The Complete Guide to Commercial Insurance Endorsements

Learn how commercial insurance endorsements provide customized coverage for you. Understand how the insurance endorsement types can empower your business. September 10 • Risk Management

I Signed, Now What? Understanding Insurance Subjectivities

Often referred to as the “pitfalls” of a quote, insurance subjectivities are certain conditions you must follow to ensure the coverage you need.

How to Choose a Commercial Insurance Broker

Cost may be a concern, but it should not be your primary concern. So what then should you look for when selecting a commercial broker?

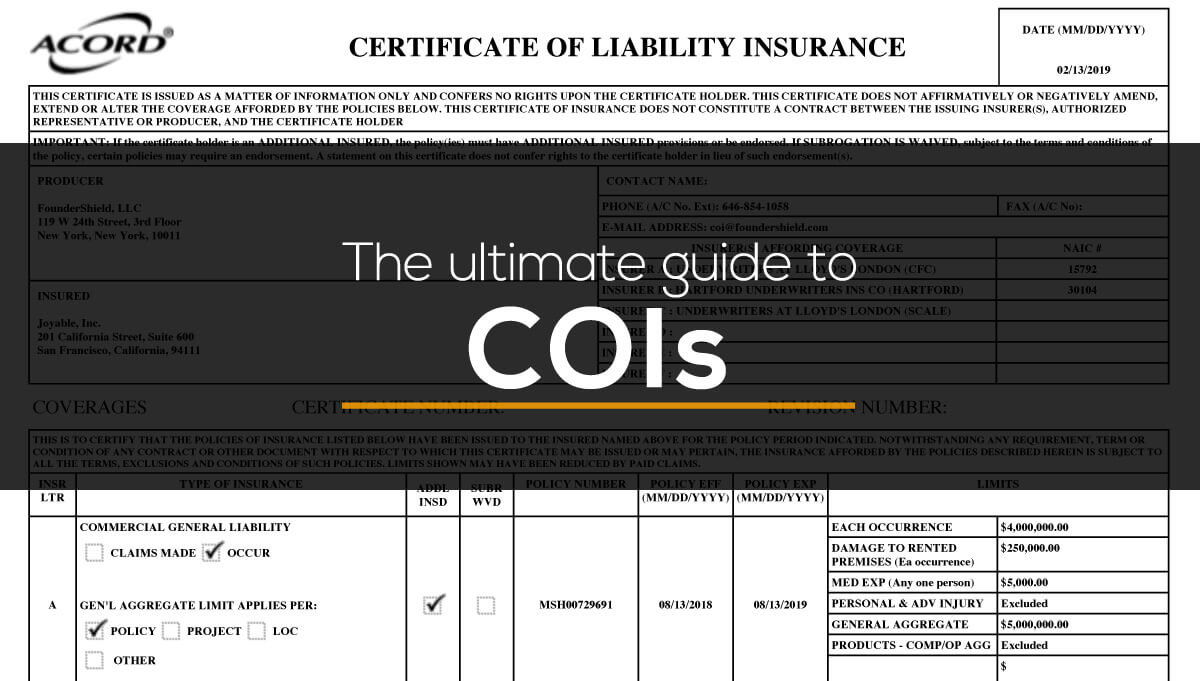

Understanding Certificates of Insurance (COIs)

Everything you need to know about Certificates of Insurance (COIs)!

Robobroking: What you need to know about automated insurance brokers

Online brokers using automation and AI make it easier than ever to get commercial insurance. But how do you know if they’re right for your business?

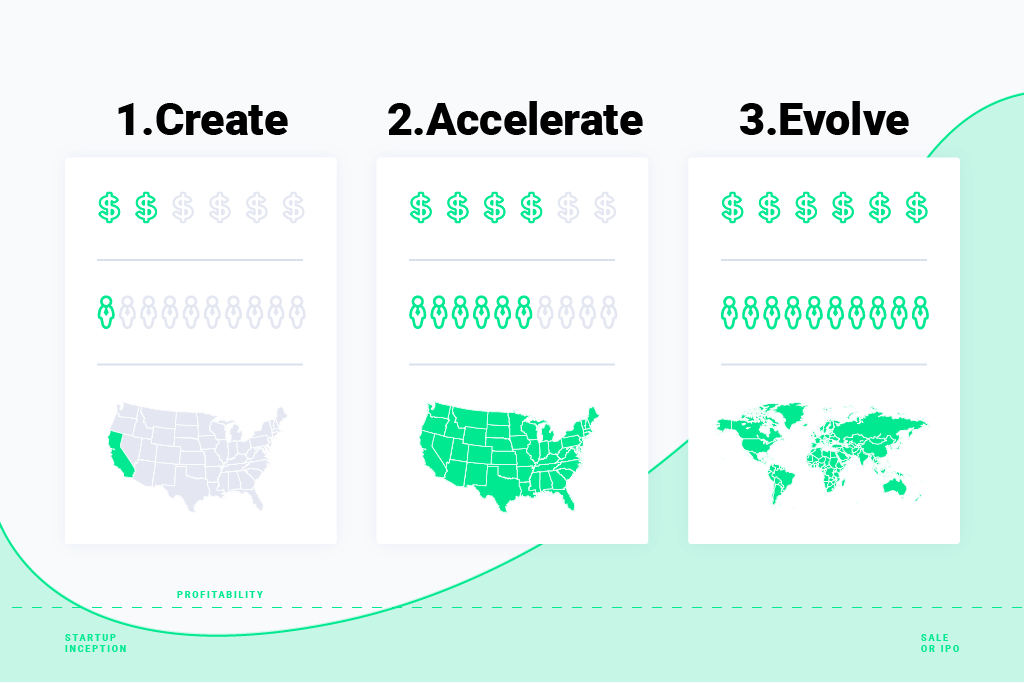

How to generate revenue & funding with insurance

How do you turn a cost center into a revenue engine? We discuss how high-growth companies can get this done with right Insurance. (via TechCrunch)

Expanding to the US? Use a Local Insurance Broker

Expanding to US? Find out why using local insurance broker can save you some big headaches.

How do companies protect traveling employees?

Technology may be breaking down geographic barriers but that doesn’t mean sending your employees overseas is getting any safer. Businesses whose employees travel internationally are familiar with these risks. But how do they protect traveling employees? Every company faces unique challenges, yet certain risks are ubiquitous across industries. We’ll delve into why these risks matter

Errors and Omissions Risks Checklist for Startups

We track down Errors and Omissions (E&O) policies for the majority of the companies we work with. It’s extremely important coverage for anyone leveraging technology or social media, which most startups constantly do. Even using things as simple as AWS or Facebook login can expose your company to a lawsuit, and in a fast-paced,

Insurance 101: what’s a retention?

Ever feel like reading your policy creates more questions than it answers? You’re not alone. Insurance is filled with jargon. While there’s good reason for your insurance policy being a 100+ page monster filled with a dizzying web of definitions and exclusions, the ‘why‘ doesn’t really matter to most people…they just want to know what’s

Startup Risk Tips: Optimizing your Insurance Policies

Insurance should be seen as more of an investment than a cost, but given the busy and chaotic lives of Founders, it sometimes becomes a check-the-box activity. When utilized properly, companies can get value from their policies well beyond that generated by a “set it and forget it” approach. Here are a few tips to optimize your insurance policies

The Top 5 Business Insurance Requirements from Landlords, Clients, and Investors

We see all kinds of business insurance requirements (and coverage change requests) from our clients’ landlords, clients, investors, business partners, and more. These requests are processed by creating an “endorsement” on the policy that puts the change into effect. From a location change to adding a new coverage to a liability policy, some endorsements are

Business Insurance Package Policies & How They Benefit Startups

Choosing commercial insurance can be daunting. You want your company to be properly protected, but you don’t want to break the bank. Luckily, that’s why business insurance package policies exist! Insurance carriers frequently bundle various coverage types together, providing a cost-effective approach compared to acquiring them individually. This strategy not only keeps expenses in check

How Insurance Companies Measure Payroll (and Bill You For It)

If you’re a growing business operating in the 21st century, you’ve most likely read about or experienced the importance of separating salaried employees from 1099 workers (Independent Contractors). If you’re less well-read on the subject, bottom line is this: at the end of the year, your workers compensation insurer will “audit” your payroll and charge

Patent and IP Insurance: Protect Your Ideas

So what exactly is the value of an idea? These days it can make or break your business. There has been a 71% increase in patent lawsuits over the last 6 years. There was a mind-blowing number – 2,754 to be exact – of patent infringement lawsuits filed in 2015; for which the

FS101: Minimum On-Demand Delivery Insurance Requirements

Update: We’ve released a new whitepaper examining the Sharing Economy industry. We dive into the insurance landscape, legal climate and how to approach risk management for companies in this sector. You can download the report here! Basic risk management tips for on-demand delivery companies We work with no shortage of on-demand companies operating in the ride share, car

Behind the Scenes: Quoting Insurance for Scaling Companies

Let’s go shopping! Think of the insurance market like a fruit market. You want the fresh, clean, beautiful fruit that’s in season! You shop around, check for bruises or marks, and then decide which fruit to buy. The way we get insurance quotes is quite similar. We review all the quotes that we receive from

The Importance of Tail Insurance Coverage for Startups

A tail insurance policy is one of the most important risk mitigation tools for a startup approaching an exit. The mission for every founder is pretty much the same: get some traction, get funded, scale rapidly, and hit an exit opportunity. While the occasional unicorn might be fortunate enough to IPO, most startups go the

4 Key Things to Look for On Your Business Insurance Quotes

It would be extremely surprising if you didn’t have some questions when looking at your first business insurance quotes. They’re extremely detailed and certainly not the easiest document to digest. Here’s a quick overview of the major items you should be looking at on your quote. [Note: this article is mainly pertaining to errors and