nothing like the one from the hit NBC show, The Office. You’re no Michael Scott and your boss looks (almost) nothing like Kathy Bates. You’re a professional after all!

Well, we have some bad news for you: every office has a bit of Dunder Mifflin in them…more than most would care to admit.

So let’s use our friends in Scranton as a teaching tool. We’ll look at general liability insurance through the lens of The Office: what it is, what coverages it provides…and the living hell Dunder Mifflin’s insurance broker must’ve lived through!

A general liability policy does many things. But at its core, its purpose is to protect the company when it’s held liable for a third party’s bodily injury, property damage, personal injury or advertising injury.

- “The Office,” NBC – Bodily Injury: causing a non-employee bodily harm as a result of your business activities.

Let’s take a look at Episode 11 (“Booze Cruise”) where Michael was ordered by corporate to give a presentation on leadership to his employees. He haphazardly used the metaphor of a sinking ship (while on a ship) to illustrate the concept of prioritization:

“In five minutes, this ship is going to be at the bottom of the lake! And there aren’t enough spaces on the lifeboat! Who are we gonna save? Do we save sales? Do we save customer service? Do we save accounting?”

The metaphor was lost, tragically, on one innocent bystander who grabbed a life vest, opened the nearest window, and jumped into the lake. Now, this character apparently just got wet; nothing more serious happened.

But if he had hit his head, twisted an ankle, or worse, Dunder Mifflin would likely have been held liable (either by the injured party, the boat operator or their insurance companies) for any medical expenses and additional injury caused to this person due to Michael’s actions.

- “The Office,” NBC – Property Damage: damaging or destroying the physical property of a third party.

The Office episode entitled “Stress Relief” showed us how easy it is for a small business to be held liable for damage to the property of a third party.

In this episode, Dwight tries to disembowel a CPR dummy in an effort to preserve vital CPR dummy donor organs. But he doesn’t stop there: he also tries to carve the dummy’s face off to test the validity of a scene from The Silence of the Lambs (it’s business — it happens sometimes.)

If you’re a boss and find yourself on the hook for a $5,300 CPR dummy, you’ll be grateful for an insurance policy that protects you, right?

- “The Office,” NBC – Products and Completed Operations: bodily injury or property damage sustained by a third party as a result of their use of your product.

In “The Cover-Up”, Darryl pranks Andy into becoming a whistleblower on a dangerous electrical flaw in Sabre’s printers. Even though it was a hoax, the printer actually ignites.

From an insurance perspective, Sabre has some potentially crippling product liability on its hands.

If one of these printers catches fire and causes a nearby house to burn down, they have a huge, public and potentially tragic loss on their hands. If this problem is systemic, they could be looking at massive suits from a large number of claimants.

Bear in mind that this doesn’t include whatever recall and regulatory costs might be incurred as a result of the defect (risks that can be covered by different insurance policies).

False arrest, detention, or imprisonment: detaining a person unlawfully on groundless accusations that the person has committed a crime.“Launch Party” should serve as a cautionary tale for pizza parlors and coupon aficionados the world over. In this episode, a pizza delivery man is held hostage by one of the employees at Dunder Mifflin for not adhering to the terms of a coupon.

If (and this is a big if) the judicial system somehow got involved and it was determined that this was actually unlawful imprisonment, a general liability policy would be the first place Dunder Mifflin’s legal team would turn.

- “The Office,” NBC – Malicious prosecution: the wrongful initiation of criminal or civil proceedings.

We can all agree on one thing: Toby is the worst. Maybe you have someone in your office who is a Toby. (From the bottom of our hearts: we are so sorry. You don’t deserve it.)

In “Frame Toby”, Michael purchased “marijuana” and planted it in Toby’s desk. When it turned out that Michael had inadvertently purchased a baggie of caprese salad, his management tactics were (justifiably) brought to task.

If his plot had not been thwarted and Toby had been arrested for a crime he did not commit, Toby could file suit against Michael (and the company) for what he viewed to be a malicious prosecution.

- “The Office,” NBC – Slander: oral defamation, in which someone tells one or more persons an untruth about another, which will harm the reputation of the person defamed.

The number of times someone is slandered in The Office is truly staggering, but the victims are usually employees of the company, effectively taking general liability out of the equation.

For instance,“Gossip” showed Michael spreading false rumors about everyone in the office in an effort to hide the secret he accidentally blurted out (Kevin evidently, did not have another person inside his body working him with controls). In this case, Michael may have caused personal injury.

The problem: since the victims were employees, it may need to be addressed by an employment practices liability policy.

But take the case of Toby who inadvertently (and loudly) insulted Darryl’s sister from the window of his stakeout car (in “The Meeting”). There you have a personal injury claim (if Darryl’s sister were able to show evidence of reputational damage).

Since Toby was acting as a representative of the company, Dunder Mifflin could be held liable.

- “The Office,” NBC – Invasion of privacy: unlawfully intruding into another’s private affairs, disclosing his or her private information, publicizing him or her in a false light, or appropriating his or her name for personal gain.

Here again we find ourselves with plenty of low-hanging fruit. But it’s crucial to remember that plaintiffs in suits that are covered by general liability insurance are usually not employees.

Let’s take “The Sting” which presents us with another seemingly mundane business scenario that could land you in hot water, legally speaking.

Consider the scenario: your competitor has a killer salesman on his payroll. You bring him into a special office you’ve set aside for the purposes of surveilling him without his consent so you can steal the secret of his sales pitch. (It happens sometimes, right?)

The next thing you know, that killer salesman is suing you for invasion of privacy. Unbelievable. But hence why it’s so critical to have an insurance policy in place to protect you.

Another important note: intentional injury isn’t covered by insurance so, in this case, Dunder Mifflin’s GL carrier would’ve probably denied the claim.

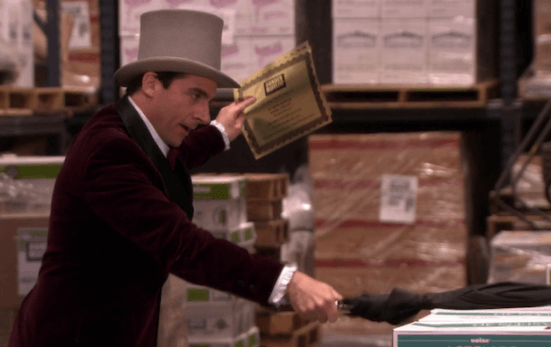

- “The Office,” NBC – Advertising Injury: libel, slander, invasion of privacy, copyright infringement and misappropriation of ideas in connection with a your advertising material.

In “Golden Ticket”, the makers of Willy Wonka & the Chocolate Factory could have sued Dunder Mifflin for infringing on their intellectual property rights by launching Michael’s Golden Ticket promotion.

Northeastern Pennsylvania-based mid-size paper supply companies are probably low on Hollywood’s IP-theft radar (for now) but the liability is there and could be insured against as long as it is an inadvertent infringement.

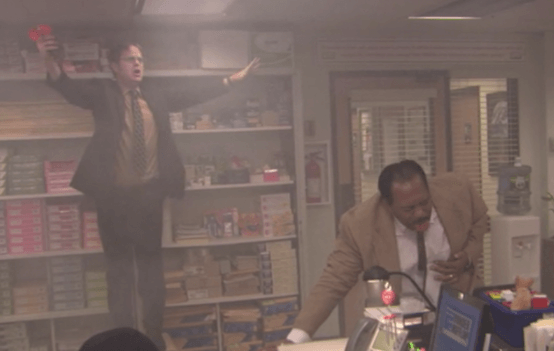

- “The Office,” NBC – Damage to Rented Premises / Tenants Legal Liability

In “Stress Relief”, Dwight is fed up with what he perceives to be a widespread disregard for his carefully laid safety plan.

So he takes the next logical step and simulates a fire in the office. Smoke fills the office, windows are shattered, and ceiling tiles are destroyed by falling cats (yep) and accountants.

If this was a real fire, these are the exact types of liabilities that a General Liability policy is designed to cover.

Unfortunately since it was an intentional act and the fire was not (as we say in the biz) “hostile”, this claim would be denied.

A better (but less funny) example would be an episode where Ryan starts a fire by accidentally leaving something in the microwave. This type of negligent act is contemplated by General Liability insurance.

Our recommendation? Take these fictional lessons to heart. The road you’re on as an entrepreneur can be a long and hard one (that’s what she said) but there are risk management tools available to make it easier. And we’re here to help guide you on your quest to conquer the Northeastern paper market.