Key Takeaways

In 2025, D&O insurance pricing continued to experience rather calm waters with slowly rising premiums—almost like the calm before the storm. But this is no surprise. The dormant IPO market, continuous cyber risks, and new threats such as AI and changing tariff policies signify that, while things have stayed slightly the same as in the past few years, new risk factors are entering the playground and potentially shaking things up.

For instance, underlying claims severity is rising sharply due to evolving litigation drivers, including AI, regulatory enforcement, and geopolitical sanctions. This buyer’s market is also directly juxtaposed with the highest risk environment for directors and officers for the first time in a decade, meaning that the tides could be changing.

The 2025 D&O Market Snapshot

2025 was another flat year for D&O insurance pricing, with a few decreases. This soft market can be explained by aspects like new entrants, such as Insurtech companies led by industry veterans stepping away from the traditional narrative. High-risk industries experienced slight increases as expected, with class-action lawsuits surprisingly experiencing a decrease compared to 2024.

Private D&O: Continued Softening and Capacity

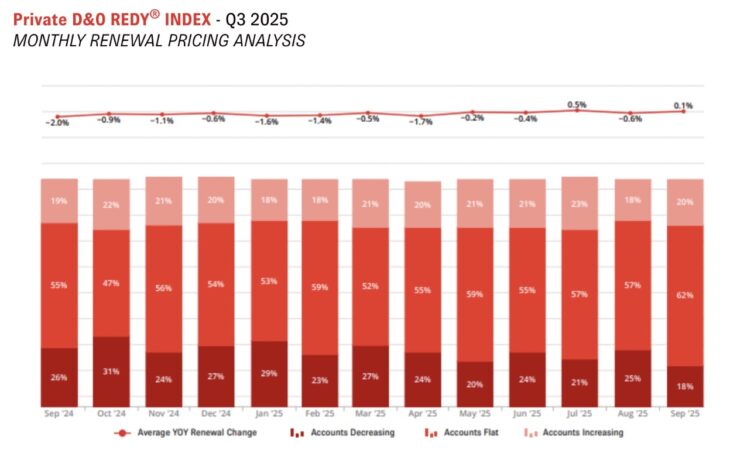

Private D&O insurance pricing continued the cycle that began in 2024, characterized by flat rates and -0% to -5% decreases on average for primary and excess. This is due to abundant carrier capacity and intense competition to gain market share, making prices favorable for buyers, except perhaps for those in high-risk industries.

Insureds in fintech, cryptocurrency, and generally VC-backed firms remain among the few experiencing higher premiums, often paying two to three times higher rates than mainstream peers. Otherwise, over 50% of renewals in 2025 were signed on flat premiums.

Source: Private D&O REDY Index Q3 2025 | CRC Group

Public D&O: Tougher, but Available

The public D&O insurance landscape, although similarly flat with modest 2-5% increases, grapples with the ongoing exposure to Securities Class Action (SCA) lawsuits, which leads underwriters to stay cautious despite the low rates and the decrease in SCAs year over year.

The stagnant IPO market is another factor impacting flat rates. However, litigation targeting de-SPAC transactions from the past two years of low SPAC traction remained a major claims driver throughout 2025.

Moreover, although claims frequency stabilized, juries and courts continued to award high-dollar settlements that led to the average cost per loss event to remain high, pressuring carrier reserves and reinsurer appetite.

Overall, insurers are gearing up for a potential uptick in IPO activity, which, despite the abundance of entrants in the market, might signify higher premiums and self-insured retention in the near-term D&O space.

The New Litigation Drivers of 2025

What set off risk alarms in 2025? While the reduction of Environmental, Social and Governance (ESG) efforts continued, creating a double-edged sword, and cybersecurity remained a concern, new factors like AI took on more relevance as more companies adopted the technology.

The AI Governance Risk

Very few companies have managed to avoid the AI bug. Most have jumped on the wagon with innovations like agentic AI that streamlines tasks and takes over around-the-clock customer service. This hype, accompanied by heightened investor interest, has unfortunately led some companies to overstate their AI usage, known as AI washing.

One of the most prominent cases of misleading investors with inflated AI claims has been Oddity, a cosmetics company slammed with a securities lawsuit that alleges their AI tech was “nothing but a questionnaire.” This case unleashed a series of AI washing lawsuits that have rendered the technology a new liability for companies, with insurers and risk managers pressing for higher governance when adopting it into their practices.

As a result, the failure of boards to adequately test, audit, or govern AI models to minimize risks of algorithmic bias and IP infringement has become an emerging errors and omissions (E&O) and D&O intersection. In such uncertain times for such a novel technology, implementing a robust Management Liability Insurance program has never been more vital.

ESG as a Dual Liability Trap

ESG was first coined in 2004 in a report titled “Who Cares Wins.” Initiatives to become more sustainable, build a healthy company culture, and invest in their social component quickly took over industries, becoming the core of many companies that followed the pulse of what their customers wished to see in them.

However, several factors have led to a recent pullback that has even triggered anti-ESG litigation, paralleling a rise in “reverse” lawsuits alleging breach of fiduciary duty and anticompetitive behavior for restricting investments based on political or social goals. For instance, asset management giants BlackRock, State Street, and Vanguard were hit with an FTC Statement of Interest case claiming their efforts to propel sustainable energy drove down coal production, which in turn raised energy prices.

Greenwashing has also been a known risky practice, akin to AI washing, where companies overinflate their sustainability efforts to gain public favor. In turn, this has created a continued exposure for claims of misleading investors or consumers about sustainability claims or climate risk targets.

Lastly, D&O underwriters are requiring specific attestations regarding ESG and DEI strategy to confirm the board is properly managing this dual political risk.

D&O Insurance Benchmarking

Cybersecurity as Management Liability

Cybersecurity became a mainstay risk across all industries, but more notably those in the tech sector, which heavily rely on digital systems to operate. The concern has been such that the US Securities and Exchange Commission (SEC) released a final rule requiring all companies to disclose cybersecurity risk management strategies and governance, and promptly report any incidents to the authorities and their users.

This mandate fully cemented cyber risk as a D&O exposure, especially as failure to disclose swiftly or accurately can now lead directly to a shareholder lawsuit.

Forecasting 2026: Underwriting and Claims Pressure

Changes might be on the horizon for the currently stable D&O insurance landscape. From rising geopolitical tensions to potential bankruptcies and EPL spills, major shifts could take place in 2026.

To start, insurers will be even more cautious when it comes to reviewing financial health. Financial distress will now be the top indicator for future D&O claims, which is why underwriters will apply extreme scrutiny to balance sheets and debt loads. This is in part due to rising bankruptcies, but also the consequence of an environment where price surges due to tariffs might seem like a revenue increase on paper.

As a result, expect underwriters to demand longer historical loss runs and more detailed quarterly financial projections.

Exclusions will also tighten due to ongoing global conflicts in places like Europe, the Middle East, and Asia. This geopolitical component is forcing carriers to refine or impose stricter War and Sanctions exclusions in D&O policies. In such cases, directors could face personal liability if the company fails to properly screen transactions, leading to potential regulatory actions and uninsured losses.

Additionally, workplace shifts are spilling over and forming new D&O risks. The high frequency of EPL claims due to wrongful termination and retaliation, and rising Wage and Hour class actions, could create new exposures for company leaders if the lawsuits allege mismanagement or failure to implement proper HR controls.

Strategic Recommendations for Boards in 2026

With new developments on the insurance front taking place in 2026, companies should also transform the way they approach insurance in their favor.

For instance, make sure to negotiate favorable terms where you can. In the current soft market, secure high limits in the excess layers, where capacity is the cheapest, to optimize your gains. You should also do your best to negotiate for Defense Outside Limits (DOL), as defense costs for complex litigation, such as AI and ESG, are skyrocketing.

Make Governance and Diligence Mandatory

Be sure to strengthen your cyber governance efforts by integrating the CISO into the board-level risk committee. If you’re doing things right, you should already be formalizing and documenting decision-making processes for incident response and regulatory reporting to avoid penalties and fines—but it’s never too late to start. This is crucial today as it’s still relatively common for cyber-related claims to morph into D&O litigation, which is a theme that started a few years ago.

And, if your company is implementing AI, conduct privileged, internal audits of every AI model used to assess IP, algorithmic bias, and data risks before they become litigation points.

Finally, ensure indemnity agreements and D&O clauses are clear, particularly around liability for foreign regulatory enforcement.

Today’s decrease in D&O premium pricing doesn’t mean there’s reduced risk. In fact, this is a time to view flat and decreased rates as a capital deployment opportunity. The real threat for 2026 is driven by unregulated innovation and the ongoing geopolitical tensions: AI, regulatory non-compliance, political pressure, and global sanctions.

Companies that manage to elevate governance above mere compliance as a requirement will secure the best terms for their D&O insurance pricing, successfully protecting their directors’ personal balance sheets in the face of inevitable litigation.