Series A Success Story: An Interview with Fig

We spoke with Justin Bailey of Fig (since acquired by Republic) about his experience on successfully closing a Series A round. He has some great tips and shares important lessons for founders embarking on their funding journey. Tell me a little bit about yourself and why you founded Fig? I’m Justin Bailey, Founder and CEO of

Admitted vs. Non-Admitted Insurance

Knowing the difference between admitted and non-admitted insurance carriers is vital—especially for high-risk companies. Here’s the scoop.

What Are Loss Run Reports?

As a small to mid-market company, it’s essential to use loss run reports to your advantage. Here’s how to make sense of these valuable reviews.

How to Choose the Best Financing Option for Your Business

Meredith from Fundera evaluates the best short and medium term financing options for startups. Find out which one is right for your business.

Commercial Umbrella Insurance: What Does It Really Cover?

When mid-market companies need more coverage than traditional policies, commercial umbrella insurance could be the answer.

Guide to Short-Term Rental Insurance

What is Short-Term Rental Insurance and Why do you need it? Short term rentals aka short term vacation rentals are gaining popularity. Over 1 million homes and rooms are being rented out short-term in the U.S. This rapidly growing industry gives homeowners a way to earn some extra income and provides travelers with alternatives to

What is Loss Payee and Lenders Loss Payable?

In the world of insurance, protecting assets and investments is paramount. Loss Payee and Lenders Loss Payable are two critical terms that come into play when third-party interests are involved. In this article, we will explore these concepts and how they relate to insurable risks.

7 Questions to Ask Before Renewing Your Restaurant Insurance

Before renewing your restaurant insurance policy, it’s vital for franchise owners to review commonly overlooked business dynamics. Here’s the inside scoop.

What does the California AB5 (gig economy) ruling mean for insurance?

California signed the AB5 (Gig Economy) ruling into law. This will have ramifications for the entire US insurance market, not just for CA.

Lawyers’ Professional Liability: A Guide for Law Firms

Lawyers’ professional liability insurance covers some of the most vulnerable parts of the legal profession. Here’s a practical guide for law firms.

The Complete Guide to Commercial Insurance Endorsements

Learn how commercial insurance endorsements provide customized coverage for you. Understand how the insurance endorsement types can empower your business.

Commercial Crime Insurance Guide

Here’s the inside scoop on commercial crime insurance guide for startups and mid-level businesses. Learn the different types of commercial crimes and what crime insurance covers.

The Ultimate Guide to Insurance Requirements in Contracts

Vendors, cities, partners, investors, etc.— often require specific insurance policies as a part of a contract. We break down why and what you need to know.

Private Companies Won’t Escape SEC Scrutiny; D&O Coverage May Be Crucial

SEC suits against Theranos and Jumio illustrate that private companies won’t avoid SEC scrutiny and that D&O insurance is more important than ever.

Key Person Insurance Alternatives

Key Person Insurance can be a valuable policy for when the unthinkable happens, but it has its disadvantages. We examine Contract protection insurance (“CPI”) and other alternatives.

Mitigating Cyber Risk with Google Cloud

Partnering with the right cloud provider is essential. Google Cloud outline how to mitigate cyber risk through trust, security, and proper cyber insurance.

Understanding Certificates of Insurance (COIs)

Everything you need to know about Certificates of Insurance (COIs)!

Robobroking: What you need to know about automated insurance brokers

Online brokers using automation and AI make it easier than ever to get commercial insurance. But how do you know if they’re right for your business?

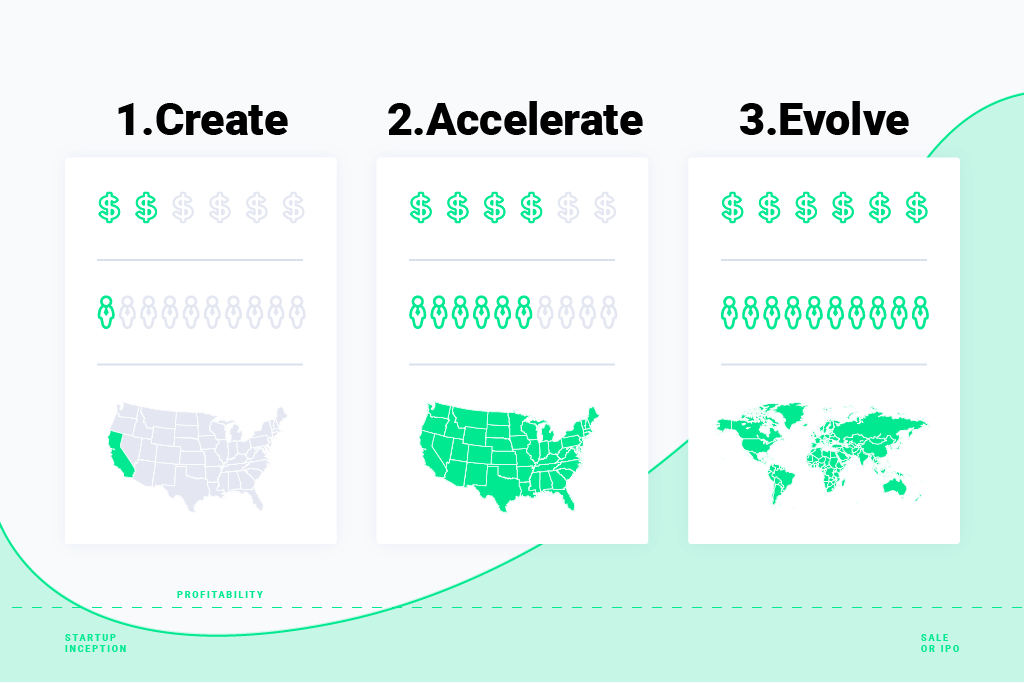

Pre-IPO Checklist 2019

Considering an IPO? We’ve created a 10 part a checklist to serve as a preliminary starting point for thought and discussion, as well as a brief primer on the process.

How to generate revenue & funding with insurance

How do you turn a cost center into a revenue engine? We discuss how high-growth companies can get this done with right Insurance. (via TechCrunch)

Top 6 Forms of Social Engineering & How to Protect Your Business

Many implement the latest antivirus software, data encryption protocols, and firewalls. But what happens if malware is introduced into the system from inside? i.e. by an employee

What’s the Right Insurance for an ICO?

Uncertainty in the ICO space is leading entrepreneurs to wonder how they can protect themselves from risk. Can these companies get insurance for an ICO like they can for other parts of their business? (Spoiler alert: yes they can)