Key Takeaways

More factors than ever before have impacted employment practices liability (EPL) insurance over the past several years. The headlines have been jam-packed with EPL litigation from the #MeToo and #TimesUp movements to social inflation to the COVID-19 pandemic. Let’s take a closer look at this corner of the insurance world to understand its current state and how it will fare in 2022.

Current EPL Insurance Landscape

Most companies experienced a 10% to 25% increase in their EPL insurance cost over the past year. However, some insurers pushed a 25% to 75% price hike, depending on a company’s specific factors. For example, high-risk states — California, Texas, Michigan, and New York — were no strangers to these drastic changes.

As mentioned, many factors can shape the EPL landscape, such as social movements or new governmental regulations. And, of course, we’ve seen much action in this space recently. Nevertheless, several factors historically impact the cost of EPL insurance, such as:

- Company size

- Turnover

- Level of compensation

- HR procedures

- COVID-19-related factors

- Number of employees

- Location

The last two points listed above require more attention, though, as they’ve each impacted this landscape significantly.

Number of Employees

Employee count is a primary rating factor for EPL insurance. What’s more, it’s typically the first thing underwriters look at. And for a good reason. As a company grows, it becomes more critical to have dedicated HR resources and procedures, including a handbook. Additionally, it’s essential to update your handbook regularly. We spotlighted this detail in a recent post, EPLI Coverage: How Does Your Employee Handbook Measure Up?

Location

The state where employees work also has a considerable bearing on the underwriting of an EPL policy. For example, employee-friendly states are often “unfriendly” to employers and their EPL insurance carriers. Also, California is the number one culprit for EPL price hikes. Even relatively small employee counts in California can drive up premiums and retention rates.

Trending EPL Insurance Issues

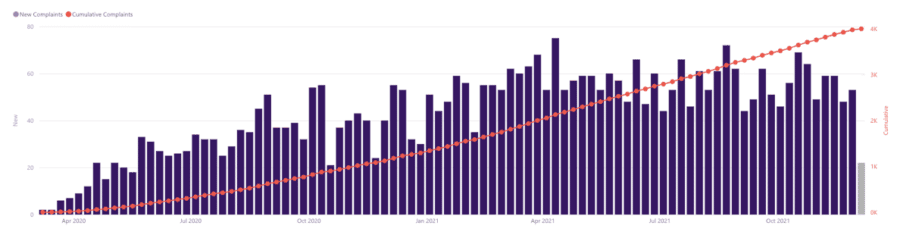

As seen below, with plenty of activity happening on the EPL landscape, we’ve watched EPL claims increase in the past two years. Here’s what we expect to unfold in 2022.

Source: JacksonLewis

Remote Work

Unsurprisingly, remote work has been a topic of discussion in EPL insurance circles since the onset of the pandemic. At this point, it comes down to what employers compel their employees to do. Is it mandatory to go into the office? If someone is fired for not coming in, is that wrongful termination?

What’s more, if it’s a flexible workplace, could employees working from home feel like they aren’t getting the same treatment as those in the office (i.e., discrimination or wrongful demotion)?

Biometric Exclusions

Biometric data privacy laws are some of the toughest in the United States. Illinois was the first to pass one of these laws in 2008, and other states are proposing and passing similar laws. We know it as the Illinois Biometric Information Privacy Act (BIPA). Although it’s been around for several years, very few claims surfaced until the past few years.

Nowadays, exclusions are added to most EPL policies regularly. We expect to see more of these lawsuits unfold in the coming years. The only way out of them is to verify you’re not collecting the information.

Here’s the thing; these particular claims likely belong on a cyber liability policy because they are privacy matters. So, it’s essential for executives to monitor these claims, mainly because some carriers have begun excluding them from cyber policies. Strangely enough, some insurance experts ask if this issue will eventually be uninsurable.

Vaccine Requirements

Undoubtedly, vaccination initiatives are top-of-mind for company leaders, given the directives trickling down from the White House. Nevertheless, the first risk to understand is compliance. For example, employers must ask if they honestly need to mandate vaccinations for their workforce.

The second risk to understand is how vaccine mandates will impact a company’s workforce. Employers must know how many employees are currently unvaccinated. Also, if employees refuse to get vaccinated and are let go, is that wrongful termination?

These complex situations are worth exploring because they may very well flesh out soon, impacting the EPL insurance landscape for years to come.

Unique Risk Profiles

Companies heavily impacted by the pandemic have experienced more significant turnover and instability. For example, hospitality companies have been hit hard. As a result, they tend to enjoy a less secure future than other companies.

Additionally, the healthcare industry is one to watch, especially now that the US Supreme Court has upheld the vaccine mandate for healthcare workers.

2022 EPL Insurance Outlook

After experiencing hard market conditions in 2021, we should see some softening for a significant number of insurers, including more flat premium renewals. However, despite a softening market, we expect the heightened underwriting scrutiny to stick around.

Companies with meaningful exposure in employee-friendly states, such as California and New York, should still expect premium and retention increases since there are more claims and less competition for these risks. Additionally, companies with meaningful employee growth are also a reason to expect similar increases.

Like most companies, you probably want an excellent result at renewal time. A big key to accomplishing this is effectively communicating how you proactively address employment practices concerns. Fortunately, our bench of experts is uniquely capable of working with your company to refine your message to the market. We can negotiate the best result possible on your behalf.

Remember, the world as we know it can change in a heartbeat. We’ve seen this happen in real-time. It’s best to be ready for life’s curveballs, and we’re here to help you stay on top of market trends. So, join us as we roll out our Risk Management Insights: D&O Insurance Trends each quarter.

————

Want to know more about EPL insurance? Talk to us! Please contact us at info@foundershield.com or create an account here to get started on a quote. You can also check our post about what is retention in insurance.