Key Takeaways

For the second year in a row, employment practices liability (EPL) insurance has remained stable, with a few renewal decreases due to higher capacity from new market entrants. However, we remain cautious on the social inflation front that continues to shift workplace dynamics and inject uncertainty for rising claims. For instance, the unanimous decision by the US Supreme Court to strike down the “background circumstances” rule for majority groups in discrimination claims may lead to more legal battles for employers. What did 2025 look like, and what should we expect for this year? Let’s take a look.

EPL Insurance Market Update

After a year of growing geopolitical tensions and changing social dynamics, premiums managed to remain stable across nearly all industries. However, certain sectors might begin seeing a small change in pricing trends in EPL insurance that reflects either rising claims volume or the ever-evolving personnel cuts.

Premium Stability at a High Baseline

Going into 2026, rates are projected to stay flat or experience a 5% increase for average accounts. However, for high-risk industries such as healthcare, tech, and hospitality, high-earner states like California and New York, and accounts with recent claims, premiums might experience a higher increase.

Bear in mind that even baseless claims can cost an average of $50,000 to $75,000 just for legal defense and discovery. This is where social inflation is playing a major part, with settlements and jury awards increasing due to it.

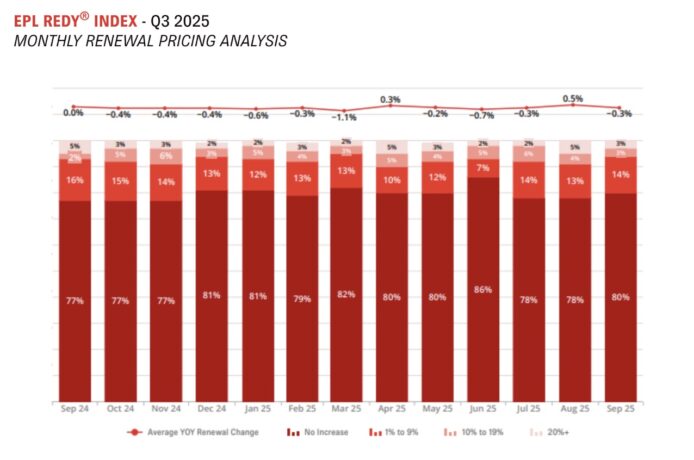

Source: EPL REDY Index Q3 2025 | CRC Group

Unfortunately, retaliation claims remain the most frequent charge filed with the US Equal Employment Opportunity Commission (EEOC), often tied to employees being disciplined for reporting discrimination or speaking out on workplace safety issues. We’ve also noticed that wrongful termination claims linked to cost-cutting layoffs and Reductions in Force (RIFs) are on the rise, where companies are failing to use objective, defensible metrics to justify their decision.

In light of these widespread circumstances, the primary EPL insurance pricing factors have been focused on employee headcount, industry classification, and claims history.

The New Regulatory Battlegrounds

Remote and hybrid work, unionization, new pay transparency regulations, and other rising employment trends are creating new standards that are leading employers to quickly adapt and enforce new best practices and mandatory rules, as well as shift company culture. As a result, EPL insurance might not always apply to these new modifications, or its scope is limited in the current policies.

The W&H Crisis

For example, there has recently been a new wave of wage-and-hour (W&H) difficulties—any unpaid overtime, misclassification of employees, and missed breaks—that can quickly turn into class-action suits that are typically excluded from standard EPL policies. Forty percent of all W&H settlements stem from overtime violations, often resulting from misunderstandings of who qualifies for it and when compensation is actually required.

This is further complicated by remote and hybrid work, which has made it more difficult to track real working hours and classify employees as exempt or non-exempt workers depending on their location. This ambiguity has further exacerbated misclassification claims.

Talking to a specialized insurer that can add the proper W&H sub-limit endorsements to your EPL insurance coverage is your safest bet to shield your company if it’s prone to these rising issues—whether you handle remote workers or offer hourly-paid work such as carpentry and other technical or manual duties.

New Pay Transparency, Equity, and Worker Status Laws

In the US, lawmakers are increasingly advocating for pay transparency that generally requires employers of five or more employees to include salary ranges in new job postings. In 2025, new states like Minnesota and New Jersey joined the list, while others like New York and California had already passed and enacted this law years prior. Not complying can result in regulatory fines and other legal issues.

For instance, not making salary ranges clear from the start can provide clear evidence for discrimination claims in the case an employee finds out a colleague with the same title earns significantly more, especially across protected classes. Such lawsuits also trigger EPL claims, impacting premiums at the time of renewal.

Employers are also facing more pressure to properly classify their workers as hired or independent contractors under W-2 employment, with even more specific cases such as AB5 in California. Misclassification might lead to massive liability for back wages, benefits, and statutory penalties.

The Governance and Tech-Driven Claims

Recent diversity, equity, and inclusivity (DEI) pullbacks and the introduction of AI in areas like hiring are creating new workplace litigation scenarios, leading to challenges and shifts on the insurance front.

The “DEI Dilemma” Claims

Economic and political pressure at the start of 2025 quickly led some of the biggest names in several industries to reevaluate and, in many cases, axe their DEI efforts, whether they included entire departments or workplace initiatives to improve equitable compensation, hiring dynamics, and other areas where marginalized groups have historically experienced disadvantages.

This sudden turn in landmark company practices triggered a dual wave of EPL claims. To start, there have been traditional claims stemming from employees in protected classes alleging a hostile work environment or discrimination/retaliation due to the reduction of equity initiatives.

However, the tides have also shifted in the opposite direction. Now, cases like Ames v. Ohio Department of Youth Services in 2025 are opening the doors to reverse discrimination litigation, where employees belonging to majority groups are alleging that prior DEI programs favored other groups, leading to unfair treatment or missed work opportunities.

These new cases have made carriers further scrutinize past and present DEI policies to determine legal defensibility and are asking for detailed documentation on termination processes to move forward with this new variety of EPL insurance claims.

The Risks of Algorithmic Bias

The surge of AI tech in almost every industry has helped streamline tasks and reduce employee strain on otherwise burdensome activities. HR departments haven’t been the exception, using AI tools to screen resumes, do performance reviews, and even get involved in deciding promotions that have inadvertently introduced systemic risks of unintentional discrimination due to algorithmic bias.

This coming year, EPL lawsuits will increasingly target the AI model itself, requiring employers to demonstrate that the technology they hire has been vetted for transparency and unbiased training material.

As lawsuits of this nature have increased, employers must become more careful about their tech providers, demanding a guarantee of fairness and regulatory compliance in their AI models to avoid running into future issues created by the novel technology (which also drives errors and omissions exposure for HR tech vendors). This must also be paired with the assurance that HR departments are including a human in the review process of all critical AI-driven employment decisions.

We believe that, to fully avoid these types of claims in the future, it’s imperative to adopt a “human orchestrated” approach to AI programs, making humans the main decision-makers, aided in part by technology.

To quote a famous IBM training manual from 1979: “A computer can never be held accountable, therefore a computer must never make a management decision.”

Risk Mitigation Mandates for 2026

After the radical change in employment practices brought about in 2020, many HR strategies went from mere recommendations to mandates. These new rules were a result of the severe losses suffered by the insurance industry from EPL claims in recent years, leading to more companies and insurers to adopt them to receive favorable premiums and offer better coverage across the board.

In today’s insurance world, the following items are non-negotiables for any business seeking favorable EPL insurance renewals in 2026, with fewer chances of increases or refusals:

- Enforce full-time, dedicated HR personnel or robust HR outsourcing.

- Perform annual updates and sign-offs on employee handbooks, anti-harassment policies, and mandatory training logs.

- Offer consistent, documented training for managers on recognizing retaliation and harassment, and handling complaints correctly.

To get even more granular with your EPL policy structure, these are some recommendations:

- Negotiate for defense costs to be paid outside the policy limit to preserve the limits for potential settlements or judgments.

- Actively seek the W&H sub-limit, which primarily covers defense costs for such complex claims.

- Consider higher deductibles/retentions for lower premiums, especially if the company has a clean loss history, balancing this against the high average settlement cost.

Overall, incoming EPL insurance trends are the result of growing legal complexity, not just claims volume. As such, they’re a reflection of the current societal, political, and technological environment that has deep-rooted ramifications in the standard conventions of workplace best practices.

Companies must follow suit, adapting to these shifts to create a healthier company culture and, ultimately, gain better insurance opportunities. Investing in comprehensive HR governance and auditing high-risk areas like pay equity and AI usage is the most effective defense against rising severity and tightening underwriting terms in 2026.