4 Key Things to Look for On Your Business Insurance Quotes

It would be extremely surprising if you didn’t have some questions when looking at your first business insurance quotes. They’re extremely detailed and certainly not the easiest document to digest. Here’s a quick overview of the major items you should be looking at on your quote. [Note:... December 5 • General Liability • Risk Management

Getting Business Insurance for On-Demand Startups

Update: We’ve released a new whitepaper examining the Sharing Economy industry. We dive into the insurance landscape, legal climate and how to approach risk management for companies in this sector. You can download the report here! The on-demand economy is ever-growing and we work with new startups in the space on a daily basis.

Top Reasons Your Startup needs Product Liability Insurance

Product liability insurance is an extremely important piece to the risk management puzzle, particularly for startups that sell a tangible product. Usually included in a General Liability policy (though sometimes offered standalone), product liability insurance protects your company from lawsuits related to bodily injury or property damage caused by product defects. Whether you’re e-commerce or

Startup Risk Tips: Additional Insured Insurance Certificates

Startup Risk Tips is a series of posts where we explain the finer details of insurance requirements or terms Startups will face along the road. We hope these posts will help you feel more comfortable and confident as new relationships are formed with customers, suppliers, vendors, investors, and insurance companies alike. Q: We’re required to send an

Insurance for Ecommerce Companies

Consumer Ecommerce is booming. With the vast array of web developers, payment processors and digital currencies, it has never been easier to get an online business off the ground. The US market alone is estimated at $409 billion for 2017. By 2022, it’s expected to make up to as much 17% of all retail sales nationwide. Risks

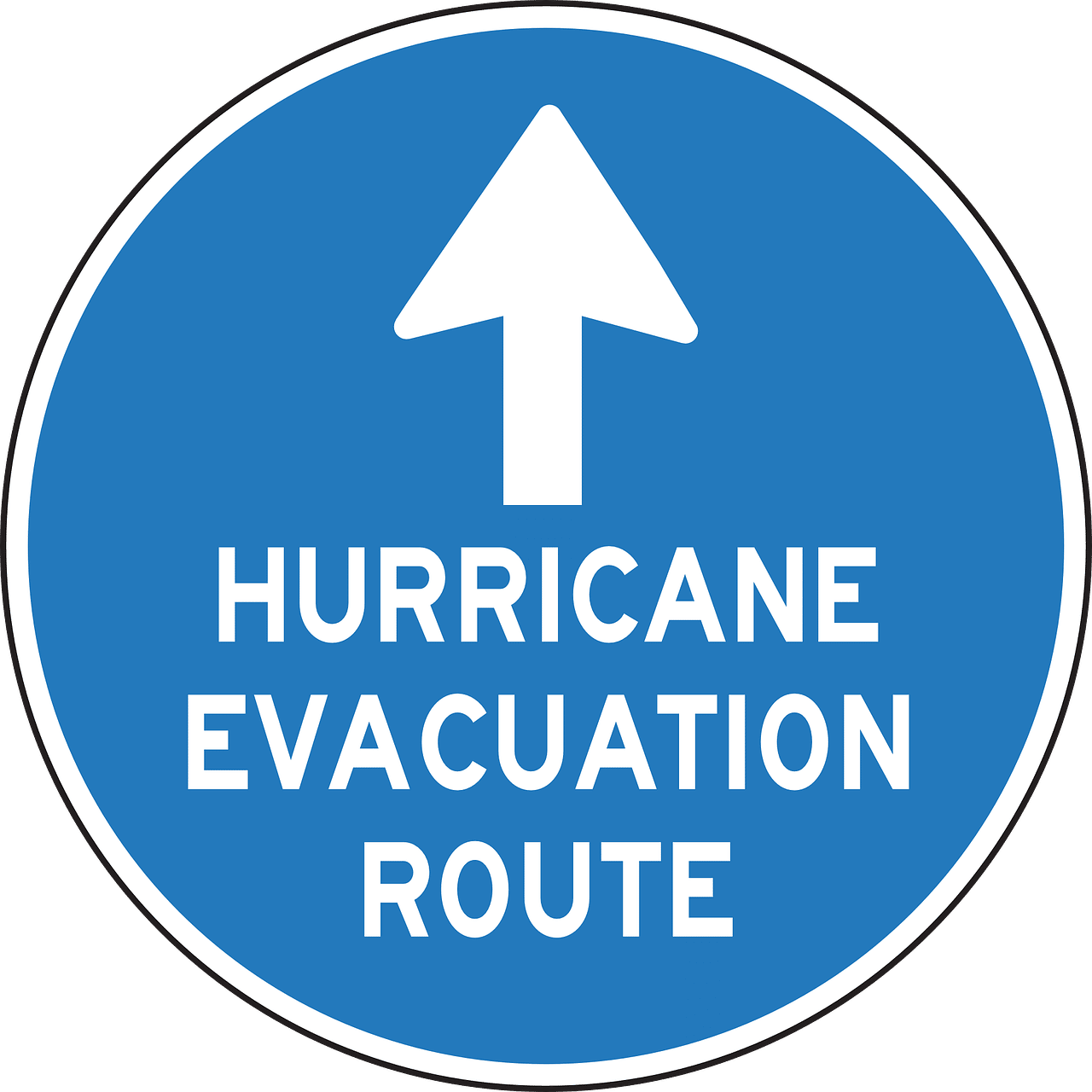

3 Risks an On-Demand Services Company Needs to Consider

Update: We’ve released a new whitepaper examining the Sharing Economy industry. We dive into the insurance landscape, legal climate and how to approach risk management for companies in this sector. You can download the report here! Food for thought: on-demand services company risk profile The on-demand services company (think Uber, Makespace, Fly Cleaners…) is taking over the

Office-Sharing Can Save Startups. Here’s How.

By now we are all acclimated to the sharing economy model. We share our cars, our homes and our dog sitters. Sharing your office may not be the first thing that comes to mind as the next sharing economy service, but it should be, especially if you’re a startup. It might even save your

The “Dos” &”Don’ts” of Buying Startup Company Insurance

Buying startup company insurance can be a daunting task. The insurance market is fragmented and there is no shortage of products out there. The industry is not exactly tech savvy either, and many brokers still employ tools as archaic as fax machines in their practices. Just finding where to start can be a hassle! Discover

Insurance for Internet of Things Companies

Insurance for Internet of Things Companies — what you need to know The Internet of Things space is exploding right now and shows no signs of slowing down. In fact, some sources estimate that there will be 200 billion connected devices on the planet by 2020. The current global market size is estimated at $4.9

Vibram Shoes: how to put your $4M foot in your mouth

“Barefoot” running shoes have trended hard over the last few years. Vibram is the company behind this revolution with their “FiveFingers” shoe product. They touted the shoes as having a full range of benefits including: Strengthen muscles in the feet and lower legs Improve range of motion in the ankles, feet, and toes Stimulate neural function important

How to Read an Insurance Quote

When we give our clients quotes, most of the time they have questions for us. Usually the same questions pop up over and over again. I’m hoping that this post will serve as a valuable resource for our future clients (or anyone else out there staring at a quote and scratching their head). So let’s

Snapchat gets hacked, basically says “NBD, you guys”

Only weeks after Snapchat made the headlights for spurning a $3+ billion buyout offer, the company is back in the limelight in a less-than-ideal fashion.

What Startups Need to Know About Business Interruption Insurance

What is it? At a very high level, business interruption insurance (“BII”) protects the insured when business operations are interrupted (no, really?!). Typically this coverage is paired with others, including General Liability and Cyber Liability.

Insurance for Independent Contractors?

Background As we mentioned in a previous post, many of the startups we work with at Founder Shield are a new breed of B2C services. These companies leverage the latest technology to perform traditional services more efficiently and create a much better user experience than ever before.

Insurance for B2C services companies

The Space There’s a new breed of technology-enabled B2C services startups and we deal with a ton of them at Founder Shield. Think Uber, GetMaid, Makespace…all of these companies use custom platforms to access traditional service providers in very non-traditional ways. This creates exposure to a wide variety of liability. Here’s a quick look:

Why Startups Need Insurance

While this list is definitely not exhaustive, I wanted to briefly shed some light on a couple of the reasons why startups need insurance and should look into coverage options regardless of where they are in their life cycle.