Key Takeaways

You’re a homeowner; a car owner; a business owner. You have insurance, but when should you turn to your insurance for help? Will a duck quack “Aflac”? Will the Mayhem Man mimic an exact situation the common policyholder will encounter? Probably not.

“I pay all this money for insurance, and as soon as I submit a claim, my insurance premium skyrockets.”

Is this always true? Of course not. Is submitting a claim to your insurance company somewhat of a double-edged sword? My opinion is that it’s not…but you could make the argument. So that begs the question, how does the common business owner know when to turn to their insurance for coverage? The short answer is, turn to your insurance broker for guidance. But it’s important for policyholders to have a working knowledge of how insurance companies view the relationship between retained losses insurance and policy premiums.

Dealing with Risk: What insurance companies look at

There are two key elements the insurance companies consider when it comes to analyzing a policyholder’s claim history:

Claim frequency looks at how often the insurance company is put on notice regarding an incident that may (or already did) result in a claim. Let’s consider a hypothetical situation in which a business owner pays $50,000 a year for insurance. Over the course of this year, they submitted four claims, resulting in a $4,000 settlement for each. At the end of the 12-month period, the insurance company collected $50,000 and only paid out $16,000 – seems like a profitable account for the insurance company.

But this is a prime example of how the loss ratio (premium collected: claims paid) is not indicative of the insurance company’s view of the account. If this particular business experienced four separate incidents in the past year, it is only a matter of time until a more catastrophic loss is incurred — and for this reason, the insurance company can justify a steep increase in insurance premium upon renewal of this account.

Claim severity focuses more on the total dollar amount the insurance company pays out on a specific claim rather than the number of claims submitted. In the case of a severe, or catastrophic claim, there’s no question that it needs to be reported to the insurance company, but there’s also a slim chance that the premium does not increase upon renewal. Often times after a severe loss, a business (the insured) is forced to tweak their operations to demonstrate to insurers their awareness of loss exposures and willingness to change to avoid certain risks.

How to deal with it

Let’s use a couple examples to work through how claim situations can play out.

Example 1. At your company’s retreat, two employees jumping on a trampoline collide and each sustains serious head injuries.

- Without question, this incident must be reported to the insurance company.

- Moving forward, there are several changes the company should take:

- The company could do away trampolines altogether

- The company can implement a strict 1 person limit on the trampoline at a time at future retreats

Example 2. A child chokes on your company’s newly designed wearable fitness tracker.

- There’s no telling the injury that can be sustained by a choking child — a claim is almost certain to follow.

- Decide what can be implemented to prevent a similar occurrence:

- Offer a large storage container (unable to fit in a child’s mouth) as a case to store the USB chip.

- Change the packaging so that a child is unable to open without an adult’s assistance.

- Include a disclaimer that your product is for adult use only.

If a policy holder only has one severe loss, often considered a “shock” loss, it may be easier to convince a new insurance company that this type of loss cannot happen again due to operational changes (ex: remove all trampolines).

So if a catastrophic claim (one that alleges a high dollar amount in damages) should always be reported, how does a policyholder know when to retain smaller claims to keep their loss frequency down? Again, turn to your broker for guidance! A soft rule of thumb is to retain a loss if the alleged damages are less than twice the policy deductible.

Example 2. Your company’s office is broken into and a laptop is stolen. Consider the following property policy:

- Property Deductible = $1,000

- Business Personal Property Limit = $50,000

- Cost to replace the laptop = $1,600

In this scenario, it may be more cost effective in the long run for the insured to retain this loss rather than report the incident to the insurance company. The insurance benefits are likely too minimal to justify the claim history.

Thinking long-term

More importantly than when to report a claim, are actions you could take to prevent a claim. Here are some important procedural considerations when trying to minimize future losses:

- Past losses (claims history) – The saying “history tends to repeat itself” often proves true in insurance as well. By understanding what caused past losses, it’s easier to make adjustments to prevent the same occurrence from causing loss.

- Personnel – Look to employ people with a clear understanding of your businesses goals, and the proper way to achieve these goals. This type of personnel should look to be retained, rewarded, and used as examples of how to conduct business.

- Administrative guidance – The tone is set by company executives. These key people should present specific risk management guidelines, often in the form of safety manuals and an open-door policy for employees to report questionable behavior that may result in potential loss for the business. Good training can prevent a lot of headaches down the road.

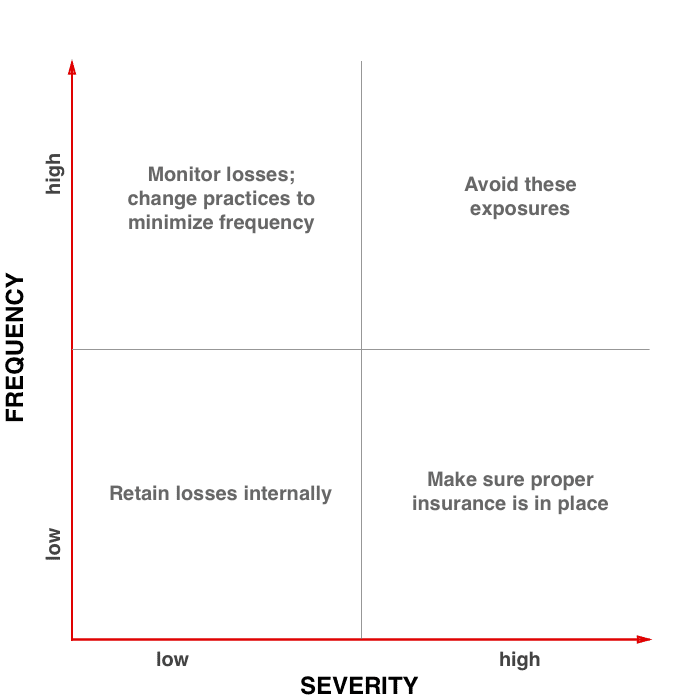

Don’t have the time or resources to implement such detailed risk management practices and procedures? Here’s a quick chart to illustrate how different loss exposures should be handled:

All business insurance claims must be considered on a case-by-case basis, as there are different exposures to consider, and risk management procedures to apply. But the one universal pointer applicable everywhere (and I would be remiss to not mention it one last time) is to consult with your insurance broker when it comes to claims!