Key Takeaways

Corporate leaders search for the best way to go public, which is usually the path that swiftly puts money into their wallets. That said, a recent trend has emerged among late-stage companies, primarily entities attempting to go public fast: forgoing the traditional route. More specially, this new trend is for late-stage companies to choose SPACs over the conventional way — but why? Let’s examine SPACs vs. IPO for going public to help you decide what’s suitable for your company.

Understanding SPACs

Although special purpose acquisition companies, or SPACs, dominate the news currently as a popular Wall Street topic, they’re still a mystery to many. To sum up, a SPAC is a shell company, also known as a “blank check company,” purposely raising funds through an IPO with the sole goal of acquiring another company. By following this path, the SPAC can bypass the traditional IPO process.

Perhaps when WeWork’s IPO went sideways and the unicorn settled on another way to go public, this strategy started picking up speed. But SPACs are nothing new, and WeWork wasn’t the only one to opt for this path for going public. In 2020, about 200 SPACs raised nearly $70 billion in total funding. Some of these companies include Virgin Galactic, Opendoor, Nikola Motor Co., and DraftKings, which went public via the SPAC route. Unsurprisingly, investors expect a healthy pipeline in 2021.

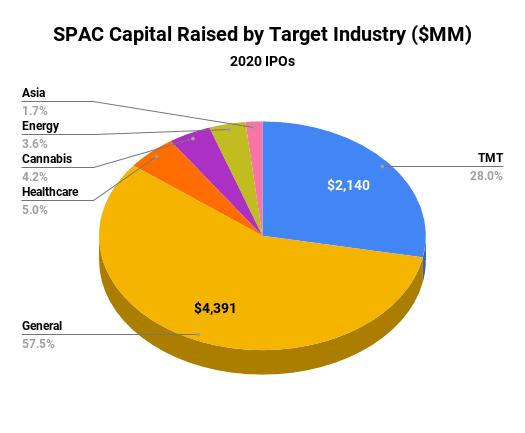

Source: SPAC Research

SPACs tend to focus on industry sectors and typically hone in on a limited range of industries. The significant “General” category in the above graph likely represents companies that hadn’t revealed or settled on their chosen industry. However, they can invest in any industry sector they choose, the same as any other investor.

“You can think it like: an IPO is basically a company looking for money, while a SPAC is money looking for a company.” – Don Butler of Thomvest Ventures

IPO vs. SPAC

SPACs were historically a last resort for small and medium enterprises (SMEs) that might have otherwise faced issues raising capital on the open market. However, several factors forced companies to rethink their going public strategy, namely the global pandemic.

As a result, it’s vital to understand the differences between a traditional IPO and SPACs. Don Butler, managing director at Thomvest Ventures, sums up the IPO vs. SPAC concept best, “You can think it like: an IPO is basically a company looking for money, while a SPAC is money looking for a company.”

In looking for a better explanation between these paths, consider that a SPAC goes public first. Furthermore, it’s most often backed with a valuable management team that intends to acquire a (private) company. However, SPACs are under time restraints, only having two years to acquire a company to “put in its shell.”

As Butler alluded to earlier, IPOs signify a stock market launch by a private company. These companies offer company shares to investors, hoping to earn the most from these initial sales. A lot goes into a private company going public, from meeting the Securities and Exchange Commission’s (SEC’s) requirements to hiring investment banks. IPOs are an exit strategy for founders and early investors.

Benefits of SPACs

SPACs have worked as a unique and successful way to navigate the global pandemic. The market volatility has made going public excruciating, causing many companies to postpone their IPOs. For some businesses, this health crisis and economic slump ruined their plans altogether. For others, they merely looked for an alternate route — enter SPACs stage left.

The surge of SPACs in 2020 proves that this route was highly attractive (and still is) for companies looking to exit. Companies merged with a SPAC, giving them the chance to bypass the exhausting process of a traditional IPO.

Instead of waiting for up to six months — registering an IPO with the SEC and jumping through hoops, per se — companies experience a closed acquisition in only a few months. What’s more, most founders recognize that the due diligence process of traditional IPO is far more grueling than the SPAC process.

Another benefit of SPAC mergers is that SPAC sponsors allow target companies to negotiate their fixed valuations with them. Plus, with so many institutional investors backing this trending SPAC route, it’s likely here to stay for a while.

Drawbacks of SPACs

Despite SPACs being a highly regarded way to achieve a public status, this route still carries plenty of risks with it. For example, SPAC shareholders might reject a target company’s acquisition.

On top of that, investors are entering these deals blindly, hence the name “blank check companies.” This route’s time frame also presents many SPAC sponsors with issues, mainly because they must find a decent acquisition within two years. Sometimes, this means settling for a workable deal instead of the best possible deal.

Also, it might not be surprising that SPAC mergers don’t have the same average returns as traditional IPOs. From 2015 to 2020, the post-market returns for SPACs fell short for investors.

Insurance Considerations for SPACs

Going public, no matter the avenue, creates vulnerabilities for any newly-public company. On that same note, before a SPAC transaction closes, there are insurance policies that founders must consider.

For example, directors and officers (D&O) insurance protects the SPACs board members and management team. Not only are there a list of listing rules for stock exchanges that a board of directors must comply with, but rarely do investors sign the dotted line without D&O insurance in place. Here’s what this vital policy covers:

Side A

Protects solely the individual directors by paying the defense costs and settlements levied on the directors as a result of a lawsuit. Side A will only pay the individual directors when the entity is unable (i.e., insolvent) or legally not permitted to do so. Typically, individual directors will ensure that the company purchases additional Side A coverage on top of the traditional ABC coverage.

Side B

Indemnifies the entity after the entity has paid the individuals named in the lawsuit.

Side C

This is entity coverage. Should the entity be named along with the individual directors in a lawsuit, this coverage protects the balance sheet of the company and will reimburse and costs/settlements incurred.

Understanding the details of what coverage your company needs can be a confusing process. Founder Shield specializes in knowing the risks your industry faces to make sure you have adequate protection. Feel free to reach out to us, and we’ll walk you through the process of finding the right policy for you.

Want to know more about D&O insurance? Talk to us! Please contact us at info@foundershield.com or create an account here to get started on a quote.