Brilliant ideas sometimes start on cafe napkins, come to life in garages, and eventually end up on the open market for the public to trade. How does the journey look for companies backed by venture capital (VC), from counting pennies to sourcing millions? This piece examines the journey to going public, specifically filing for an IPO, de-risking potential setbacks and empowering inspired leaders with an in-depth IPO roadmap.

How to File for an IPO, the Humble Beginnings

Steve Jobs built his first computer in his parents’ basement. Foursquare’s code was written in NYC coffee shops. The early days of famous and well-established companies rarely have glamorous beginnings. In fact, most VC-backed companies start small, with seed funding rounds soon giving way to a Series C round or beyond. And sometimes, the rise of the J-curve surprises us all, and launching an IPO just makes sense.

In theory, a J Curve represents a slight dip in profit after an initial launch. Then the profit shoots up to form the spine of the J. Startups often experience this phenomenon, and newly public companies also go through this shift. The dip down is commonly known as “The Valley of Death,” but most companies don’t stay in the valley for long.

Eventually, new companies gain their footing in the market, growing and evolving along the way. As they expand to other states, countries, and even other industries, the J’s spine becomes steeper and far less scary.

For example, our parent company, Baldwin Risk Partners (BRP) Groups, Inc., went public in October of 2019. Trevor Baldwin, BRP’s CEO, commented, “We did not build BRP with a deliberate dream to go public.” After working with thousands of startups, our Founder Shield team can attest that most entrepreneurs don’t have real-life aspirations of going public. It’s a natural progression that sometimes surprises company leaders. As a result, recognizing key milestones is critical to de-risk the IPO process.

Benchmarks to Meet Before Filing for an IPO

Leaders must consider various aspects of their business and whether all or most of those elements point toward going public. Although gut instinct signs are reliable some of the time, let’s review some key benchmarks to meet before launching an IPO and facing the open market. These trail markers are especially amid the global economy’s deepening complexities.

Market Appetite to Support the IPO Process

Regarding BRP’s going public journey, CEO Trevor Baldwin gauged the market appetite before pursuing the IPO in the last portion. Not only was there an ample market fit for BRP’s products and services, but the market was actually starving for them. But let’s explore that idea further. Our culture adores tech-enabled products and services, and companies always need risk management solutions. So naturally, the market fit was flawless — people would buy these things because they already were.

Let’s take that idea a step further. Terrific market fit historically motivates investors to gladly jump on board — aka buy stocks in that company — a concept known as market appetite. When the market fit and market appetite align, such as the BRP case, sparks fly. Baldwin realized that the market appetite was ripe, and BRP needed to move forward fast to take advantage of it. In reviewing your company’s profile, particularly before filing for an IPO, ask these questions:

- How well do you fit in the market?

- Are investors salivating for your particular solution?

- Are you the answer they’re searching for, and you merely need the capital and opportunities to bring your product to a global audience?

Financials to Successfully Underwrite an IPO

Our Customer Success Director, John Olson, put it best, “Companies ready to go public delivery against their forecast time and time again.” Here’s the thing; investors want proof of a company’s financial intelligence before doling out any cash. And that’s just for starters. Here’s what your finances need to look like before filing for an IPO.

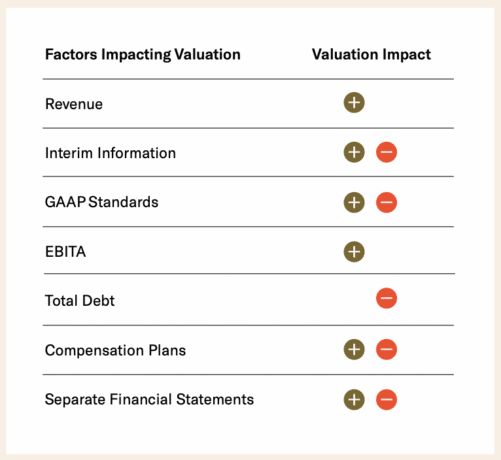

Revenue

For starters, how is your revenue? Many experts think that companies should go public when revenue hits $100 million. However, some have taken the leap at $50 million and others at $300 million. It’s not only about incoming money; instead, it’s more about growth potential and history to back up your equity story.

For example, a significant part of your valuation will depend on your sales growth in the fiscal year before launching an IPO. Upon examining your revenue, can you also unfold a successful growth strategy backed up by uptrending revenue stats?

Interim Information

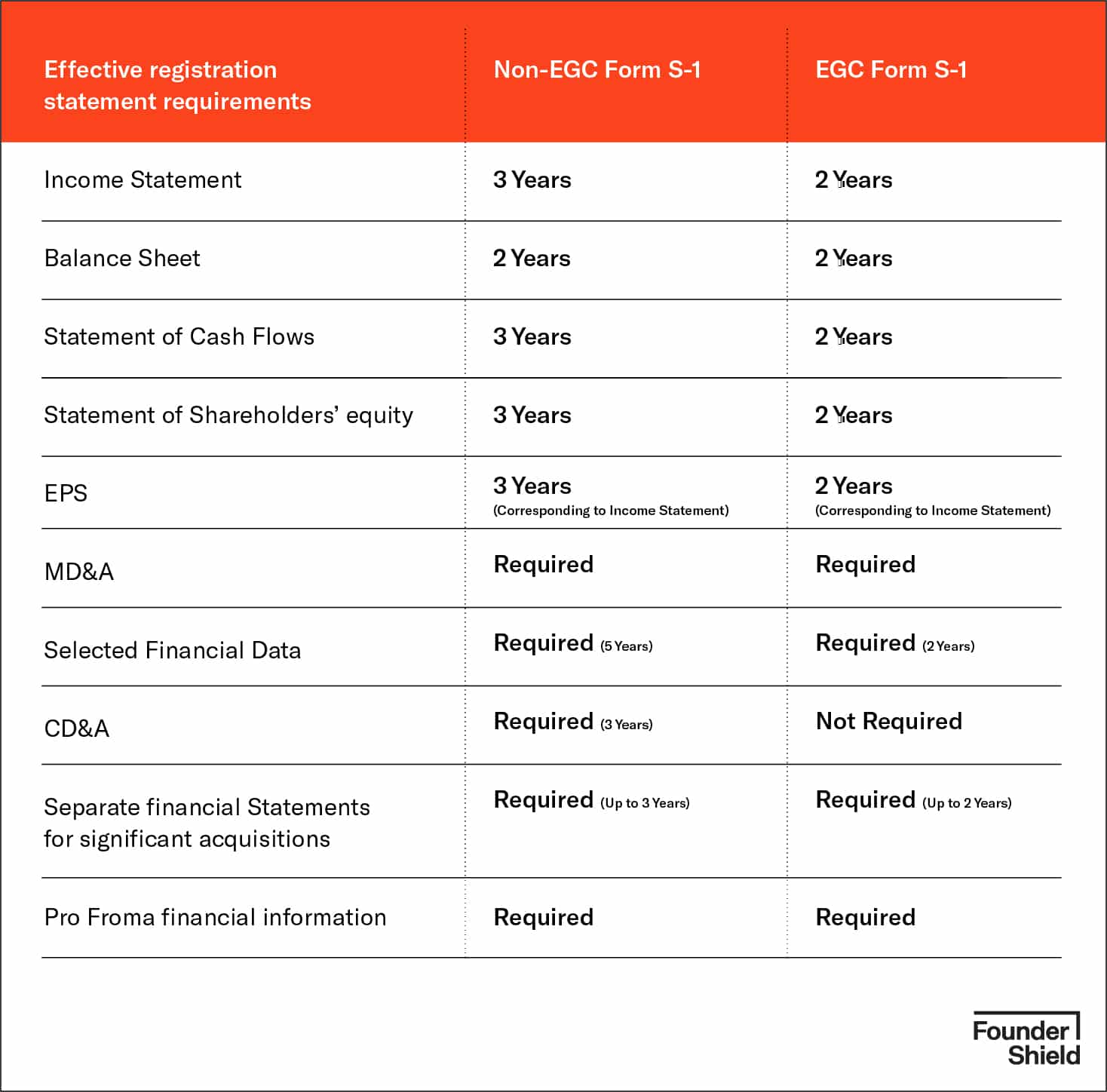

Companies must have audited financial and interim or reviewed information to go public. Regardless of whether you’re an emerging growth company (EGC) or non-EGC, the SEC informs you on best practices to prepare your financial statements.

GAAP Standards

On that same note, the SEC follows the US generally accepted accounting principles (GAAP) standards. These established concepts serve as guidelines for public companies, which is likely slightly different from most financial statements private companies prepare.

Consider quarterly financials, for example. The sooner you develop more sophisticated handling of financial statements, the better. The same goes for complying with the Sarbanes-Oxley Act, which contains 11 significant sections focused on public company financial practices.

EBITA

Companies are more likely to achieve premium valuation if they have top-notch earnings before interest, taxes, and amortization (EBITA). Unfortunately, below-average EBITA margins often result in the opposite outcome. In other words, investors search for companies with an inherent ability to create value.

Total Debt

Going public means your company must present balance sheets, income statements, and cash flow statements to the public. Along with these fundamental requirements, your debt will impact your going public valuation, as well. Disclosing debts isn’t necessarily a tell-all situation and mainly helps investors leverage your capital structure.

Compensation Plans

Retaining top-tier talent, such as critical management and employees, should be prioritized. Developing compensation plans is essential for forming your key team now and after going public. Perhaps, you plan to grant equity securities, establish employee stock ownership plans (ESOPs), or employee stock options (ESO). No matter which long-term incentive you choose, prepare them for the grand reveal.

Separate Financial Statements

Lastly, if your company has acquired or been acquired, the SEC might require you to file separate financial statements regarding specific entities. These statements address equity method investments, guarantors of public debt securities, and affiliates whole securities collateralize a registered debt issuance. Naturally, additional information that the SEC requires will call on you to spend more time in preparation.

“We found that VC-backed companies have a higher likelihood of receiving a premium valuation than other companies (78% versus 54%).” – Boston Consulting Group

Preparing the required financial statements in a timely manner when launching an IPO is often a significant hurdle. Companies ready to go public consistently have reports that are on-time and audit-ready. There is nothing light or breezy about the SEC during the IPO process, and the toe-tapping never dulls. Remember that a company typically must provide three years of audited financial information and up to five years of unaudited data in its offering documents. Going public means your financial statements must be in order, with no exceptions.

Management Team to Navigate the Steps of an IPO

With such stringent financial requirements, company accountants have their hands full during any significant business change. Filing for an IPO is huge, and the method of handling risk becomes a critical aspect of the process. It takes deliberate and purposeful planning to ensure that potential setbacks are minimized, and the company’s financial position is well-prepared for the scrutiny of investors and regulators. Management must anticipate and manage the risks laid out before them, making many decisions along the way, from financial projections to compliance with accounting standards and more.

Imagine a seasoned Finance Director with a wealth of experience navigating the intricate landscape of taking a company public, particularly in the audit of insurance companies. This remarkable professional is a battle-hardened veteran, unshaken by the prospect of countless SEC audits or the formidable task of managing voluminous financial reports.

Your company’s CFO should also be spotlighted. Are they the right person for the job? Will your current CFO take responsibility for the lion’s share of pre-going public tasks and serve as the face of the company for investors?

The CFO and Finance Director examples are only for starters. The finance team, board of directors, tech specialists, etc., are vital parts of your management team that can make or break your company when launching an IPO. Choose those critical hires wisely, and have them in place before you are neck-deep in the IPO process. We’ve conveniently listed a checklist of critical hires later in this guide.

Capital to Support Going Public

If you’ve undergone any level of fundraising, you’re well aware of the money it takes merely to launch those endeavors. Getting all your ducks in a row isn’t always cheap, and filing for an IPO is a similar venture but times ten.

By going public, a company gains the opportunity for more capital by offering shares through the open market. The flip side of that same coin is that companies must hire strategic managers, investment banks, an SEC counsel, etc.

Common Expenses When Going Public

Operational Unit |

Line Items |

|

|---|---|---|

LEGAL |

Due diligence performance Drafting S-1 Form Managing SEC comments |

|

PRINTING |

Digital support SEC filings and distribution Document Management |

|

ACCOUNTANT |

Advisory fees SEC reviews Comfort letter issuance |

|

UNDERWRITING |

Investment bank underwriting fee 3.5% to 7% of gross IPO proceeds Single direct cost to going public |

It’s a big step for a company — but it shouldn’t be a sink or swim situation. If filing for an IPO would make a marked impact on your company and its culture, then wait. Yes, going public is a tremendous opportunity; however, a strong business will only become stronger, not become unearthed by the open market. Going public should be a “we can, but we don’t have to” endeavor if there’s a backup plan up your sleeve. It shouldn’t kill you.

Growth Opportunity to Justify Filing for an IPO

Conventional wisdom says that what’s currently happening in a company will continue to happen, only in a much greater capacity after pouring capital into it. Companies ready for launching an IPO deliver against their forecast time and time again. So, consider your expansion strategy before going public.

Briefly, let’s revisit BRP’s exit plan. The company had successfully been executing an acquisition-based growth strategy. After their IPO, Baldwin’s overall goal was to continue pursuing the same M&A path. Only now the company had opportunities for more capital, and thus, more acquisitions.

It’s not so much sticking with your current strategy as it is committing to a proven method. Growth strategy often shifts and evolves; however, what’s your company’s core strategy? Establishing this element is of utmost importance before filing for an IPO.

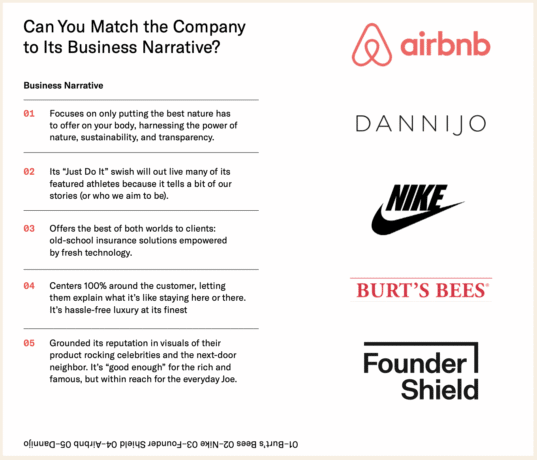

Business Narrative to Motivate Underwriting an IPO

Lastly, this is potentially the most emotionally driven aspect, but let’s talk about your business story. According to Forbes, storytelling is vital to any business as it can turn a company into a legacy. Our society celebrates the human experience now more than ever, especially post-pandemic. Humanizing your company can win loyal customers for life and create a stimulating marketing strategy. And that’s only the beginning.

So, what’s your unique business story? On that same note, how does your narrative fit into the market? Being comfortable telling your business story is a milestone indicating you’re ready for launching an IPO.

Sure, you might operate similarly to other companies in your industry, but what makes you special? Pinpoint your company’s core values, and shout them from the rooftops, letting them infuse every area of your business.

Pros and Cons of Filing for an IPO

There’s more to this decision than merely making sense of being the next logical step. The fit must be epic. Here’s a list of the most popular reasons we’ve seen companies IPO:

- Boost their brand awareness

- Provide a partial exit for existing owners

- Improve their standing with lenders (i.e., creditworthiness)

- Upgrade their equity

- Open doors for more acquisition currency

- Support expansion and valuation potential

- Increase attractiveness to top-tier talent

- Enjoy separation between management and capital

Even with the numerous pros to going public, cons also exist. The following is a list of the most common and often overlooked factors that might turn you off to the IPO idea:

- Investor relationships take a lot of time and energy.

- Managing the SEC’s transparency and disclosure requirements post-IPO is a tall order.

- Companies face more scrutiny from the open market from shareholders and the public alike.

- Delivery upon the promises you made to investors is challenging.

- It’s possible to experience negative earnings per share after going public.

De-Risk the Journey to IPO

Alternatives to Consider Before Launching an IPO

Plenty of well-known companies have chosen to go public via an IPO: Stripe, Airbnb, DoorDash, and Snowflake, to name a few. And many of their IPO stories are incredibly successful (we’re looking at you, Snowflake). However, this route isn’t right for everyone. So, let’s talk about determining the best way for you to go public.

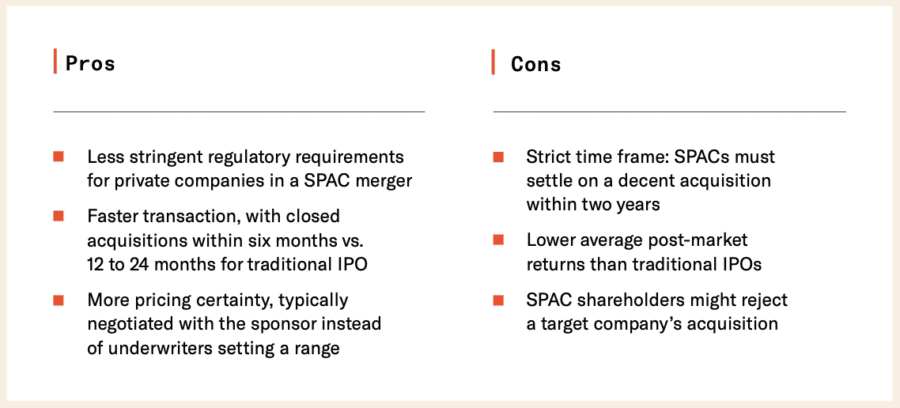

SPACs

Never before have special purpose acquisitions companies (SPACs) been as popular as they are now. Also known as “blank check companies,” SPACs raise funds through an IPO with the only goal of acquiring another company. Don Butler of Thomvest Ventures describes them best, “You can think of it like: an IPO is basically a company looking for money, while a SPAC is money looking for a company.”

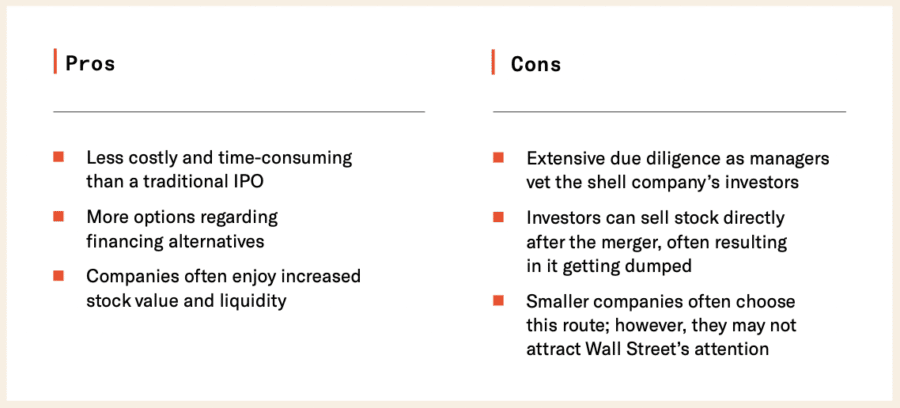

Reverse Merger

Reserve mergers are sometimes called reverse takeovers or reverse IPOs. A traditional IPO combines raising capital with going public; however, a reverse merger separates these two functions similar to a SPAC. Private company investors acquire the shares of a public shell company, which is registered with the SEC. The private company officially goes public when it trades shares with the shell company in exchange for stock.

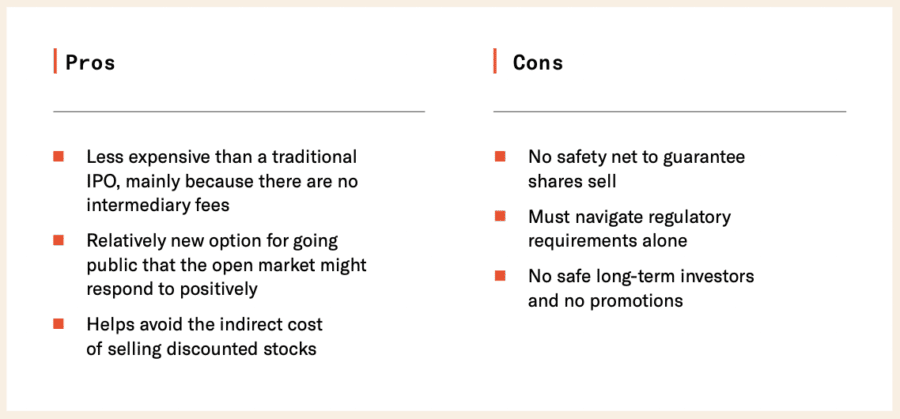

Direct Listing

Direct listings are sometimes called direct placement or direct public offerings. While traditional IPOs enlist the help of underwriters to facilitate the IPO process for a fee, direct listing companies bypass the help from intermediaries. Instead, they sell shares directly to the public themselves.

Critical Checklist Before Filing for an IPO

De-risking the journey of filing for an IPO requires more than merely ticking items off of a to-do list. It takes deliberate and purposeful planning. Without a strategy, even the best intentions can fall flat quickly. Company leaders must anticipate and manage the risks laid out before them, making many decisions along the way.

Are Your Financial Reports In Order?

Perhaps the most intimidating part of filing for an IPO is having your financial reports reviewed. Although it’s a necessary part of the process, financial planning and analysis require mounds of effort. Underwriters typically ask for financial projections, combing through your company’s past budgets and historical performance along the way.

It’s time to become familiar with preparing realistic budgets and current financial forecasts, as these are vital tools for research analysts after you’re operating as a public company. In the meantime, consider the following financial requirements for underwriting an IPO:

- IPO Financial Reports

Have You Recruited a Team of “Critical Hires”?

Managing the necessary forms, reports, and statements will require a powerful team of highly engaged leaders. A word of advice from BRP’S CFO, Brad Hale, is to audit your team — mainly the financial team — before launching an IPO. Furthermore, choose individuals who’ve actually gone through an IPO process before, not only those currently closing the books.

All team members play a vital role; however, we consider a few distinct positions on your IPO team to be exceptionally crucial. Hale pegged these roles accurately when he coined them “critical hires.” Here are a few critical hire positions to consider before filing for an IPO:

SEC Consulting Team

Companies considering a public offering often encounter requests and situations that they’ve never experienced before. An SEC consulting team consists of individuals who understand the needs of SEC registrants, providing detailed guidance and support (i.e., SEC compliance, audit and tax consultation, etc.). Members of this particular team have been in the fox holes plenty of times, and they can provide you with extraordinary support during the IPO process. According to Hale, this particular group of people should be some of your very first hires for your IPO team.

Director of Finance

As you recruit seasoned individuals for your SEC consulting firm, your Finance Director will likely be next in the line of critical hires. During our IPO discussion, Hale mentioned that Financial Directors are currently in huge demand. In other words, they’re hard to come by — but they’re also indispensable. During the IPO process, the Director of Finance leads the finance department, managing the budget and financial forecasting. This role generates reports and assists the CFO in decision-making. Experience matters in building a powerful financial team.

Finance Department

The most significant investment you’ll make as you build your A-team will be in your finance department. This group should consist of individuals with technical accounting and SEC reporting experience. They’ll be responsible for navigating complex financial transactions. This group no doubt includes your financial planning and analysis (FP&A) team. Remember, public company expertise is necessary to keep pace with the financial reporting demands of the SEC for public companies.

CFO

As imagined, the SEC continually demands more from public companies, and many CFOs are surprised at the time it takes to manage their new responsibilities. Hiring a CFO who’s worked for a public company is great; hiring one who’s been through the IPO timeline is even better. The right CFO can be a game-changer; this position usually stands beside the CEO in the spotlight for much of the journey.

Legal Counsel

Having a general legal counsel on your side during the IPO process is invaluable. Nowadays, these individuals can provide insights about corporate governance and tend to be more hands-on than in the past. Plus, when it comes to filing for an IPO, a general counsel can review contracts, transactions, bylaws, etc., and keep your company between the lines. In short, they know how to file for an IPO and have probably assisted in the process numerous times.

Governance

When you hear others talk about the “trickle-down” effect, your company’s management is where the waterfall starts. The board of directors, audit committee, and chief compliance officer, to name a few, govern the business. These are the people who establish internal control, make crucial decisions, review bylaws, and oversee the company’s financial state. The right individuals at the top make the “trickle” far more favorable during the IPO process.

Information Technology

Sometimes, information technology (IT) is overlooked when embarking on various endeavors, such as launching an IPO. Nowadays, your Director of IT or CIO is one of the most critical roles. Cybercriminals don’t offer you a free pass because you’re transitioning from a private to a public company. Instead, data protection and cybersecurity must be even more rigorous than ever before. Your IT leaders must understand the ever-changing digital landscape and the SOX compliance requirements after you’re public.

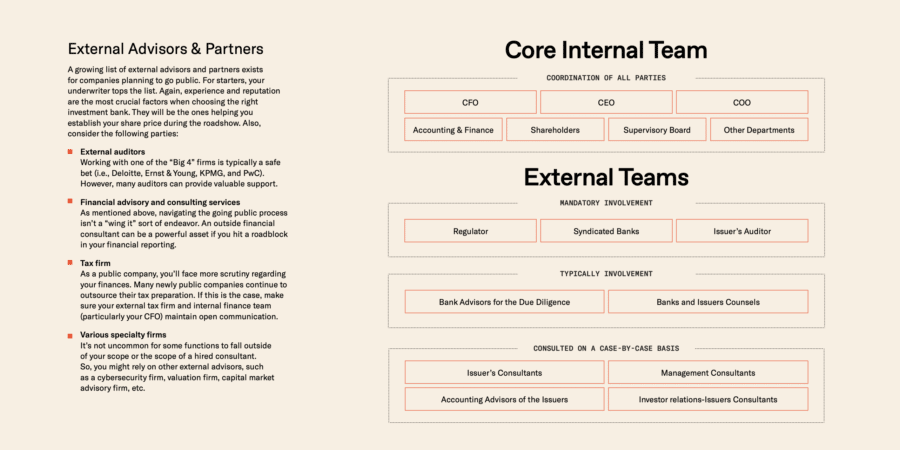

Lastly, besides the critical hires mentioned above, consider adding an underwriters’ counsel, financial printer, roadshow consultant, capital markets advisor, and other industry-specific professional advisors to your going public team, such as:

External auditors

Working with one of the “Big 4” firms is typically a safe bet (i.e., Deloitte, Ernst & Young, KPMG, and PwC). However, many auditors can provide valuable support along the IPO timeline.

Financial advisory and consulting services

As mentioned above, navigating the IPO process isn’t a “wing it” sort of endeavor. An outside financial consultant can be a powerful asset if you hit a roadblock in your financial reporting.

Tax firm

As a public company, you’ll face more scrutiny regarding your finances. Many newly public companies continue to outsource their tax preparation. If this is the case, make sure your external tax firm and internal finance team (particularly your CFO) maintain open communication.

Various specialty firms

It’s not uncommon for some functions to fall outside of your scope or the scope of a hired consultant. So, you might rely on other external advisors, such as a cybersecurity firm, valuation firm, capital market advisory firm, etc.

Have You Chosen the Right Underwriting Partner?

As you near the IPO process, you must refine your company’s equity story. Doing so requires well-thought-out engagement with investment banks. These relationships will bolster your credibility and also soften market receptivity. Investment bankers usually have experience in marketing, financial structuring, pricing, and assisting underwriters during the IPO process.

According to Leslie Fenton, Managing Director at Oppenheimer & Co, “If your lead investment banker is an expert in your sector and has a track record of taking companies public, then their distribution, their institutional brokers, will have good relationships with the largest institutional investors who are known for investing in not only common stocks but also initial public offerings.”

Additionally, accounting firms facilitate IPOs by ensuring financial transactions and statements are accurate and legal. These firms are critical in assessing financial performance and health, primary areas of concern during the IPO timeline. In evaluating an underwriting partners, some crucial questions to ask include:

- Do they have in-depth knowledge of your industry and business?

- Can they tell your business story for optimal market reception?

- What’s their reputation and experience?

- How does their team measure up?

- Do they fit in your going public timeframe?

Choosing a Stock Exchange Listing

Most people are familiar with the New York Stock Exchange (NYSE) and the National Association of Securities Dealers Automated Quotations (NASDAQ). Both of these American stock exchanges are household names. However, there’s also the London Stock Exchange, Tokyo Stock Exchange, Shenzhen Stock Exchange, and about 11 more exchanges worldwide with a market capitalization of more than $1 trillion.

Our guide focuses on the NYSE and NASDAQ, both of which require a minimum security listing price of $4 per share. However, the NYSE requires companies to have $1.1 million publicly-traded shares already, whereas NASDAQ requires $1.25 million. Also, the NYSE requires a minimum collective market value of $100 million, and NASDAQ requires $45 million.

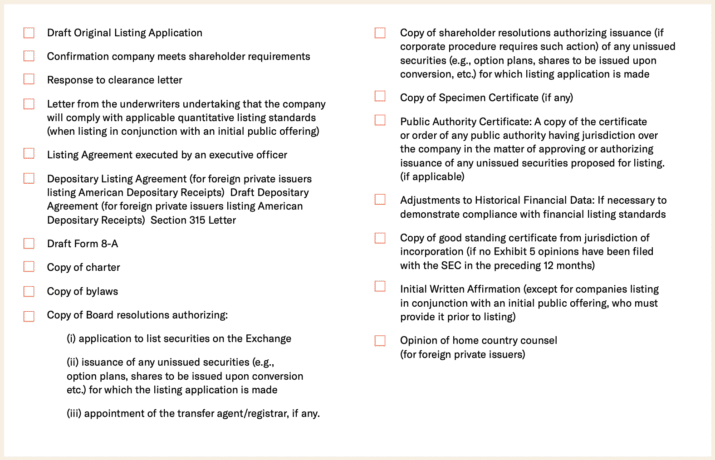

NYSE

The NYSE provides a Checklist for Supporting Documents Required for Original Listing Application and a step-by-step process to support companies as they register. The steps are as follows:

Step 1: Choose Your Market

Step 2: Reserve Your Ticker Symbol

Step 3: Submit Your Application

Step 4: Select Your Designated Market Maker (DMM)

According to the checklist mentioned above, here are the supporting documents required to list on the NYSE:

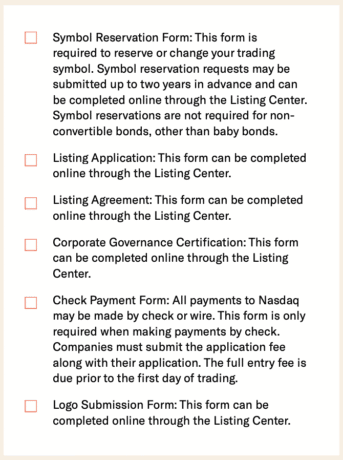

NASDAQ

NASDAQ unfolds its listing timeline relatively straightforward; however, it’s not merely a flash in the pan. As outlined below, the NASDAQ listing process can take six weeks.

Week 1: Company submits application for listing, and Nasdaq Listing Qualifications Staff begins its review.

Weeks 2-3: Staff completes its preliminary review and prepares a comment letter.

Weeks 3-4: Company addresses any issues raised by Staff.

Weeks 5-6: Staff completes their review, and the company is approved for listing.

NASDAQ features a short document checklist on its Initial Listing Guide. Using NASDAQ’s guide, we’ve included a list of the required documents here:

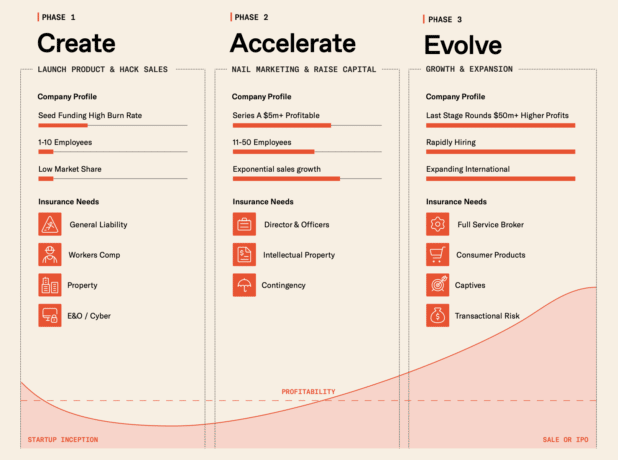

Have You Evaluated New Insurance Needs?

Transitioning from a private to a public company is more than merely jumping on board the NASDAQ or NYSE train. Instead, a lot of intricate planning and strategy go into this IPO process. What’s more, there’s a unique choreography that companies must learn and follow.

Part of the strategy mentioned earlier is forecasting your risks and mitigating them. Let’s be frank; your insurance program will change during this going public transition. Regulatory changes, shareholder demands, and your financial projections will dictate these changes. Nevertheless, here are the most popular insurance coverages that companies consider when embarking on this venture:

- General Liability: General liability offers broad protection against some of the most fundamental risks companies face. Known as “slip-and-fall” or “all-risk” insurance, this policy covers personal or property damage and bodily injury occurring on the business premises.

- Directors & Officers: Shareholders, competitors, investors, etc., can sue a company’s directors and officers, putting their personal assets at stake. Directors and officers (D&O) insurance protects these assets from lawsuits alleging leaders of wrongful acts managing the business.

- Professional Liability: Professional liability, also known as errors and omission (E&O) insurance, covers companies in third-party or client lawsuits claiming substandard work or service. Work errors or oversights, missed deadlines, budget overruns, etc., often result in costly cases — but E&O insurance responds to these mishaps.

- Employment Practices Liability: Any company with employees faces the risks of allegations, such as discrimination, wrongful termination, breach of contract, etc. This coverage protects companies against lawsuits related to employment practices.

- Cyber Liability: Cyber insurance protects companies from third-party lawsuits relating to electric activities (i.e., phishing scams). Plus, it offers many recovery benefits, supporting data restoration and reimbursement for income lost and payroll spent.

- Fiduciary Liability: When a company sponsors an employee benefits plan, it accepts fiduciary responsibility to its employees. This coverage protects from legal liability should a benefit plan administrator practice improper plan care.

- Health & Employee Benefits: With health and employee benefits insurance, employers can offer healthcare, vision and dental, and life insurance, plus retirement plans (i.e., 401(k), etc.). It’s a budget-friendly way to support employees’ wellbeing, retain new talent, and save money on company taxes.

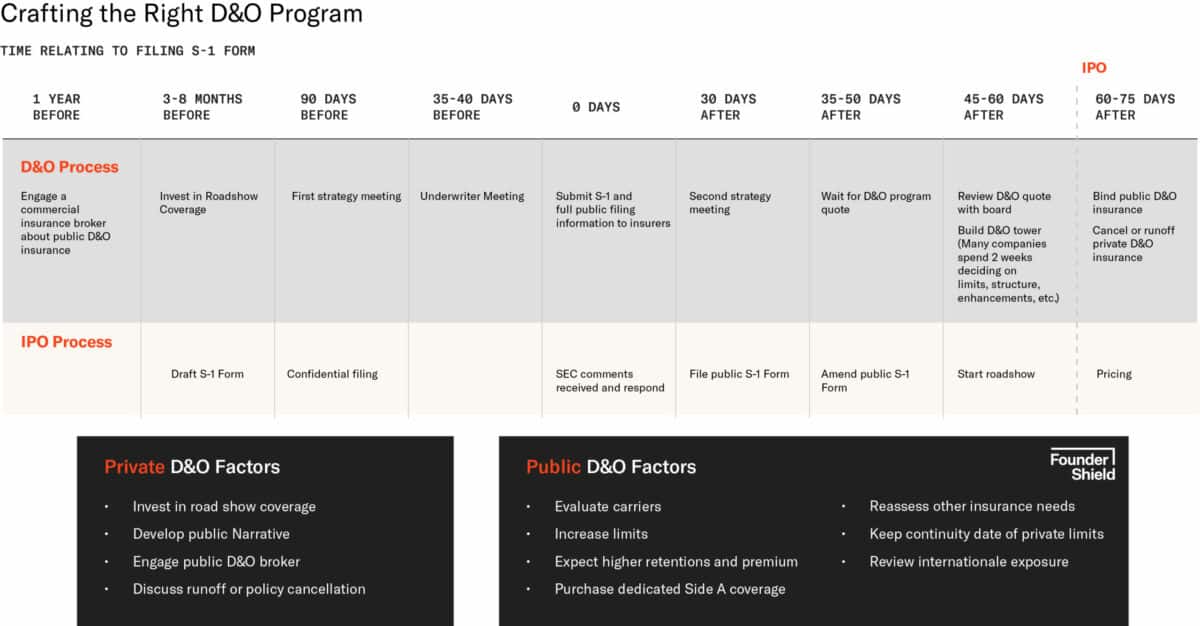

Have You Secured Public D&O Insurance Coverage?

Having experienced rounds of financing before, you’re well aware of the value of D&O coverage. Most investors won’t give you the time of day unless you have this vital policy. However, going public allows more opportunities for scrutiny and potential D&O litigation for company leaders. As a result, now is the time to review your D&O insurance policy to see if it can stand up to the open market.

D&O coverage protects your board members, protects your balance sheet, and defends against allegations. Unfortunately, security litigation has increased globally, causing a challenging D&O market. And further still, SPAC-related litigation is a significant reason for the hardening D&O market. Before we go down the rabbit hole of class-action lawsuits, though, let’s review the three parts of a typically D&O policy, including:

- Side A: Protects solely the individual directors by paying the defense costs and settlements levied on the directors due to a lawsuit. Side A will only pay the individual directors when the entity is unable (i.e. insolvent) or legally not permitted to do so. Typically, individual directors will ensure that the company purchases additional Side A coverage over the traditional ABC coverage.

- Side B: Indemnifies the entity after the entity has paid the individuals named in the lawsuit.

- Side C: This is entity coverage. Should the entity be named along with the individual directors in a lawsuit, this coverage protects the company’s balance sheet and will reimburse and costs/settlements incurred.

Structuring D&O Insurance Towers

How a company structures its D&O insurance tower is based on its size (market cap). Our team has built towers for as much as $750 million in D&O limits and as small as $1 million. Regarding structure, a fair baseline is ⅔ A-B-C coverage and ⅓ Side A coverage.

That said, there will typically be a minimum base layer of A-B-C coverage of $5 million, and sometimes $10 million, depending on the company. Excess of $5 million/$10 million will usually focus on Side A coverage.

However, public D&O insurance relies heavily on a company’s risk tolerance and budget. Some companies with a high-risk tolerance purchase Side A-only programs solely to protect their directors and officers from personal financial loss, mainly for budgetary reasons.

As imagined, a lot of benchmarking and analytics go into these choices. We’ve seen many management teams work diligently on what was non-negotiable on Side A alone. Their strategy was to then get as much A-B-C coverage as possible. It’s a necessary spend, no matter how the cookie crumbles.

- DO Timeline for IPOs

Do You Understand How to File for an IPO?

Once you can tick the above items off your checklist for launching an IPO, it’s vital to understand what happens next in the IPO process. The following is the typical order of events in the process of going public.

Holding the Kick-Off Meeting

Think of the kick-off meeting as an “all hands on deck” gathering. This meeting draws all the players together to discuss the ultimate going public game plan from company executives to accountants, from underwriters to lawyers.

Drafting the S-1 Filing

Here in the US, the IPO process involves a document called the S-1 Registration Statement. It’s known by other names across the world, but we’ll call it the S-1 in this guide. It might take several months to draft the S-1 once your overarching going public team wraps up the kick-off meeting.

Holding Pre-IPO Meetings

Companies usually meet with bankers and salespeople to devise a plan outlining selling the offer to investors. It’s also during this phase that you will typically issue what’s known as a “red herring,” or preliminary prospectus, a sales-driven summed-up version of the S-1 sans the offering price and proceeds.

A primary focus after submitting the S-1 is to conduct research. The equity research analyst and the equity sales team typically lead that charge. Armed with current data, you can start estimating a price range for your offering.

Managing SEC Comments & Revisions

Many executives worry most about responding to SEC comments during the IPO process. It is a tall order, no doubt. However, every public company has worked through SEC comment letters and survived.

Submitting Amended Prospectus S-1/A

Once you’ve answered the SEC comment letters, amending what required amending, it’s time to submit the amended prospectus. Keep in mind that you’ll file any changes to the initial S-1 under SEC Form S-1/A. This document is also titled Amendment No. # to File S-1.

Preparing the Roadshow

The going public roadshow is when company executives dedicate a week or two to meet with investors. In the COVID-19 era, in-person meetings have been replaced with virtual meetings. Company executives showcase the company in a comprehensive presentation. Investors also ask in-depth questions about the company. It’s a chance for investor relations to become solidified and secure accurate share pricing.

Pre-Selling Company Shares

Before going public and listing your stock on the public exchange, you can sell large blocks of discounted shares in private sales. Private equity firms, hedge funds, and other institutions typically make up most of your buyers. There are many risks involved because no one can guarantee that your company will make it through the going public process. So, selling your shares at a lower price to these investors is one way to counterbalance the risk, per se.

Filing for an IPO involves many moving parts, from comprehending the IPO process to launching an IPO to mastering the IPO timeline. In short, it’s a tall order — potentially the toughest endeavor your team will navigate together. But we’ve been there before, and we get it.