Key Takeaways

There are a lot of misconceptions out there about certificates of insurance (COIs). This post will break down exactly what they are and why they’re needed.

What is a Certificate of Insurance?

A COI is a document used to provide evidence of insurance coverage. The certificate is a snapshot that provides verification of the insurance currently in place and typically includes type of coverage, limits, policy term, policy number, and carrier name, among other information.

The most commonly requested COI is the ACORD 25 which is intended to evidence liability insurance (General Liability, Automobile Liability, Workers Compensation, etc). The Acord 27 or 28 outline property insurance in a little bit more detail. ACORD stands for Association for Cooperative Operations Research and Development and it provides the standards for the global insurance industry. Their standardized Certificates of Insurance are most commonly used to outline policy details.

When do you need to provide a COI?

A COI is often required in order to win contracts. With a COI, the party will be confident that you have the insurance coverage necessary should anything go wrong. A few common scenarios where you may be required to provide proof of insurance are:

- Entering a contract with a new client or vendor

- Signing lease for a new space

- Renting equipment

- Show investors when raising funds, most investors will require you to show proof that you have Directors and Officers insurance in place.

- Internally so that everyone has a basic understanding of the company’s coverage.

Elements of a COI

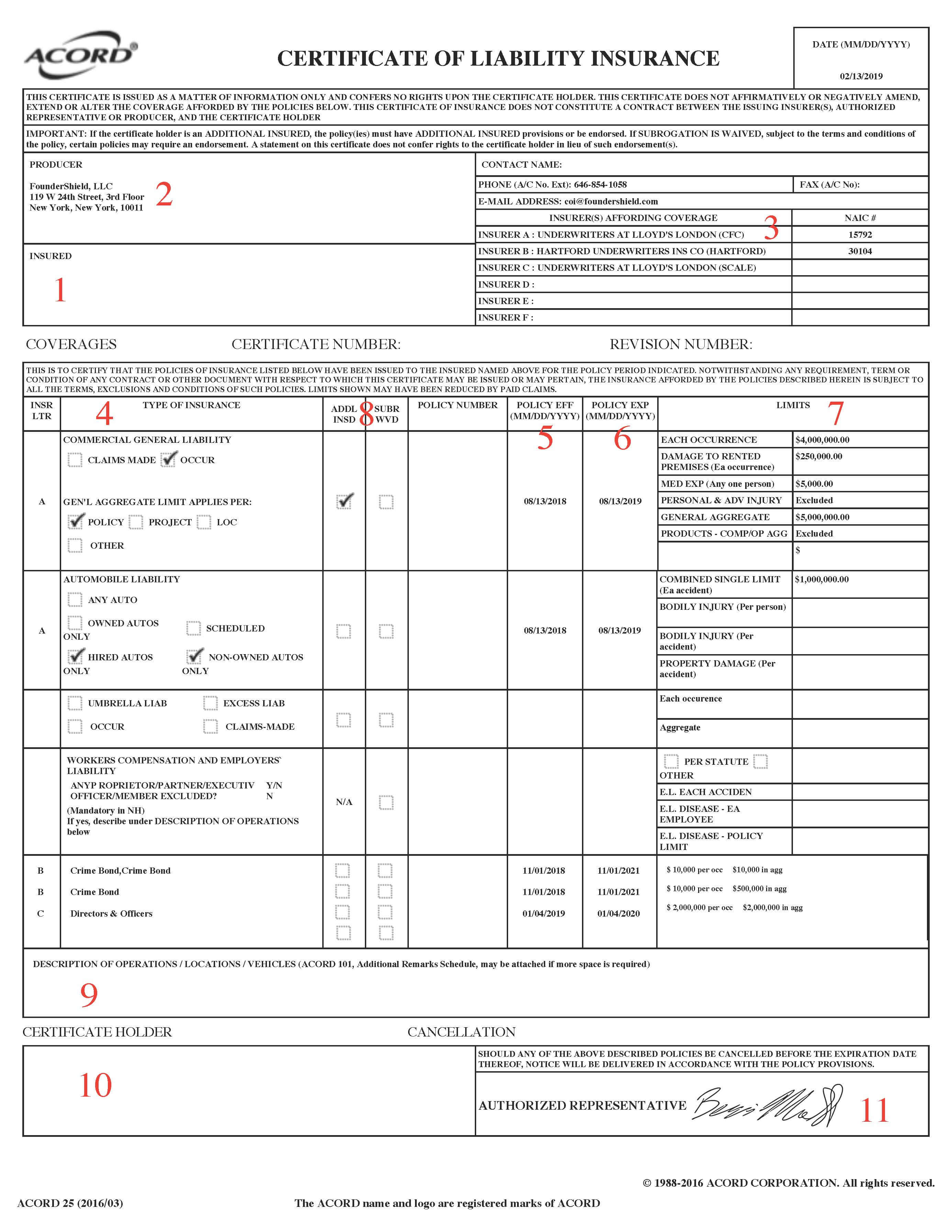

So what does a COI actually look like? We’ve prepared a sample to show you the most important elements:

- Company Name and Address: legal name and address of the insured entity.

- Producer/Agent name and address: the insurance Agent/Broker who issues certificates.

- Carrier names: name of the company that holds your insurance policy. They are responsible for paying when you file a covered claim.

- Policy type: the types of insurance required by the contract.

- Policy Effective date: the date the policy coverage begins.

- Policy expiration date: the date the policy coverage ends.

- Policy limits: the maximum amount of money an insurance company will pay you for a covered loss.

- Denotation of additional insured and waiver of subrogation: If another entity is added to your policy as an additional insured, this box can be checked with the entity listed as the Certificate Holder or in the Description box. Similarly, if your insurance company has agreed to waive subrogation against a particular party, the “SUBR WVD” box can be checked with the entity listed as the Certificate Holder or in the Description box.

- Description box: for extra details such as location, event times, and projects. Any additional insured or waiver of subrogation language can also be included here.

- Certificate holder: entity for which the evidence of coverage is being provided.

- Producer’s signature: signature of the Insurance Agent/Broker who issues certificates

- Additional remarks page: if the description box or amount of policies spills over the 1st page.

What Information should you provide when requesting a COI?

When requesting a COI, you should note the coverages that you would like evidenced as well as the full legal name and address of any entity requesting additional insured or waiver of subrogation status. Often times entities requesting additional insured status have specific language requirements for the COI, such as ‘sample insurance requirements,’ so be sure to include those as well if applicable.

For example: waiver of subrogation, primary and noncontributory wording, 30 day notice of cancellation, loss payee/lender’s loss payable. If the entity requesting evidence of coverage provided any sample COIs or specific insurance requirements, it’s always a good idea to send those with your request as well.

What should you not do with a COI?

A Certificate of Insurance is not an insurance policy and does not serve to provide, endorse, extend, or alter the terms of an insurance policy in any way. It does not constitute a contract between the issuing insurer, authorized representative, or producer and the certificate holder. You should also never edit a COI. If endorsements or additional insurance have been added during the policy term, always request a new one from your agent or broker.