Key Takeaways

Remember when business insurance was just a boring PDF you signed once a year and shoved into a digital filing cabinet? For founders and risk managers, those days are gone—reactive planning is dead. You need to get ahead of the risk curve.

Today, insurance is a survival mechanism. We are watching startups ship generative AI tools before the ink is dry on the code, platforms crossing into highly regulated banking sectors, and global watchdogs tightening the leash. As part of our annual Trends Series, we sat down with Jonathan Selby, our Tech Industry Lead, for some deeper insights.

- “The stakes aren’t just “high”—they are existential. One hallucinations-prone AI model or a single lapsed security protocol isn’t just an operational disruption annoyance; it can trigger client losses, regulatory scrutiny, and lawsuits that drain capital faster than any missed sales target.” — Jonathan Selby, Tech Industry Lead at Founder Shield

While the “hard market” that has strained tech budgets for years is finally loosening, coverage still won’t be easy nor cheap. Insurers remain selective. Favorable rates and broad terms are reserved for companies that arrive at the negotiating table with strong security practices, clear risk documentation, and a proactive insurance strategy.

We’re going to walk you through exactly what the insurance ecosystem looks like right now and, more importantly, where it’s headed in 2026.

How Tech Hubs Influence Risk & Coverage

To figure out where the insurance rates are going, you have to follow the innovation.

By 2026, the data shows that “innovation” isn’t just software—it’s agentic AI and quantum readiness. If you follow that innovation, you’ll find that insurance carriers are moving away from broad “catch-all” policies and toward precision pricing.

That said, the United States is still the undisputed heavyweight champion in tech hubs. According to Dealroom, the San Francisco Bay Area remains the “Global Champion,” leading the pack in enterprise value and patent output, with New York, Boston, and Austin hot on its heels. But the map is getting wider. Hubs like Paris are breaking into the top tier, and we are seeing serious traction in emerging markets from Lagos, Nigeria, to Pune, India.

Source: Top Tech Ecosystems | Dealroom.co

Why does this geography matter for your policy? Because tech companies have stopped staying in their lanes. They are scaling globally and crossing industries. We are seeing software companies offering banking services and logistics platforms managing sensitive healthcare data. This blurring of lines creates a complex web of risk that a standard, off-the-shelf policy simply wasn’t built to cover.

The Era of Cross-Industry Risk

If there is one trend defining 2026 already, it’s vertical integration.

Imagine a standard SaaS platform that helps trucking companies track their fleets. Ten years ago, that’s all they did. Today? That same platform is processing payments (fintech) and selling cargo insurance (insurtech). They aren’t just a software company anymore; they are a bank and an insurer wrapped in code.

- “Everyone is trying to capture more value by controlling more of the chain. But here is the catch: when a software provider starts acting like a bank, they inherit a bank’s liability profile. When you blur industry lines, you blur liability lines.”

— Jonathan Selby, Tech Industry Lead at Founder Shield

Risk Implication: The “Hybrid” Nightmare

As Selby mentioned, when a software provider starts acting like a bank, they inherit a bank’s liability profile—and traditional insurance buckets often fail to capture that hybrid nightmare.

Consider a health-tech app. If the platform glitches and gives a patient the wrong dosage, what is that?

- Is it a Cyber claim? (Maybe, if it was a data integrity issue)

- Is it Medical Malpractice? (It resulted in bodily injury)

- Is it a Tech Error? (The code failed)

Traditional insurance buckets like errors & omissions (E&O) often fail to capture these hybrid risks. This interconnectedness also means a failure in one department—say, your payment gateway goes down—can torch client contracts in a completely different vertical. You have to look at your risk holistically, or you’ll find yourself with a gap exactly where your business models overlap.

The Twin Forces Shaping 2026 Tech Risk

Two massive forces are dictating the risk landscape right now: the explosion of AI and our absolute reliance on digital infrastructure.

AI Acceleration

GenAI has graduated from “cool party trick” to core business driver. But as we explore in our guide to insurance for generative AI businesses, this tech is a double-edged sword.

While your engineers are using AI to write code faster, cybercriminals are using the exact same tools to write better malware and craft phishing emails that don’t look like spam anymore—they look like they came from your CEO.

- “AI is both your greatest asset and your attacker’s newest weapon. It is no longer enough to have a policy; you must navigate a landscape where silent risks determine whether you are truly protected or dangerously exposed.”

— Jonathan Selby, Tech Industry Lead at Founder Shield

Supply Chain Dependencies

We are all living in the cloud. Reliance on Amazon Web Services (AWS), Microsoft Azure, and third-party APIs means we are all connected.

Think of it like a high-rise building. A simplified supply chain is efficient, but it creates systemic risk. If the power goes out in the basement (AWS has an outage), the lights go out in the penthouse (your app). One outage at a major provider doesn’t just take down one company; it takes down thousands. Insurers are terrified of this “aggregation risk,” and they are pricing their policies to reflect that fear.

The reality? Your security perimeter is gone. You aren’t just defending your own network anymore; you’re defending against your vendor’s bad day.

How the Economy Shapes Tech Insurance

The insurance market might be stabilizing, but let’s be real: the broader economy is still putting the vise on tech budgets. Startups are dealing with tighter cash flows and investors who are watching every penny.

Valuation Shifts

We are seeing a massive correction from the pandemic-era highs, and that volatility is creating a minefield for directors & officers (D&O) liability. When valuations drop, or revenue projections miss the mark, investors get litigious. They start looking for people to blame.

Common triggers we’re seeing include:

- Valuation drops post-acquisition: Allegations that the target company “overstated performance” during due diligence.

- Missed revenue targets: Investors claiming they were misled by overly optimistic projections during fundraising.

- Sudden operational disclosures: The “Why didn’t you tell us sooner?” lawsuit that follows the sudden revelation of a security flaw.

Cost-Cutting vs. Security

When the runway gets short, the CFO naturally circles the IT budget. But cutting security spend is a dangerous game. Insurers view tools like multi-factor authentication (MFA) and endpoint detection and response (EDR) as non-negotiable.

If you cut these to save cash, you will pay for it in premiums—or worse, you won’t get a quote at all.

- “In 2026, financial resilience and cyber maturity are the same thing. You cannot have one without the other. Treat your insurance application as a technical validation, not just a paperwork exercise.”

— Jonathan Selby, Tech Industry Lead at Founder Shield

Emerging Trends That Affect Tech Coverage

Beyond the code and compliance, broader market dynamics are quietly rewriting the risk map. In 2026, three specific industry trends are creating new exposures that standard security audits might miss.

- Economic Fragility & The Insider Threat: When budgets tighten, headcount is often the first thing to go. But layoffs do more than just lower your burn rate; they strip away your institutional knowledge and leave remaining teams stretched thin. We often see a spike in “human error” claims simply because fewer people are doing more work. Worse, it increases the risk of disgruntled insider threats, such as employees who still have access to sensitive systems but no longer have loyalty to the logo.

- Consolidation & Inherited Risk: The M&A market is thawing, but growth by acquisition comes with a catch: buying a company means buying its tech debt. We’ve seen acquirers inherit massive security holes—unpatched servers, shadow IT, or weak permission structures—that they didn’t have time to fix before a breach occurred. You might have a robust security posture, but if you buy a company that doesn’t, its vulnerability becomes your liability on Day One.

- Third-Party Reliance & Aggregation: The modern tech stack is built on dependencies. If your entire operation relies on AWS, Salesforce, and a handful of critical APIs, your risk profile is effectively tied to their uptime. This is “aggregation risk.” If a major vendor falls, they take thousands of companies down with them. Insurers are terrified of this because it means paying out hundreds of claims from a single event, and they are pricing policies to reflect that fear.

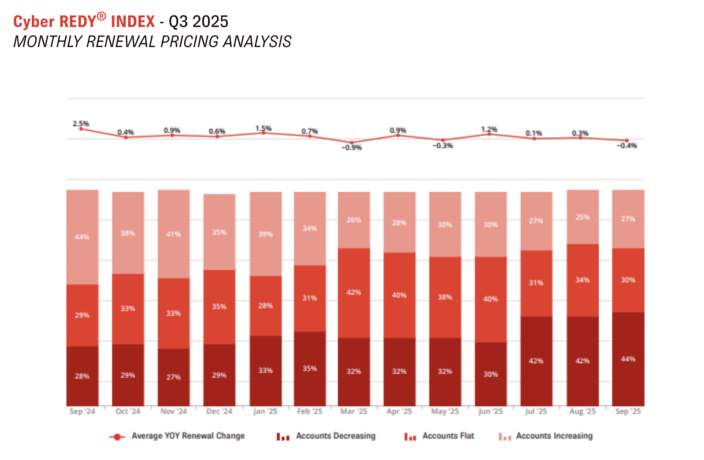

Benchmarks and Risk Metrics Driving Price

To figure out where the insurance rates are going, you have to follow the innovation. In 2026, “innovation” is no longer a buzzword—it’s a data point. Carriers have moved past static historical tables and are now anchoring premiums to real-time “insurability” metrics like cyber hygiene scores, API uptime, and AI governance frameworks. For growth-stage leaders, this shift means that the cost of risk is increasingly dictated by the quality of your tech stack, not just your industry category.

The Convergence of Tech E&O and Cyber

For technology companies, trying to keep professional liability and cyber liability in separate boxes is becoming a relic of the past.

Functionally, they cover different things. Tech E&O is about performance. Did your code fail? Did your platform crash during a client’s biggest sale? Cyber liability is about security. Did a hacker break in? Did ransomware lock your servers?

Cyber Risk Management Guide

But in the wild, these lines get blurry fast. If a bad actor exploits a bug in your software to steal user data, is that a coding failure (E&O) or a security breach (Cyber)? In the old days, that gray area was a nightmare where carriers would point fingers at each other while you waited for a payout.

To fix this, the market is moving aggressively toward “Blended” forms. Carriers are now offering integrated policies that wrap both risks into a single package. It solves the finger-pointing problem and makes renewals significantly less painful.

Mandatory Security Controls: The Pricing Lever

Underwriting today isn’t just about what you do; it’s about how locked down you are. Your security posture is the single biggest lever you have to control your premium.

Insurers have stopped asking nicely. If you want favorable terms, MFA, EDR, and immutable backups are the price of admission.

The Paradox: Claims Frequency vs. Severity

In 2026, the sheer volume of attacks is actually going up. Thanks to AI automation, bad actors are launching phishing and credential-stuffing attacks at an industrial scale. One example is the “RockYou2024” leak that exposed 10 billion passwords.

But while the frequency of attacks is rising, the average severity (the dollar cost per mess) is trending down for companies that are prepared.

Why? Because those mandatory controls are working. MFA stops a stolen password from becoming a breach. EDR catches a hacker before they can deploy ransomware. The attacks are still happening, but they aren’t turning into company-ending disasters. That drop in severity is the main reason we are finally seeing insurance rates soften.

The Evolving Regulatory Landscape

Regulation used to be the legal team’s problem—a bit of paperwork to file and forget. Now? It has mutated into a massive liability engine that sits right on your balance sheet.

Global Compliance Pressure

If you operate across borders, you are navigating a minefield. The risk isn’t just the fine itself; it’s the reputational crater that opens up the moment you fall out of compliance. In 2026, two specific regulatory frameworks are driving the bulk of this exposure:

- Digital Operational Resilience Act (DORA): Europe is drawing a line in the sand for 2025. DORA moves beyond simple data privacy; it’s an operational survival test. It forces financial institutions—and crucially, the tech vendors they rely on—to prove they can take a digital punch and keep standing. If you are a U.S. SaaS platform selling to EU banks, DORA compliance is effectively your new license to operate. Without it, you’re a liability they can’t afford to keep.

- CCPA/CPRA & US Privacy Laws: Back home, the threat is shifting. We are seeing a weird surge in “long-tail” claims that have nothing to do with being hacked. Plaintiff attorneys have built a cottage industry around “Pixel lawsuits”—suing companies for using standard tracking tools without perfect disclosures. If your privacy policy says one thing and your website code does another, you are painting a target on your back.

The SEC and Corporate Governance

For public companies (or those dreaming of an IPO), the SEC has stopped asking nicely. New rules demand you disclose material cyber incidents fast.

The danger here is the “double dip.” First, you get hit by ransomware (the cyber loss). Then, if you stutter on the disclosure or try to downplay it, you get hit by a shareholder lawsuit (the D&O loss). It turns one bad day into two expensive legal battles, hammering your insurance limits from both sides.

What’s Next for Tech Liability and Coverage

In 2026, the distance between “technical glitch” and “catastrophic liability” has vanished. As innovation moves into its most autonomous phase yet—driven by agentic AI and deeper supply chain integration—the insurance industry is fundamentally redrawing the lines of coverage. It is no longer enough for tech leaders to simply have a policy; they must now navigate a landscape where silent risks and contractual backstops determine whether they are truly protected or dangerously exposed.

Generative AI Liability: The Next Frontier

Generative AI has graduated from “novelty” to “core infrastructure,” but for insurers, it represents a massive, undefined frontier of liability. If your product touches GenAI, you are effectively fighting a war on two fronts.

First, you have the product risk (E&O). We are seeing a new wave of claims where AI models “hallucinate” incorrect facts that lead clients into financial losses, or where hiring algorithms demonstrate systemic bias. These are professional negligence claims, plain and simple, but they are born from code rather than human error.

Second, you have the attack vector (Cyber). Bad actors are using the same technology to bypass your defenses. We are seeing sophisticated “deepfake” CEO impersonations and voice cloning used to authorize fraudulent wire transfers. As we’ve noted in our cyber security tips for founders, this drastically increases the severity of financial fraud claims because the attacks look and sound exactly like trusted insiders.

The Underwriting Response: Insurers are reacting to this volatility with caution. Many are moving to exclude “Silent AI” risk—ambiguous scenarios where AI isn’t explicitly mentioned—from standard policies. You need to read the fine print to ensure you don’t end up with a dangerous gap where your cyber policy covers the hack, but your E&O policy specifically excludes the lawsuit resulting from your AI’s bad advice.

Supply Chain Attacks

Third-party vendor compromise remains the top systemic risk in the tech ecosystem. Hackers love supply chain attacks because they offer a “one-to-many” payoff: compromise one vendor, and you gain access to hundreds of their customers.

Because of this, insurers are looking beyond your firewalls—they are auditing your legal agreements. Underwriters are now scrutinizing your downstream contracts to see if you have strong indemnity clauses (making vendors pay for their own breaches) and audit rights (allowing you to verify their security). If you can’t show that you are contractually transferring this risk, carriers will view you as the ultimate backstop for your vendor’s failures and price your policy accordingly.

What to Expect from Technology Insurance in 2026

The 2026 market is opening a window of opportunity, but it won’t stay open for everyone. If you want to capitalize on the softening rates, you need to be proactive.

1. Overall Claims Severity Remains High

While the frequency of attacks might be stabilizing, the cost to clean them up certainly isn’t. Catastrophic breaches are becoming more expensive to fix, from legal fees to forensic audits.

The Smart Move: Use the competitive market to buy a bigger safety net. Excess layers—the coverage that kicks in when your primary policy is tapped out—are cheaper right now than they have been in years. It’s the perfect time to “load up” on capacity while the pricing is in your favor.

2. Favorable Terms Will Require Mandatory Controls

Insurers aren’t just asking if you have security measures. They want proof that they’re effective and consistently monitored. This means showing evidence of patch management, incident response readiness, and active monitoring, not just ticking boxes on a form.

The Smart Move: Treat the application as a verification process. Gather reports, audits, or monitoring logs that demonstrate your security posture in action. Presenting this documentation upfront gives underwriters confidence and positions your company for the most favorable pricing and terms.

3. AI-Related Exclusions Will Become Pronounced

As AI claims start hitting the headlines, insurers are quietly rewriting the fine print. You can expect to see sharper language, excluding risks around generative content and IP infringement.

The Smart Move: Scrutinize the exclusions list. Don’t just accept the standard wording. Work with a specialist broker to push back on these new clauses and ensure you don’t end up with a coverage gap between your Tech E&O and Cyber policies right where your biggest innovation risks lie.

The Takeaways for Tech Companies in 2026

Technology insurance in 2026 isn’t just about finding coverage—it’s about timing and preparation. Rates are more reasonable than they’ve been in years, but the risks companies are carrying have grown more complex. AI adoption is accelerating, regulations are tightening, and small missteps now have much bigger consequences.

What we’re seeing across the market is a clear divide. Companies that invest in security, governance, and transparency are getting rewarded with better pricing and broader coverage. Companies that don’t are finding themselves stuck—paying more, negotiating harder, and still ending up with limited protection. That gap isn’t closing anytime soon.

This is where having the right partner matters.

At Founder Shield, we work closely with technology companies at critical growth moments—expanding internationally, launching AI-powered products, or preparing for the next funding round. Our job isn’t just to place insurance. It’s to help you tell your risk story clearly, align coverage with how your business actually operates, and anticipate the questions underwriters are going to ask before they ask them.

When insurance is done right, it supports growth instead of slowing it down. If you’re planning for 2026 and beyond, now is the time to make sure your program is built to keep up. Let’s talk about how to position your coverage as a strength, not a constraint. Learn more or schedule a meeting below.