Key Takeaways

Headline after headline reported the D&O insurance market as a hard market. To top it off, some mention of SPACs typically followed. If you’re like us, this particular news has gotten a bit tasteless. So, where are we at now, and what’s the state of the D&O market? Did SPACs ruin it for everyone else?

In our annual trends post, let’s review a few critical aspects of recent D&O happenings to see how our predictions stacked up. We also unfold a handful of predictions for 2022.

What Affects D&O Insurance Premium?

We reported last year that several outlying factors sunk their teeth into the D&O market, such as the global pandemic and Environmental, Social, and Corporate Governance (ESG) issues. Nevertheless, the following elements historically influence the D&O insurance market:

- Company size

- Assets or revenues

- Number of employees

- Specific industry

- Market trends

- Management experience

- Business ownership structure

- Years in business

- Operating costs

- Business scope

- Company’s financial security

- Claim history

How Much Has Private D&O Pricing Changed?

According to Jeff Hirsch, EVP of Scale Underwriting, the state of the D&O insurance market depends on who you ask. He continues,” An underwriting shop still looking to recover for losses paid during the last market downturn wants to convince its customers that the market remains ‘hard’ — seller side economics.

If you’re entering this highly competitive space, you’re looking to take business away from incumbents. So, you would describe the market as ‘softening.’ It’s ‘flat’ if you want to keep your renewal book options open and make a splash into new business.”

From different angles, the D&O market appears more nuanced than ever before. However, we do look forward to more stability in 2022 after several rocky years. Fresh entrants into the space will undoubtedly provide more rate stability, competitive advantage, and abundant new capacity.

That said, the worsening fiduciary liability market continues to impact the D&O insurance market as the two policies often go hand-in-hand. We see that some industries face more issues than others regarding securing D&O insurance, especially those with nuanced risk profiles. For example, cannabis, crypto, fintech, real-estate-related business, and private startups valued at over $1 billion (unicorns) face D&O challenges.

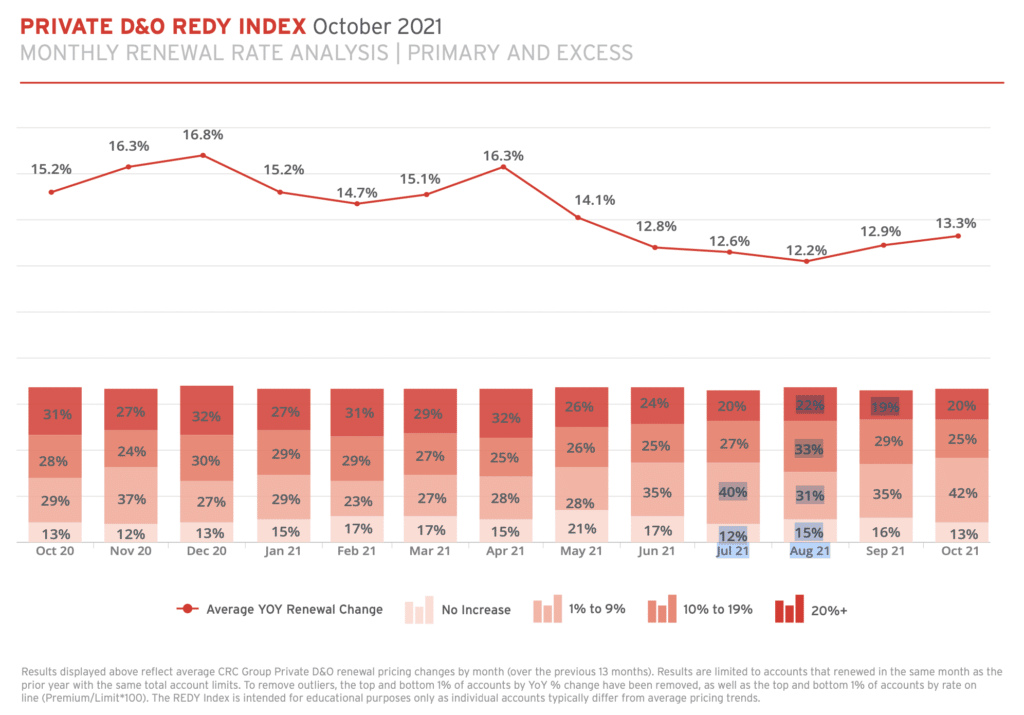

Here’s a snapshot of Q3 courtesy of The REDY Index from CRC Group to give you a taste of the movement we’ve seen in the private D&O market.

Source: The REDY Index from CRC Group

How Much Has Public D&O Pricing Changed?

Much like private D&O, its public counterpart has also been on a steady upward mountain climb. Strangely enough, companies going public via IPO or direct listing are all in the same boat. The route to going public hasn’t changed the cost of D&O insurance tremendously.

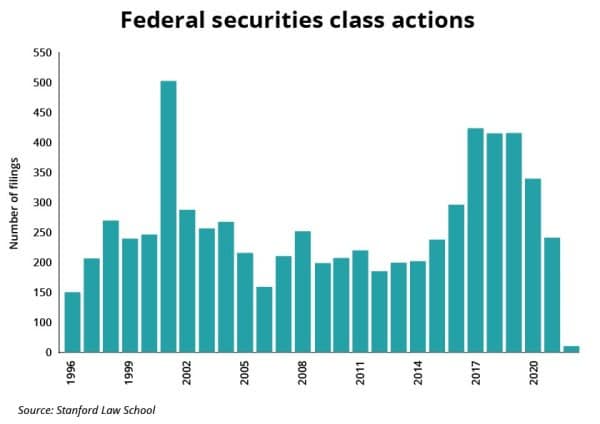

More than anything, the shock wave from D&O litigation over the past few years has finally started to settle — mainly following the Federal Court’s 2018 decision in Cyan. However, the frequency and severity of securities class action suits are decreasing, as are parallel filings, impacting D&O pricing trends overall. Consider the number of filings over the past few decades as outlined below.

Although this is undoubtedly a step in the right direction, other market factors may unfold to make a significant change in pricing trends. Things like the shortening span between IPO and a public companies first securities event and the wave of SPAC litigation may continue to push pricing upwards.

High-Profile D&O Suits in 2021

Delaware was seemingly a hotspot for D&O litigation in 2021, with a slew of policyholder-friendly rulings coming from the state. However, let’s look at three interesting cases from the US that caused a few furrowed brows.

- Myriad Genetics: An investor filed suit in Delaware against Myriad Genetics’ board members and leadership. The suit named several executives, claiming they lied about Myriad’s flagship pipeline product and overstated earnings.

- Calamos Asset Management: Calamos was hit with a class-action suit in 2017 over their merger, costing them a $22 million settlement. However, the company attempted to overturn the ruling in 2021, claiming that the settlement involved wrongful acts against its executives that were covered. The court ruled that the insurer, Travelers, didn’t have to help cover the settlement costs.

- First Solar, Inc.: Facing two class-action lawsuits, both from Delaware, First Solar claimed that the lawsuits weren’t related. However, the court ruled otherwise. Both cases alleged wrongful conduct but consisted of different plaintiffs, causes of action, and time frames. It’s no surprise that they each played out in court.

The D&O Market Results for 2021

The reports are in, so it’s time to see how our 2021 predictions stacked up. Let’s review what our team said to see how on-target we were. Did we get it right?

D&O Pricing Increases

As predicted, many public D&O companies worldwide experienced increased D&O costs in the past year. Referencing earlier in the post, the overall condition — soft, hard, or flat — of the D&O insurance market depends on who you ask, according to Jeff Hirsch, EVP of Scale Underwriting, an MSI company.

Waves of Derivative Litigation

According to Kevin M. LaCroix, attorney, author of The D&O Diary, and Executive VP of RT ProExec, “2021 was a particularly eventful year “ regarding D&O litigation. Although waves of derivative litigation surfaced, the levels were closer to those in 2017-2019 than the skyrocketing levels we experienced in 2020. LaCroix attributes this trend to many factors, including the number of federal court merger objection class-action lawsuit filings.

Pandemic-Inducted Cyber Attacks

Forbes reports that we’ve experienced a massive shift to remote and hybrid work over the past two years. As we predicted, cybercriminals welcomed the change with open arms, exposing and taking advantage of security gaps in businesses worldwide. That said, cyber incidents top the list of worldwide business concerns, followed by business interruption and natural catastrophes.

ESG Concerns

As predicted, ESG concerns have quickly risen to the top of many Board’s priority lists, impacting D&O pricing trends more than ever before. As one of Founder Shield’s insight Claim Managers, Sojee Kim, points out, the significant problem is that there is no single global standard of a framework for ESG related disclosures.

Kim continues, “These are complex and often industry-specific issues. ESG disclosures are mostly voluntary, so we see a great deal of information from companies in the same space that are not standardized or even reconcilable from each other.”

The D&O Market Outlook for 2022

Few underwriters expect retentions to increase this year, which is positive. The rate of securities class action lawsuits is also on a downward slope. Although we anticipate a steady stream of these suits, we’ll settle for a slowdown.

SPACs have stolen the spotlight for the past couple of years. But the SEC hasn’t turned a blind eye to these happenings. New regulations are underway that might cause SPACs to drop the mic and exit the stage left. Another shove off stage is that SPAC-related D&O litigation has skyrocketed, causing D&O pricing to increase over fivefold in 2021. We expect to see equally notable shifts unfold in 2022.

However, the SEC isn’t only watching SPACs. We expect the SEC to focus on climate change, specifically whether companies provide climate disclosures. Lastly, ransomware will raise the stakes in 2022, forcing Boards to focus more on cybersecurity than ever before — but we touch on this topic below.

Founder Shield’s Outlook

We could list a dozen or more predictions for 2022; however, we’re going to focus on only a handful of issues we expect to play out this year. Let’s dive in.

Good Premium Opportunities

Let’s circle back to Hirsch, “We think the market is continuing to evolve. There are good premium opportunities tied to class and industry. At the same time, some brokers should be able to make good cases for flat or only slight premium increases, depending on the client and how it has fared through the pandemic and economic downturn.”

Cybersecurity Remains a Priority

Most directors and officers have felt increased pressure to mitigate cybersecurity better. This risk prioritization has come as no surprise, given the giant shift to remote and hybrid work. Nevertheless, executives are responsible for maintaining the best cybersecurity practices throughout their workforce and thus protecting their digital assets. If a data breach occurs, a shareholder’s suit may hit directors and officers incredibly hard, thus utilizing D&O insurance for cyber claims. Unfortunately, we expect this type of litigation to continue in the future.

EVP and Customer Success Manager Rachel Jenkins explains further, “We are starting to see more, still limited but increasing, cyber claims bleed into D&O through shareholder litigation as there is an increased fiduciary duty on the C-suite to maintain proper cyber controls through regulation and industry requirements.

The requirement to maintain proper controls is shifting more on the company via pressure from insurance carriers and regulators eager to contain the swift uptick in cyber events. So, the fallout from weak security & privacy programs is magnified and seen as evidence of a lack of oversight and proper management. Carriers are combating this with strong cyber exclusionary wording, potentially with carve backs for Side A coverage.

Furthermore, while D&O currently is structured so that it should be able to respond to protect directors and officers for their business judgments. Underwriters are consistently looking to broaden their cyber exclusions in preparation for an increase in D&O claims related to cyber events.”

Adding Costs on Excess Layers

In previous years, carriers under-priced excess layers as they related to risk level. We saw a massive spike in rates during 2020 and 2021, mainly due to carriers attempting to over-correct the previous years’ pricing issues. Despite the increase in cost and suit severity, there’s heavy competition in excess layers. Nevertheless, we expect this aspect to be somewhat shaky as it unfolds in 2022, even among D&O insurance veterans.

According to Kyle Jeziorski, EVP and Broking Manager, “We are actually starting to see some ‘flattening’ and even slight reductions on renewal business for excess layers of D&O. IPO pricing is still going to be expensive, but there has been an influx in new entrants to the market given the increased costs, which is driving more competitive rates in the excess market. This is a typical aspect of the insurance market cycle. Hard market –> Increased Prices –> new entrants taking advantage of the pricing –> more competition –> softening of the market.”

Supply Chain Disruption Suits

Every trip to the grocery store is proof of the mess the global supply chain is in. Company executives nationwide (worldwide!) have been fighting this battle for over two years now. We anticipate supply-chain disruptions causing plenty of business interruption issues, no doubt. Once again, though, we agree with Kevin LaCroix that a more significant problem we might see unfold is the broken supply chain leading to D&O claims, such as securities class action lawsuits.

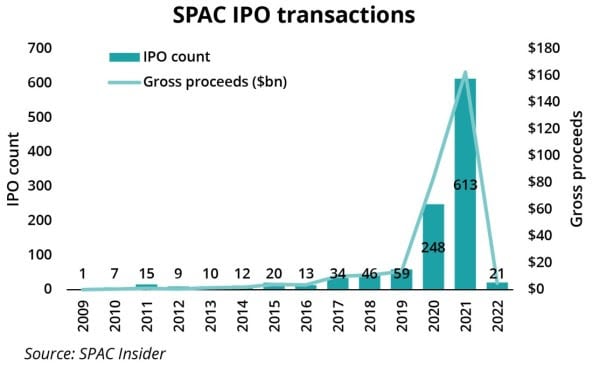

D&O Premium Spike for SPACs

As we’ve written before, there is a shrinking list of carriers who will underwrite SPACs. As a result, D&O insurance rates for companies after the de-SPAC transaction can be as high as 30% more than those of a post-IPO company. Strangely enough, the number of SPAC IPO transactions was outrageously high during the past two years, as highlighted in the graph below.

Nevertheless, the SEC is cracking down on many regulations related to SPACs, so we expect the SPAC bandwagon to slow down significantly this year.

According to our own Jonathan Selby, General Manager, “If litigation continues to skyrocket — and it’s trending in that direction now — that could certainly slow down the SPAC boom.”

Remember, the world as we know it can change in a heartbeat. We’ve seen this happen in real-time. It’s best to be ready for life’s curveballs, and we’re here to help you stay on top of market trends. So, join us as we roll out our Risk Management Insights: D&O Insurance Trends each quarter.

Want to know more about D&O insurance? Talk to us! Please contact us at info@foundershield.com or create an account here to get started on a quote.