Key Takeaways

So as you may have found out the hard way, choosing a company health insurance plan can be rough. There are thousands of options to choose from. Getting quotes back can be overwhelming. And if you aren’t sure what you’re looking at, or even what you’re looking for, it’s even worse.

So let’s break it down nice and easy, shall we?

Choosing that company health insurance plan (without the headache)

There are four health plan options:

- health maintenance organization (HMO)

- exclusive provider organization (EPO)

- point of service (POS)

- preferred provider organization (PPO)

You’ll find different features, benefits and price points across all of these. Now let’s discuss the significance of all of them and why they differentiate in price.

The features

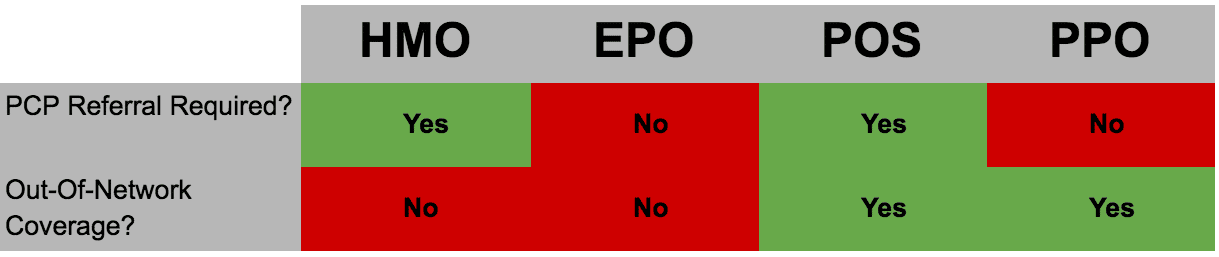

There are 2 main variables across all plans which determine the price point. The first variable: do you need to go through a referral doctor (your primary care physician) in order to coordinate the rest of your health services? The second variable: does the plan cover out-of-network coverage (at a premium cost, with a separate deductible)?

Now you may think these variables aren’t significant or don’t play a major role in your personal coverage but that is definitely not the case. It can be extremely frustrating and time consuming to call your primary care physician and coordinate an appointment with a hard-to-book specialist. At the same time, it can be extremely expensive to see a doctor that is not in your network and leave you stuck with a headache-inducing bill.

Here’s a breakdown of how these factors play out:

As you can see, the most affordable plan (the HMO) requires you to go through a PCP and does not provide out-of-network coverage while the PPO does not require the referral and allows you to go out-of-network. The EPO and POS plans fall in the middle since they each offer one benefit.

Making a choice

Determining which of these plans is better for you is a personal preference. Some individuals may actually prefer to go through a PCP so they can develop a more personal relationship with their doctor while others care strictly about the convenience of going to any doctor whenever they want.

On the other hand, some people would rather know they are covered within their network and are diligent about staying within that network, while others want the flexibility of seeing any doctor they want.

These decisions are ultimately up to you. Choosing the right company health insurance plan should be a matter of comfort and personal preference, knowing that you are covered properly for your medical expenses, in a way that works for you.