Authored articles

Commercial Umbrella Insurance: What Does It Really Cover?

When mid-market companies need more coverage than traditional policies, commercial umbrella insurance could be the answer.

Read Article

7 Questions to Ask Before Renewing Your Restaurant Insurance

Before renewing your restaurant insurance policy, it’s vital for franchise owners to review commonly overlooked business dynamics. Here’s the inside scoop.

Read Article

Lawyers’ Professional Liability: A Guide for Law Firms

Lawyers’ professional liability insurance covers some of the most vulnerable parts of the legal profession. Here’s a practical guide for law firms.

Read Article

Product Liability & Product Recall Insurance Guide

What’s the difference between Product Liability and Product Recall insurance? We break down everything you need to know.

Read Article

Private Companies Won’t Escape SEC Scrutiny; D&O Coverage May Be Crucial

SEC suits against Theranos and Jumio illustrate that private companies won’t avoid SEC scrutiny and that D&O insurance is more important than ever.

Read Article

Key Person Insurance Alternatives

Key Person Insurance can be a valuable policy for when the unthinkable happens, but it has its disadvantages. We examine Contract protection insurance (“CPI”) and other alternatives.

Read Article

Marriott & SPG Data Breach: What you need to know

Everything you need to know about the Marriot & SPG data breach. Who is at risk, what data was stolen and how to protect your business against cyber attacks

Read Article

Public vs. Private Company D&O Insurance Explained

We break down the differences between private vs. public D&O policies and discuss common claim scenarios.

Read Article

Jobs Act 3.0 Explained: How it will Impact Business

The House has passed Jobs Act 3.0. What does this mean for business? We discuss the key takeaways of the act and how it will impact future IPOs.

Read Article

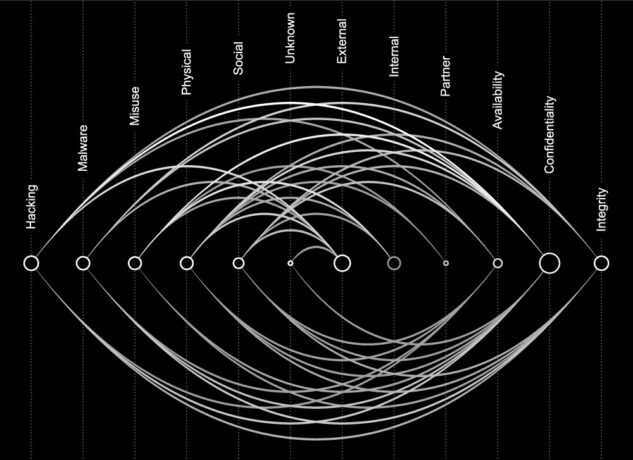

5 Takeaways from the Verizon Data Breach Report 2018

Every year Verizon releases a report that details real-world security incidents, data breaches, and the trends behind them. We discuss 5 takeaways every business needs to know

Read Article

Top 6 Forms of Social Engineering & How to Protect Your Business

Many implement the latest antivirus software, data encryption protocols, and firewalls. But what happens if malware is introduced into the system from inside? i.e. by an employee

Read Article

Denied Insurance Claims: 10 That Will Not Be Covered

Insurance companies typically have the right to refuse to approve claims because of specific reasons, ranging from deceptive activity to duplicate coverage. Find out what won’t be covered so you can get the maximum benefit from your policies.

Read Article

Understanding Insurance Audits

The word “audit” is intimidating but in the insurance world it’s nothing to worry about! In this post, we look at what insurance audits are, why carriers need to perform them and how you can prepare so you’re not caught off guard.

Read Article

What’s the right insurance for an ICO?

Uncertainty in the ICO space is leading entrepreneurs to wonder how they can protect themselves from risk. Can these companies get insurance for an ICO like they can for other parts of their business? (Spoiler alert: yes they can)

Read Article

Breaking bad: moving from a big broker to a startup

In this special post, one of our outstanding teammates discusses their experience moving from a big corporation to a startup. Less than a year later and this insurance guru is showing us that some bad habits aren’t all that hard to break. You can actually enjoy coming to work.

Read Article

How do companies protect traveling employees?

Technology may be breaking down geographic barriers but that doesn’t mean sending your employees overseas is getting any safer. Businesses whose employees travel internationally are familiar with these risks. But how do they protect traveling employees? Every company faces unique challenges, yet certain risks are ubiquitous across industries. We’ll delve into why these risks matter

Read Article

5 facts startups need to know about the GDPR

Any business that comes in contact with EU citizens will have to follow new rules as of May of this year. The General Data Protection Regulation (GDPR), passed by EU Parliament in April 2016, directly impacts businesses in the US, EU and elsewhere. Its purpose is to set uniform standards for data protection and prevent businesses from

Read Article

Growing concerns about cybersecurity in dating apps

Vulnerabilities have been discovered in some popular dating apps. What lessons can other businesses take away? Anyone who uses an app assumes that there’s a certain amount of privacy involved. This isn’t unique to dating apps. Consumers accept that the app marketplace and/or developer will collect usage and error data and certain forms of personally

Read Article

The 3 most important facts about IP insurance for startups

Too many companies ignore one of the most common legal risks out there: intellectual property (IP) infringement. In past posts, we’ve talked about the high frequency of IP litigation as well as the dangers posed by patent trolls. But let’s keep it simple — what do you need to know? There are a few important

Read Article

Cold Weather Warning: Does your insurance cover burst pipes?

We’ve seen some intense weather over the past few weeks. Had you ever heard of a bomb cyclone before? Yea, us neither. What we do hear about — unfortunately way too often — is an insurance claim that usually accompanies cold weather: water damage from frozen plumbing. So does your insurance cover burst pipes? Let’s

Read Article

What is a theft exclusion?

…and why is it in a holiday blog post? Two great questions! As we approach the holiday season, closing out year-end projects and dreaming about dancing sugar plum fairies and swelling Amazon carts, it’s important that we focus on what’s important to us. We at Founder Shield know that while most people say the important

Read Article

D&O cheat sheet for venture backed companies

Want to know more? Want to read more on the subject? Check out our blog posts on directors & officers insurance.

Read Article