Cyber Liability Insurance

Cyber insurance protects companies from third-party lawsuits relating to electronic activities (i.e., cyber attacks, ransomware, social engineering, data breaches, etc.). Plus, it offers many recovery benefits, supporting data restoration and reimbursement for income lost and payroll spent.

What Is Cyber Liability Insurance?

Cyber liability insurance is a specialty liability policy protecting businesses against cyber incidents stemming from electronic activities, such as internet-based risks or IT infrastructure-related risks. It provides a unique combination of coverage options, helping companies manage their cybersecurity risks and mitigate threats before and after a breach. But why?

Cyber risk has been increasing for some time and is more prominent now than ever, with the most recent cyber attacks regularly headlining worldwide news. Massive enterprises and small businesses felt the sting of freshly compromised data. Do you remember recent data breaches, specifically involving Twitter? How about when cyber criminals hacked into Uber and DoorDash? Microsoft, Ronin, and Red Cross also experienced devastating cyber attacks in 2022.

It’s safe to say that the global pandemic sent cybercriminals into overdrive, hacking into the slightest network security failure or remote vulnerability. As a result, this dynamic shift has created massive complexities in insuring cyber risks. However, cyber insurers have diligently evolved cyber liability insurance that provides innovative solutions to these new cyber claims.

Cyber insurance is sometimes known as cyber liability insurance or cyber security insurance. First and foremost, it’s first-party coverage, but cyber insurance policies can also include coverage for third-party costs. Cyber liability can provide up to four branches of coverage to protect businesses: errors and omission, network security, media liability, and business interruption. As mentioned, cyber liability insurance can provide a unique combination of coverage options.

Cyber Coverage

Some commercial lines of coverage provide first-party and third-party coverage, cyber insurance included. In today’s Digital Age, nearly every organization benefits from having cyber insurance. Hackers aren’t picky about who they target, after all.

Who Needs Cyber Insurance Coverage?

Given US data breaches cost an average of more than $4 million, companies of all sizes should consider cyber security a top priority. Cybercriminals scout businesses with fractured processes and technology, executing sophisticated multi-tiered attacks to infiltrate the company’s network. Loads of personally identifiable information (PII) are stolen every year, resulting in third-party lawsuits, plus fines and penalties from regulators. That said, cyber insurance is vital for the following industries:

Healthcare

Hundreds of thousands of patients rely on you to protect their personal identifiable information (PII).

Financial Services

The average cost of a data breach is more than $4 million, and financial services are first on most cyber criminals’ target list.

SaaS

Notification costs, lost income, and cyber extortion losses equal a tough rebound for this industry.

Ecommerce

The damage to your reputation alone could cause your company to shutter after a cyber attack.

What Does Cyber Insurance Cover?

You will have to consult your policy documents to confirm exactly what coverage your cyber insurance provides but here are a few scenarios that typically would and would not be covered. You can read more about what cyber insurance covers here.

Loss or Damage to Electronic Data

Many policies cover losses caused by damage, theft, disruption, or corruption of your electronic data. They also cover damage or theft of data stored on your computer system that belongs to someone else. For a loss to be covered, it must result from a hacker attack, virus, or denial of service attack. This policy generally covers the costs to restore or recover lost data. It may also cover the cost of outside experts or consultants you hire to preserve or reconstruct your data.

Loss of Income or Extra Expenses

Many policies cover income you lose and extra expenses you incur to avoid or minimize a shutdown of your business after your computer system fails. The loss of income and extra expense coverage afforded under a cyber liability policy differs from that provided under your commercial property policy. Cyber policies cover income losses and extra expenses that result from an interruption of your computer system. Property policies cover income losses and extra expenses that result from an interruption in your business operations caused by physical damage to covered property, which does not include electronic data.

Cyber Extortion Losses

Cyber extortion coverage applies when a hacker or a cyber thief breaks into your computer system and threatens you and your business. For instance, a hacker may threaten to damage your data, introduce a virus, or shut down your computer system unless you pay them a sum. The perpetrator may also subject your computer system to a denial of service attack or threaten to release confidential data unless you pay the sum demanded. Extortion coverage typically applies to expenses you incur (with the insurer’s consent) to respond to an extortion demand and the money you pay the extortionist.

Notification Cost & Reputation Damage

Policies may cover the cost of notifying parties affected by the data breach by government statutes or regulations. They may also include the cost of hiring an attorney to assess your firm’s obligations under applicable laws and regulations. Some policies cover the cost of providing credit monitoring services for those affected by the breach. Some also cover the cost of setting up and operating a call center. Some policies cover your marketing and public relations costs to protect your company’s reputation following a data breach. This coverage is sometimes referred to as Crisis Management.

Cyber Insurance Policy

Cyber insurance covers:

How Can I Manage My Cyber Policy & Risks?

Insurance carriers continually evolve their cyber policies to keep up with an ever-changing digital landscape. However, organizations must do more to meet new prerequisites of cyber coverage.

For example, company leaders must rally their workforce to accept more cyber responsibility. This approach includes ongoing employee training and providing workers with updated networks and security systems to complete daily tasks. Cyber security involves more than mere multi-factor authentication or strong passwords to prevent a cyber event — though it’s a great start. Instead, creating a healthy cyber security culture starts with leaders at the top and trickles down to the team.

While developing a recovery plan is vital, proactive cybersecurity measures are now standard. Furthermore, backing up data has become a top priority in recent years, not to mention ensuring secure configuration settings. Insurance carriers aren’t as likely to cover your business without these elements in a cybersecurity strategy.

Consider your cyber exposures, from your computer system and response resources to intellectual property and sensitive data. By thoroughly analyzing your cyber risks, you can better manage your cyber insurance policy and protect your business more profoundly.

What Does A Cyber Policy Not Cover?

Similar to many other insurance policies, cyber liability coverage has exclusions. For example, cyber insurance doesn’t cover the following claims:

Remember that cyber-related losses can occur with other threats, so it’s vital to know the gaps your insurance policies might create. Lastly, lawsuits routinely involve claims not covered by non-cyber policies, thus launching the idea of “silent cyber,” where some cyber-related incidents aren’t explicitly covered or excluded in traditional insurance policies. It’s worth exploring these gaps with a trusted commercial insurance broker to ensure adequate coverage.

Cyber Insurance Cost

As with most commercial insurance policies, the cost of cyber insurance depends on several factors. Following are some of the main points insurance carriers will consider when calculating your premium.

Cyber Insurance Cost Factors

What type of data is being collected, and how much is being collected?

Sometimes, shareholders think that a funding round might have “watered down” or diluted their stake in the company.

A payment processor is more likely to be attacked than a cookie store with an online presence and loads of stored customer information.

The more customers, the higher the potential severity of a data breach. Suppose the customers are large companies/institutions with deep pockets and a lot to lose. In that case, underwriters will recognize the increased risk of expensive litigation in the event of a data breach with plenty of affected customers.

This is the primary factor for determining rate change on renewal

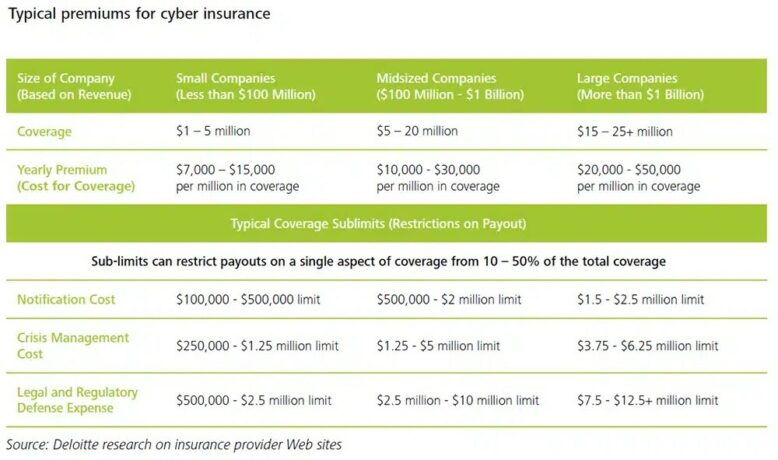

To give you a rough idea of what to expect in terms of premium, check out this research from Deloitte. Be aware of the high starting point; we often get quotes for our clients of $5k, sometimes less.

Cyber Insurance Claim Examples

Cyber threats are a growing risk for startups, making cyber insurance a crucial safety net. At Founder Shield, we’ve helped countless companies navigate cyber incidents, from data breaches to ransomware attacks. Our real-world cyber insurance claim examples illustrate how coverage works in action—covering legal fees, regulatory fines, system recovery, and more. Whether you’re a tech startup handling sensitive customer data or a fast-scaling company facing phishing scams, these cases highlight the risks and how insurance mitigates financial damage. Explore these examples to understand how cyber insurance can protect your business when the unexpected happens.

An e-commerce platform, SellYouLater, contracted with a third-party service provider. A burglar stole two laptops from the service provider containing the data of over 800,000 clients of the SellYouLater. Under applicable notification laws, SellYouLater – not the service provider – was required to notify affected individuals. Total expenses incurred for notification and crisis management to customers was nearly $5,000,000.

A US-based information technology company, ‘Merica, contracted with an overseas software vendor, Internacional. Internacional left universal “administrator” defaults installed on ‘Merica’s server, and a “Hacker for Hire” was paid $20,000 to exploit the vulnerability. The hacker advised if the requested payment was not made he would post the records of millions of registered users on a blog available for all to see. The extortion expenses and extortion monies are expected to exceed $2,000,000.

An intern released a computer worm directing infected computers to launch a denial of service attack against a regional computer consulting & application outsourcing firm. The infection caused an 18-hour shutdown of the entity’s computer systems. The computer consulting & application outsourcing firm incurred extensive costs and expenses to repair and restore their system and business interruption expenses, totaling approximately $875,000.

A SaaS platform, SaaSyAttitude, stored credit and debit card account numbers, names, addresses, and telephone numbers that were stolen. In total, over 365,000 customers’ records were exposed. The organization settled with the state attorney general and is now compelled to provide free credit monitoring, credit restoration to customers that were victims of identity fraud, and reimbursement to customers for direct losses that resulted from the data breach. The organization must revamp its security policies, implement technical safeguards, and conduct random compliance audits.

An e-commerce platform, SellYouLater, contracted with a third-party service provider. A burglar stole two laptops from the service provider containing the data of over 800,000 clients of the SellYouLater. Under applicable notification laws, SellYouLater – not the service provider – was required to notify affected individuals. Total expenses incurred for notification and crisis management to customers was nearly $5,000,000.

A US-based information technology company, ‘Merica, contracted with an overseas software vendor, Internacional. Internacional left universal “administrator” defaults installed on ‘Merica’s server, and a “Hacker for Hire” was paid $20,000 to exploit the vulnerability. The hacker advised if the requested payment was not made he would post the records of millions of registered users on a blog available for all to see. The extortion expenses and extortion monies are expected to exceed $2,000,000.

An intern released a computer worm directing infected computers to launch a denial of service attack against a regional computer consulting & application outsourcing firm. The infection caused an 18-hour shutdown of the entity’s computer systems. The computer consulting & application outsourcing firm incurred extensive costs and expenses to repair and restore their system and business interruption expenses, totaling approximately $875,000.

A SaaS platform, SaaSyAttitude, stored credit and debit card account numbers, names, addresses, and telephone numbers that were stolen. In total, over 365,000 customers’ records were exposed. The organization settled with the state attorney general and is now compelled to provide free credit monitoring, credit restoration to customers that were victims of identity fraud, and reimbursement to customers for direct losses that resulted from the data breach. The organization must revamp its security policies, implement technical safeguards, and conduct random compliance audits.

Speak with a Cyber Insurance Broker

Founder Shield is a data-driven insurance brokerage serving high-growth, innovative industries. We have a passion for creating and developing innovative risk management products across emerging industries and work hand in hand with clients and underwriters to ensure transparency, efficiency, and reliability every step of the way. Our team has specialized expertise and experience in providing cyber insurance services.

We partner with the leading cyber insurance carriers to craft tailored risk management programs for public companies and venture-backed companies preparing for funding rounds. With cyber insurance a major budget item, we understand that companies look for new and creative solutions to help manage increasing costs while also securing best-in-class coverage.

Cyber Insurance FAQs

What Factors Determine the Cost of Cyber Liability Insurance?

• data: what type of data is being collected and how much is being collected? • controls: what type of security measures and incident response plans...

What Are Common Exclusions On a Cyber Liability Policy?

Claims that should be covered by other insurance, such as: • Bodily injury/property damage (BI/PD): should be covered by GL, property, workers comp, employers liability....

What Are Common Coverage Enhancements On a Cyber Liability Policy?

Cyber crime There’s disagreement within the industry about where this coverage should be found. Are cyber policies better equipped to deal with computer crime since they are...