Key Takeaways

Most fast-growth companies tend to have one concern in common: legitimacy. The “real deal” companies go far, after all. Perhaps you’re ready to move past the seedling stage and are trying to attract quality leadership to your board of directors. Or, you’re embarking on a Series A funding round to harness professional momentum.

No matter your aim, securing directors & officers (D&O) insurance is likely on your to-do list to help you come across as legit. More importantly, this coverage makes you legit, covering vital aspects of your company’s leadership. That said, the average total cost for companies without D&O insurance is $394,000 should they be hit with a D&O related claim.

In this fifth post of our Series A series, we delve into the details of D&O insurance for your emerging business. We cover what D&O insurance is, what it covers, and the importance of landing a policy before your Series A funding round. Let’s begin.

What Is D&O Insurance?

In the past, D&O insurance wasn’t much more than a tick on a checklist. Business owners understood that they needed this policy to move forward professionally, protecting the assets of key persons and whatnot, but comprehension didn’t extend far beyond that mindset.

In today’s world, rich with venture capital investors catapulting startups into the deep blue of business, D&O is invaluable—but it serves a much more important purpose than a mere tick on a list. According to Chubb’s 2016 survey, over 25% of private companies faced a claim over a three-year period. Furthermore, the ones without the backing of a D&O policy reported an average loss of almost $400,000.

Leadership

As imagined, D&O insurance still protects the personal assets of key company individuals. However, the scope has expanded significantly. In other words, D&O protects directors, officers, managers, and employees who make company decisions if a claim is filed against them. The policy covers legal defense costs and financial loss.

Companies can depend on a D&O policy for reimbursement to indemnify its executives against covered claims. Besides leadership, the policy would defend the corporate entity if the company itself was named, as well. The cost of claims against company management can quickly skyrocket, but D&O coverage helps to shoulder the financial blow.

It’s not uncommon for insurers to extend coverage outside the board of directors, such as employees and volunteers. Hired lawyers, external consultants, and members of advisory boards all fall in this category, too.

Coverage

D&O insurance covers types of claims that concern an individual’s actions and decisions in their capacity as leader of the company, such as:

- Allegations of breach of fiduciary duty

- Mismanagement of shareholder voting procedures

- Unfair trade practices

- Misrepresentation

- Securities violations in connection with private placements

- Failure to comply with regulations and laws

Additional limits are also typically available to protect executives by providing indemnification when the company is insolvent. Naturally, this additional protection comes in handy when companies are in financial trouble and more likely to face a D&O suit.

D&O insurance will also cover investigation costs if a shareholder sues you after acting on behalf of the company, or otherwise known as a derivative demand claim. Plus, D&O covers legal defense costs of a dilution suit from a former executive.

What Does D&O Cover?

Many companies are misguided, believing that they don’t need D&O coverage because they’ve never faced such a loss. That said, some industries are more prone to specific exposures as opposed to others. But D&O coverage can usually benefit most businesses.

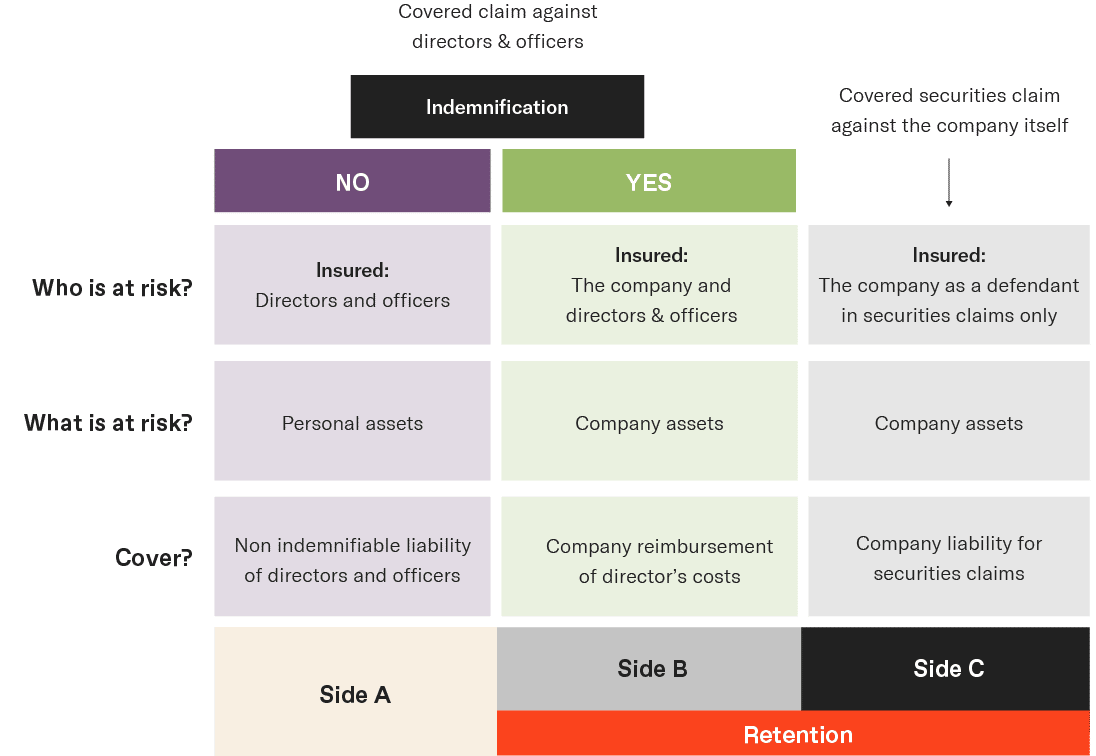

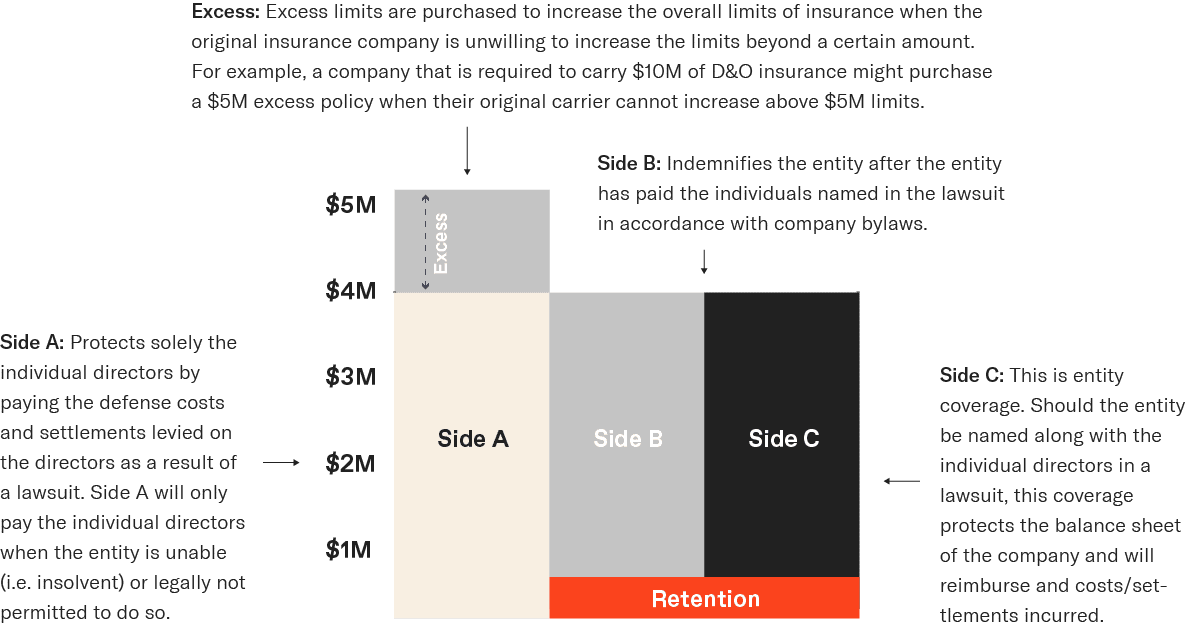

As mentioned, D&O covers several aspects of company leadership, but there are a few sides to that coin, including:

Side A

One of the most valuable elements of D&O insurance is undoubtedly the Side A policy. Mainly because without Side A coverage, individual members of leadership would face personal exposure to hefty defense costs and settlements in the event of a lawsuit.

In other words, Side A insurance protects individual directors by paying legal expenses and settlements if an unindemnifiable claim situation arises.

Keep in mind that these situations happen for various reasons. Sometimes insolvency or bankruptcy is the chief problem. Other times, it’s illegal for the entity to pay individual directors. In these situations, Side A of the D&O insurance policy would kick in.

Side B

After the entity (typically the company) indemnifies its directors and officers in a lawsuit, the Side B policy reimburses the company. Ultimately, this coverage backstops the company’s indemnification obligations to its directors and officers.

Self-insured retentions (SIRs) or deductibles often apply to Side B insurance coverage. Retentions are essentially amounts that companies must pay out-of-pocket before the insurance policy responds to a claim. To learn more about what are retentions in insurance, check out this guide that explains the concept and its relevance.

Side C

This part of D&O insurance is known as “entity coverage.” In other words, it protects the balance sheet of the company if the entity is named alongside the individual director in a lawsuit. Side C will reimburse the legal costs and settlements incurred.

Naturally, much broader coverage applies to private companies under a Side C policy as opposed to public companies.

Why Do Investors Request It?

Venture capital (VC) investors make deliberate choices involving calculated risks every day. After all, investing in startups isn’t exactly a fool-proof endeavor. VCs face multiple exposures—failed exiting strategies, profit loss, disappointing management, negative industry trends, etc.—so, protecting their investment is second-nature.

Take the recent shareholder class-action case against San Francisco-based Juul labs. In a series of shady circumstances, Juul’s valuation of $38 billion dropped to a mere $24 billion. Unfortunately, this occurred after Altria invested $12.8 billion in Juul, which prompted the lawsuit.

The complaint named nine of Juul’s current directors as well as several former members of the board. Breach of fiduciary duties, failure to provide accurate financial information, and imposing restrictions on minority shareholders are a few of the accusations in the case.

Again, VC investors make deliberate choices involving calculated risks. But things aren’t always as black and white as we’d like them to be. Just ask those Altria investors acting on Juul’s board who were blindsided with the above claim. Here are a few more reasons VCs request D&O insurance.

Minimizes Exposures

As a result, a company with D&O liability insurance looks very attractive to an investor. Some investors will require D&O insurance before signing a check. What’s more; is that most VCs won’t even consider drafting a term sheet without it. D&O insurance is that vital.

This approach only makes sense, too. For example, if a fiduciary mismanagement claim should arise, investors will want D&O coverage in place to protect their investment (you and your company) in addition to their personal assets and VC firm.

Safeguards Board Members

Plus, investors often serve as an active member on the portfolio company’s board of directors, which opens up a whole new set of exposures.

Consider the following claim situations regarding D&O insurance and how having the coverage could significantly impact your VC endeavors:

#1 – Inaccurate Disclosure

Multiple investors participated in a SaaS startup’s Private Placement. Over $5M was raised to fund capital expenses, provide working capital, and cover operating losses. However, these same investors filed a class-action lawsuit against the SaaS company.

The counsel investigated both corporate and public records as well as various company documents. In the end, the Private Placement Memorandum (PPM) contained an unaudited year-end balance sheet and statement of profits and losses that were materially misleading.

Outcome: Total defense costs and settlement exceeded $500,000

#2 – Investor Fraud

A company offering specialized medical billing services to a particular client receives compensation based on a predetermined percentage of the total billing amount. In a significant turn of events, an audit in insurance, specifically a Medicare audit, revealed that services amounting to over $1 million had been inaccurately billed to the client. Consequently, the client is obligated to reimburse Medicare, while the company is similarly compelled to refund the commissions received.

Amid the investigation, the company conducts a round of financing. However, it fails to mention that its cash flow could be significantly hindered should it be required to repay the commissions. An investor in that round of financing alleges breach of fiduciary duty and fraud when the company is incapable of paying interest on the security.

Outcome: Settlement and defense exceeded $250,000

Increases Credibility

Most VC investors have been around long enough to know that it takes more than matching polos to make a business legit. Although the popping collars are nice, VCs are more concerned with the “behind-the-scenes” strategy instead.

For starters, having a D&O policy in place shows that you understand your industry, knowing full well the specific risks you face. It also speaks volumes to investors that you know how to manage risk. This aspect of business savvy is where many entrepreneurs fall short—managing risk is a sort of art in the business world.

What Limits Should You Buy?

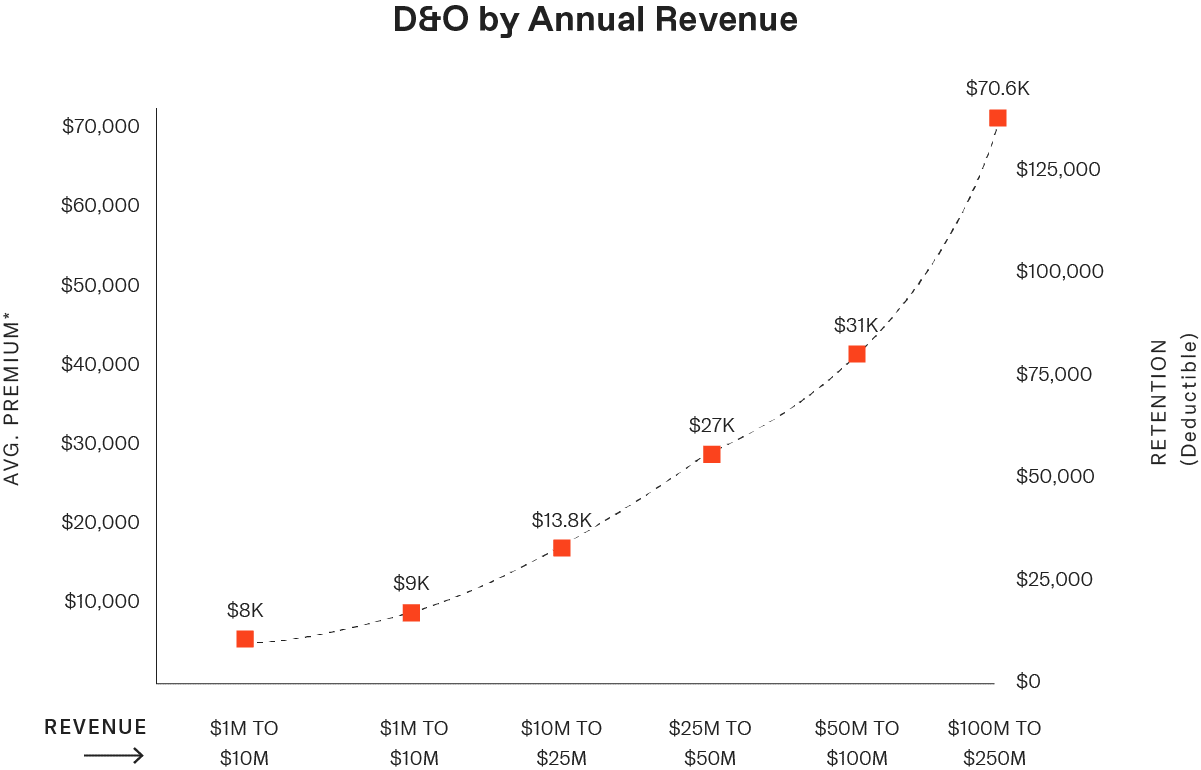

Choosing the appropriate D&O insurance limits for your business depends on a few factors, such as:

- Business financials

- Shareholders

- Industry

- Revenue

- Debt

- Legal history

Although we’d be thrilled doling out solid numbers for you, landing on one figure for one business in one blog post is impossible. Plus, appropriate limits will vary case by case, depending on a combination of the above factors. Some companies might only require $5M, while others need up to $50M or even $500M.

Below is a chart displaying averages from actual Founder Shield client data to give you an idea of where your D&O limit needs might fall. (we also have a D&O benchmarking infographic if you’d like to learn more)

As your company evolves and you take on new professional endeavors, you’ll face unique exposures, as well—especially during a Series A growth spurt. Founder Shield specializes in knowing the risks you face at each stage of development, and we work to make sure you have adequate protection. Feel free to reach out to us, and we’ll walk you through the process of finding the right policy for you.

Want to know more about Series A funding? Talk to us! You can contact us at info@foundershield.com or create an account here to get started on a quote.