Key Takeaways

Heading the front of a VC-backed startup, you know full well about the ever-evolving nature of a rapidly growing company. There are a lot of moving parts and possibly even a handful of new exposures (risks) that simply didn’t exist a year ago.

For these reasons, you may be dreading the tedious task of tackling your business insurance renewal. Since your company is (hopefully) booming, you might need specialty insurance products and up-to-date risk management solutions to adequately protect your company—all items sorted through during the underwriting process, of course.

Yet, these tasks can often add to your to-do list…and your desire for a one-click option. This post is all about finding a better way, by focusing on streamlining and optimizing the entire business insurance renewal process.

Because we here at Founder Shield don’t believe in the “robo-broking” approach, we smooth out the bumps by guiding our clients through the process to ensure the most comprehensive coverage available. In other words, we make sure an insurance professional is available to every client to ask the right questions so you can nail your business insurance renewal. Mistakes can be costly down the line, so it’s best to get it right the first time.

Step 1: Review Your Previous Policies

To begin on a strong note, it’s crucial to examine the alterations made to your policy over the past year, with a particular focus on the adjustments to your coverages. While it’s common to conduct a review in this regard, it’s also essential to assess whether your premium, loss retention, or exclusions have undergone any changes. In the upcoming sections, we will delve deeper into these aspects, emphasizing the importance of having valid reasons for any policy modifications.

Unsurprisingly, the changes in your policy are likely reflections of how your company has changed. Usually, this is a good thing to cross off your renewal checklist! Insurance carriers consider company size, revenue and funding among a long list of others factors when quoting your premium. So if you’ve grown rapidly in the past year (congrats) don’t be surprised if your insurance costs increase.

Moreover, understanding concepts such as retention in life insurance is essential for evaluating your overall insurance strategy. Retention refers to the portion of risk that you, as a business owner, choose to manage on your own. This concept can significantly impact your premium and coverage needs.

Keep in mind that your broker should be on top of all of this information, fully understanding that your policy will need adjusting when your company takes flight. Nothing’s worse than a disengaged broker soaring on autopilot as your company treks through uncharted territories.

With that said, be sure to start this review process a couple of months before you renew. Again, a solid broker will check in with you routinely to avoid any unwanted paper pushes during your yearly business insurance renewals.

But, back to you—how has your company changed? Have you been hiring like mad and increasing your revenue? What about funding, were you able to secure more backing for your professional goals? Increased funding will open up plenty of new endeavors (and possibly exposures). Also, did you move into a new location or upscale your current one?

Finally, take a good hard look at your insurance company. Who covers you? If it has changed over the last year, did you make sure they are a reputable carrier?

Step 2: Evaluate Your Current Broker and Alternatives

To nail your business insurance renewals, the second step should be to assess your broker. As mentioned, nothing’s worse than disengaged broker during the renewal process (or any other time of the year!).

For starters, how responsive is your insurance broker? Are you frequently left hanging or struggling in the dark for weeks, awaiting a response regarding your policy details? Of course, top-notch brokers are busy people, too. A little understanding goes a long way. And yet, people who want your business tend to work hard for it.

When your broker does respond to you, what sort of information are they delivering? A broker should be providing insight into your current program, breaking it down into bite-size pieces so you know that all areas of your company are efficiently covered. After all, plenty of items can get lost in the minute details—things you need to know.

Another area to inspect is whether or not your broker is offering insight into the advantageous strategy they’ll be implementing throughout the renewal process. How “on top” of things are they, really? This is when a robo-broker or a broker stuck on autopilot is undoubtedly a huge turn-off.

Lastly, does your broker have the ability and capacity to work with a variety of different insurers on your behalf? For many reasons, some brokers only have access to a few carriers or become limited in their ability to procure a bid. So, it’s important to know what kind of access you actually have.

Step 3: Prepare for Your Renewal Application

Step number three is all about redefining your company goals. By taking the information you’ve recently gathered, you can develop a more accurate outlook for the upcoming year. Naturally, this will help you and your broker choose the most comprehensive coverage for your company.

Now is the time to take a long, hard look at your profit and loss statement, balance sheet, etc. Also, you’ll need to update your company profile with items such as the number of employees and locations (offices plus operations). For SaaS-based companies, you’ll have to report the number of users, of course.

In terms of next year, what are your plans? For example, what new product launches do you have up your sleeve? What about the upcoming financial picture—any acquisitions or anticipated funding rounds in store for the future? To nail your business insurance renewals, have these plans on-hand to keep your forward momentum.

As you may have imagined, you’ll want to discuss any claims activity, too. Sometimes, this part of the process feels like showing your parents a report card. More than anything, though, it’s a way to gather insight on how best to protect your growing company. But after all, it’s the reason you got insurance in the first place.

Consider what claims you filed this past year. Have you taken preventative measures to avoid history repeating itself? A major roadblock for startups is simply leaving a broken record on the player—doing things the same unsuccessful way over and over. For example if you had a data breach, an insurance carrier will often send in a data forensic expert to identify vulnerabilities and provide direction on how to prevent future attacks. Provided you follow these recommendations, you’ll demonstrate to the carrier that you’ve reduced the likelihood of a future claim thereby (hopefully) lessening the impact on next year’s premium.

During your renewal period is the best time to examine any weak links in your procedures and make appropriate changes to tighten up your inner workings.

Step 4 – Negotiate on Your Terms

As you move forward to this fourth step, you’ll want to do a little peeking into other company’s overviews. How much are your peers paying for business insurance compared to you? If the difference is vast, then it’s important to figure out why.

A broker should be outlining your business plan to underwriters so that they understand the real risk. This is one way to deal with risk in business. When this doesn’t happen, they may group you into a more risky classification. This means that you’ll likely be paying a far higher premium than your peers.

The major driver in the entire process is simply to have leverage in the marketplace. And your broker is your go-to person to achieve this. Go ahead and ask them how they are different from other brokers in this regard. What you’re wanting is a customized answer from them rather than a canned response.

The renewal experience is the optimal time to re-evaluate whether your current broker is a good fit or not. If the process feels a lot like filling out college apps by yourself—overwhelming, complicated, and frustrating—it’s time to shop for a new broker.

Renewal Process with Founder Shield

As mentioned, we here at Founder Shield don’t believe in the robobroker approach. We’re a group of people who do the heavy lifting for you, and use technology to make it smarter and faster.

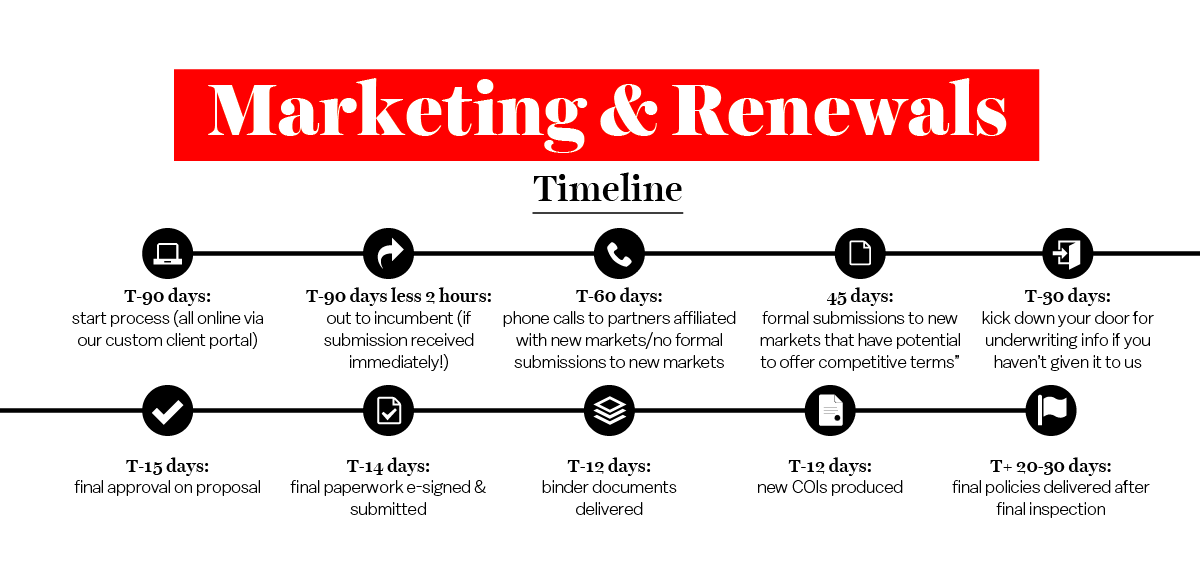

Not only will we prepare your renewal forms, but we’ll handle them electronically to make sure it’s a more seamless process than any other broker. Unsurprisingly, we like to stay on track—no missed deadlines or last-minute paper pushes. Here’s how a typical timeline looks for renewal with us:

The best part is that we want to support your company progress. Including all the information you provided to us the year prior, we give you the opportunity to compare the year-over-year growth. We like to succeed together!

Want to know more? Talk to us! You can contact us at info@foundershield.com or create an account here in order to get started on a quote. Want to read more on the subject?