Pre-IPO Checklist 2019

Considering an IPO? We’ve created a 10 part a checklist to serve as a preliminary starting point for thought and discussion, as well as a brief primer on the process.

How to generate revenue & funding with insurance

How do you turn a cost center into a revenue engine? We discuss how high-growth companies can get this done with right Insurance. (via TechCrunch)

Key Man Insurance: VCs – You’re Doing it Wrong

Given our relationships with a lot of early stage VCs in around the country, we do a ton of Key Man Insurance policies. If you’re unfamiliar with these, Key Man policies are basically a life insurance policy that pays out to the company if anything happens to the “Key Man.” And if you’re unfamiliar with

The Top 2 Dangers of Portfolio Company Lawsuits

In our previous piece on Venture Capital Insurance, lawsuits from your employees and Employment Practices Liability Insurance (EPLI) took the spotlight. This article focuses on the risks posed by portfolio companies. For more info on how to protect your VC, take a look at our intro post, as well as our summaries of SEC investigations and lawsuits from

Employee Lawsuits: The Top 3 Risks Faced by VC’s

This is the fourth installment of Founder Shield’s VC-Focused series. Last week, we reviewed some examples of lawsuits from your investors and how you can protect yourself. Be sure to also check out our introductory post as well as our discussion of the impact of regulatory investigations and the insurance policies that will help you stay afloat when the SEC

Top 4 Venture Capital Insurance Claims from Investors

This is the third installment in Founder Shield’s venture capital (VC)-Focused series and explains venture capital insurance claims VCs might face from their investors. If you’d like to learn more about the basics of what these insurance policies do and don’t cover, check out our intro post as well as our post about regulatory investigations.

Venture Capital Insurance and the SEC

In our first post on venture capital insurance, we took a high level view of four scenarios where this management liability, professional liability, and employment practices liability insurance policy could protect you, your firm, and your investors. We also spoke about the potential costs of having — as well as not having — this liability

Venture Capital Insurance is an Investment, Not a Cost

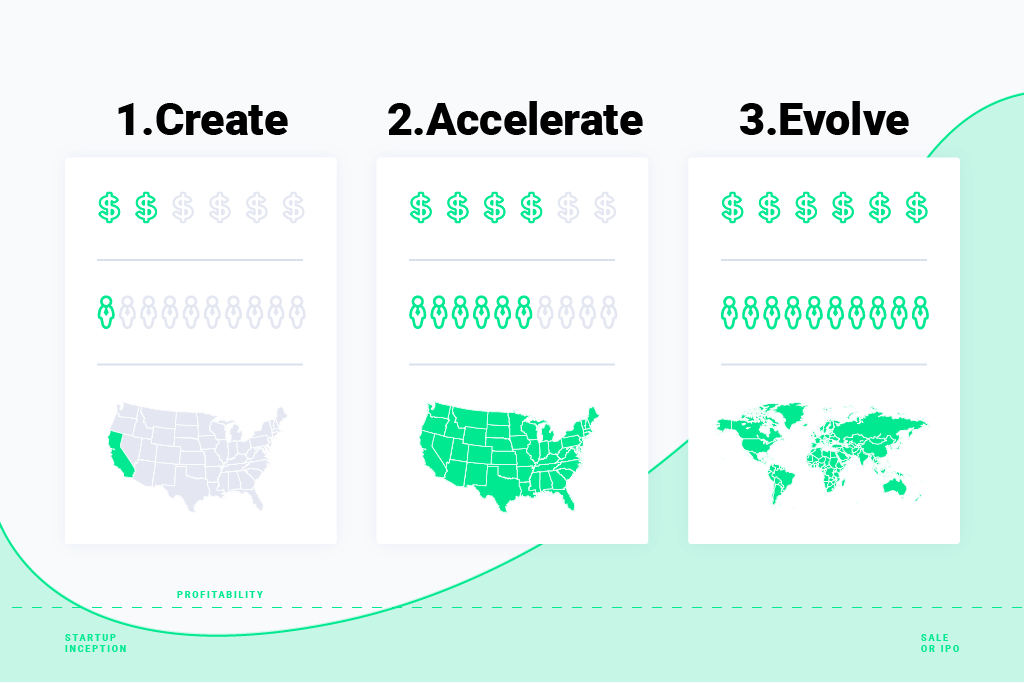

This is the first of a series of articles we will be posting about the world of venture capital insurance.

The Top 3 Startup D&O Insurance Lawsuits / Claims

D&O Insurance is one of the most important types of insurance for startups. You’ll undoubtedly see it on the term sheet of the vast majority of institutional investors because it’s a big risk exposure for both you (the founder) personally and your investors.

We created a new Key Man insurance product…and it’s awesome.

Key man insurance for startups doesn’t really exist in the life insurance markets. There are a few reasons for this and I’ll explain the big ones.

Startups: Don’t Overlook Key Man Insurance

We usually talk about key man insurance with our clients in the wake of a freshly closed round of institutional funding. Investors typically make their portfolio companies get key man insurance to protect their own cash. They realize that at most startups, the team is the company. It takes a truly phenomenal team to guide