Key Takeaways

Errors and omissions (E&O) insurance, also known as professional liability or “malpractice” insurance, protects high-growth companies from third-party liability allegations. Although widespread coverage, it’s not a one-size-fits-all policy. Some industries pay higher premiums than others, mostly because of their unique exposures. This post explores why this non-uniformity in E&O insurance costs occurs and what to expect from your E&O policy.

What Is Errors & Omissions Insurance?

As mentioned, E&O insurance protects businesses against liability allegations from third parties. No matter how meticulous you manage your company, mishaps happen, and people file lawsuits against your company. Human error, dissatisfied clients, and accusations that your product or services caused someone else financial loss are the most common basis for these claims.

Similarly, Managed Service Providers (MSPs) have their own set of specific risks, which can impact their E&O insurance costs significantly. With the rapidly changing environment for small or mid-market businesses, MSPs face various challenges, and it’s essential for them to have appropriate coverage. Understanding the nuances of MSP insurance can help mitigate potential risks and ensure comprehensive protection.

The premise is that most companies claim that their product or service will perform according to industry standards — but they sometimes don’t. It’s not the end of the road for businesses that face these allegations; it’s a mere hiccup, thanks to E&O insurance.

E&O coverage responds in these cases by protecting your business from lawsuits. It pays your defense costs as well as settlements and judgments against your company. This role has earned it the informal recognition as “malpractice insurance.”

What Drives E&O Premium Costs?

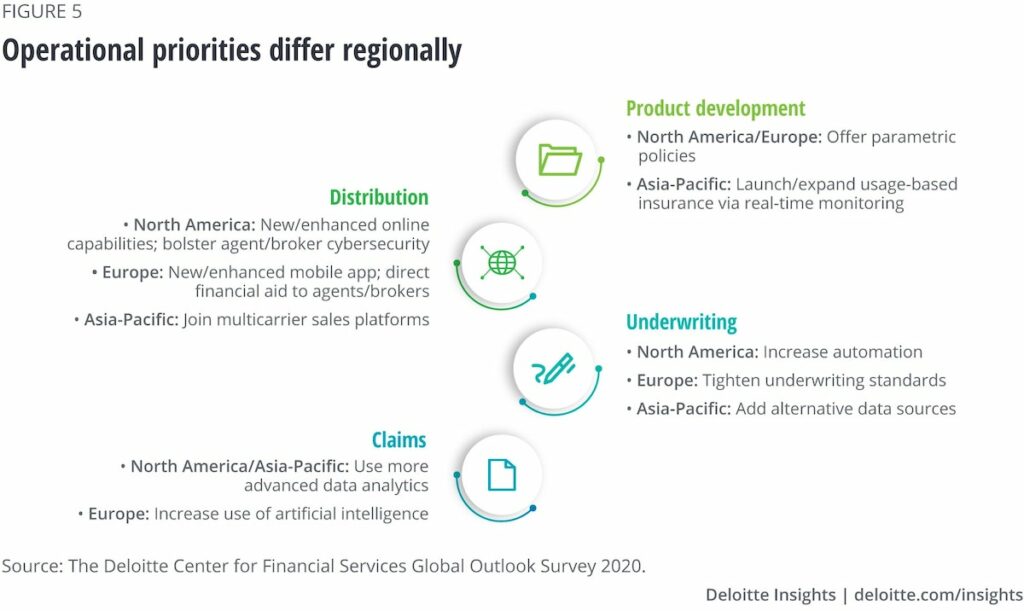

In response to the COVID-19 pandemic, the insurance industry is speeding up many digitization efforts and tightening up in other areas, as well. According to Deloitte’s 2021 Insurance Industry Outlook report, this industry will focus on the following areas to pivot from the pandemic’s impact. Here’s a graphic from Deloitte’s report to use as a reference point for what E&O underwriters are navigating:

Source: Deloitte

That said, plenty of factors drive insurance rates across the board. E&O insurance has unique characteristics merely because of what it provides to policyholders. Let’s look at a few drivers for E&O costs.

Industry

Depending on the industry, one company might pay E&O premiums that are half of what another business pays. For example, technology companies, such as IT professionals, tend to experience higher premiums than others. IT businesses often pay double what an accounting company pays for insurance.

And building design professionals, for obvious reasons, can pay double what an IT company pays. An error in building design could crush a business (literally), whereas an accounting firm can typically fix a bookkeeping error relatively painlessly. In short, it’s all about the specific risks an industry faces.

Media and advertising companies face significant exposures regularly so that industry often has higher premiums. Consider the audience and the messages being blasted online continually. Not only are these online services often challenging to measure, but individuals can quickly misunderstand them.

Coverage Limits

It’s not surprising that the claim limits on an E&O policy impact the premium significantly. That said, premiums can vary from company to company, ranging from $250,000 to $2 million. The sweet spot for small businesses is typically a $1 million / $1 million policy — but let’s review those limits:

- Occurrence limit: The amount an insurer will pay to cover any single claim while the policy is active.

- Aggregate limit: The amount an insurer will pay to cover all claims during the lifetime of the policy, which is typically one year.

Naturally, small business needs differ significantly from mid-market companies. What’s more, the US is home to over 200,000 mid-market companies or companies with annual revenue ranging from $10 million to $1 billion. An E&O policy that suits a small business won’t likely work for a high-growth company. These organizations tend to face more risk, requiring more robust coverage — frequently resulting in a higher premium.

History

Underwriters can learn a lot about a company merely by reviewing its claim history. If your business has a past peppered with claims, expect your E&O costs to be higher than claim-free companies. Remember, underwriters use facts to analyze how risky your business is to insure. The more claims you’ve filed, the riskier you come across to an insurer.

How to Save Money on Your Insurance

If you’ve had a bad run recently and had to file several claims for various reasons, you can still enjoy reasonable E&O rates. It comes down to how strategic you are with your policy. Here are a couple of tips to save money on premiums.

One-Time Premium Payment

Many individuals and businesses opt to pay a portion of their premium every month. Not only does this help spread out the cost, but it’s also slightly easier to budget. While this is a convenient option, it’s not usually the most cost-efficient.

Most times, insurance carriers tab on a few bucks each month merely to offer individuals this payment method. A few dollars on a personal auto policy isn’t impossible to manage, but commercial insurance is far different from a mere auto policy. Plus, the difference in premium cost could vary significantly with this added charge.

Consider making a one-time annual premium payment. This approach will help to maintain lower E&O premium amounts. Most accounting departments can savvily dedicate funds for premium costs, no matter how it’s paid. Shifting to this method will save your company money in the long run.

Avoid Policy Lapses

Insurance typically comes in either claims-made or occurrence policies. We’ve dissected these two policy types in-depth here: Claims-made vs. Occurrence Insurance Policies Explained.

Like many liability coverages, an E&O policy must be active for a business to collect insurance benefits. Furthermore, it must be active when the claim is filed and when the alleged mistake occurred. If the policy is no longer in force, insurance carriers can deny the claim right from the start.

To ensure your retention amount insurance remains uninterrupted, it is crucial to steer clear of policy lapses. Consequently, making timely payments and strategically coordinating carrier switches is of paramount importance. Accumulating a history of start-stop coverage can lead to substantial rate hikes, as underwriters perceive this approach as less stable.

Understanding the details of what coverage your company needs can be a confusing process. Founder Shield specializes in knowing the risks your industry faces to make sure you have adequate protection. Feel free to reach out to us, and we’ll walk you through the process of finding the right policy for you.

Want to know more about errors & omissions insurance? Talk to us! You can contact us at info@foundershield.com or create an account here to get started on a quote.